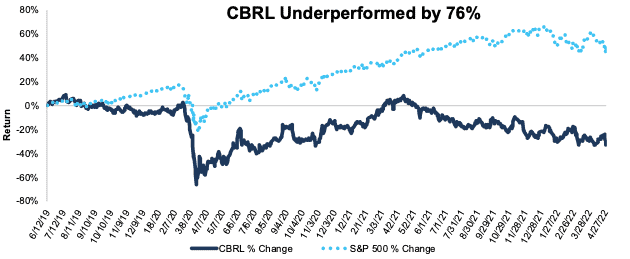

Cracker Barrel Old Country Store (CBRL) – Closing Long Position – down 33% vs. S&P up 43%

We made Cracker Barrel (CBRL: $111/share) a Long Idea on June 12, 2019 and reiterated our opinion on April 29, 2020 and on February 24, 2021. CBRL earned an Attractive rating at the time of our first report. We believed the business’ rising return on invested capital (ROIC), growing same-store sales, and potential to expand its physical footprint meant that the expectations baked into the valuation of its stock at the time were overly pessimistic.

All of our research[1] leverages our more reliable fundamental data[2], as proven in The Journal of Financial Economics and shown to provide a new source of alpha, to get the truth about earnings.

During the nearly three-year holding period, CBRL underperformed as a long position, falling 33% compared to a 43% gain for the S&P 500.

While we expected the company’s superior profitability and strong liquidity would help the business grow during a recovery from pandemic-related disruptions, the company’s Core Earnings over the trailing twelve months (TTM) are 38% below fiscal 2019 levels. As we look ahead, rising labor and supply costs will pressure the company’s margins. More importantly, Cracker Barrel’s struggle to drive guest traffic to pre-pandemic levels, and shrinking off-premise revenue, mean opportunities for long-term profit growth are dimming, too.

Given the formidable challenges facing Cracker Barrel’s business, this stock holds limited upside potential with increased risk of permanent profit decline. We believe there are better opportunities in this market that present much more favorable risk/reward and are closing this long position.

Figure 1: CBRL vs. S&P 500 – Price Return – Unsuccessful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on April 29, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features our Robo-Analyst research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Three independent studies from respected institutions prove the superiority of our data, models, and ratings. Learn more here.