Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and Marketwatch.com

When executives’ compensation incentives are not aligned with creating shareholder value, you risk having executives whose goals are not aligned with investors. The consequences of such misalignment are behavior like what we are seeing with Valeant (VRX), whose stock is down 74% YTD and whose internal controls may get a qualified opinion by their auditor. The primary culprit for this kind of misalignment is the compensation committee. They are responsible for designing, approving and recommending to the Board of Directors the executive compensation plans for companies. They make the rules that the executives play by.

We know that Valeant is not the only company with misaligned executive incentives. There are many others, many of which have already been put in the Danger Zone and some who will go into the Danger Zone soon. This week, however, compensation committees land in the Danger Zone because of the role they play in creating the problems that lead to shareholder value destruction.

Here’s How Non-GAAP Performance Goals Misalign Executive Behavior

From a recent release by Valeant:

“The tone at the top of the organization and the performance-based environment at the company, where challenging targets were set and achieving those targets was a key performance indication, may have been contributing factors resulting in the company’s improper revenue recognition.”

The “tone at the top” wasn’t simply a performance-based environment that led to issues. All executives should strive to achieve certain “performance goals.” The problem comes from what type of performance was emphasized, in particular, achieving non-GAAP targets that fail to reflect actual business operations. In it’s most recent proxy statement, the goals for achieving cash and/or stock bonuses at VRX ranged from:

- Total shareholder return

- Revenue growth

- “Do at least one significant deal that creates substantial shareholder value”

- “Cash EPS” – Valeant’s term for non-GAAP EPS

None of these goals lead to generating the cash flows Valeant needs to pay its debt holders. In reality, they are straw men for corporate performance with no real connection to the economics of the business. The result of these misaligned goals manifests in a major divergence between real cash flows and Valeant’s “cash” (i.e. fake) earnings.

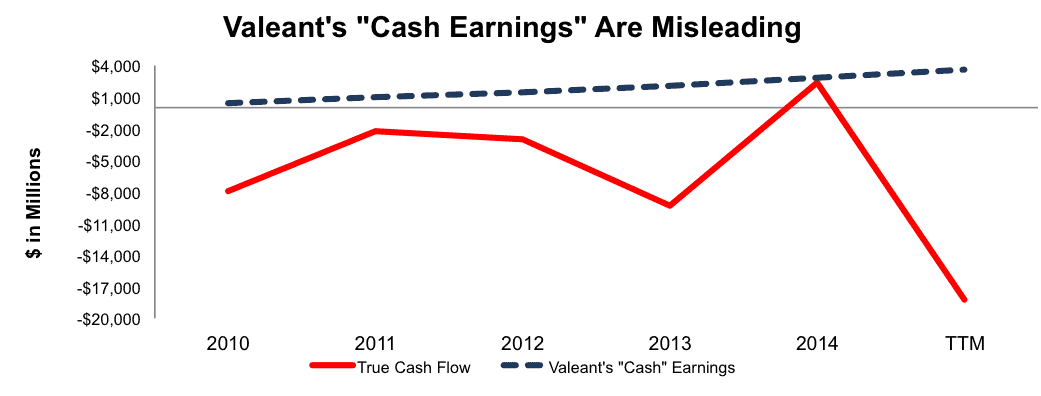

Figure 1: Executives Grow “Cash” Earnings At Expense of Real Cash Flows

Sources: New Constructs, LLC and company filings

From 2010 to the trailing twelve months, Valeant grew “cash” earnings from $421 million to $3.55 billion. At the same time, free cash flow was positive only once, and, cumulatively is -$38.4 billion.

Of all the goals, the worst for shareholders is, ironically, “Do at least one significant deal that creates substantial shareholder value” because there was no accountability for the amount management would pay for acquisitions. As a result, executives could exploit the hi/lo fallacy to boost earnings while gouging profits.

The only thing worse than a bad rule is not enforcing the rules. Valeant executives got paid for the Allergan deal even though Valeant failed to actually acquire Allergan (a deal that would not have created shareholder value even if it had gone through).

Essentially, executives received the “significant deal” bonus with an “A for effort” note attached. In total $14.3 million was paid under the annual cash incentive program in 2014 and total compensation across five executives totaled $122.9 million. Compare this with 2013, when four executives were paid “only” $23.8 million.

In hindsight, what happened at Valeant almost looks inevitable given the misalignment of their performance goals and creating shareholder value.

