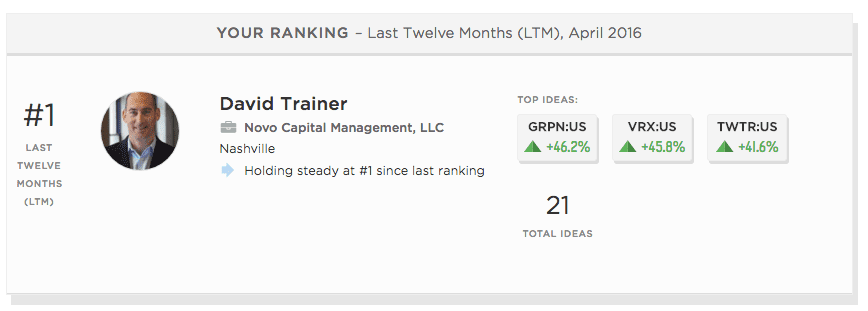

New Constructs #1 Stock Picker – April 2016

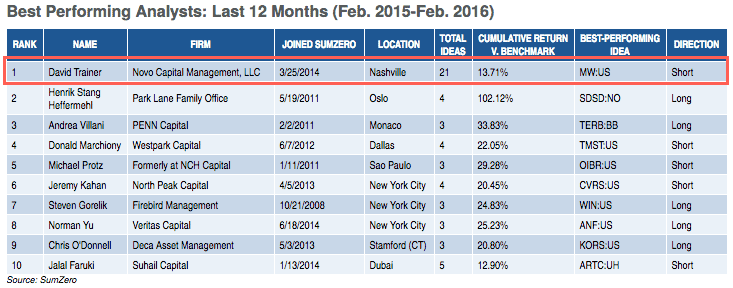

The latest rankings are out and New Constructs' CEO David Trainer is April's #1 ranked stock picker over the last twelve months (LTM) per SumZero Rankings.

Kyle Guske II, Senior Investment Analyst, MBA