Many companies are still not complying with the Financial Accounting Standards Board’s (FASB) new standard (ASU 2016-02) for reporting operating lease assets and liabilities on the balance sheet. This standard went into effect in 1Q19 and goes a long way towards closing the loophole that allows companies to hide trillions of dollars in capital off the balance sheet.

This report updates our previous research on the best and worst disclosure practices and highlights a troubling new disclosure tactic that enables companies to hide more operating leases off the balance sheet again.

Why Disclosure Matters – Required for Accurate Earnings Models

Without compliant disclosures, investors cannot measure corporate performance or, the focus of this report, the real value of operating lease ROU assets & liabilities. Our models leverage detailed footnotes analysis to capture the impact of off-balance sheet debt from operating leases on NOPAT/income statements, invested capital/balance sheets, and the weighted-average cost of capital (WACC). This diligence is the backbone of our more reliable & proprietary fundamental data and research, as proven in The Journal of Financial Economics.

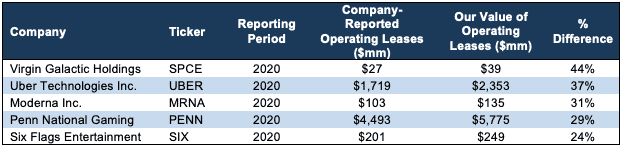

Though ASU 2016-02 aims to relieve investors of at least some of the rigorous footnotes analysis required to assess operating lease liabilities, plenty of footnotes work remains to ensure we get the right value across 5,000+ companies for our clients and partners. Figure 1 shows just how different our measure of the NPV of operating leases is compared to what companies disclose.

Figure 1: Balance Sheet Impact: Large % Differences in Reported and Adjusted Operating Lease Assets

Sources: New Constructs, LLC and company filings

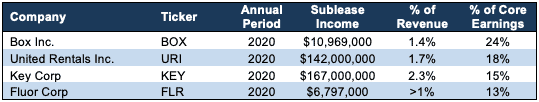

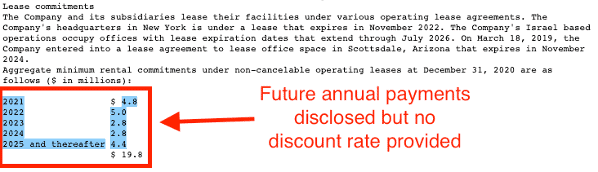

Operating leases also distort EBIT/EBITDA, Core Earnings[1], and NOPAT. We resolve this distortion by removing sublease income, a non-operating item (excluding Real Estate and Restaurants), from operating expenses. Figure 2 shows how big an impact the sublease income adjustment has on Core Earnings. For example, Box Inc’s (BOX) sublease income is 24% of Core Earnings. Again, investors need adequate disclosures from companies in order to get this data and gain an accurate understanding of corporate performance.

Figure 2: Income Statement Impact: Sublease Income Overstates Earnings

Sources: New Constructs, LLC and company filings

Even With New Rules, Companies Are Hiding Operating Leases Again

At the end of the day, FASB’s narrowing the loophole that allowed companies to hide trillions of dollars in capital off the balance sheet was a good first step. However, it cannot be the last step.

In 2020 10-Ks and 2021 10-Qs “non-commenced” leases, or leases that a company has signed a contract and began making payments for, but are not yet available to use, are further obfuscating lease disclosures and lease ROU assets & liabilities.

These non-commenced leases are often disclosed in the yearly lease payments table or only in a separate footnote, which means these lease liabilities do not appear on balance sheets.

We will publish an upcoming report dedicated to this bad disclosure trend that will detail what investors need to know and how we will treat it moving forward.

Below, we provide new examples of good, bad, and non-compliant disclosures regarding operating leases.

The Good Disclosure Practices

We begin with examples of some of the best disclosures so that investors can see how good disclosures look and how easy it is for companies to provide them. Plus, they provide a point of reference for understanding just how bad the bad disclosures are.

