We published an update on this Long Idea on October 31, 2024. A copy of the report is here.

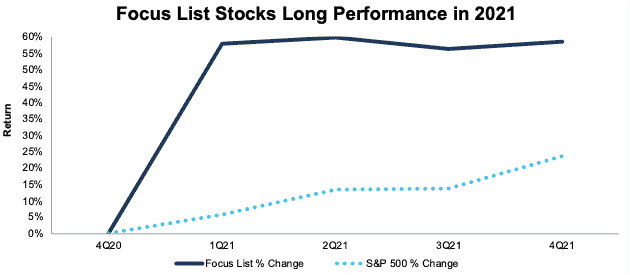

Our Focus List Stocks: Long Model Portfolio outperformed the S&P 500 by 35% in 2021. This report looks at a Focus List Long stock that outperformed in 2021 and is positioned to outperform again in 2022. Recently we highlighted three underperformers from 2021 that remain undervalued, which you can read here.

AutoZone inc. (AZO: $2,000/share) outperformed in 2021 and still presents quality risk/reward. We also feature two other Focus List stocks that outperformed in 2021, General Motors (GM) here and HCA Healthcare (HCA) here.Focus List Stocks Outperformed in 2021

The Focus List Stocks: Long Model Portfolio contains the “best of the best” of our Long Ideas, and leverages superior fundamental data[1], which provides a new source of alpha. The current Model Portfolio is available here while real-time updates are available to Pro-and-higher members.

The Focus List Stocks: Long Model Portfolio returned[2],[3], on average, 58% in 2021 compared to 23% for the S&P 500, per Figure 1.

Figure 1: Focus List Stocks: Long Model Portfolio Performance from Period Ending 4Q20 to 4Q21

Sources: New Constructs, LLC

Because our Focus List Stocks: Long Model Portfolio represents the best of the best picks, not all Long Ideas make the Model Portfolio. We published 66 Long Ideas in 2021 but added just six of them to the Focus List Stocks: Long Model Portfolio during the year. Currently, the Focus List Stocks: Long Model Portfolio has 39 stocks.

Figure 2 shows a more detailed breakdown of the Model Portfolio’s performance, which encompasses all the stocks that were in the Model Portfolio at any time in 2021.

Figure 2: Performance of Stocks in the Focus List Stocks: Long Model Portfolio in 2021

Sources: New Constructs, LLC

Performance includes the performance of stocks currently in the Focus List Stocks: Long Model Portfolio, as well as those removed during the year, which is why the number of stocks in Figure 2 (45) is higher than the number of stocks currently in the Model Portfolio (39).

Outperforming Focus List Stock: AutoZone (AZO): Up 77% vs. S&P 500 Up 27% in 2021

We added AutoZone to the Focus List Stocks: Long Model Portfolio in November 2019, and the stock outperformed the S&P 500 by 50% in 2021. Despite large gains in 2021, we see more upside in the stock as the company is positioned to extend its decades-long profit growth even further. See our most recent report on AutoZone here.

Main Reason for Outperformance: Retail and Commercial Demand for Used Cars: In a year plagued by supply issues for new vehicles, demand (and prices) for used cars, which require more maintenance, soared. AutoZone is positioned to benefit from such growth in both retail and commercial markets. AutoZone has successfully leveraged its retail store footprint to drive sales growth in its commercial business, and, as of fiscal 1Q22, the company had expanded its domestic wholesale program to 86% of its retail markets.

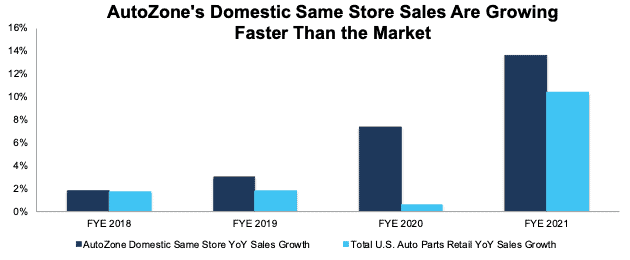

Per Figure 3, AutoZone’s strong domestic revenue growth has led to market share gains. In each year since fiscal 2018, the company has grown its domestic store sales faster than the U.S. automotive parts market.

