Even though Coinbase’s ($100 billion expected valuation) revenue surged over the past 12 months, the company has little-to-no-chance of meeting the future profit expectations that are baked into its ridiculously high expected valuation of $100 billion.

The crypto markets are very young, and we expect many more companies to compete for the profits Coinbase enjoys today. As the crypto currency market matures, we expect Coinbase’s transaction margins to drop precipitously.

The race to the zero phenomenon that took place in late 2019 with stock trading fees will likely make its way to the crypto trading space. We expect Coinbase competitors to cut their trading fees to zero in an effort to increase market share.

Coinbase’s expected valuation of $100 billion implies that its revenue will be 1.5x the combined 2020 revenues of two of the most established exchanges in the marketplace, Nasdaq Inc. (NDAQ) and Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange.

Our calculations suggest Coinbase’s valuation should be closer to $18.9 billion – an 81% decrease from the $100 billion expected valuation.

This rest of this report aims to help investors sort through Coinbase’s financial filings to understand the fundamentals, using more reliable fundamental data, and valuation of this upcoming direct listing.

Cryptocurrency Market Remains Niche Despite Recent Headlines

In its S-1, Coinbase notes “crypto has the potential to be as revolutionary and widely adopted as the internet.” While such a statement can lead to lofty valuations based on a “growth story”, the reality is the cryptocurrency market remains far from “mainstream”.

According to data analytics firm CivicScience, 66% of U.S. adults are “not interested in” crypto and 18% have “never heard of it.” Similarly, CivicScience finds that while the number of people investing in cryptocurrencies is rising quickly, it still remains low at just 9% of U.S. adults. For reference, Pew Research Center estimates 90% of U.S. adults used the internet in 2019.

A Mature Market Could Crush Profitability by 98%

As a leading cryptocurrency exchange and brokerage firm in a nascent market, Coinbase charges a large spread on each trade and a trading fee (which is the greater of a flat fee or a variable percentage fee based on region, product feature, and payment type)- both of which are unsustainably high.

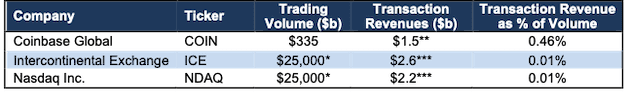

In 2020, Coinbase collected ~0.57% of every transaction in fees, which totaled $1.1 billion in trading revenue on $193 billion in trading volume. In total, these trading fees made up 86% of revenue in 2020. If we assume a similar breakdown of Coinbase’s reported $1.8 billion in total revenue in 1Q21, trading fees would equal ~$1.5 billion on $335 billion in trading volume, or ~0.46% of every transaction.

As the cryptocurrency market matures and more firms inevitably pursue Coinbase’s high margins, the firm’s competitive position will inevitably deteriorate. For example, if stock trading fees are any indicator for crypto trading fees, we should expect them to quickly go lower if not to zero. Competitors such as Gemini, Bitstamp, Kraken, Binance, and others will likely offer lower or zero trading fees as a strategy to take market share, which would start the same “race to the bottom” that we saw with stock trading fees in late 2019. Similarly, if traditional brokerages begin offering the ability to trade cryptocurrencies, they will most certainly cut down on the unnaturally wide spreads in the immature cryptocurrency market.

For example, if Coinbase’s revenue share of trading volume fell to 0.01%, equal to traditional stock exchanges, it’s estimated 1Q21 transaction revenue would have been just $35 million, instead of an estimated $1.5 billion.

To get a sense of just how untenable Coinbase’s competitive position is, Coinbase’s estimated transaction revenue as a percent of trading volume in 1Q21 is 46 times higher than Intercontinental Exchange, which runs the New York Stock Exchange (among others) and Nasdaq Inc., which runs the Nasdaq. The likelihood of Coinbase maintaining such high fees is very low in a mature market. See Figure 1.

