We closed this position on November 18, 2020. A copy of the associated Position Update report is here.

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way

Charles Dickens wrote those words about 18th century London and Paris, but he may as well have been writing about National Presto Industries (NPK: $112/share). The last few years have been the spring of hope for NPK’s thriving Defense segment, but they’ve been the winter of despair for its Housewares/Small Appliances business.

Fortunately for investors, these two segments are totally unrelated. NPK can easily sell off the underperforming Housewares segment – as it has done with poor performing businesses in the past – and become a pure-play Defense company. NPK’s Defense segment is already worth more than the enterprise value of the company, so any price they can get in a sale of the Housewares segment will just be an added bonus for investors. The value that could be unlocked in a spin-off (and even the undervaluation of the combined firm) make NPK this week’s Long Idea.

Accounting Earnings Understate Profit Growth

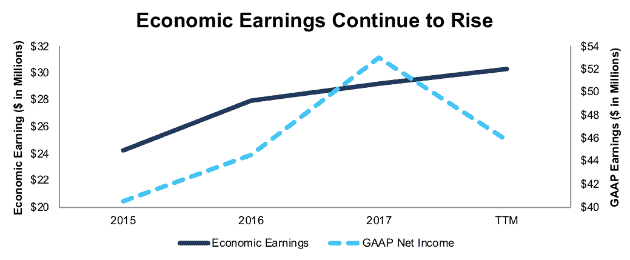

Investors that just look at GAAP net income may be led to believe that NPK’s profitability is in decline. After several years of rising accounting earnings, GAAP EPS declined by 18% over the trailing twelve months (TTM) period.

This GAAP earnings decline is the result of accounting distortions, not any decline in the real cash flows of the business. Figure 1 shows that NPK’s economic earnings have continued their steady upward trend despite the decline in GAAP earnings.

Figure 1: Economic Earnings and GAAP Net Income Growth Since 2015

Sources: New Constructs, LLC and company filings

The main cause for this disconnect is an $8 million non-operating gain on the sale of its Absorbents Products business that artificially increased GAAP net income in 1Q17.

In addition, two hidden items artificially decreased GAAP earnings over the trailing twelve months:

- A $1.25 million increase in LIFO reserves

- A $250 thousand loss on the disposal of property, plant, and equipment.

Combined, these two items account for ~3% of GAAP net income. Once we adjust for these non-recurring expenses, we see that the true cash flows of the business continue to rise.

Defense Segment Carrying the Load

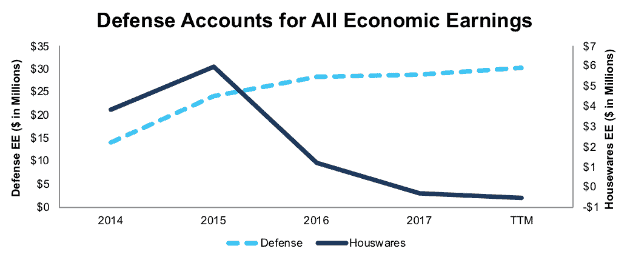

When we analyze the two segments individually, NPK’s fundamentals look even more encouraging. Figure 2 shows that the Defense segment ($30 million economic earnings) has steadily grown to account for more than 100% of the company’s economic earnings, while Housewares (-$1 million economic earnings) now loses value for investors.

Figure 2: Economic Earnings by Segment Since 2014

Sources: New Constructs, LLC and company filings

Growing industry consolidation has steadily squeezed the Housewares business. In 2017, the top 10 home appliance makers held a 66% market share, up from 57% in 2015. Home appliances increasingly require connectivity solutions and technological expertise that a small standalone company such as NPK cannot supply.

This trend has impacted almost every company in the industry. Economic earnings for the eight standalone home appliance companies we cover have declined from $1.1 billion in 2013 to -$700 million TTM.

With no sign of this trend reversing, NPK would be better off selling its Housewares business to a larger conglomerate such as Hitachi or Samsung that could leverage technology to rejuvenate its struggling brands. Selling off Housewares would also leave a best-in-class Defense business that generates more than enough cash flow to support the entire valuation of the company.

Defense Segment Improvement Showcases Its Advantages

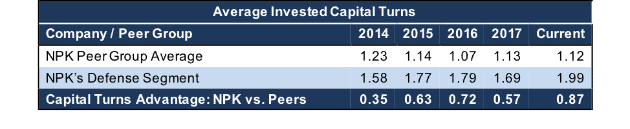

NPK’s Defense segment has a sizeable and growing advantage versus its peers in terms of both capital allocation and cost control. Figure 3 shows that the Defense segment’s invested capital turns (a measure of balance sheet efficiency) have risen since 2014 even as industry averages have declined.

Figure 3: Rising Capital Turns Advantage

Sources: New Constructs, LLC and company filings

NPK’s Defense segment has the third highest capital turns among the 35 defense companies we cover. The company has taken a disciplined approach to capital allocation, preferring to hold on to cash or return it to investors rather than invest in low-return projects. Such prudent management has paid off in the form of superior balance sheet efficiency.

