American Express (AXP $59/share) is undervalued compared to the broader market and relative to the firm’s potential.

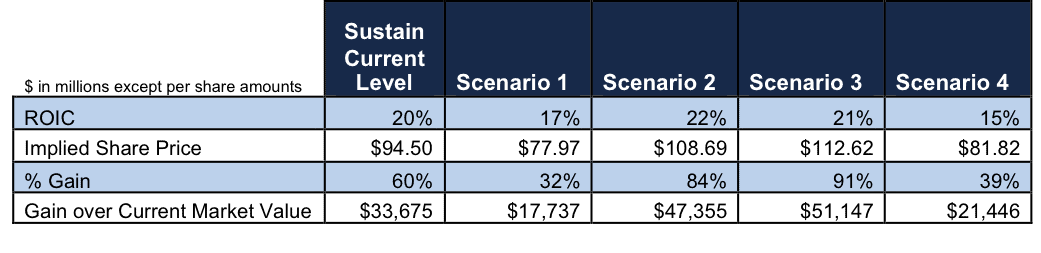

Thesis: Management can boost the market value of AXP in the amounts below[1] by aligning the firm’s strategy and performance compensation with real cash flows or what we call return on invested capital (ROIC).

Our thesis is predicated on the ideas that (a) real cash flows matter and (b) superior profitability is ultimately rewarded by the market.

While these ideas are by no means new, they are underappreciated these days for a variety of reasons, including the difficulty in applying them with scale. Nevertheless, if you think cash flow matters, we expect you will find our thesis on AXP and ROIC compelling. We believe our proposals are very reasonable and American Express’s management is well positioned to realize the potential value of implementing our proposals.

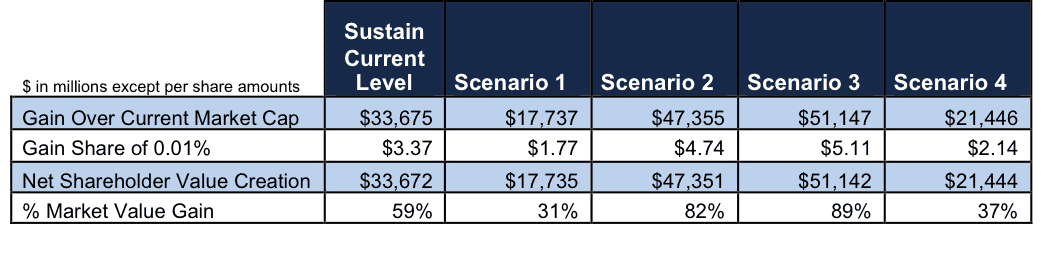

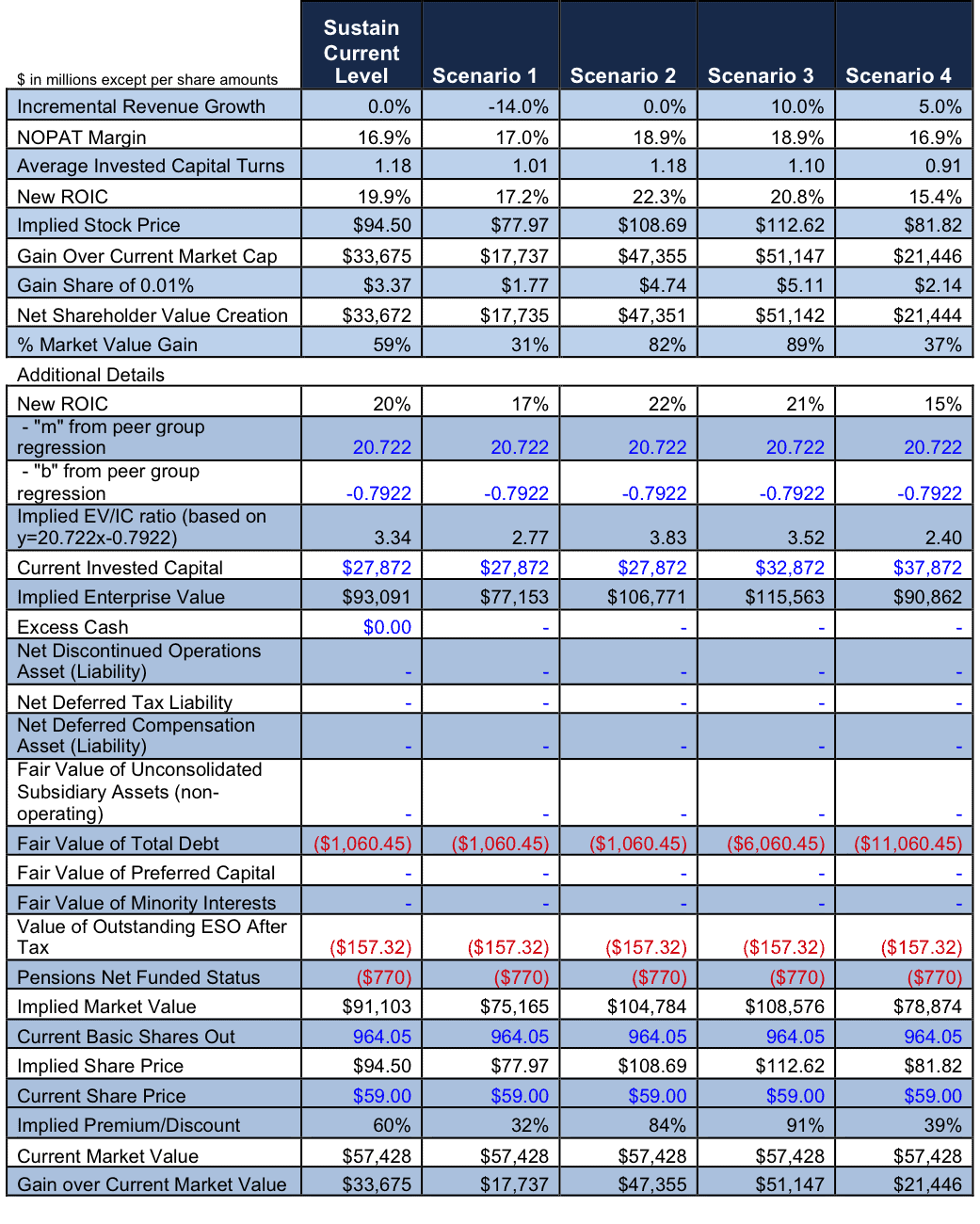

Figure 1: Value Creation Potential for AXP Management

Sources: New Constructs, LLC and company filings.

