Some big hitters like Alphabet (GOOG), IBM (IBM), Intel (INTC), and PepsiCo (PEP) reported earnings late last week, and we are seeing some major themes emerge during this earnings season. Specifically, many companies are beating 1Q25 estimates but cutting or pulling guidance for the full year.

Opportunities to buy quality businesses at undervalued prices are rising given the disconnect between past performance and future expectations.

Our readers know we go into detail explaining the themes and opportunities we’re seeing in our Earnings Watch Parties. We uncover the truth that is hidden behind company filings and press releases.

The diligent work that goes into analyzing all the information in a 200+ page filing is how our Stock Ratings drive alpha in the any market.

By leveraging our superior fundamental research, we’ve identified one such opportunity and featured it as this week’s Long Idea.

Demand for chicken has been rising for decades, and it is currently the most consumed protein across the globe. Health benefits and affordability have driven much of the demand, while the beef market has struggled with low cattle stock, rising prices and falling demand.

Without a beef operation to drag down profits, this leading chicken producer benefits from the fast-growing market while maintaining profitability and generating cash. Pilgrim’s Pride (PPC: $53/share) is this week’s Long Idea.

PPC offers favorable Risk/Reward based on the company’s:

- growing sales across all business segments,

- rising chicken and pork demand,

- best in class profitability, and

- cheap stock valuation.

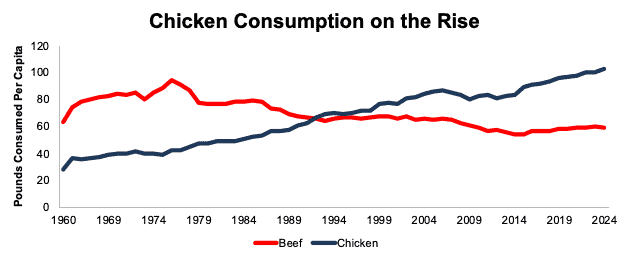

Chicken Demand Overtakes Beef

Chicken has steadily gained popularity over the last couple of decades, with the chicken consumption per capita in the U.S. rising from 28 pounds in 1960 to 103 pounds in 2024. Growth in chicken consumption has come largely at the expense of beef consumption, which, per capita, fell from 63 pounds in 1960 to 59 pounds in 2024. As a result, in the U.S., chicken is the most consumed protein.

Figure 1: Chicken and Beef Consumption per Capita in the U.S. From 1960 to 2024

Sources: The National Chicken Council

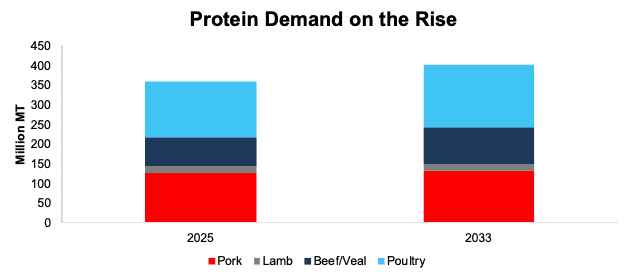

Chicken Demand Expected to Continue to Grow

Chicken consumption is projected to continue its steady rise across the globe.

The global chicken market is forecasted to grow 6% compounded annually from 2024-2033.

On a consumption basis, global poultry consumption is projected to rise from 143 million metric tons (MT) in 2025 to 160 million MT in 2033. See Figure 2.

Figure 2: Protein Consumption: 2025-2033

Sources: Pilgrim’s Pride Investor Day Presentation

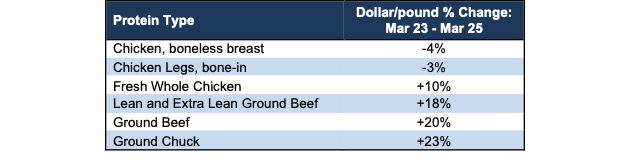

Chicken Remains More Affordable Than Beef

The trend in chicken consumption vs. beef consumption highlights the former’s “attractiveness” to consumers, which is driven largely by its relative affordability. According to data from Circana, and provided in Pilgrim’s Pride’s investor presentation, 87% of home prepared meals contain meat and poultry and the dollar per pound is a top 3 factor in the meat purchasing decision.