Figure 1: Coinbase Transaction Revenue Vs. Traditional Exchanges

Sources: New Constructs, LLC and company filings

*Estimated based on average daily trading volume of $100 billion as reported by Cboe Global Markets.

** Estimated as 86% of Coinbase’s 1Q21 total revenue, which equals Coinbase’s transaction revenue as a percent of total revenue in 2020

***ICE and NDAQ transaction revenues equals each firm’s cash equity trading revenues

Coinbase also recognizes that future profitability could fall when management notes it will “meaningfully increase investment in sales and marketing” – likely to defend its market position from rising competition. In its 1Q21 update, the company guided for sales and marketing expenses to be between 12-15% of net revenue in 2021, which is a significant increase from 5% of net revenue in 2020. Rising expenses as a percent of revenue would hurt margins going forward while the firm’s valuation implies margins will hold steady (see details below).

Current Profits Are Drop In the Bucket Compared to Expectations

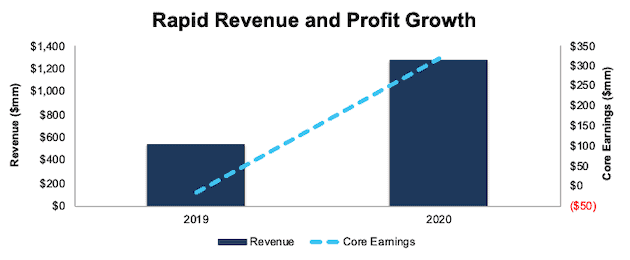

Coinbase stands out against recent IPOs due to the fact it actually generates a profit. Coinbase grew revenue by 139% year-over-year in 2020, and Core Earnings[1] improved from -$17 million to $317 million over the same time. In 1Q21, revenue grew more than 9x year-over-year (YoY).

Figure 2: Coinbase’s Revenue & Core Earnings: 2019-2020

Sources: New Constructs, LLC and company filings

These results are impressive, and Coinbase may be a good company, but COIN, at $100 billion, is not a good stock as we show below.

Coinbase Is Priced to Be the Largest Exchange (by Revenue) in the World

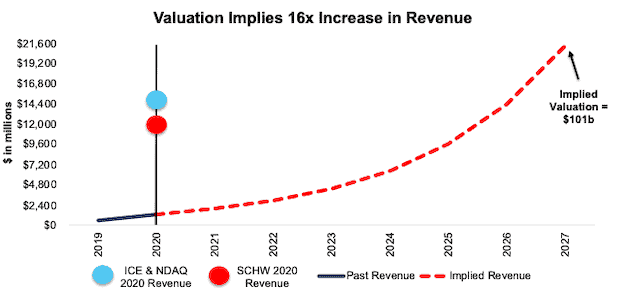

Our reverse discounted cash flow (DCF) model allows us to illustrate how overpriced COIN is. See Figure 3.

In order to justify its expected $100 billion valuation, Coinbase must:

- maintain a 25% NOPAT margin (above Nasdaq’s 19% but below Intercontinental Exchanges’ 31% in 2020) and

- grow revenue by 50% compounded annually (well above Nasdaq’s highest seven-year revenue CAGR [2004-2011] of 30%) for the next seven years. See the math behind this reverse DCF scenario.

In this scenario, Coinbase would earn $21.3 billion in revenue by 2027, which would be 1.5x Intercontinental Exchange and Nasdaq’s combined 2020 revenue, 46% of the TTM revenue of the 11 top Financial & Commodity Market Operators[2], and nearly double Charles Schwab’s 2020 revenue.

Figure 3 compares the firm’s implied future revenue in this scenario to its historical revenue, and the 2020 revenues of Intercontinental Exchange and Nasdaq combined as well as Schwab’s (SCHW) revenue.

Figure 3: Expected Valuation Implies Greater Revenue Than ICE & NDAQ Combined

Sources: New Constructs, LLC and company filings

If Coinbase maintained its fees at 0.46% of trading volume (as outlined above), this scenario implies that trading volume on Coinbase’s platform would be $4.6 trillion by 2027, which would equal 97% of the total cryptocurrency trading volume in 2020.