We support our thesis by showing:

- How undervalued AXP is relative to real cash flows and ROIC

- How to ensure the market rewards a higher ROIC

- Targeted proposals on how management can improve ROIC

- How to quantify the size of the prize if management improves ROIC

1. How Undervalued Is AXP?

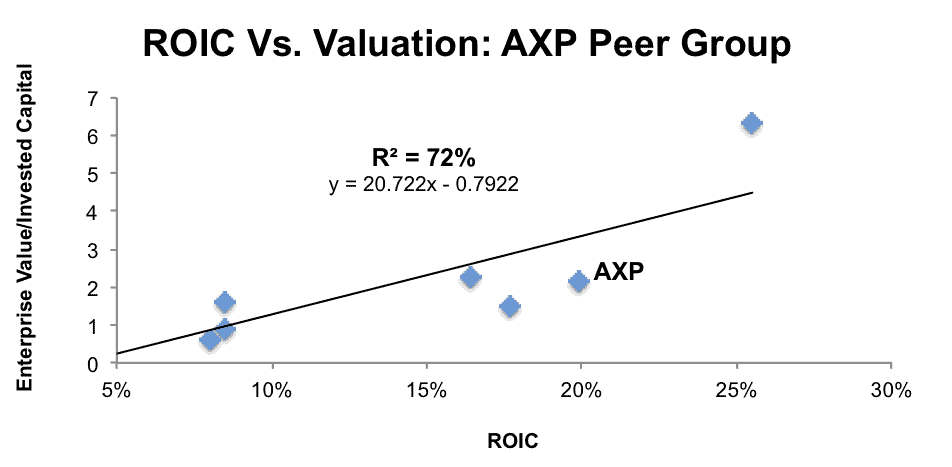

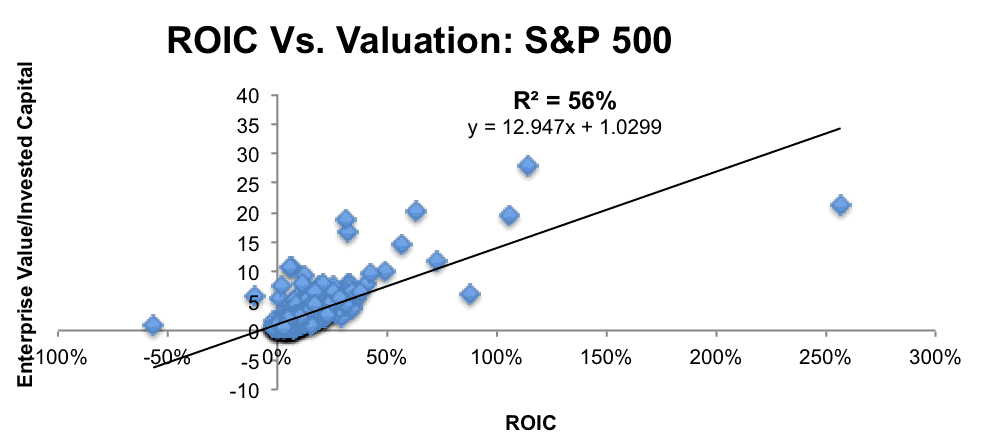

We find the relationship between ROIC and stock valuation intuitive. Over the long term, the market assigns the most value per dollar invested to the companies that produce the most cash per capital invested. Statistical analysis (see Figure 2 and additional Figures in Appendix B) shows that the biggest driver of stock valuation is, by far, ROIC.

Figure 2 also shows that AXP is among the cheapest of its peers and that ROIC explains 66% of the changes in stock valuation for AXP and its peers.

Figure 2: AXP Is The Cheapest Of Its Peers

Sources: New Constructs, LLC and company filings.

In Appendix B, we provide further evidence for the explanatory power of ROIC and stock market valuations.

So What Is the Stock Worth?

Based on the linear equation from Figure 2, the stock is worth ~$94/share if we assume that AXP can maintain its current ROIC of 20%. That upside translates into an additional $34 billion in market cap or $35 per share for investors.

The other way to interpret Figure 2 is to assess what the stock market is telling us by valuing AXP at $59/share. By assigning AXP an Enterprise Value/Invested Capital (a cleaner version of price-to-book) ratio of 2.13, the market is saying that it believes AXP’s ROIC will permanently decline to 14%[2].

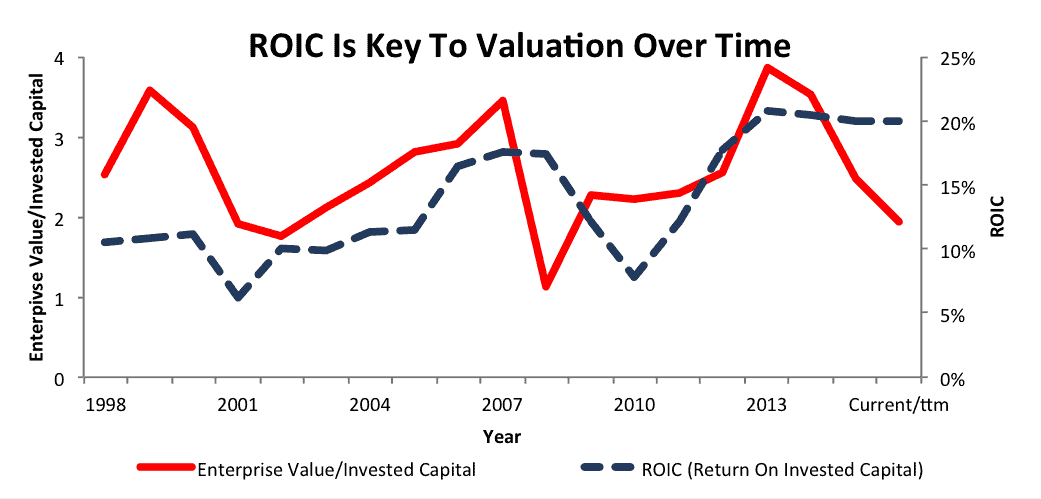

The strong correlation between ROIC and AXP’s stock price shows there is big upside for shareholders if management can convince the market it is focused on boosting ROIC.