Over the past two years, the spread between ground beef prices and chicken prices has grown, which only increases the attractiveness of chicken. Over those two years, the dollar per pound of boneless breast chicken and chicken legs, bone in has fallen 4% and 3% respectively, while the cost of ground beef has increased 20%. See Figure 3 for more details.

Figure 3: Change in Protein Prices: March 2023 – March 2025

Sources: U.S. Department of Agriculture (USDA)

The spread between chicken prices and beef prices is likely to continue growing in 2025 too. According to the USDA, cattle inventory contracted for the sixth year in 2024, and the number of cattle on January 1, 2025 represents the lowest level of national herd since 1951. The USDA projects commercial beef production to fall nearly 2% in 2025 while overall protein availability will rise 1.2% YoY.

Pork Market Is Growing Too

Like chicken, pork consumption is also on the rise, with pork consumption per capita rising slightly from 49 pounds in 2015 to 50 pounds in 2024.

The global pork market is forecasted to grow 4% compounded annually from 2025 to 2034.

More near-term, the USDA projects commercial pork production to increase 3% YoY in 2025, with strong demand and higher beef prices helping to support overall pork pricing.

Global Leader

Pilgrim’s Pride is the second largest chicken producer in the U.S., trailing only Tyson Foods (TSN). The company is geographically diversified as it sells its products in the U.S., Mexico, U.K., and Europe. According to the company’s most recent investor day presentation, it accounts for:

- 1 out of every 6 pounds of chickens sold in the U.S.,

- 1 out of every 4 pounds of chickens sold in Mexico,

- 1 out of every 4 pounds of chickens sold in U.K., and

- 1 out of every 4 pounds of pigs sold in the U.K.

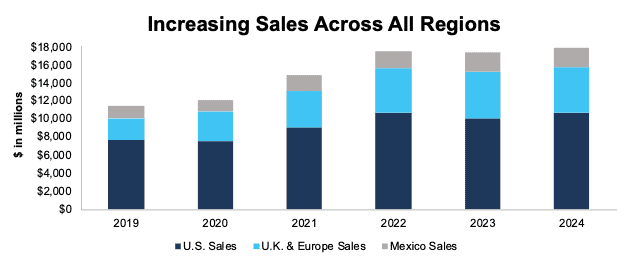

Over the last five years, Pilgrim’s Pride’s U.S., Mexico, and U.K. and Europe sales grew 7%, 9%, and 17% compounded annually, respectively. Combined, sales across all geographic segments have grown 9% compounded annually from 2019 to 2024. See Figure 4.

Figure 4: Pilgrim’s Pride’s Sales by Region: 2019 – 2024

Sources: New Constructs, LLC and company filings

Diversified within Chicken Products Too

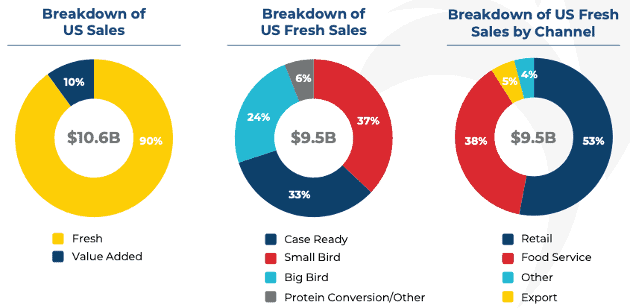

Pilgrim’s Pride’s largest revenue generating segment is its U.S. operations, which accounted for 59% of 2024 revenue and 68% of 2024 gross profit.

The company mainly sells fresh products, which accounted for 90% of U.S. revenue in 2024. But its fresh sales are well diversified with 37% of U.S. fresh sales from small bird products, 33% from cage ready products, 24% from big bird products, and 6% from protein conversion or other products in 2024. See Figure 5.

