Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

Using our database of footnotes adjustments (featured by HBS & MIT Sloan), we revealed that TTM core earnings fell below GAAP net income for the first time since 2006.

The market doesn’t understand this earnings distortion because investors are not fully digesting footnotes. And honestly, who can blame them – who has time to read filings that can be 200+ pages long? That’s why we have spent the last 19 years training our machine learning engine to read SEC filings and pull out thousands of datapoints. Using our proprietary footnotes database, we created an Earnings Distortion Scorecard[1] to show how much unusual gains/losses distort core earnings from Compustat and Wall Street and find companies with significantly over/understated earnings.

Our Earnings Distortion Scorecard reveals this stock has significantly overstated earnings, despite reporting in-line with consensus estimates on October 30, 2019. Further, our reverse discounted cash flow (DCF) model reveals the expectations for future profit growth baked into the stock are overly optimistic. Zynga (ZNGA: $6/share) is in the Danger Zone.

A Stock with Overstated TTM Earnings

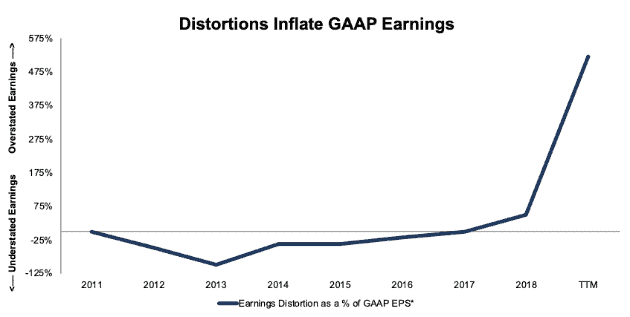

From 2011-2017 earnings distortion understated reported earnings. Importantly, however, in 2018 and the TTM period, ZNGA’s reported earnings have hit an inflection. Now, over the trailing twelve months, earnings were overstated by over 500%, in large part due to income from unusual gains, not apparent to investors analyzing earnings releases or income statements. Executives hide the one-time nature of these gains by only disclosing them in the fine print to make the headline numbers look better than they should. Figure 1 provides a historical look at the earnings distortion in ZNGA’s GAAP earnings.

Figure 1: ZNGA Earnings Distortion – Significantly Overstated in 2018 & TTM

Sources: New Constructs, LLC and company filings

*The formula for Earnings Distortion as a % of GAAP EPS uses the absolute value of GAAP EPS.

As unusual income increases, so does the level of earnings overstatement in GAAP and street earnings. Note that HBS and MIT Sloan empirically prove that street earnings do not capture 40%+ of material unusual items.

The likelihood that ZNGA misses earnings expectations in the future increases as Earnings Distortion increases because the real fundamentals of the business are weaker than street earnings suggest.

Why Earnings Data is Wrong and Our Data is the Most Accurate

In “Core Earnings: New Data and Evidence,” Ethan Rouen and Charles Wang from HBS and Eric So from MIT Sloan show that corporate managers use non-operating and less persistent income-statement items to manipulate earnings.

“Street earnings for firms that meet or just beat analyst expectations are more likely to selectively exclude these items [non-operating and less persistent income-statement items].” – Abstract

Furthermore, the authors show that only New Constructs research includes the footnotes data needed to get the truth about earnings. Traditional data providers and analysts are missing or mis-categorizing a very material and growing amount of unusual gains/losses.

“…many of the …{unusual gains/losses} collected by New Constructs do not appear to be easily identifiable in Compustat…” – page 14

In other words, companies purposely manipulate earnings and the market is inefficiently assessing earnings because too few people read financial footnotes. These footnotes contain important information that is required to measure reported and core earnings accurately. Only New Constructs accurately identifies and adjusts for these footnote disclosures.