Such a switch in focus is not necessarily easy. The prevailing focus of the stock market over the last several years has been on more technical measures of stock price performance. On the rare occasions when fundamentals are a topic of conversation, they are usually discussed in terms of non-GAAP cash flow or earnings per share (EPS) instead of ROIC.

There has been a lack of focus by the markets on long-term, rigorous fundamental research for some time. As a result, most management teams focus instead on what analysts and investors ask for.

This opens the door for those managers who want to be ahead of the curve and earn premium valuations by focusing on ROIC. If you don’t buy into the regression above, then Figure 3 should convince you of the importance of ROIC for AXP. The strength of the relationship between ROIC and valuation up until recently is evident.

Figure 3: ROIC Is Highly Correlated With AXP’s Valuation

Sources: New Constructs, LLC and company filings.

Markets No Longer Believe in Sustainability of AXP’s ROIC

From 1998 to 2014, AXP increased its profitability and valuation at a solid rate, with significant dips mirroring the market in 2001 and 2008. That relationship changed in 2014. For the past two years, AXP has maintained its impressively high ROIC of 20%, but the stock has fallen nearly 50%.

Even though profits remain high, investors appear to be convinced that the company’s ROIC will decline in the near future. This fear stems from a number of developments, including the loss of Costco (COST) and JetBlue (JBLU) cobranded card partnerships and an adverse court ruling that prohibits AXP’s “nondiscrimination provisions” in contracts with merchants.

Essentially, the court ruling will allow businesses that accept American Express to encourage shoppers to use other cards, including charging customers that use American Express higher prices. Businesses want this change because American Express charges significantly higher merchant fees—about 1% more of the sale—than competitors Visa (V) and MasterCard (MA).

These higher fees finance generous rewards programs, which have helped American Express to attract high-income, high-value customers and forced (most) merchants to begrudgingly accept it as payment. Now, the court ruling and the loss of two valuable cobranded partnerships raises the possibility that American Express might have to lower its fees in line with the competition.

As a result, AXP has seen a massive drop in its stock price despite two years of excellent profitability due to mounting concerns over the sustainability of its margins, ROIC and overall business model. The company has responded with a reorganization plan to cut $1 billion in expenses, but more work remains to be done if it wants to prove the value and sustainability of its ROIC to investors.

2. How to ensure the market rewards the focus on ROIC

We believe the majority of sophisticated investors would enthusiastically welcome a return of focus on ROIC by management teams. In the mid 1990s, there was a large movement in the corporate community to focus on shareholder value. Unfortunately, this movement was overshadowed by the tech bubble and has never really recovered.

To get credit for focusing on ROIC, management needs to effectively communicate this shareholder value-based strategy to the investment community and show they are dedicated to it.

Investors are looking for four things when assessing management’s focus on ROIC:

- Leadership: the focus on ROIC needs to start at the top, with the CEO. If the boss doesn’t back the plan, then it is hard to believe that everyone else will.

- Tie to capital budgeting: every capital allocation decision needs to pass the “Net Present Value” test, which measures whether ROIC is greater than WACC, i.e. expected cash flows are high enough to cover all costs, including the cost of equity capital.

- Tie to compensation: linking compensation to ROIC shows management wants to be accountable for the real drivers of valuation and sends a strong message about its priorities.

- Communication: In addition to highlighting EPS growth, revenues, and other traditional metrics, management should highlight ROIC and how it is driving improvement of that metric.

Indeed, showing a clear link between management’s strategy and creating value for shareholders will likely compare well to the typical Wall Street road show. The more detailed that management can be about how it is driving a focus on ROIC through the organization, the more it can impress investors and the more likely it can earn a premium valuation.

We think investors would be impressed by a management presentation with an emphasis on improving ROIC over the long term, as they were when Google became Alphabet.

We also think the size of the prize is large enough to warrant management’s attention. Below, we provide a framework for articulating to investors how management can drive increases in ROIC.

3. Targeted proposals on how management can improve ROIC and how much value that creates

Figure 1 shows how much the stock can gain if management convinces investors it can achieve four different levels of ROIC. The first scenario was covered above when we showed the stock price improvement that results from the market believing AXP’s 20% ROIC can be maintained. The other three scenarios are based on management implementing the specific operational proposals below[3].

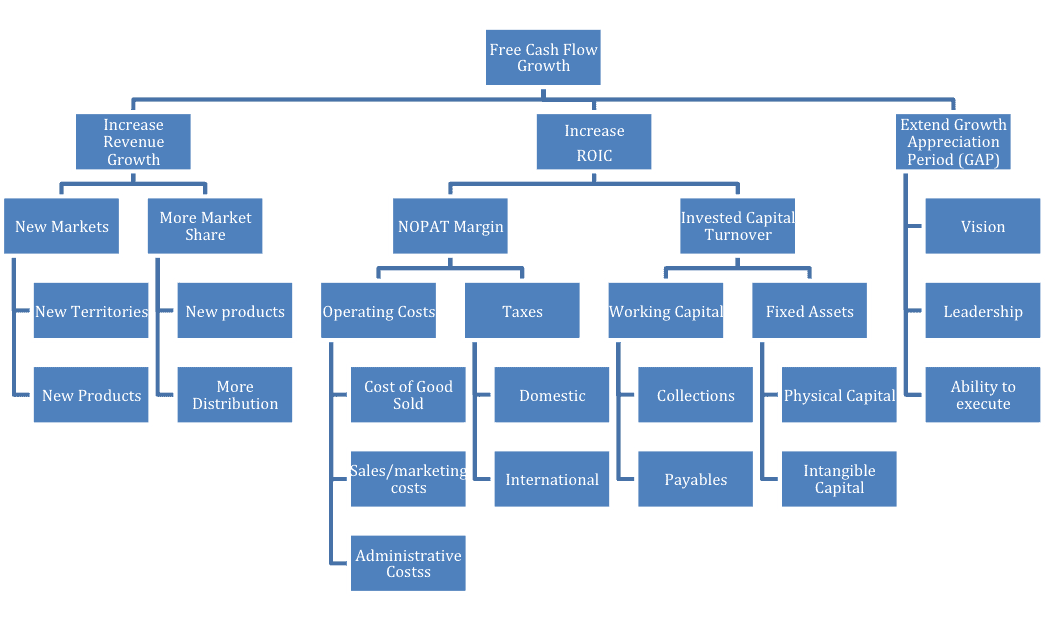

Overall, management wants to maximize future free cash flow. ROIC is not the only driver of future free cash flow, though it is the most important by far. There is even more upside to AXP if management can achieve improvement in all drivers of free cash flow, which we list below.