Figure 5: Pilgrim’s Pride’s Breakdown of U.S. Sales in 2024

Sources: PPC Investor Presentation

Quality Fundamentals Across Decades

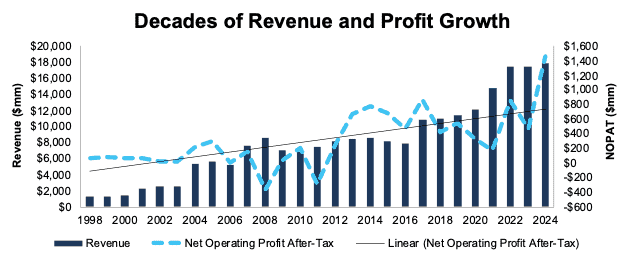

Pilgrim’s Pride has capitalized on the growing demand for chicken, and despite not being a flashy high-growth company, has grown its top- and bottom-line for more than two decades.

The company has grown revenue by 11% and net operating profit after-tax (NOPAT) by 12% compounded annually since 1998. See Figure 6.

The company improved its NOPAT margin from 5% in 1998 to 8% in 2024 while invested capital turns fell from 2.5 to 2.1 over the same time. Rising NOPAT margins are enough to offset falling invested capital turns though, and, drive return on invested capital (ROIC) from 13% in 1998 to 17% in 2024.

Additionally, the company’s Core Earnings grew 14% compounded annually from $51 million in 1998 to $1.4 billion in 2024.

Figure 6: Pilgrim’s Pride’s Revenue and NOPAT Since 1998

Sources: New Constructs, LLC and company filings

More recently, Pilgrim’s Pride has grown revenue 9% compounded annually over the past five years while NOPAT has grown 22% compounded annually over the same time.

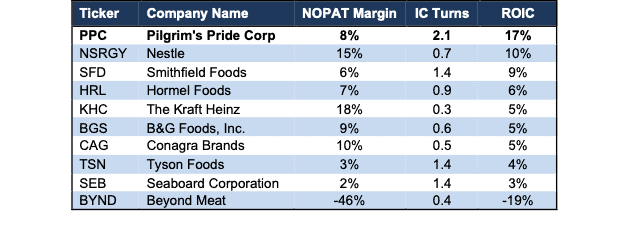

Best-in-Class Profitability

Pilgrim’s Pride is not only one of the largest global meat producers, but it is also the most profitable among publicly-traded peers.

Pilgrim’s Pride has the highest operational (NOPAT margin) and capital (invested capital turns) efficiency, which in turn drives its ROIC to rank highest among publicly-traded peers, which include Tyson Foods (TSN), Smithfield Foods (SFD), and Hormel Foods (HRL) and more meat and food producers. See Figure 7.

Figure 7: Pilgrim’s Pride’s Profitability Vs. Peers: Trailing Twelve Months (TTM)

Sources: New Constructs, LLC and company filings

No Guarantee, But Future Special Dividends Could Provide Yield

Pilgrim’s Pride does not pay regular dividends or repurchase shares. As of December 31, 2024, the most recent share repurchases occurred in 2022.

However, the company did announce a special dividend of $6.30/share in March 2025, which was paid out in mid-April 2025. Based on the closing price the day before the dividend was announced, the special dividend provided a yield of 12.5%.

While special dividends are, by their very nature, not recurring and “special”, should Pilgrim’s Pride provide an additional special dividend, the potential yield to investors could be significant.

Ample Cash Flow Generation

Since 2018, Pilgrim’s Pride has generated a cumulative $1.8 billion in free cash flow (FCF), which equals 13% of its enterprise value. The cumulative FCF is positive despite a large cash burn in 2021 following the disruption caused by COVID in the year prior.

