Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and Marketwatch.com

When the momentum in a stock runs out, the results can be ugly. After falling over 20% on May 6, 2016, this week’s Danger Zone pick has since rebounded and might have investors thinking now is the time to buy. Unfortunately, the fundamentals of this company reveal a different story. Growing losses, misleading non-GAAP metrics, and significant competition land Imperva Inc. (IMPV: $39/share) in the Danger Zone this week.

Businesses Don’t Succeed Because of Revenue Growth

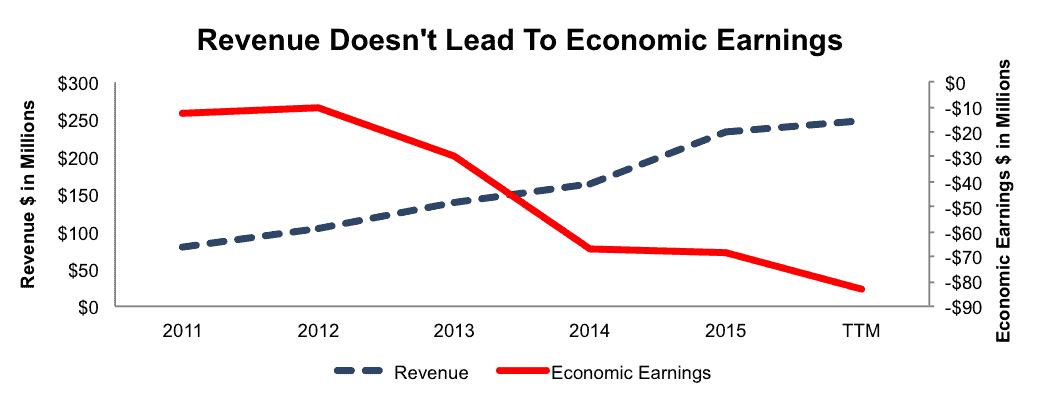

Like many newer technology companies, Imperva impressed investors with robust revenue growth despite increasing profit losses. From 2011-2015, Imperva has grown revenue by 31% compounded annually while Imperva’s economic earnings, the true cash flows of the business, declined from -$13 million in 2011 to -$83 million over the last twelve months. Figure 1 highlights the discrepancy between revenue and economic earnings. See the reconciliation of Imperva’s GAAP net income to economic earnings here.

Figure 1: Revenue Growth Equates To Greater Losses

Sources: New Constructs, LLC and company filings

In addition to negative economic earnings, Imperva’s return on invested capital (ROIC) has been negative each year since IPO and is currently a bottom-quintile -18%. Not surprisingly, Imperva is burning through cash, losing a cumulative -$416 million in free cash flow from 2011-2015.

Non-GAAP Earnings Create A False Picture

As is increasingly well-known, non-GAAP earnings are not a reliable indicator of a company’s operations. Here are the expenses IMPV removes to calculate its non-GAAP metrics, including non-GAAP operating income and non-GAAP net income:

- Stock-based compensation expense

- Acquisition-related expense

- Amortization of purchased intangibles

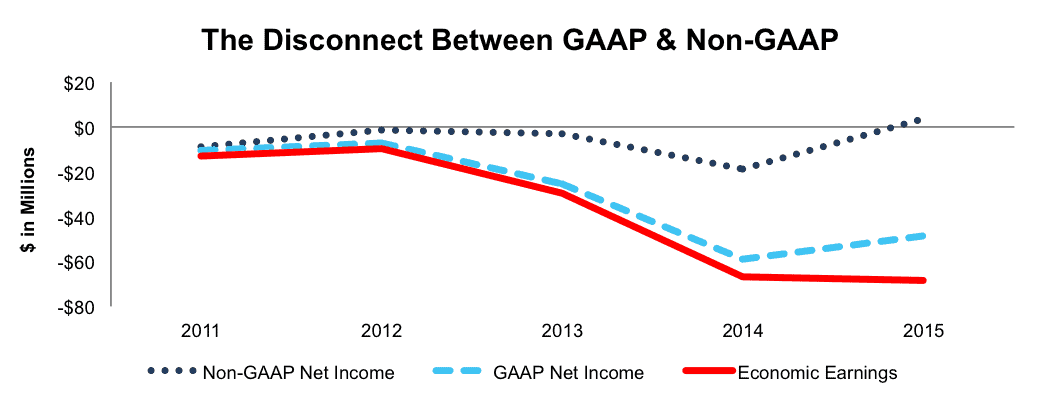

By removing these costs, Imperva paints a wildly different view of its business compared to the true economics. For example, since 2011, Imperva’s non-GAAP net income has improved from -$8 million to $3 million in 2015. Meanwhile, Imperva’s GAAP net income has fallen from -$10 million in 2011 to -$49 million in 2015. Economic earnings have declined even further, from -$13 million in 2011 to -$68 million in 2015. See Figure 2.

Figure 2: Imperva’s Non-GAAP Creates Distorted Reality

Sources: New Constructs, LLC and company filings

The main driver behind higher non-GAAP results is exclusion of Imperva’s heavy use of stock-based compensation. In 2015, Imperva removed $51 million (22% of revenue) in stock-based compensation expense to calculate non-GAAP net income. 2014 was more of the same, as the company removed $37 million (23% of revenue) in stock-based compensation expense to calculate non-GAAP net income. Stock compensation is a real cost of doing business and should not be excluded when calculating net income.

Negative Profitability Creates Competitive Disadvantages

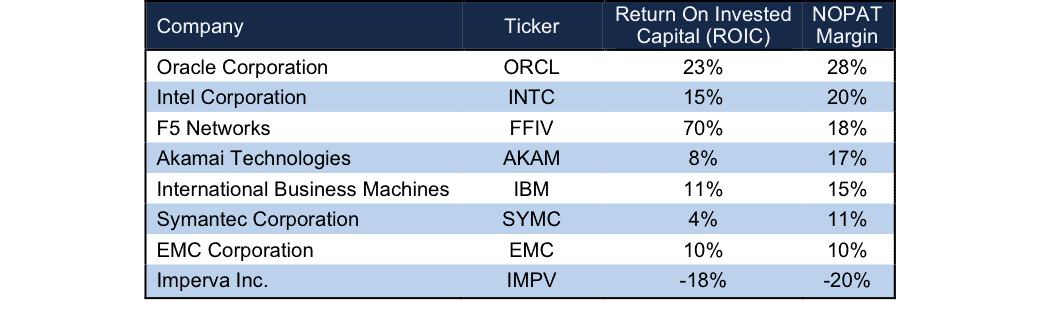

Imperva operates across multiple segments of the cyber security industry and faces significant competition across its business lines. IBM (IBM), Intel Security Group (formerly McAfee and now owned by Intel (INTC), and Oracle (ORCL) operate in database security. EMC Corp (EMC) and Symantec Corp (SYMC) operate in file security. Lastly, Akamai Technologies (AKAM) and F5 Networks (FFIV) operate in web application security. Imperva identifies each of these firms as direct competition, and each of them is significantly more profitable in regards to ROIC and NOPAT margin, per Figure 3.

Figure 3: Imperva’s Profitability Ranks Last Amongst Competition

Sources: New Constructs, LLC and company filings

Bull Hopes Ignore Reality, Acquisition Risk To Bear Case

IMPV saw its price soar through much of 2015. Many high profile cyber attacks pushed the entire industry higher, including peers such as Palo Alto Networks (PANW) or Fortinet (FTNT), which saw similar increases in stock price. Now that the hysteria has died down, the fundamental case for Imperva looks rather weak. Much of the bull case rests on Imperva’s continued ability to grow its revenue without regard to profits. It is hard to see how Imperva will grow profits given how poor its margins are and how strong its competition is.

Particularly troubling for bull arguments is the pace at which Imperva’s costs are rising. Research & development costs, sales & marketing costs, and general & administrative costs grew by 32%, 34%, and 38% compounded annually from 2011-2015 – all of which are higher than Imperva’s 31% revenue CAGR over this same time.