Figure 3: Change in YoY Sales: AutoZone Vs. Total U.S. Market

Sources: New Constructs, LLC, company filings & FRED

Why AutoZone’s Shares Can Drive Higher: Supply Network Is Increasingly Valuable: AutoZone relies on its large store network and customer service to grow its retail and commercial business. The firm’s larger stores serve as both retail outlets and fulfillment centers that enable smaller stores to offer a larger inventory. This fulfillment network creates a widening moat for the business which is difficult to replicate especially in light of limited warehouse supply.

Furthermore, long-term tailwinds are favorable for the auto repair market. The average age of vehicles on U.S. roads has steadily climbed from 9.6 years in 2002 to 12.1 in 2021. Older vehicles mean increased demand for auto parts as vehicle repair costs tend to increase as cars get older.

The firm’s durable business model has also enabled it to improve its profitability. AutoZone’s ROIC over the past five years has improved from 22% in fiscal 2017 to 34% TTM.

It is also noteworthy that AutoZone reports the truth about its earnings. The firm’s GAAP Earnings of $2.3 billion over the TTM are equal to its Core Earnings. Companies that report the truth about their earnings are more likely to outperform the market.

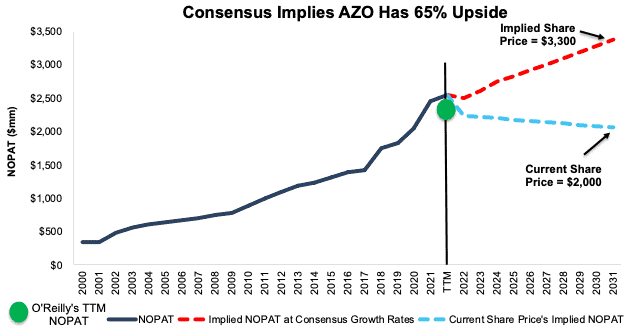

Priced for Permanent Profit Decline: AutoZone’s price-to-economic book value (PEBV) ratio is 0.8. This ratio implies that the market expects AutoZone’s profits to permanently decline by 20%.

Below, we use our reverse discounted cash flow (DCF) model to analyze the expectations for future growth in cash flows baked into AutoZone’s current share price.

In this scenario, if we assume AutoZone’s:

- NOPAT margin falls to 15% (five-year average vs. 17% TTM) from fiscal 2022 – 2031 and

- revenue falls by 1% (vs. consensus expectations for a CAGR of 5% from fiscal 2022 – 2024) compounded annually from fiscal 2022 – 2031, then

AutoZone’s NOPAT falls 4% compounded annually over the next decade, and the stock is worth $2,000/share today – equal to the current price. See the math behind this reverse DCF scenario. For reference, AutoZone has grown NOPAT by 11% compounded annually over the past two decades.

Shares Could Reach $3,300 or Higher: If we assume AutoZone’s:

- NOPAT margin falls to 16% (three-year average),

- revenue grows at a 5% (equal to consensus expectations) CAGR from fiscal 2022 – 2024, and

- revenue grows by 3% (below its 10-year CAGR of 6%) each year thereafter through fiscal 2031, then

the stock is worth $3,300/share today – 65% above the current price. See the math behind this reverse DCF scenario. In this scenario, AutoZone grows NOPAT 3% compounded annually over the next decade.

Over the past decade, AutoZone grew NOPAT by 9% compounded annually. Should AutoZone grow profits closer to historical levels, the upside is even greater.

Figure 4: AutoZone’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article originally published on January 12, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.

[2] Performance represents the price performance of each stock during the time in which it was on the Focus List Stocks: Long Model Portfolio in 2021. For stocks removed from the Focus List in 2021, performance is measured from the beginning of 2021 through the date the ticker was removed from the Focus List. For stocks added to the Focus List in 2021, performance is measured from the date the ticker was added to the Focus List through December 31, 2021.

[3] Performance includes the 1745% increase in GME stock price during its time on the focus list in 2021.