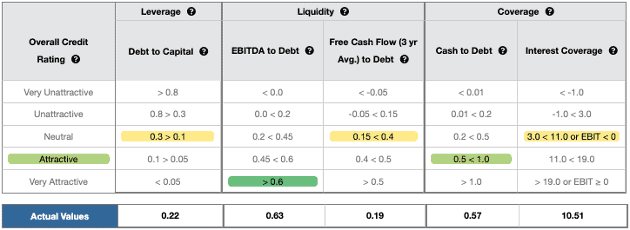

Strong Balance Sheet and Credit Rating to Weather Uncertainty

Pilgrim’s Pride’s total debt has fallen from $3.7 billion in 2021 to $3.6 billion in 2024 while its cash and equivalents increased from $428 million to $2.0 billion over the same time. The result, Pilgrim’s Pride’s adjusted debt net of cash has fallen from $3.7 billion in 2021 to $2.4 billion in 2024.

Pilgrim’s Pride earns an Attractive overall Credit Rating and scores an Attractive-or-better rating in two of the five credit rating metrics.

Even if economic conditions deteriorate or demand fluctuates, the company’s strong financial footing secures its operations for the foreseeable future.

Figure 8: Pilgrim’s Pride’s Credit Rating Details

Sources: New Constructs, LLC and company filings

Input Cost Increases Already Priced Into the Stock

Prices of primary ingredients (corn, soybean, and wheat) in feeds for chickens and pigs heavily impact Pilgrim’s Pride’s costs, along with all meat producers. In 2024, corn, soybean, and wheat accounted for 42%, 38%, and 5% of Pilgrim’s Pride’s feed costs, respectively.

For 2025, the USDA forecasts a record corn crop in 2025 and projects average prices for corn, soybean, and wheat to fall in 2025 compared to 2024. In the short-term, this dynamic is a plus for Pilgrim’s Pride, as it can spend less on feed and increase margins.

However, there is no guarantee that feed prices will remain low. A bad growing season, impacted by weather for example, or another supply chain shock such as 2020, where corn and soybean prices soared, would negatively impact Pilgrim’s margins and profits.

The good news for potential investors is that Pilgrim’s Pride’s stock price implies that the company’s profits will permanently decline by 40%; so, we think any increase in feed costs is more than priced into the stock.

Owners Put a Floor Under this Stock

JBS S.A., the world’s largest meat producer, currently owns over 82% of Pilgrim’s Pride’s outstanding common stock. JBS initially acquired its controlling interest in the company after helping it emerge from bankruptcy protection in 2009 with an $800 million investment, which equaled a 64% stake at the time.

More recently in August 2021, JBS offered to buy the remaining 20% of Pilgrim’s Pride. JBS’ offer represented a 22% premium to Pilgrim’s Prides trailing 30-day average price. However, Pilgrim’s Pride and JBS couldn’t reach an agreement and after six months, JBS withdrew its offer in February 2022.

Since then, the stock has roughly doubled, and it appears that Pilgrim’s Pride’s management team made the right choice. Given our outlook on the fundamentals of this business, we do not think another similar offer from JBS is outside of the realm of possibilities for Pilgrim’s Pride, in which case investors could be looking at a quick 20%+ gain. Even if no new offer is forthcoming, demonstrated interest from a large inside investors like JBS should instill confidence in PPC investors.

Current Price Implies Profits Will Fall

At its current price, Pilgrim’s Pride’s price-to-economic book value (PEBV) ratio is 0.6. This ratio means the market expects the company’s NOPAT to permanently decline 40% from 2024 levels. This expectation seems overly pessimistic considering Pilgrim’s Pride has grown NOPAT by 12% compounded annually since 1998 and 6% compounded annually since 2014.

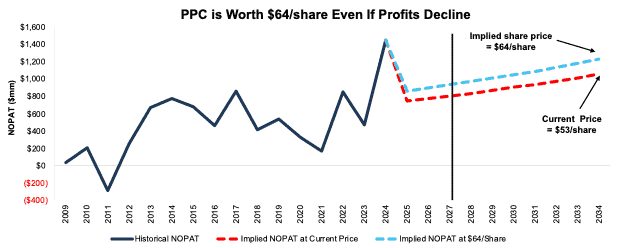

Below, we use our reverse discounted cash flow (DCF) model to analyze expectations for different stock price scenarios for PPC.

