Retail turnaround stories are very appealing given the right conditions. A company must have a resilient brand, a clear plan moving forward, and the ability to execute that plan. Since its start in 1997, this American icon has created a captivating and recognizable brand and recently shown promising signs of successful execution. Investors have largely ignored the stock and as it currently trades below its economic book value, value investors have a prime entry point. This week’s stock pick of the week is Build-A-Bear (BBW: $16/share).

Ignore Stock Action, Follow Business Fundamentals

Build-A-Bear shares were relatively flat on the year until the company announced its 1Q15 results in May. Revenue disappointed short-term investors and BBW fell 23% over the next two months. However, there are many reasons to be optimistic about Build-A-Bear: same store sales, margins, and pre-tax profits all increased. 1Q15 may appear to be an issue if one follows the stock price in isolation. In reality, the underlying business operations are performing very well.

The Strong Beginnings of a Turnaround

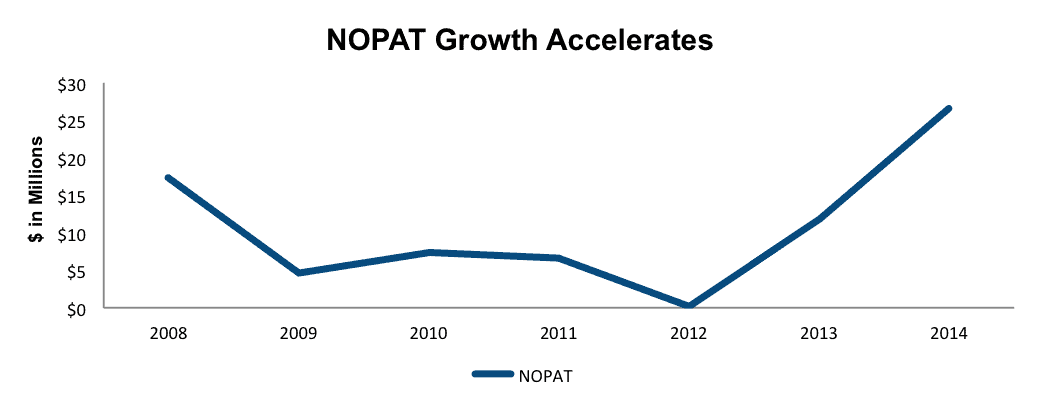

From 2004 to 2012, Build-A-Bear struggled with a bloated cost structure, unproductive stores, and a stale product. ROIC fell to just 0.1% in 2012 with NOPAT bottoming out at $180,000. Although business operations broke down, the brand remained strong.

In 2012, numerous initiatives designed to lower costs while simultaneously building the brand were undertaken. To keep up this momentum, the company also brought aboard a new CEO, Sharon John, who had previous experience working at Mattel and Hasbro. Since this time, Build-A-Bear has realized robust operating performance. Operating profit (NOPAT) grew to $27 million in 2014 and on a trailing twelve-month basis has continued to increase to $28 million, indicating strength this year. Figure 1 shows the company’s strong NOPAT performance both before and after rightsizing the business, placing strict controls on costs, and bringing Sharon John aboard.

Figure 1: A Turnaround In the Making

Sources: New Constructs, LLC and company filings

Consistent with NOPAT, return on invested capital (ROIC) has increased significantly, to 10% over this same period. ROIC improvements are the result of Build-A-Bear’s lowered invested capital and NOPAT growth. Invested capital has declined from $480 million in 2007 to $271 million in 2014. This significant decline is largely due to the closing of unprofitable stores, which allowed Build-A-Bear to cut off balance sheet debt by half since 2007.

Free cash flow increased to $55 million in 2014 and economic earnings turned positive after years of being negative.