Compensation Committees Fail Across The Board

VRX’s “tone at the top” admission may be rare, as only four other companies have used such language from 2010-2015 in their Internal Controls of Financial Reporting opinions. We cover four of these five companies, and each of them receives a Dangerous rating and has for quite some time. However, compensation committee’s creating a misalignment of interests is widespread and often surfaces in companies that land in the Danger Zone. Since 2014, 53 out of 69 companies placed in the Danger Zone have executive compensation plans directly related to non-GAAP metrics. A sampling of these metrics include:

- Adjusted EBITDA

- Adjusted operating income

- Adjusted Net Income

- Core Sales Growth

- Normalized Gross Margin

- Non-GAAP Net Revenues

- Total Bookings

- Customer Satisfaction

- # Of Customers

- Club Openings

- “Financial Operations Efficiency”

- Dollar retention

- Manufacturing Cash Flow

- Adjusted Free Cash Flow

- Organic Net Revenue Growth

The large number of Danger Zone companies with poor executive pay plans is no coincidence. If compensation committees set goals misaligned with shareholder interests, it is only natural for executives to focus more on what their best interests, i.e. pay, instead of shareholders’ interests, i.e. real cash flow. This divergence of interests expands over time as executive’s efforts to compensate themselves at the expense of shareholders compound over the years. Figure 2 shows the five worst performing Danger Zone picks since 2014.

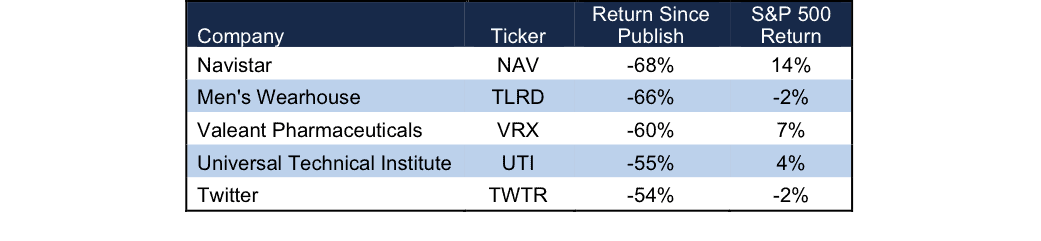

Figure 2: Worst Performing Danger Zone Stocks Since 2014

Sources: New Constructs, LLC and company filings

Navistar (NAV) pays executives based on adjusted EBITDA margin and revenue growth. Men’s Wearhouse (TLRD) paid executives for meeting EBIT growth, excluding the Jos. A Bank acquisition. Valeant Pharmaceuticals (VRX) compensation committee emphasized “Cash” EPS and revenue growth. Universal Technical Institute (UTI) incentivized executives to meet EBIT, graduate placement, and completion rate goals while Twitter (TWTR) pay was solely at management discretion, with 99% of pay tied to equity-based compensation.

Unfortunately, only four of the 69 Danger Zone companies referenced above include return on invested capital (ROIC) in their executive compensation plans. ROIC is a metric that has been proven to create shareholder value, links corporate performance to valuation, and, we believe, should be the first are foremost measure for executive compensation.

Misaligned Compensation Undermines the Integrity of the Capital Markets

We believe that the purpose of the capital markets is to allocate capital to its most efficient use. The best way to quantify “the most efficient use” is through ROIC, which measures the return of cash flow per dollar of capital invested. When compensation committee’s align incentives with goals that fail to create true value, they undermine the integrity of capital markets. Investors must trust the agents of capital (i.e., executives) to focus on earning the highest return per dollar invested, and thereby growing shareholder value. When this trust is broken, through misaligned incentives, Pandora’s box is opened to any number of untrustworthy actions.

Worse yet, misaligned incentives tend to attract executives that are more likely to misbehave. Truly good managers will naturally want to maximize shareholder value. That is their purpose, not maximizing non-GAAP EPS for a few quarters to get the big annual bonus. This short-term focus mirrors the compensation and mindset of hedge fund managers, who can earn massive performance bonuses for outperforming in any given year. With the ability to earn hundreds of millions in compensation in just a few short years, executives can, and will, take actions with little regard to the future. If events take a turn for the worse, as in the case of Valeant, executives can ride off with little fear of losing the large compensation they received during their tenure as clawback rules are rarely enforced.

Investors Need To Be Aware of Poor Executive Compensation

It’s a known fact that executives will manipulate earnings. One of the top reasons for manipulation is to meet bonus targets, which makes transparency and details on executive compensation material information to investors. We include a compensation analysis in each of our Danger Zone reports. it is important to note that the risk of a Valeant-type episode exists for every company with misaligned executive compensation. Sometimes, the risk is more obvious, such as the case of Jarden Corporation (JAH), whose entire business model was built upon growing “adjusted EPS.” Adjusted EPS was also the main determinant of executive pay. While growing adjusted EPS, the company’s economic earnings remained negative and were only getting worse.

Other firms, such as Qlik Technologies (QLIK), have larger issues such as deteriorating margins and little competitive advantage. By itself, focusing on non-GAAP metrics is no more a red flag than normal. However, alarms go off when the compensation committee states in the Proxy Statement:

“Over the past three years, we have increased our emphasis on non-GAAP operating profit and we now reward our executive officers for over-performance of this key financial measure”.