- Increase ROIC[4].

- Extend the Growth Appreciation Period (GAP). This driver is also known as the Competitive Advantage Period (CAP). It links strategy to valuation and is measured with a dynamic discounted cash flow model.

- Increase revenue growth. This driver is last because it does not add value if the company’s ROIC is not above its WACC[5]. Top line growth is all too often the primary focus of investor attention when it should always be secondary to ROIC.

Per Figure VI in Appendix C, we can break each of these drivers down into more discrete elements of a business. As outsiders, we cannot go as deep as management. However, we recommend management show investors how they directly link the most discrete elements of the business to Free Cash Flow growth. This analysis should apply to each business line or division within a firm as well as the overall firm.

Recommendations for Increasing Free Cash Flow and Creating Shareholder Value

A.Increase ROIC:

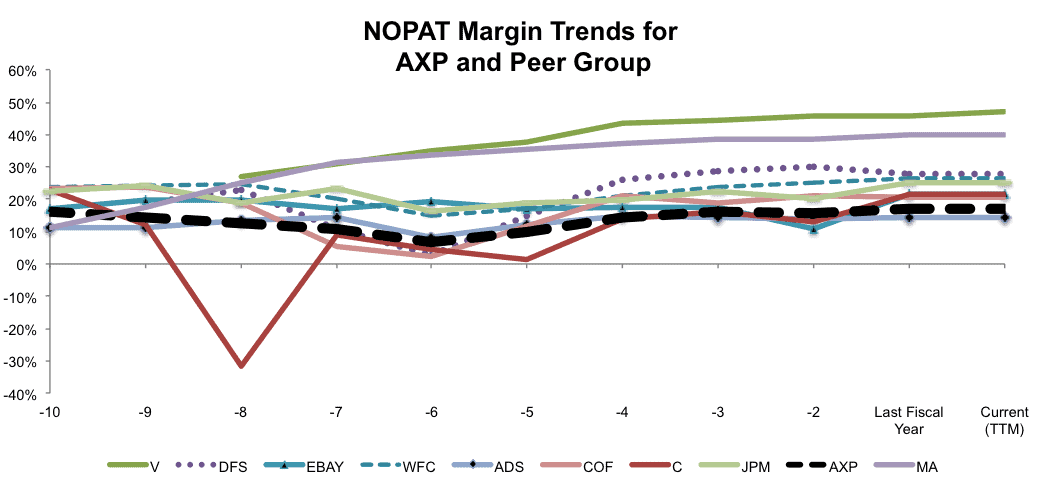

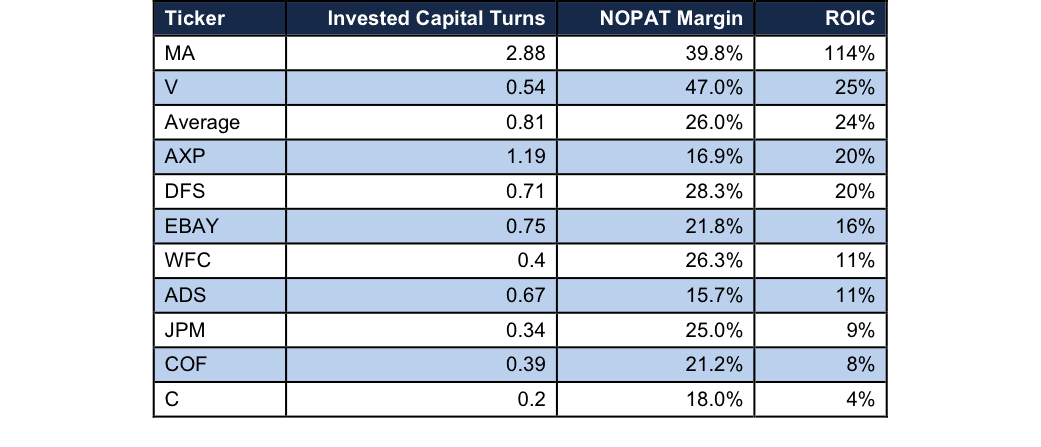

We begin by breaking down ROIC into its prime components – NOPAT Margin and Invested Capital Turnover – so we can provide more targeted advice.

I. NOPAT Margin: Cost Control Already Underway

The company has already stated its commitment to boosting margins by cutting unnecessary costs. However, it’s provided very little detail as to which costs it will cut. Already some organizational shifts have occurred, including the consolidation of the company’s marketing activities, and executives have confirmed that some layoffs are likely as well. AXP’s 17% NOPAT margin last year was its best going back, at least, to 1998, so its management has already shown an ability to cut costs.

Still, cutting $1 billion annually is a big task and will likely require assistance in a number of areas. Consultants that could help AXP reduce costs related to fraud, personnel management, and other overhead could deliver significant value.

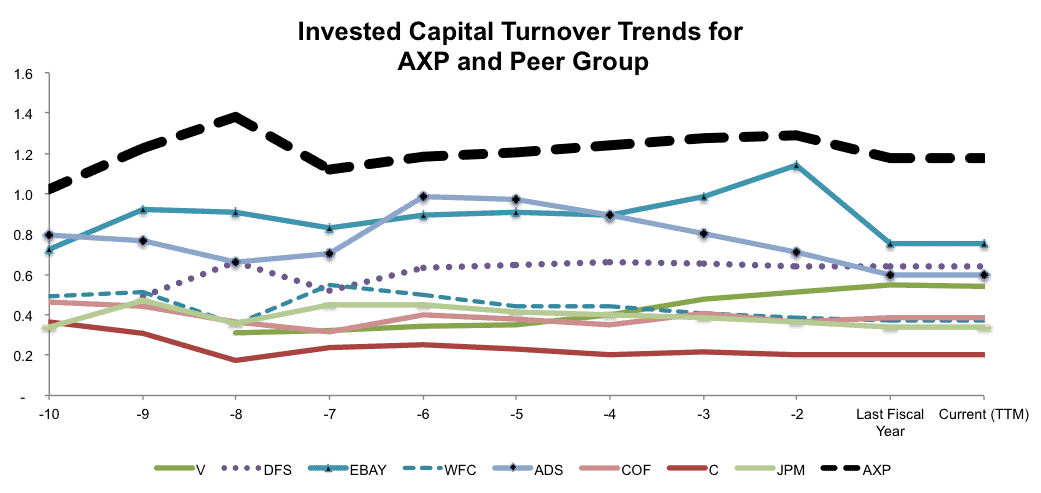

II. Capital Turnover: Focus On Receivables

As shown in Figure 6 below, AXP already has the best capital turnover of its peer group at 1.18 (excepting MA, whose miniscule invested capital takes its numbers off the charts). The company’s high fee, high reward structure and closed-loop model give it an advantage over other card companies on this front.