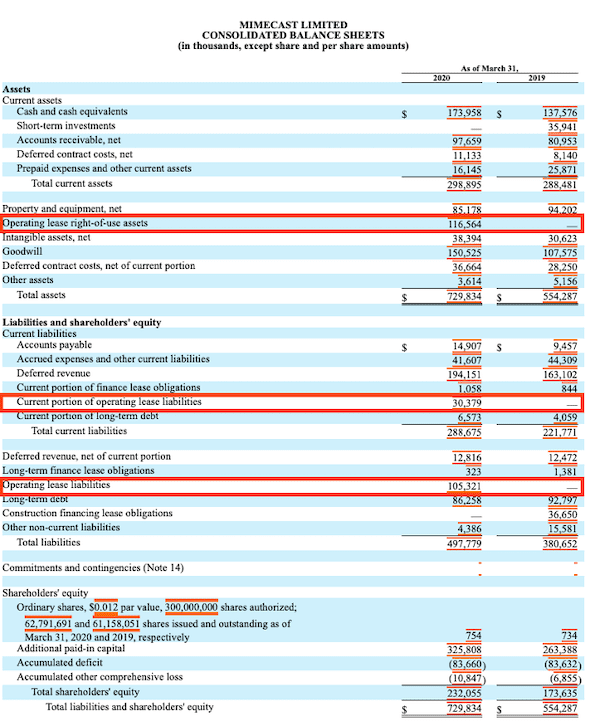

Good Disclosure #1: ROU Assets & Liabilities: This 2020 10-K disclosure from Mimecast Ltd (MIME) of the operating leaseROU assets and current/long-term liabilities on the balance sheet is an example of the best disclosure of this information. In total, we estimate about 52% of companies provide this level of disclosure for their operating leases in 10-Ks and 10-Qs. Contact us to request more details on which companies provide the best/worst disclosures. Note that we will provide certain details to clients only.

Figure 3: Mimecast’s Operating Lease Assets & Liabilities Disclosure in 2020 10-K

Sources: New Constructs, LLC and company filings

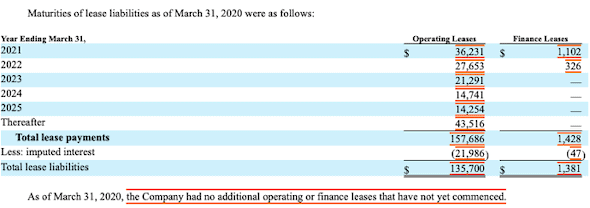

Good Disclosure #2: Future Annual Payments: This 2020 10-K disclosure from Mimecast of the future annual payments in an operating lease note, as a table, with a breakout of each individual year, is an example of the best disclosure of this information. In total, we estimate about 97% of companies provide this level of disclosure for their operating leases in 10-Ks and 64% in 10-Qs.

Figure 4 Mimecast’s Future Annual Payments Disclosure in 2020 10-K

Sources: New Constructs, LLC and company filings

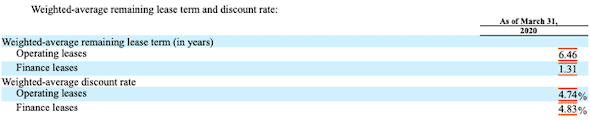

Good Disclosure #3: Discount Rate: This 2020 10-K disclosure from Mimecast of the discount rate used to determine the NPV of the operating lease payments in a table in the operating lease note is an example of the best disclosure of this information.

Figure 5: Mimecast’s Operating Lease Discount Rate Disclosure in 2020 10-K

Sources: New Constructs, LLC and company filings

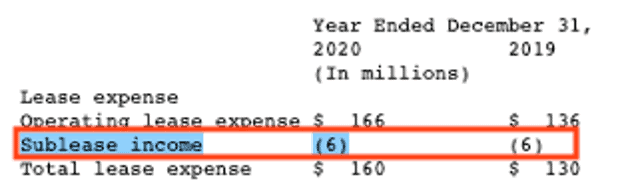

Good Disclosure #4: Sublease Income: This 2020 10-K disclosure from PayPal (PYPL)of sublease income reported in a table in the operating lease note is an example of the best disclosure of this information. In total, we estimate about 95% of companies provide this level of disclosure for their operating leases in 10-Ks and 96% in 10-Qs.

Sublease income is usually a non-operating item for most companies (with the exception of Real Estate and Restaurants) that reduces reported operating expenses, such as selling, general, and administrative. We add back sublease income in our adjusted EBIT/EBITDA, Core Earnings and NOPAT calculations because it leads to overstated profits and represents unusual income not core to the company’s core operations.

