This week’s Filing Season Finds report highlights some of the most interesting footnote disclosures in the 727 10-Ks and 10-Qs our Robo-Analyst[1] analyzed last week.

- Altria’ Group’s (MO) elimination of operating lease disclosure and

- unusual items in the 10-Ks of Viatris Inc. (VTRS) and eBay Inc. (EBAY).

Since 2005, we’ve reported how traditional earnings measures are unreliable due to accounting loopholes that allow companies to manage earnings. Our Economic Earnings and Core Earnings research closes those loopholes and provides more reliable[2] analysis of profits that also deliver a new source of alpha.

Altria Group’s Lease Disclosures Go Up in Smoke

Normally, we highlight interesting items our Robo-Analyst finds in financial filings, but this update is instead about what it didn’t find. Altria Group (MO) removed all disclosure of operating leases in its 2021 10-K.

Historically, Altria found itself on the list of worst operating lease disclosures. The company grouped future annual operating lease payments into multi-year timeframes in the Contractual Obligations table and only mentioned right-of-use (ROU) assets and lease liabilities in paragraphs, rather than identifying these items on the balance sheet. In 2021, the company took the only step they could take to make their disclosure worse and eliminated the Contractual Obligations table altogether, thereby removing any disclosure of operating leases.

The Financial Accounting Standards Board’s (FASB) new standard (ASU 2016-02) for reporting operating lease assets and liabilities on the balance sheet went into effect in 1Q19, but many companies have yet to comply – Altria included. We’ve extensively discussed disclosure practices in prior reports here and here.

Without compliant disclosures, investors cannot measure corporate performance or the real value of operating lease ROU assets & liabilities with fidelity. Our models leverage detailed footnotes analysis to capture the impact of off-balance sheet debt from operating leases on NOPAT/income statements, invested capital/balance sheets, and the weighted-average cost of capital (WACC). However, even the most diligent of models cannot account for data that is not available because a company eliminates disclosure entirely.

Other Material Earnings Distortions & Insights We Found

From disclosures in the footnotes and MD&A:

Viatris Inc. (VTRS) – Restructuring is Costly and Causes Reported Earnings To Be Understated

- In Viatris’ 2021 10-K, analyst Sam Moorhead noted that our Robo-Analyst found numerous non-operating charges that materially lower GAAP earnings. These charges include:

- $1.2 billion in amortization of inventory step-up bundled in cost of sales – page 98

- $535 million in restructuring and related costs bundled in cost of sales – Page 61

- $352 million in restructuring and related costs bundled in SG&A – page 65

- $235 million in acquisition related costs bundled primarily in SG&A – page 97

- $13 million in restructuring and related costs bundled in R&D – page 65

Note: these $2.3 billion in non-operating charges are not on the income statement. They can only be found with careful analysis of footnotes, which legacy firms tend not to do. We deduct them from our measures of net operating profit after-tax (NOPAT) and Core Earnings to calculate the true recurring profits of the business. After removing all Earnings Distortion (-$3.0 billion, or 233% of GAAP earnings), we reveal that Viatris’ 2021 Core Earnings of $1.7 billion, or $1.40/share, are much higher than GAAP earnings of -$1.3 billion, or -$1.05/share.

eBay Inc. (EBAY) – More Unusual Income Than You May Realize

- Most investors are likely aware of eBay’s $13.4 billion in income from discontinued operations that stem from the sale of its Classified’s business and eBay Korea, given that it was reported directly on the income statement. However, that is not the only unusual gain that boosts eBay’s GAAP earnings in 2021. Analyst Cody Fincher noted that our Robo-Analyst found an additional $486 million gain on an equity investment in KakaoBank reported as an operating gain in eBay’s cash flow statement. After removing all Earnings Distortion ($13.6 billion, or 100% of GAAP earnings), we reveal that eBay’s 2021 Core Earnings of -$8 million, or -$0.01/share, are much worse than GAAP earnings of $13.6 billion, or $20.52/share.

The Power of the Robo-Analyst

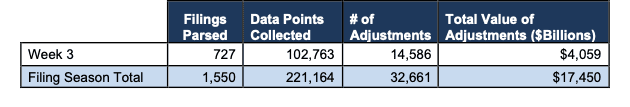

From the 727 10-K and 10-Q filings analyzed by our Robo-Analyst last week, we collected 102,763 data points. This data led to 14,586 Core Earnings, balance sheet, and valuation adjustments with a combined dollar value of $4.1 trillion. The adjustments were applied as follows:

- 6,053 income statement adjustments with a total value of $334 billion

- 5,681 balance sheet adjustments with a total value of $1.7 trillion

- 2,852 valuation adjustments with a total value of $2.1 trillion

Figure 1: Filing Season Diligence for Filing Season 2022

Sources: New Constructs, LLC and company filings.

Every year in this six-week stretch from mid-February through the end of March, we parse and analyze roughly 2,000 10-Ks and 10-Qs to update our models for companies with 12/31 and 1/31 fiscal year ends. This combination of technology and human expertise enables investors to overcome the flaws in legacy fundamental research and make more informed investment decisions.

This article originally published on March 7, 2022.

Disclosure: David Trainer, Hunter Anderson, Sam Moorhead, Cody Fincher, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.