Fueling the Turnaround: Lower Expenses and a Differentiated Experience

To return to profitability, the company has focused numerous efforts around its store base. The company’s physical store count has fallen from 442 in 2012 to 386 in 1Q15. New stores are moving away from traditional mall spaces and are instead being built in tourist-heavy locations. Tourists are willing to spend more on consumer items during their travels and Build-A-Bear looks to capitalize on this trend. Lastly, Build-A-Bear is exploring the use of pop-up stores, temporary store locations usually located in high traffic areas. These pop-up stores not only generate buzz, but also can help determine demand in an area before spending the necessary capital to open a full-blown store. As a result of these initiatives, operating margin has increased each of the last three years to 7.5% in 1Q15.

With costs coming under control, Build-A-Bear also focused on what uniquely sets it apart from competitors: the emotional pull of its stuffed animals. Traditional toy makers cannot create the experience that Build-A-Bear can, as there is nothing personal about the production of a standard toy. Build-A-Bear has been renovating its stores to make the building process much more personal and intimate. For example, adding customization features, such as sound messages further endears an emotional attachment to the product. Interactive stations have been placed in stores to invoke additional interaction amongst Build-A-Bear’s young consumers, who have become accustomed to technology at increasingly younger ages. The changes to store layout and product personalization have resulted in same stores sales increasing in each of the past three quarters.

How Will Build-A-Bear Continue the Turnaround?

Luckily for investors, Build-A-Bear is not content with the progress made thus far and is actively seeking future growth opportunities, even those outside the traditional teddy bear market. The company is establishing its own licensed products, which include cookies, backpacks, and mobile games. An interactive video series that turns Build-A-Bear’s stuffed animals into standalone characters is also in the works. These supplementary products are intended to create brand loyalty in addition to generating new revenue streams. Build-A-Bear hopes to move its reach beyond that of its stores and drive engagement through multiple touch points with consumers.

Possibly the biggest avenue for Build-A-Bear’s continued success stems from CEO Sharon John’s prior experience at Hasbro, a company that we’ve previously written on. Hasbro built a hugely successful business model through licensing some of the most popular brands across the globe, and Build-A-Bear is looking to do the same. The company has licensing agreements with Disney, Universal Pictures, My Little Pony, and Teenage Mutant Ninja Turtles among others. Through these agreements, Build-A-Bear is able to offer products that tap into the enormous popularity of movies such as Frozen, Avengers, Star Wars, and even the recent Minions movie. These franchises increase consumer demand without requiring heavy capital investments in an expanded store footprint.

Impact of Footnotes Adjustments and Forensic Accounting

To reveal true economic performance of Build-A-Bear, we look deeper into the company’s 10-K reports. For 2014, we made the following adjustments.

We removed $2 million (1% of revenue) in non-operating expenses in our assessment of NOPAT. The net effect of income statement adjustments after removing non-operating income was $13 million.

We made $266 million worth of balance sheet adjustments to calculate invested capital. One of the largest adjustments made when calculating invested capital was the removal of $46 million in excess cash or 51% of reported net assets.

As it pertains to Build-A-Bear’s valuation, we made $194 million worth of adjustments with a net impact of $103 million. The largest adjustment we made to Build-A-Bear’s shareholder value was $139 million to reflect the claim on cash flows from off balance sheet debt. This adjustment represents 51% of the firm’s market value.

Build Your Portfolio with Build-A-Bear

Despite the turnaround Build-A-Bear is executing, the stock remains down 21% on the year. This decline provides an excellent entry point. At its current price of $16/share, Build-A-Bear’s price to economic book value (PEBV) ratio is 0.9. This ratio implies that the market is expecting profits to decline permanently by 10%. This low expectation implies that the turnaround efforts at the company fail despite strong signs to the contrary.

If Build-A-Bear can achieve just 6% pre-tax (NOPBT) margins (below the 7.4% achieved in 2014) and grow NOPAT by 5% compounded annually for the next seven years, the stock is worth $23/share today – a 43% upside. We feel the company could easily meet or exceed this scenario as it continues to strengthen its brand, create strategic licensing deals, and extend its reach beyond its stores. BBW shares provide investors the opportunity to get in on the turnaround as it’s happening.

Disclosure: David Trainer, Allen Jackson, and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: The Community- Pop Culture Geek (Flickr)