Financial companies that focus on lending don’t have much control over their capital efficiency, as every loan creates a corresponding asset and liability and regulators impose minimum capital levels. One way for AXP to improve its capital turnover is to become more efficient at collecting Card Member Receivables (which totaled $44 billion last year).

Consultants that could help AXP collect its receivables more rapidly and reduce the amount it has to reserve for potential loan losses (currently $1 billion) could deliver value by delivering more revenue for the same amount of capital on the balance sheet.

B. Increase Revenue Growth

Within the discipline of improving ROIC, we can propose strategies for growing revenue. Growing revenue without regard to whether or not ROIC exceeds WACC can lead to shareholder value destruction. Per Figure VII in Appendix C, the company can grow revenue by selling into new markets or creating new products. These goals can be accomplished in many ways. The one way we recommend that management not grow the top line is by acquisition given the negative impact on ROIC.

One way to grow in the near-term for AXP would be to expand and leverage the power of its brand, which management clearly views as one of its key competitive advantages. The company’s self-selected peer group in its proxy statement includes “iconic global consumer brands” such as Coca Cola (KO), Nike (NKE), and Disney (DIS).

Declining sales, along with the loss of Costco and JetBlue, suggest that AXP’s brand may have lost its cache among high-end consumers. Successful marketing efforts to restore the prestige of its brand could pay off.

International markets represent another compelling growth opportunity. AXP brought in just $4.7 billion in revenue (14% of total revenue) from its international card services division last year. Compare that to Visa (V), where 47% of revenue comes from outside the U.S.

Expanding into new markets could help AXP grow revenue and potentially even increase its NOPAT margin, as the company pays significantly lower taxes abroad than it does in the U.S.

C. Extend Growth Appreciation Period (GAP)

Whereas revenue growth and ROIC can be measured concretely, GAP is harder to quantify. With the right tools, though, we can calculate the future cash flows required to justify a given stock price. Our dynamic DCF model gives us a “market-implied GAP” that shows how many years of profit growth the market embeds in share prices. This model also allows us to measure the concrete amount of value created or lost by extending or shortening GAP. While we can discretely measure the impact of GAP on valuation, we do not pretend we can predict what GAP will be. Ultimately, the length of GAP in the stock price will be a function of how well management can convince investors of its ability to sustain a high ROIC. Please refer to section “2. How to ensure the market rewards the focus on ROIC” for our proposal on how to communicate with investors.

GAP clearly seems to be the biggest problem for AXP at the moment. Increasing competition and technological changes in the payments business have raised questions over whether the company has a sustainable competitive advantage anymore.

Addressing the other issues above will take a lot of work, but they’re also relatively straightforward. The path to improving GAP is not so simple, and it will require innovation. Whether that’s embracing mobile payments, leveraging the power of big data, or some innovation not dreamt of yet, AXP needs to prove to the market that it can stay on the forefront of technology and maintain its competitive advantage.

4. How to quantify the size of the prize if management improves ROIC

These scenarios apply to both the existing investments in the business as well as to new investments. The key is to analyze both through the lens of ROIC and its drivers.

Scenario 1: AXP is priced for such a significant decline in profitability that it can deliver significant value simply by declining less than the market expects. A 14% drop in revenue, with no change in margins or invested capital, would give AXP a 17% ROIC and increase its market value by ~$18 billion, for an implied share price of $78.

Scenario 2: AXP’s current $1 billion cost cutting plan would increase its NOPAT margin to 19%. If we assume capital turnover remains at 1.18 or same level as for fiscal year 2015, they would achieve an ROIC of 22%. This 200 basis point improvement in ROIC would increase AXP’s market value by $47 billion and give it an implied share price of ~$109[6].

Scenario 3: Let’s assume AXP invested $5 billion (funded by debt) in innovation that results in 10% revenue growth and an overall improvement to NOPAT margin of 200 basis points. Capital turnover would rise to 1.1, NOPAT margins would rise to 19% and ROIC to 21%. These improvements drive an implied stock valuation of $113/share, which equals an $51 billion increase in market cap.

This innovation could come in many forms. Maybe it’s developing tools that will leverage big data to reduce credit losses or improve customer service. Maybe it’s a mobile payments solution that increases convenience and security for customers. The credit card business may seem somewhat commoditized, but there are significant opportunities for innovation and differentiation that AXP could pursue

The key point of this proposal with respect to innovation is that management must evaluate any new ventures through the lens of ROIC. Given the market’s current expectation, new investments in innovation must yield an ROIC of more than 14% to be accretive to shareholders.

Scenario 4: In this scenario, we analyze the impact of innovation efforts that are not guided by ROIC and shareholder value. To isolate the impact of misguided innovation efforts, we assume that the company can maintain a 20% ROIC on its existing business. In addition, the company invests $10 billion in debt-funded innovation that increases revenue by 5% over 2015.The NOPAT margin stays constant and capital turns are lowered from 1.18 to 0.91. ROIC falls to 15% though NOPAT rises by $275 million.

$275 million in incremental profit divided by a $10 billion investment yields an ROIC of just 3%. This investment would decrease AXP’s overall ROIC by about 450 basis points. As shown in Figure 4, profits might grow from the current level, but shareholder value would be less than if the firm invested nothing in innovation and focused solely on maintaining ROIC for the existing business. In fact, shareholder value in this scenario is barely better than Scenario 1. Committing significant capital at a low return destroys value.

Figure 1 summarizes the value creation opportunities for these four scenarios along with the value of maintaining the current level of ROIC. Appendix A Figure III has details behind all of these calculations.

Figure 4 goes one step further to analyze how management might consider compensating those that help execute the value-creating strategies. Rather than pay traditional rates and fees, one could propose a gain share model to ensure your consulting partners are aligned with increasing ROIC.

The total increases in market value under each scenario are impressive. Offering just 1/100th of a percent of those gains provides a healthy payday to implementation and consulting partners while still handsomely rewarding investors.