Further undermining the bull case, the stock is already priced for perfection. The current stock valuation implies that Imperva will grow revenues at a significantly faster pace than the industry average and make major market share gains. For reference, the cyber security market is expected to grow by 10% compounded annually from 2015-2020, yet IMPV’s current valuation implies the company can grow revenues by 30% compounded annually for well over a decade. We’ll highlight Imperva’s overvaluation in greater detail below.

The biggest risk to our thesis is that a larger competitor or firm looking to grow its security business acquires Imperva at a value at or above today’s price. As we’ll show below, unless a competitor is willing to destroy shareholder value, an acquisition at current prices would be ill advised.

Acquisition Hopes Rest on A Buyer Wiling To Overpay

We don’t think Imperva is an attractive acquisition target at its current price. To begin, IMPV has liabilities that investors may not be aware of that make it more expensive than the accounting numbers suggest.

- $35 million in outstanding employee stock options (3% of market cap)

- $27 million in off-balance-sheet operating leases (2% of market cap)

After adjusting for these liabilities we can model multiple purchase price scenarios. Unfortunately for investors, only in the most optimistic of scenarios is IMPV worth more than the current share price.

Figures 4 and 5 show what we think Microsoft should pay for IMPV to ensure the deal is truly accretive to MSFT’s shareholder value. Microsoft could be a potential acquirer of Imperva to bolster cloud security and was once named as a possible acquirer back in 2014. We think Microsoft has limits on how much it will pay for IMPV to earn a proper return, given the NOPAT or cash flows being acquired.

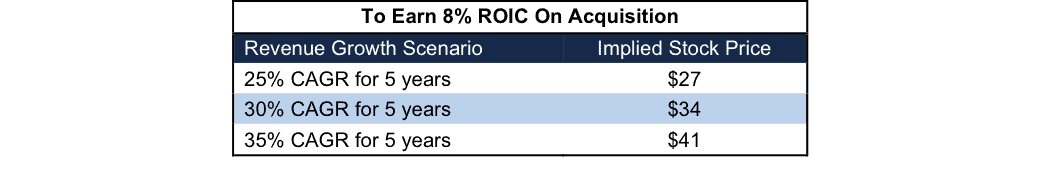

Each implied price is based on a ‘goal ROIC’ assuming different levels of revenue growth. In each scenario, we conservatively assume that Microsoft can grow Imperva’s revenue and NOPAT without spending on working capital or fixed assets. We also assume Imperva achieves a 10% NOPAT margin, similar to competitors EMC and SYMC. Imperva’s current TTM NOPAT margin is -20%.

Figure 4: Implied Acquisition Prices For MSFT To Achieve 8% ROIC

Sources: New Constructs, LLC and company filings.

Figure 4 shows the ‘goal ROIC’ for MSFT as its weighted average cost of capital (WACC) or 8%. Only if IMPV can grow revenue over 35% each year for the next five years while also raising its NOPAT margin from -20% to 10% is the firm worth more than its current price of $39/share. For reference, consensus estimates expect Imperva to grow revenue by 30% in 2016 and 24% in 2017. We include this scenario to provide a best-case view. Note that any deal that only achieves an 8% ROIC would be only value neutral and not accretive, as the return on the deal would equal MSFT’s WACC.

Figure 5: Implied Acquisition Prices For MSFT To Achieve 30% ROIC

Sources: New Constructs, LLC and company filings.

Figure 5 shows the next ‘goal ROIC’ of 30%, which is Microsoft’s current ROIC. Acquisitions completed at these prices would be truly accretive to MSFT shareholders. Even in the best-case growth scenario, the most MSFT should pay for IMPV is $9/share (77% downside). Management teams should be held accountable for capital allocation decisions that hurt investors. Any deal above $9/share would lower MSFT’s ROIC.

Without A Takeover, Growth Expectations Remain Overly Optimistic

Barring acquisition, to justify its current stock price of $39/share, IMPV must immediately achieve positive NOPAT margins of 1% (compared to -20% over the last twelve months) and grow revenue by 30% compounded annually for 23 years.

Even if we assume Imperva can achieve 5% NOPAT margins, well above current margins but below entrenched competitors, the stock is still overvalued. If IMPV can achieve 5% NOPAT margins and grow revenue by 30% compounded annually for the next decade, the stock is worth only $27/share today – a 31% downside. Each of these scenarios also assumes the company is able to grow revenue without spending on working capital or fixed assets, an assumption that is unlikely, but allows us to create a truly best case scenario.