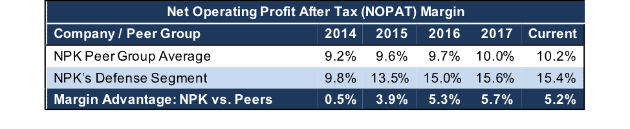

NPK has also excelled at keeping costs low. While the entire industry has experienced rising margins in recent years, NPK’s Defense segment has expanded its after-tax profit (NOPAT) margin at a much more rapid rate.

Figure 4: Rising NOPAT Margin Advantage

Sources: New Constructs, LLC and company filings

NPK CEO Maryjo Cohen is very frugal. She lives in a three-bedroom, poured concrete home with her mother, flies coach, and stays in Holiday Inns when she travels. She’s applied this mindset to the company and done a good job of keeping costs low.

Cost control is especially important for the Defense segment because most of its contracts span several years and are performed on a fixed-price basis. When prices are fixed, cutting costs is the most effective way to improve profitability.

Superior margins and capital turns help NPK’s Defense segment achieve the highest return on invested capital (ROIC) in the industry. No other Defense company generates as much profit per dollar invested in the business.

Superior ROIC Is Correlated with Shareholder Value

Numerous case studies show that getting ROIC right is an important part of making smart investments. Ernst & Young recently published a white paper that proves the material superiority of our forensic accounting research and measure of ROIC. The technology that enables this research was featured in Harvard Business School.

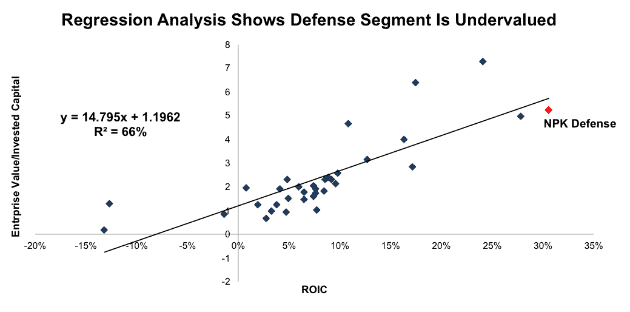

Per Figure 5, ROIC explains 66% of the difference in valuation for the 34 stocks we cover in the Defense sector.[1] Even if we write-off the value of the Housewares segment entirely, NPK’s defense business trades at a discount to its peers based on its position below the trend line in Figure 5.

Figure 5: ROIC Explains 66% of Valuation for Defense Stocks

Sources: New Constructs, LLC and company filings

The Defense segment’s enterprise value per invested capital (which is a cleaner version of price to book that does a better job of capturing the capital invested in the business) implies that the market expects its ROIC to decline from 31% to 27%.

If the Defense segment were to trade at parity with its peers, it would be worth $121/share, or 6% above the current share price. Given its status as the most profitable company in the industry, we would argue that it deserves to be valued at a premium to its peers.

On top of that value, the Housewares segment should still have some value to an acquirer despite its struggles. NPK was able to sell its struggling Absorbents business in 2016 for $67 million, which was slightly more than the carrying value of that segment’s assets. If Housewares fetches the value of its non-cash assets, or ~$80 million, that would add another $11.50/share of value to NPK, creating a total value for the company of ~$133/share, a 16% premium to the current stock price. This combined value sets a conservative baseline valuation for the company as a whole.

Valuation Implies Low Growth Expectations

At its current price of ~$114/share, NPK has a PEBV of 0.9, which implies that the market expects NOPAT to permanently decline by 10%. This pessimistic expectation is unwarranted, especially when one considers the significant tax cut NPK is set to receive. NPK has a cash tax rate of 33%, above the industry average of 28%, which means it should benefit more from tax reform than most of its peers.

If NPK sells the Housewares segment this year, and the Defense business grows revenues at a long-term rate of 4% compounded annually for the next ten years, while maintaining its pretax margin of 23% and benefitting from a reduction of its tax rate to 21%, the stock is worth $171/share today, 50% above the current share price. See the math behind this dynamic DCF scenario here.

We think NPK would be better off selling its Housewares segment, but even if the company keeps the businesses together, it should still be able to exceed the low expectations implied by its stock price.

Even if we project the decline in Housewares to be a drag on NPK’s pre-tax margin and revenue growth, the stock still has significant long-term value. If pre-tax margins for the company fall from 19% to 18%, and revenue grows by 3% compounded annually for the next decade, the stock is worth $161/share, 41% above the current stock price. See the math behind this dynamic DCF scenario here.

Bear Case Is Overblown – Defense Spending is Not Falling Off a Cliff

NPK is a small-cap company that has not invested in a lot of PR. Management doesn’t do earning calls, and the stock has no sell-side coverage. As a result, the few reports that get published can have an outsized impact on the stock. Such is the case with last November’s bearish article posted on the company in the Value Investors Club.