Figure 4: Potential Market Value Gains Are Substantial

Sources: New Constructs, LLC and company filings. See Appendix B for details on calculations behind these results.

Note that in each of the scenarios above, we assume that AXP will trade at par (on the regression trend line) with its peers based on its ROIC. The stock would warrant a premium valuation (above the trend line) by virtue of management’s focus on ROIC and its ability to communicate that focus to investors. Either way, we believe we have presented both a very achievable and meaningful opportunity for AXP’s management to create value for investors.

Competitive Strength Vs. Peers Makes ROIC Goals Appear Doable

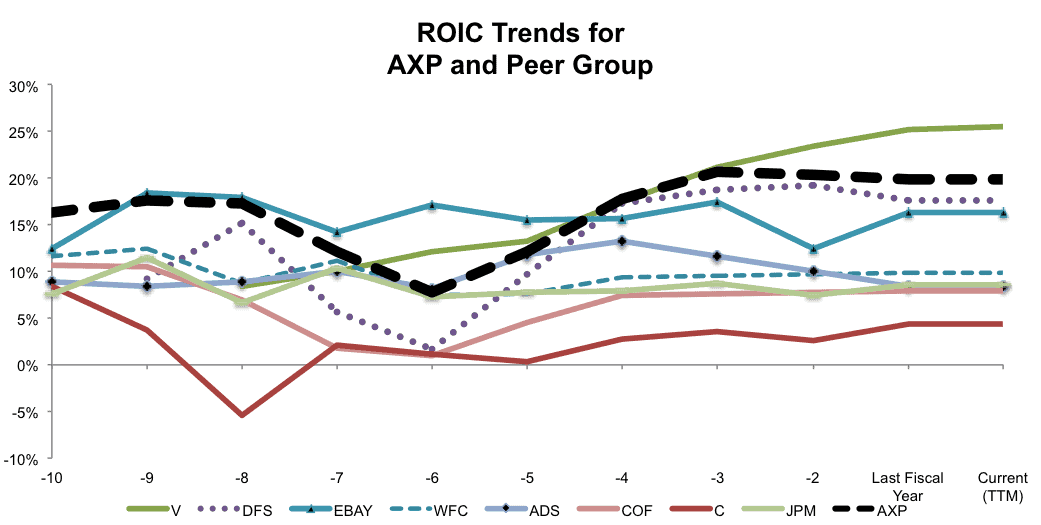

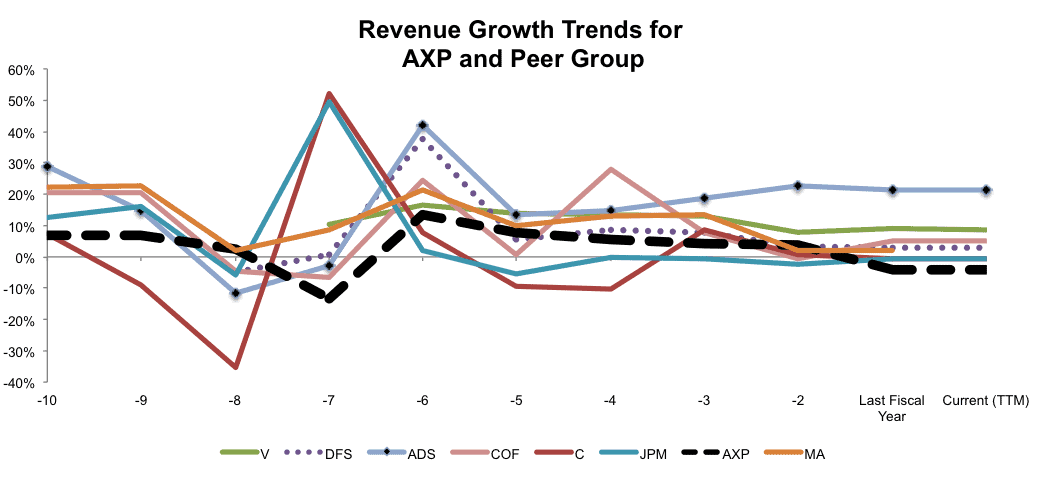

As part of the process for developing specific recommendations on how management can drive free cash flow growth, we review how AXP and its peers have performed along the drivers of free cash flow growth over the past several years.

The consumer credit recovery since the recession has helped the card companies such as Visa (V), Discover (DFS), and American Express hit new highs. (MasterCard (MA) has been excluded from Figure 5 due to its ROIC being so high that it throws off the scale). Meanwhile, larger, more traditional financial institutions have not recovered their pre-crash levels.

Figure 5: Card Companies Hitting New Highs

Sources: New Constructs, LLC and company filings.

Figure 6 shows that AXP’s business model has helped it to consistently beat its peers in terms of capital turnover (again excluding MA and its incredibly small capital base).

Figure 6: AXP Leads The Pack

Sources: New Constructs, LLC and company filings.

On the other hand, AXP’s model also gives it structurally lower margins. AXP’s closed loop system gives it more expenses, and it pays out significant rewards to its customers. See Figure 7.

Figure 7: Near The Bottom For Margins

Sources: New Constructs, LLC and company filings.

Many financial/payments companies continue to grow at a healthy rate, but AXP is starting to see revenue declines (EBAY and WFC are excluded due to the impact of large acquisitions/divestments). See Figure 8

Figure 8: Growth Has Turned Negative

Sources: New Constructs, LLC and company filings.

As these charts show, AXP’s business may be facing some challenges, but it also has many advantages compared to its peers.

Figure 9 shows that AXP ranks at or near the top of its peer group for ROIC and capital turns.

Figure 9: AXP Stacks Up Well Against Peers

Sources: New Constructs, LLC and company filings.

Conclusion

Given its strong standing amongst its peers, AXP should not be trading at such a large discount. The company faces significant challenges in the near future, but we think the case for earning a higher valuation is logical and looks achievable.

We’ve attempted to provide a very clear path forward for management along with a robust indication of how much value that path could create for shareholders.