But What If Coinbase Is Not the Largest Exchange in the World?

We review an additional DCF scenario to highlight the downside risk should Coinbase see profitability fall in-line with traditional brokerages as competition enters the market and cryptocurrency trading becomes a more commoditized business.

If we assume Coinbase’s:

- NOPAT margin falls to 23% (market-cap-weighted average of 18 Investment Banking & Brokerage Services firms under coverage, compared to 25% in 2020) and

- revenue grows by 21% compounded annually for the next decade (Nasdaq’s greatest 10-year revenue CAGR), then

COIN is worth just $18.9 billion – an 81% downside to the expected valuation. See the math behind this reverse DCF scenario. However, matching Nasdaq’s fastest 10-year revenue CAGR could prove too optimistic given the volatile nature and niche status of the cryptocurrency market. If cryptocurrency fails to break through on a more mainstream level, as alluded to in Coinbase’s “average MTU possible scenarios” and trading volumes remain dwarfed by stock trading, Coinbase’s growth story would end and the stock would drop precipitously. The company could go bankrupt.

Each of the above scenarios also assumes Coinbase’s working capital and fixed assets increase YoY at a rate equal to 10% of revenue. This growth in invested capital is just under half the YoY change in invested capital as a percent of revenue in 2020.

IPO/Direct Listing Is Not Without Warning Flags

Despite a profitable business, investors should be aware that Coinbase’s S-1 is not absent some notable red flags.

Public Shareholders Have No Rights. A risk of investing in Coinbase, as with many recent IPOs, is the fact that that the shares sold provide little to no say over corporate governance.

Coinbase is going public with two separate share classes, each with different voting rights. Coinbase’s direct listing is for Class A shares, with one vote per share. Class B shares provide 20 votes per share and are held by company executives and early investors. For instance, Co-founder and CEO Brian Armstrong holds 22% of the voting power, and all executives and directors collectively hold 54% of the voting power. Notable investor Marc Andreessen owns 14% of the voting power in the firm through Andreesen Horowitz. In the end, all public investors combined can expect to gain no more than ~17% of voting power after rewarding the company with a stupendous valuation.

Concentration Risk is Large

Investors in Coinbase must be aware that the firm’s heavy reliance on Bitcoin and Ethereum create unique concentration risks. In 2020, Bitcoin and Ethereum accounted for 56% of Coinbase’s trading volume and an equal percentage of transaction revenue. Should demand for these two crypto currencies decline without an offsetting increase in new cryptocurrencies, Coinbase could see significant cuts to its trading volume and transaction revenue.

Non-GAAP EBITDA Overstates Profitability

While often a favorite of unprofitable companies, Coinbase still presents investors with an overstated picture of its fundamentals through its use of adjusted EBITDA. Adjusted EBITDA allows management significant leeway in excluding costs in its calculation. For example, Coinbase’s adjusted EBITDA calculation removes stock-based compensation expense, acquisition related expenses, and more.

Coinbase’s adjusted EBITDA in 2020 removes $205 million (16% of revenue) in expenses including $70 million in stock-based compensation expense. After removing these items, Coinbase reports adjusted EBITDA of $527 million in 2020. Meanwhile, economic earnings, the true cash flows of the business, are much lower at $285 million.

While Coinbase’s adjusted EBITDA follows the same trend in economic earnings over the past two years, investors need to be aware that there is always a risk that adjusted EBITDA could be used to manipulate earnings going forward.

Emerging Growth Company Designation Means Less Transparency

Coinbase ceased to be an Emerging Growth Company as of December 31, 2020. However, because it filed its draft registration statement to the SEC prior to this date, it is still able to take advantage of the reduced disclosure requirements available to Emerging Growth Companies. We’ve outlined these reduced disclosure requirements here. This designation means reduced transparency for investors, which only increases the risk of investing in Coinbase.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Fact: we provide superior fundamental data and earnings models – unrivaled in the world.