Breaking Down ZNGA’s Earnings Distortion

Over the TTM period, ZNGA had $249 million in net earnings distortion that cause earnings to be overstated. Notable unusual gains include:

- $314 million in other income, primarily related to sale of its headquarters – Page 3 3Q19 10-Q

- $4 million in other income, primarily related to rental revenue from a tenant – Page 3 2Q19 10-Q

- $2 million in other income, primarily related to rental revenue, and offset by increased interest expense – Page 3 1Q19 10-Q

In total, we identified $0.26/share in net unusual income in ZNGA’s TTM results. After removing this earnings distortion from GAAP net income, ZNGA’s TTM core earnings are -$0.21/share or significantly lower than $0.05/share in reported earnings.

Additional Red Flags: Deteriorating Fundamentals

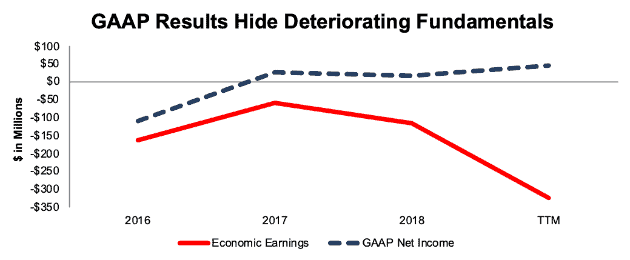

In addition to overstated earnings, ZNGA’s fundamentals are headed the wrong direction. ZNGA’s net after-tax operating profit (NOPAT) has fallen from $25 million in 2017 to -$202 million TTM. It’s NOPAT margin fell from 3% to -17% while its return on invested capital (ROIC) fell from 2% to -11% over the same time.

Worse yet, economic earnings, which account for all income statement adjustments and changes to the balance sheet, fell from -$60 million in 2017 to -$323 million TTM. See Figure 2. Long-term, ZNGA’s economic earnings have never been positive in its history as a public company.

Figure 2: ZNGA’s Economic Earnings Decline

Sources: New Constructs, LLC and company filings

ZNGA’s Fundamentals Also Lag Peers

Beyond trending in the wrong direction, Zynga’s fundamentals also look weak compared to peers, as defined in ZNGA’s proxy statement. Further, they show no signs of improvement since we first put ZNGA in the Danger Zone in September 2013.

Per Figure 3, Zynga’s invested capital turns, NOPAT margin, and ROIC fall well below the market weighted average of its peers.

Figure 3: Analyzing the Capital Efficiency of ZNGA vs Peers – TTM as of November 22, 2019

Sources: New Constructs, LLC and company filings

Per Figure 3, Zynga generates $0.64 of revenue per $1 of capital invested into its business, which is less than half the $1.49 generated by peers.

ZNGA’s -17% NOPAT margin means for every $1 it earns in revenue, it loses $0.17 after accounting for all operating expenses. ZNGA’s TTM NOPAT margin is down from 0.7% in 2018.

The above analysis gives us insights into the drivers of return on invested capital (ROIC), which measures how much profit a company generates for every dollar invested into its business. It is the true measure of a company’s cash on cash returns and, most importantly, there is a strong correlation between improving ROIC and increasing shareholder value.

As Figure 3 shows, ZNGA’s -11% ROIC is well below the market weighted peer average peer ROIC of 1%.

Expensive Valuation Adds to Risk of Owning ZNGA

With a price-to-earnings (P/E) ratio of 127, ZNGA already appears overvalued by traditional metrics. The Technology sector has an average P/E ratio of 30 and the S&P 500 average sits at 23. However, ZNGA’s P/E actually understates just how expensive the stock is, as earnings are distorted by non-operating income.

Our reverse discounted cash flow (DCF) model more rigorously assesses the valuation of this stock by quantifying the expectations for future profit growth baked into the stock price. When we look at the expectations implied by its valuation, the stock looks even more expensive.