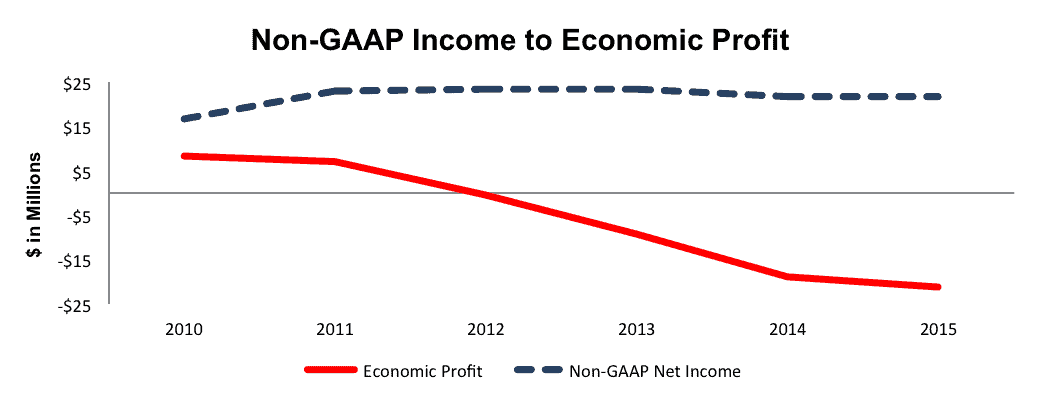

Not surprisingly, Qlik’s GAAP net income, net operating profit after-tax (NOPAT), ROIC, and economic earnings have declined as the company has focused more on non-GAAP metrics. Figure 3 below shows the disconnect between true profits and non-GAAP net income.

Figure 3: Qlik’s Non-GAAP Illusion

Sources: New Constructs, LLC and company filings

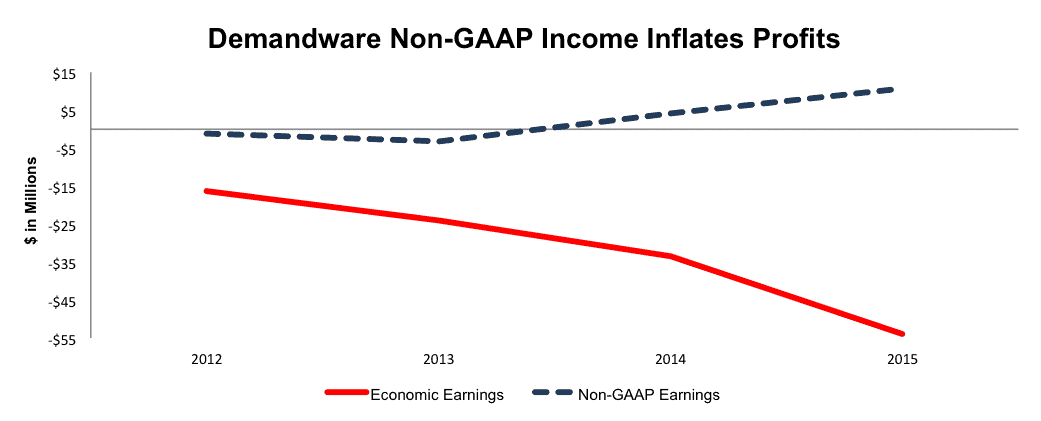

Another company we’ve exposed for their egregious use of non-GAAP metrics is Demandware (DWRE). The compensation committee at Demandware has aligned executive interests with non-GAAP EBITDA and dollar renewal percentage. Figure 4 shows that non-GAAP net income has grown from -$1 million in 2012 to $11 million in 2015 while economic earnings have declined from -$16 million to -$55 million.

Figure 4: Demandware’s Non-GAAP Nonsense

Sources: New Constructs, LLC and company filings

Compensation Committee’s Lack Accountability

At the end of the day, compensation committee’s need to be held accountable. Currently, members of the committee are tightly tied to executives. In the case of Jarden, we noted in our Danger Zone report that the three largest recipients of a bonus tied to a non-GAAP metric also held seats on the Board of Directors. The group that was supposed to protect the interest of shareholders was instead comprised of executives that can vote to give themselves larger bonuses. That is not how corporate governance should work.

It is clear that many compensation committees are failing shareholders. We will continue to find these companies and highlight them in the Danger Zone so our clients can make more informed investment decisions.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: 401kcalculator.org (Flickr)

3 replies to "Danger Zone: Compensation Committees"

Excellent article guys!

This should be required reading for all directors, executives and investors.

A piece of the mosaic that shows us why some get rich unethically at the expense of others. Nice job.

Forbes article calling out the exec comp plan of VRX as the culprit for the company and stock’s fall: http://www.forbes.com/sites/nathanvardi/2016/04/13/valeant-pharmaceuticals-prescription-for-disaster/#10e22d966c65

We are not the only ones pointing out the corporate governance issues.