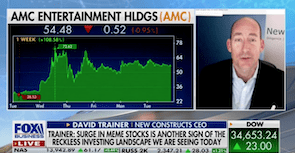

Focus List Stocks: Short – Update 6/16/21

We’ve made the following update to our Focus List Stocks: Short Model Portfolio as of June 16, 2021.

Kyle Guske II, Senior Investment Analyst, MBA