In order to justify its price of $6/share, ZNGA must improve its NOPAT margin to 7% (up from -17% TTM) and grow NOPAT by 35% compounded annually for the next 14 years. 7% is the average NOPAT margin of peers (per ZNGA’s proxy statement) that earn a positive margin. The average of all peers is much lower at -2%. This expectation for rapid growth looks rather ambitious considering the mobile game market is expected to grow by 20% compounded annually from 2017-2026 (according to industry research provider Research and Markets). See the math behind this reverse DCF scenario.

Even if ZNGA achieves a NOPAT margin of 5% (the company best is 3% - achieved in 2017) and grows NOPAT by 32% compounded annually for the next decade, the stock is worth just $2/share today, a 67% downside to the current stock price. See the math behind this reverse DCF scenario.

Each of the above scenarios also assume ZNGA is able to grow revenue, NOPAT and FCF without increasing working capital or fixed assets. This assumption is unlikely but allows us to create best-case scenarios that demonstrate how high expectations embedded in the current valuation are. For reference, ZNGA’s invested capital has increased by an average of $124 million over the past five years.

The combination of overstated earnings and an expensive valuation earns ZNGA our Very Unattractive rating and a spot in this month’s Most Dangerous Stocks Model Portfolio.

Missed Earnings Could Sink Shares

ZNGA has met or beaten EPS expectations in each of the past 10 quarterly earnings reports. These results have beaten expectations by an average of just $0.01/share. Despite the narrow beats, expectations have only risen. At the end of 2018 consensus estimates expected 2020 EPS of $0.22/share.

As of 11/22/19, consensus estimates expect 2020 EPS of nearly $0.27/share. Per Figure 1 though, these earnings beats are the result of a significant increase in the value of one-time or unusual gains. Without the aid of these non-recurring gains, beating earnings going forward, after expectations have risen, will be all the more difficult.

As noted above, the HBS and MIT Sloan paper proves managers manipulate earnings to beat consensus expectations. We also know that non-recurring gains and income cannot boost profits forever. As the levers to manipulate earnings disappear, any miss on consensus expectations could force investors to evaluate ZNGA on the true fundamentals of the business. Such a shift would send shares down to more rational levels.

How You Can Leverage the Earnings Distortion Scorecard

“Trading strategies that exploit {adjustments provided by New Constructs} produce abnormal returns of 7-to-10% per year.” – Abstract

Core Earnings: New Data and Evidence presents a long/short strategy using our data that holds the stocks with the most understated EPS and shorts the stocks with the most overstated earnings. Positions are opened in the month each 10-K is filed and held until the next 10-K is filed, or about a year.

This simple, low turnover strategy produced abnormal returns of 7-to-10% a year. These abnormal returns show that the market misses important data in the footnotes and that investors who adjust for unusual items can make more money. Click here for more details on our data offerings.

We have already used the Scorecard to identify two very successful Long Ideas:

- AbbVie (ABBV), which beat street estimates on November 1 and is already up 11% (compared to 3% for S&P 500) since our article.

- Qualcomm (QCOM), which beat street estimates on November 6 and is already up 9% (compared to 4% for S&P 500) since our article.

We’ve also used the Scorecard to identify the following earnings beats:

- HCA Healthcare (HCA): beat the street on October 29

- Arista Networks (ANET): beat the street on October 31

- DuPont (DD): beat the street on October 31

- Sysco (SYY): beat the street on November 4

- CVS Health (CVS): beat the street on November 6

- AmerisourceBergen (ABC): beat the street on November 7

- Booking Holdings (BKNG): beat the street on November 7

- Skyworks Solutions (SWKS): beat the street on November 12

- Walmart Inc. (WMT): beat the street on November 14

- Macy’s Inc. (M): missed the street on November 21

Defining Earnings Distortion in This Analysis

In this report, Earnings Distortion includes:

Hidden Items, Net

- + Total Hidden Restructuring

- + Hidden Foreign Currency Expense

- + Hidden Other Real Estate Owned Expense

- + Hidden Acquisition and Merger Expense

- + Hidden Legal Regulatory & Insurance Expense

- + Hidden Derivative Related Expense

- + Hidden Other Financing Expense

- + Other Hidden Non-Recurring Expense

- + Total Hidden Recurring Pension

- + Total Hidden Non-Recurring Pension

- + Hidden Company Defined Other Expense

- - ESO Expense (Employee Stock Options) prior to 2006

Reported Items Pre-Tax, Net

- + Derivative Related Expense

- + Other Financing Expense

- + Company Defined Other Non-Operating Expense

- + Acquisition & Merger Expense

- + Legal, Regulatory, and Insurance Related Expense

- + Expenses/(Income) From Discontinued Operations

- + Foreign Currency Loss/(Gain)

- + Non-Operating Other Real Estate Owned Expense/(Income)

- + Other Non-Operating Expense/(Income)

- + Write-Downs (non-operating)

- + Restructuring Expense

- + Other Non-Recurring Expense/(Income)

- + Goodwill Amortization prior to 2002

+ Income Tax Distortion

Reported Items After-Tax, Net

- + Loss/(Gain) From Discontinued Operations

- + Other After-tax Charge

See Figure I in the Appendix for the definition of core earnings and total adjustments used in the HBS & MIT Sloan paper.

Appendix 2 provides details on the most complete data set we offer clients here.

This article originally published on November, 25, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

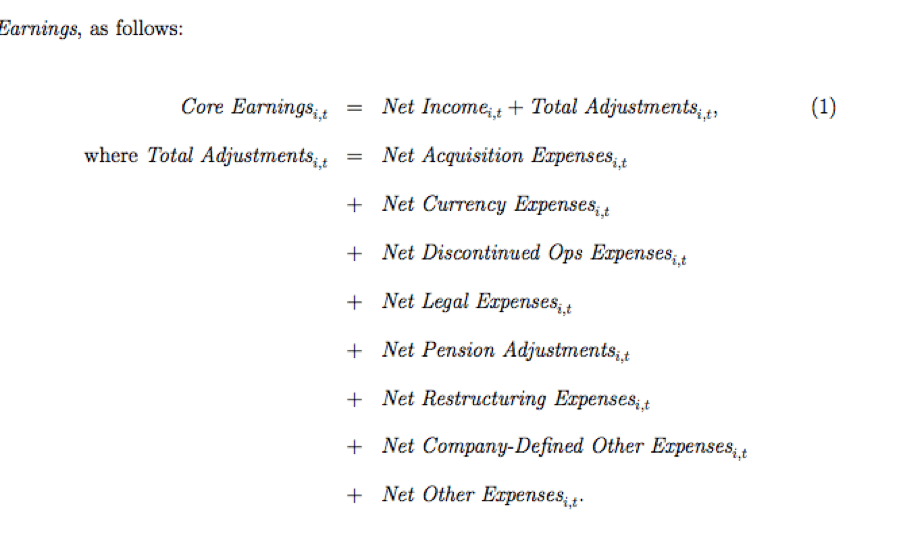

Appendix 1

Figure I contains the definition of core earnings used in the HBS & MIT Sloan paper. Certain adjustment categories we included in the analysis above were aggregated into the definition below. We believe breaking out these adjustments is necessary to ensure all necessary adjustments are captured and accounted for in calculating core earnings.

Figure I: Core Earnings Defined in the HBS & MIT Sloan Paper

Sources: Core Earnings: New Data and Evidence

Appendix 2

The HBS paper focuses on core earnings for direct comparison with GAAP earnings, IBES and First Call earnings, and Compustat’s “income before extraordinary items” and “income minus special items”. Our preferred measure of profitability, net operating profit after tax (NOPAT), includes all the items in the HBS & MIT Sloan paper as well as several others. Our complete reconciliation of GAAP net income to NOPAT is in this data dictionary. To access this data for nearly all U.S. stocks from 1998 – 2018 click here.

[1] Earnings Distortion captures all the non-recurring adjustments featured in the HBS & MIT Sloan paper. More details here.