Proof: Core Earnings: New Data and Evidence, forthcoming in The Journal of Financial Economics.

Below are specifics on the adjustments we make based on Robo-Analyst findings in Coinbase’s S-1:

Income Statement: we made $31 million of adjustments, with a net effect of removing $1 million in non-operating income (<1% of revenue). You can see all the adjustments made to Coinbase’s income statement here.

Balance Sheet: we made $1.5 billion of adjustments to calculate invested capital with a net decrease of $968 million. The most notable adjustment was $1.1 billion in excess cash. This adjustment represented 67% of reported net assets. You can see all the adjustments made to Coinbase’s balance sheet here.

Valuation: we made $12.9 billion of adjustments with a net effect of decreasing shareholder value by $10.8 billion. The largest adjustment to shareholder value was $11.5 billion in outstanding employee stock options. This adjustment represents 12% of Coinbase’ expected market cap. See all adjustments to Coinbase’s valuation here.

This article originally published on April 9, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Only Core Earnings enable investors to overcome the inaccuracies, omissions and biases in legacy fundamental data and research, as proven in Core Earnings: New Data & Evidence, a forthcoming paper in The Journal of Financial Economics written by professors at Harvard Business School (HBS) & MIT Sloan.

[2] Firms in this group include Cboe Global Markets (CBOE), CME Group (CME), Deutsche Boerse AG (DBOEF), Fidelity National Information Services (FIS), GreenSky (GSKY), Interactive Brokers Group (IBKR), Intercontinental Exchange (ICE), MarketAxess Holdings (MKTX), Nasdaq Inc. (NDAQ), Tradeweb Markets (TW), and Virtu Financial (VIRT).

4 replies to "Despite Record 1Q Results, Coinbase’s Valuation Remains Ridiculous"

Assume net income is $4 billion this year, which is plausible. That equates to a PE ratio of 25 with a market cap of $100 billion. Am I missing something? Looks fairly valued to me.

Mike, even if you believe that the expectations baked into Coinbase’s current valuation are plausible, Coinbase must meaningfully outperform those expectations for investors to realize upside potential in the stock. As we point out in this report, we believe Coinbase’s competition is likely to significantly reduce trading fees which would force Coinbase to operate at lower margins going forward. Thanks for reading!

I know I have much to learn about fundamental analysis (I am a completely self-made investor with no formal financial education). And that is part of what I am coming here to learn. However, it also causes me to see assumptions and constantly question their validity. I completely agree that there will be a “race to zero” eventually in this space. However, three questions come to mind after reading this analysis. 1) It seems that there is little to no credit given for a rapidly expanding crypto trading market. In fact, would it not be likely that we would see an exponential growth curve and that we are still in the infancy of that growth? 2) It seems that you believe that this “race to zero” is immediately imminent. However, in the online brokerage space, it took years for that space to fully realize that situation. 3) The third is the one I am, admittedly, the least knowledgeable about, but also the one that seems to bother me the most. I consistently read reports and evaluations where the analysts state a company is “worth $X” and very little consideration or explanation is given to the calculations and assumptions that are made in that statement. Markets dictate what a (public) company is worth, why do analysts insist on stating their calculation and opinion as the de facto truth about what a company is worth?

Thanks for the free analysis, insight, and education. Despite my questions, it is truly appreciated.

Scott,

Thanks for your comments. Please see the response to your questions in order. 1.) The scenario to justify the price at the time of this report assumes revenue grows 50% compounded annually for seven years. To realize any upside, the firm would have to significantly grow at an even faster rate. 2.) The race to zero will almost certainly happen faster in the crypto market than it did with stock commissions. We believe the technology and systems stock brokers use to facilitate a zero-commission business model can easily be adapted to the crypto market. Robinhood already offers commission-free crypto trading. 3.) Our goal is not to tell you what a stock is worth, rather, we aim to clearly explain what the expectations baked into the current price for a stock are. Thanks for reading!