Figure 6: PayPal Sublease Income Disclosure in 2020 10-K

Sources: New Constructs, LLC and company filings

The Bad Disclosure Practices

The below examples include disclosures that are not as good as the prior examples because they make the information needed to assess operating leases harder to find in filings.

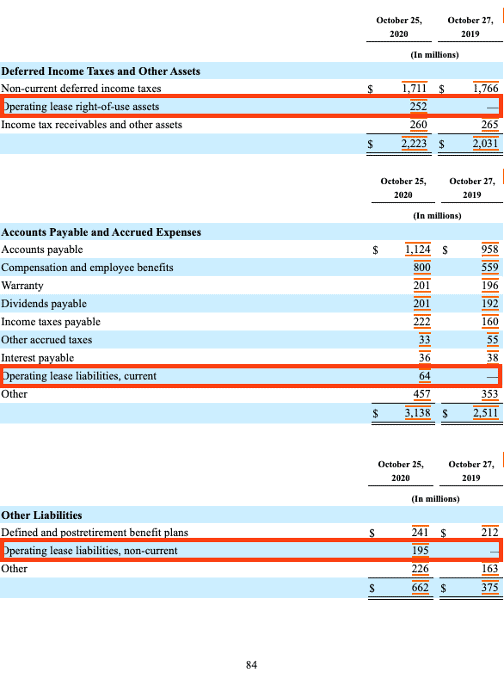

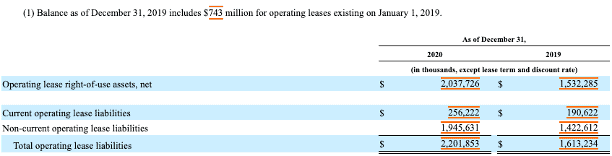

Bad Disclosure #1: ROU Assets & Liabilities: Instead of disclosing their operating lease ROU assets and liabilities on the balance sheet in the 2020 10-K, Applied Materials Inc. (AMAT) buries that information in “Other” on the balance sheet. Analysts and investors have to find the breakout of the “Other” value in the footnotes. It is far more convenient to get this data from the balance sheet and not have to search through potentially hundreds of pages of footnotes to find it. In total, we estimate about 32% of companies disclose ROU assets & liabilities this way in in 10-Ks and 22% in 10-Qs.

Figure 7: Applied Materials “Other Assets” Disclosure in the Footnotes in 2020 10-K

Sources: New Constructs, LLC and company filings

Bad Disclosure #2: ROU Assets & Liabilities: In Figure 8, Atlantic Capital Bancshares Inc. (ACBI) double buries, or makes it doubly hard to find, its operating lease right-of-use assets and liabilities in its 2020 10-K. Instead of being on the balance sheet directly or disclosed in a table in the footnotes, we have to dig further into the text supporting the footnotes table to find the operating lease/ROU values.

Figure 8: Atlantic Capital Operating Lease Disclosures Buried in Footnotes in 2020 10-K

Sources: New Constructs, LLC and company filings

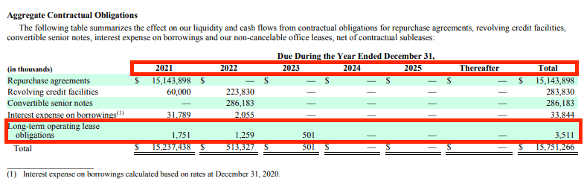

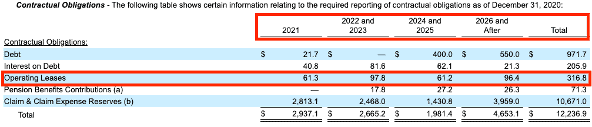

Bad Disclosure #3: Future Annual Payments: In Figure 9, Two Harbors (TWO) discloses its future annual payments in an “aggregate contractual obligations” table in its 2020 10-K, rather than breaking out the values in a table specifically related to operating leases. In total, we estimate about 1% of companies disclose annual payments in this way in 10-Ks and less than 1% in 10-Qs.