The article exaggerated minor changes to the company’s 40mm ammunition contract with the Department of Defense to argue that Defense segment revenues were about to fall off a cliff. This report sent the stock down over 10%.

In reality, the DoD used other companies for its training ordinance, which was a small part of NPK’s business to begin with, but it retained NPK as the sole prime contractor for live action rounds. The continued strength of the Defense segment through Q1 shows the fallacy in this bear case.

40mm orders may decline somewhat over the life of the new five-year contract that was signed last year, but NPK has expanded its Defense segment in other areas, such as detonators, booster pellets, and Load, Assemble and Pack (LAP) operations on ordnance related products. The fickleness of government contracts adds an element of risk to any Defense company, but there’s no special reason to believe that NPK’s business will decline in the coming years.

Tax Cuts Could Spur New Investment and Growth

As mentioned above, NPK has historically been a very cautious company when it comes to capital allocation. In fact, during the mid-2000’s they were threatened with being reclassified as an investment company due to the large amount of cash held on the balance sheet.

Currently, NPK is sitting on $139 million (18% of market cap) in excess cash. The lower corporate tax rate should open up more opportunities for NPK to invest that money in projects that earn a suitable ROIC. New investments or acquisitions in the Defense segment could spur growth to send shares higher. The recent $61 billion increase to the Pentagon budget should create more opportunities for the Defense segment to win new business.

A successful sale of the Housewares segment, especially at a higher-than-expected price, would also be a positive catalyst for the company. NPK could reinvest the proceeds of that sale, raise its dividend, or buyback its undervalued shares.

More Transparency Would Improve Corporate Governance

While NPK is a public company, it is run in many respects like a family business. Maryjo Cohen took over the company from her father Melvin in 2002, and she owns 27% of the outstanding shares. NPK does not hold regular earnings calls, puts out very short press releases, and does not have a dedicated investor relations site.

In some respects, this structure has been a positive. Avoiding the distractions from playing the quarterly earnings game allows management to take a disciplined approach to capital allocation. Cohen earns a relatively small salary of just $600 thousand per year, and she doesn’t have large bonuses tied to easily manipulated metrics such as Adjusted EBITDA.

However, the lack of transparency does create problems for investors. The bearish article in the Value Investors Club probably wouldn’t have had as big an impact if NPK gave a more thorough breakdown of the contracts and outlook for the Defense segment. More transparency would be a long-term positive for the stock price.

In addition, we’d like to see more disclosure surrounding executive compensation. NPK relies mostly on regular salaries to compensate executives, but it does occasionally award discretionary bonuses. Rather than making these awards on an ad-hoc basis, NPK should tie bonuses to metrics that have a clear link to shareholder value, such as ROIC.[2]

Dividend Yield Tops 5%

NPK pays a regular dividend of $1/share, and it recently paid a special cash dividend of $5/share on top of that, for a dividend yield of 5.3%. While special dividends are by definition non-recurring, NPK has paid out an additional amount on top of its regular dividend in each of the past four years. With plenty of cash on hand and a 4.5% free cash flow yield, there’s no reason to expect NPK to cut back on its dividend payment in the future.

Minimal Insider Trading and High Short Interest

Insider activity has been minimal over the past 12 months with four thousand shares acquired and no shares sold. These purchases represent less than 1% of shares outstanding.

There are currently 974 thousand shares sold short, which equates to 19% of the float and 27 days to cover. The high short interest means that a positive catalyst, such as a new contract, earnings beat, or a sale of the Housewares segment, could lead to a rapid rise in the stock as shorts scramble to cover.

Critical Details Found in Financial Filings By Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[3] findings in National Presto’s 2017 10-K:

Income Statement: we made $16 million of adjustments, with a net effect of removing $10 million in non-operating expense (3% of revenue). We removed $13 million in non-operating income and $3 million in non-operating expenses. You can see all the adjustments made to NPK’s income statement here.

Balance Sheet: we made $167 million of adjustments to calculate invested capital with a net decrease of $125 billion. Outside of the excess cash mentioned above, the most notable adjustment was adding back $17 million in accumulated asset write-downs. This adjustment accounted for 5% of reported net assets. You can see all the adjustments made to NPK’s balance sheet here.

Valuation: we made $144 million of adjustments with a net effect of increasing shareholder value by $143 million. The excess cash mentioned above was the only significant adjustment to shareholder value.

Attractive Funds That Hold NPK

The following fund receives our Attractive-or-better rating and allocates significantly to National Presto Industries.

- Royce Special Equity Fund (RYSEX) – 3.2% allocation and Very Attractive rating.

This article originally published on June 6, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our regression excludes extreme outlier Axon Enterprise (AAXN)

[2] Ernst & Young’s recent white paper “Getting ROIC Right” demonstrates the link between an accurate calculation of ROIC and shareholder value.

[3] Harvard Business School features the powerful impact of our research automation technology in the case study New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.