While we cannot promise as large an increase as what GOOGL enjoyed last summer, if management were to signal a shift toward a more ROIC-centric strategy, we think the market could quickly move AXP from a discount to a premium valuation.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

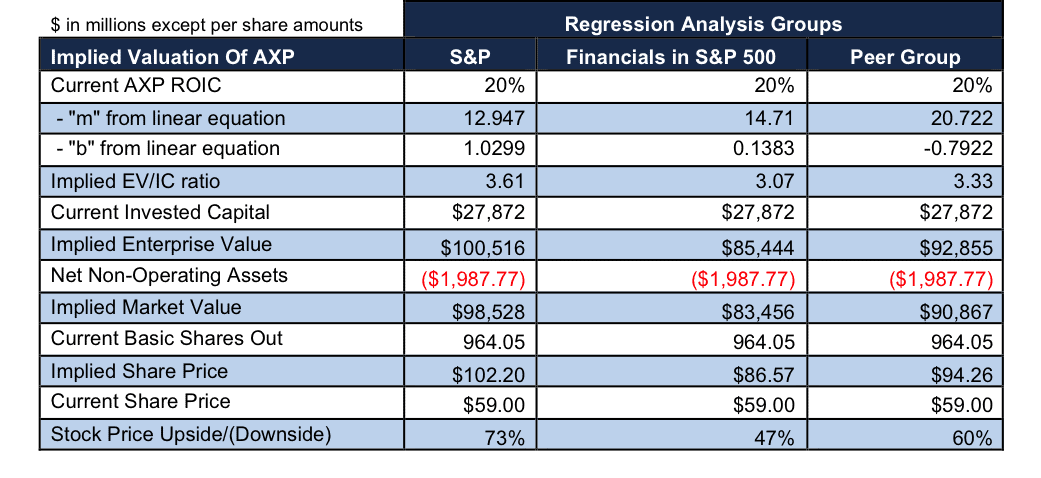

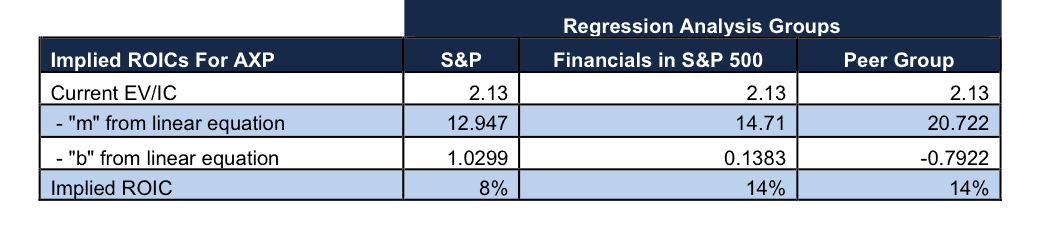

Appendix A: Implied Values Based on Linear Equations from Regression Analyses

Figures I – III show how we calculate the implied share prices and ROIC based on the three regression analyses in this report. Click here for the original spreadsheets with all calculations and details.

Figure I: Implied Stock Price and Upside for AXP Based on Linear Equations from Regressions

Sources: New Constructs, LLC and company filings.

Figure II: Implied ROIC for AXP Based on Linear Equations from Regressions

Sources: New Constructs, LLC and company filings.

Figure III: Implied Value Creation Scenario Details

Sources: New Constructs, LLC and company filings.

Appendix B: More Regression Analyses Details

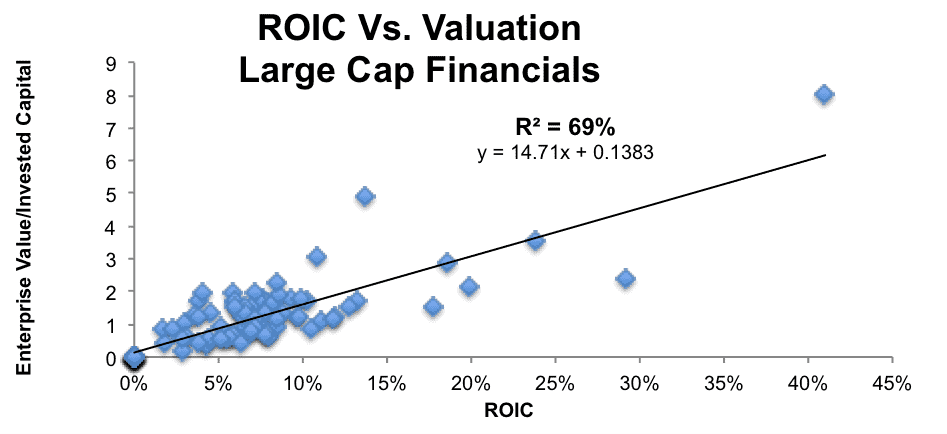

Figures IV and V show additional regressions of ROIC vs. Enterprise Value/Invested Capital (a cleaner version of price-to-book). The relationship between ROIC and valuation holds quite strongly on larger groups of stocks. Figure V shows that ROIC explains 57% of the changes in valuation for the stocks in the S&P 500.

Verify the data and regression analyses in the original spreadsheet here.

This regression framework for stock valuation was first introduced long ago by folks with much more impressive pedigrees than ours: McKinsey’s Valuation Handbook, Bennett Stewart’s Quest For Value, Credit Suisse’s Michael Mauboussin’s ROIC Patterns and Shareholder Returns. The innovation we bring to the table is modeling ROIC, free cash flow and GAP, etc. with scale.

Figure IV: ROIC Drives Valuations for the S&P 500

Sources: New Constructs, LLC and company filings.

Figure V (r-squared is 69%) shows that the explanatory power of ROIC for stock prices remains strong when we narrow the focus to large cap financial stocks.

Figure V: AXP Still Cheap Versus Other Financials

Sources: New Constructs, LLC and company filings.

Appendix C: Free Cash Flow Growth Breakdown

Figure VI: Drivers Of Free Cash Flow Growth

Sources: New Constructs, LLC and company filings.

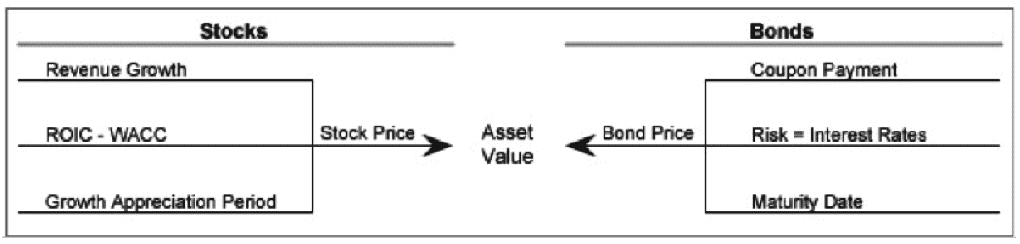

As discussed in our post, “How New Constructs’ Discounted Cash Flow Model Works,” stock valuations and bond valuations can be understood in the same way. For stocks, valuation is driven by revenue growth, ROIC, and GAP. For bonds, valuation is driven by coupon payments, risk, and maturity date. The Growth Appreciation Period (GAP) for stocks is analogous to the maturity date for a bond.