Catalyst: Unmet Expectations Will Sink Shares

As noted earlier, IMPV fell over 20% when the company issued revenue guidance that came in below consensus estimates. However, the stock has already rebounded 15%, despite no change in company operations. This pickup in momentum could be setting up investors for another disappointment.

The lowered guidance should concern investors, especially since it’s the second consecutive quarter where guidance has come in on the low end, or even below, consensus expectations. IMPV is a stock that is built on revenue growth. When the revenue growth slows, the poor underlying fundamentals will have no where to hide. Moving forward, look for a slowdown in revenue growth, as competition creeps in on IMPV’s business. At that point, investors will realize that growing revenue at all costs is not a sustainable business model.

Additionally, the waning “love for all things cyber security” represents a trend that could put pressure on IMPV. The stock initially ran up in price as the cyber security industry was pushed to the forefront of investors’ minds. However, as the exuberance wears off, investor perceptions will readjust, fundamentals will matter again, and the firms that are generating a decent return on invested capital will be the beneficiaries. Unfortunately, IMPV is not such a firm, and its share price could adjust accordingly at the first sign of trouble.

Insider Sales and Short Interest Remains Low

Over the past 12 months five thousand shares have been purchased and 606 thousand have been sold for a net effect of 601 thousand insider shares sold. These purchases represent 2% of shares outstanding. Additionally, there are 1.9 million shares sold short, or just over 6% of shares outstanding.

Executives Are Incentivized To Ignore Profits

Apart from base salaries, executives at Imperva receive cash bonuses, paid quarterly, for reaching specific revenue targets. The revenue growth targets must be met “provided the goal is achieved cost effectively.” However, we question what Imperva deems “cost effective.” In each quarter of 2015, executives received the max bonus available, despite operating expenses being higher than the operating plan target. Creating further concern, the compensation committee states in its proxy statement that being a “profitable company with little or no growth was not acceptable.”

The best way to create shareholder value, and align executives with the best interest of shareholders, is to tie performance bonuses to ROIC. The reason for using ROIC as the target metric is that there is a clear correlation between ROIC and shareholder value.

Impact of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to Imperva’s 2015 10-K:

Income Statement: we made $4 million of adjustments with a net effect of removing $2 million in non-operating expenses (1% of revenue). We removed $3 million related to non-operating expenses and $1 million related to non-operating income. See all adjustments made to IMPV’s income statement here.

Balance Sheet: we made $139 million of adjustments to calculate invested capital with a net decrease of $81 million. The most notable adjustment was $27 million (10% of net assets) related to operating leases. See all adjustments to IMPV’s balance sheet here.

Valuation: we made $61 million of adjustments with a net effect of decreasing shareholder value by $61 million. There were no adjustments that increased shareholder value. One of the largest adjustments was the removal of $34 million (3% of market cap) due to outstanding employee stock options.

Dangerous Funds That Hold IMPV

The following funds receive our Dangerous-or-worse rating and allocate significantly to Imperva.

- Catalyst Dynamic Alpha Fund (CPEAX) – 2.8% allocation and Very Dangerous rating.

- Hood River Small-Cap Growth Fund (HRSMX) – 2.4% allocation and Very Dangerous rating.

This article originally published here on June 6, 2016

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: locked.com

2 replies to "Danger Zone: Imperva Inc. (IMPV)"

Hi Kyle, could you explain the single value used for the calculation

sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001364962&owner=exclude&count=40

and how do you arrive @ $35 (or 34) million in outstanding employee stock options value?

Thanks,

Giuseppe

Giuseppe,

We use the Black-Scholes model to value employee stock options, which uses data from the company’s filings about average exercise price, expected life of the options, the risk-free rate, and expected stock price volatility, along with the current stock price of the company, to calculate a fair value for all outstanding options. For more information about our calculation of ESO liability and how it affects our model, see the link below:

https://www.newconstructs.com/outstanding-employee-stock-options/

Thanks for reading and commenting!