In the first scenario, we quantify the expectations baked into the current price. If we assume:

- NOPAT margin immediately falls to 4% (half of 2024 margin of 8% and equal to five-year average margin) through 2034, and

- revenue grows at 4% a year through 2034 (compared to 8% compounded annually in the last ten years and below forecasted chicken market CAGR of 6%) then

the stock is worth $53/share today – equal to the current stock price. In this scenario, Pilgrim’s Pride’s NOPAT would fall 3% compounded annually from 2025 – 2034.

Shares Could Go 20%+ Higher Even If Profits Decline

If we instead assume:

- NOPAT margin immediately falls to 4.7% (equal to post 2009 average) through 2034, and

- revenue grows 4% (compared to 8% compounded annually in the last ten years and below forecasted chicken market CAGR of 6%) compounded annually through 2034, then

the stock is worth $64/share today – a 21%+ upside to the current price. In this scenario, Pilgrim’s Pride’s NOPAT would fall 2% compounded annually through 2034. Should the company’s NOPAT grow more in line with historical levels, the stock has even more upside.

Figure 9: Pilgrim’s Pride’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

Sustainable Competitive Advantages Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around Pilgrim’s Pride’s business will enable it to continue to generate higher NOPAT than the current market valuation implies:

- leading positions in chicken markets around the world,

- large distribution network and presence across the globe,

- superior profitability compared to peers – both margins and ROIC, and

- strong balance sheet.

What Noise Traders Miss with Pilgrim’s Pride

These days, fewer investors focus on finding quality capital allocators with shareholder-aligned corporate governance. Due to the proliferation of noise traders, the focus is on short-term technical trading trends while more reliable fundamental research is overlooked. Here’s a quick summary of what noise traders are missing:

- growing demand for chicken,

- consistent Core Earnings growth for more than two decades, and

- valuation implies profits will permanently decline by 40%.

Earnings Beats Could Send Shares Higher

Pilgrim’s Pride has beaten earnings estimates in 8 of the past 10 quarters, including the latest quarter ended 4Q24. Beating estimates and achieving consistent top- and bottom-line growth could help explain PPC outperforming the overall Consumer Staples sector since the beginning of this year. Year-to-date, PPC is up 13% while the Consumer Staples Select Sector SPDR Fund (XLP) is up just 3%. Additional earnings beats could send shares even higher and further extend the stock’s outperformance.

Exec Comp Could Be Improved

Pilgrim’s Pride’s executives receive both annual incentives and long-term equity awards. The annual incentives are tied to “PBT margin”, which is defined as GAAP income before taxes, excluding certain adjustments, expressed as a percentage of net sales.

Long-term equity awards are tied to earnings before interest and tax (EBIT) per processed pound and EBIT margin.

We would prefer the company tie executive compensation to ROIC. Doing so ensures that executives’ interests are more aligned with shareholders’ interests as there is a strong correlation between improving ROIC and increasing shareholder value. Improving ROIC requires attention to all areas of the business, so including it in an executive compensation plan would incentivize executives to improve the entire business, not just one sales goal or earnings number.

Despite using PBT margin and EBIT goals in its executive pay, Pilgrim’s Pride’s management has grown economic earnings, the true cash flows of the business, 4% compounded annually over the last decade, from $646 million in 2014 to $921 million in 2024.

Insider Trading and Short Interest Trends

Over the past 12 months, insiders have purchased 316,919 shares and sold 176,983 shares for a net effect of 139,936 shares bought. These sales represent <1% of shares outstanding.

There are currently 6.8 million shares sold short, which equates to 4% of shares outstanding and just over four days to cover.

Attractive Funds That Hold PPC

The following funds receive an Attractive-or-better rating and allocate significantly to PPC:

- First Trust Consumer Staples AlphaDEX Fund (FXG) – 4.9% allocation and Attractive rating.

- Invesco Food & Beverage ETF (PBJ) – 3.1% allocation and Attractive rating.

- Euclidean Fundamental Value ETF (ECML) – 2.4% allocation and Very Attractive rating.

This article was originally published on April 30, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.