Figure VII: How To Price Stocks And Bonds

Sources: New Constructs, LLC and company filings.

Executives can increase shareholder value by proving to the market that the company has a sustainable competitive advantage and a longer GAP. In the context of the regression analysis, a longer or shorter GAP (relative to peers) manifests in a stock trading above or below the trend line.

Appendix D: Linking Enterprise Value to ROIC

ROIC and free cash flow all tie back to enterprise value as we show below in Figure IX. Click here for the original spreadsheets with all calculations and details.

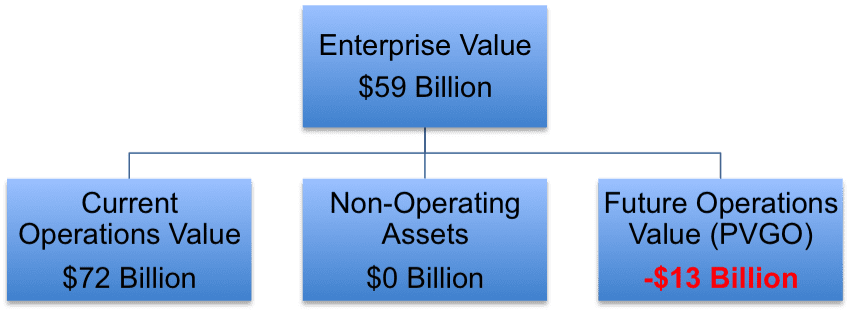

Figure VIII: The Elements Of Enterprise Value

Sources: New Constructs, LLC and company filings.

- Current Operations Value is also known as the no-growth value of the business based on the assumption that cash flows never grow from current levels. We measure it by dividing current cash flows[7] by the cost of capital or NOPAT/WACC, and it equals $57 billion for AXP. This calculation is also known as the perpetuity value of current cash flows or “pre-strategy value”.

- Non-Operating Assets for AXP equal $0[8].

- Future Operations Value is also known as the Present Value of Future Growth Opportunities or “PVGO”. This value captures the impact of what management does for the future of a company. We measure it as Enterprise Value minus Current Operations Value and Non-Operating Assets.

A key benefit of breaking down the enterprise value per Figure VII is to bring into clear focus the importance of PVGO. Understanding that we cannot change the past, a clear focus on future operations is important. We are not saying that nothing can be done to improve current operations or net non-operating assets, and they should not be entirely overlooked. We are saying that the majority of focus should be on the future operations value because that element of enterprise value will, most likely, have the largest impact on the value of the business in the future.

Given the regression analyses showing that the market expects ROIC to permanently decline, we are not surprised to see that the PVGO is -$15 billion[9].

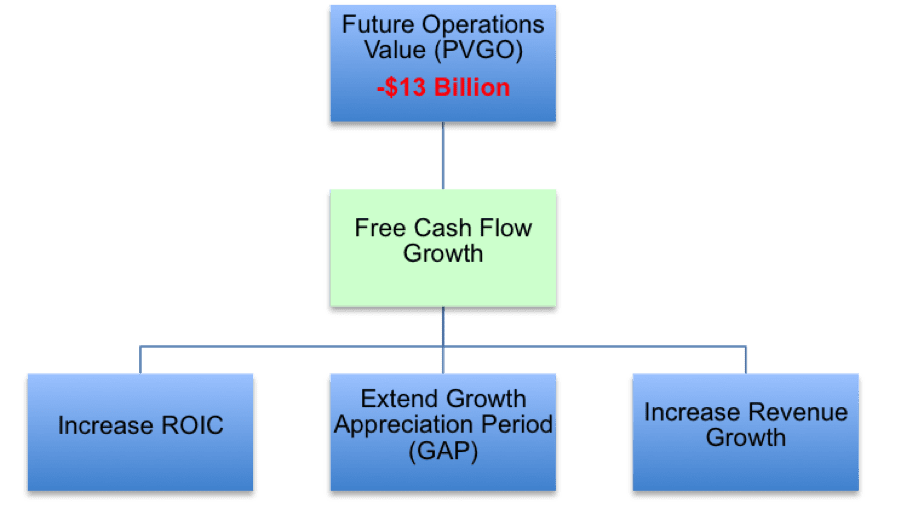

Naturally, management’s focus should be primarily on PVGO. Figure VIII shows the drivers of PVGO, the most important of which is future free cash flow growth.

Looking at enterprise value from this perspective shows how the drivers of free cash flow drive enterprise value.

Figure VI in Appendix C takes the breakdown even further to show how to link even the most discrete parts of the business to free cash flow. We hope this details help support the rigor of our thesis as well as the ease of its implementation.

Figure IX: The Drivers Of Future Operations Value

Sources: New Constructs, LLC and company filings.

While all three factors play an important role, ROIC is the most important factor. Revenue growth without an ROIC above WACC destroys shareholder value, and a consistently high ROIC is the strongest signal a company can send to the market that it has a sustainable competitive advantage and deserves a long GAP.

[1] Details behind the calculations in Figure 1 are in Appendix A.

[2] See Figures I and II in Appendix A for details behind the calculations of the implied stock prices and implied ROIC.

[3] Please see Figure III in Appendix A for details behind the calculations of the implied stock prices and ROIC.

[4] Technically this driver is ROIC-WACC. We focus on ROIC given that most of WACC is the cost of equity, which is largely outside of management’s control. ROIC reflects the operations of the business, where management can effect the most change.

[5] See Scenario 4 in Figure III in Appendix A for an example of how revenue growth without a change in ROIC creates no incremental value. The spreadsheet that provides all the implied values is available at this link.

[6] For the calculations of implied market values and stock prices, see Appendix A.

[7] Note that NOPAT is the same as Free Cash Flow when we assume there is no growth in the business.

[8] More details on non-operating assets are in our Economic Book Value definition.

[9] PVGO, in this instance, refers to all stakeholders. The market value, i.e. equity stakeholder portion, of the PVGO is -$13 billion.

Click here to download a PDF of this report.

Photo Credit: jon jordan (Flickr)