Figure 9: Two Harbors Future Annual Payments Bundled in Unrelated Table in 2020 10-K

Sources: New Constructs, LLC and company filings

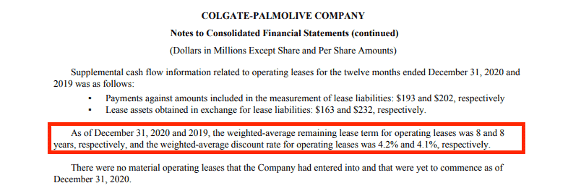

Bad Disclosure #4: Discount Rate: Colgate-Palmolive (CL) makes its operating lease discount rate difficult to find in its 2020 10-K by only disclosing it in a supporting paragraph and not in the operating lease table.

Figure 10: Colgate-Palmolive Operating Lease Discount Rate Buried in Text in 2020 10-K

Sources: New Constructs, LLC and company filings

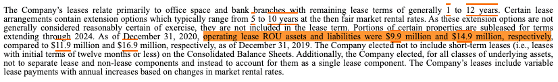

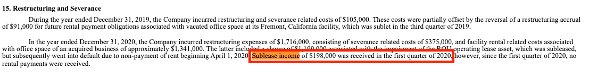

Bad Disclosure #5: Sublease Income: Figure 11 shows how Identiv Inc. (INVE) discloses sublease income in its 2020 10-K, but only within a paragraph and not a separate table. This disclosure practice is more difficult to identify, especially in filings that can run 200+ pages. In this case, sublease income was disclosed in an unrelated paragraph. In total, we estimate about 5% of companies disclose sublease income in this way in 10-Ks and 4% in 10-Qs.

Figure 11: Identiv Sublease Income Disclosed in Paragraph in 2020 10-K

Sources: New Constructs, LLC and company filings

The Ugly (and at Times Non-Compliant) Disclosure Practices

These disclosures lack information necessary for investors and analysts to fully measure the impact of a firm’s operating leases on its fundamentals.

Ugly Disclosure #1: ROU Assets & Liabilities: Instead of disclosing operating lease ROU assets and liabilities on the balance sheet in its 2020 10-K, Netflix Inc. (NFLX) buries that information in “Other” on the balance sheet. However, unlike the AMAT example above, Netflix does not break out “Other” in any way in the footnotes, which leaves analysts unable to analyze and adjust for operating leases.

Figure 12: Netflix Operating Lease ROU Assets & Liabilities Bundled in “Other” in 2020 10-K

Sources: New Constructs, LLC and company filings

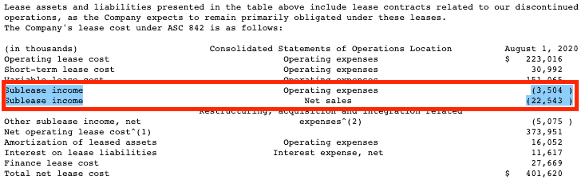

Ugly Disclosure #2 (that is also non-compliant): Future Annual Payments: Figure 13 shows that Old Republic International Corp (ORI) is not compliant with GAAP as it groups future annual payments in its 2020 10-K into multi-year timeframes. Under GAAP, aggregation of future annual payments is only allowed in the thereafter portion following five individual years. Aggregating multiple years prior to the first five makes it more difficult to assess the accuracy of the firm’s NPV calculation. In total, we estimate about 1.5% of companies disclose future annual payments in this way in 10-Ks and 2% in 10-Qs.

Figure 13: Old Republic Non- Compliant Future Annual Payment Disclosure in 2020 10-K

Sources: New Constructs, LLC and company filings

Ugly Disclosure #3: ROU Assets & Liabilities: Figure 14 illustrates how Old Republic International combines many of the worst disclosures from above by only mentioning operating lease ROU assets & liabilities in a paragraph in its 2020 10-K.

Figure 14: Old Republic Operating Lease ROU Assets & Liabilities Lack Necessary Context in 2020 10-K

Sources: New Constructs, LLC and company filings

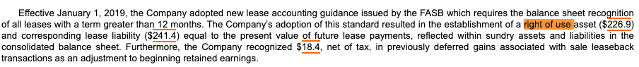

Ugly Disclosure #4: Discount Rate: Lemonade Inc. (LMND) provides a breakdown of its future annual payments in its 2020 10-K but does not disclose the discount rate used to calculate these payments. Without disclosing the discount rate, analysts cannot judge the appropriateness of the rate used and whether the balance sheet impact of the operating leases is reasonable. In total, we estimate about 8% of companies provide this level of disclosure for their operating leases in 10-Ks and 45% in 10-Qs.

Figure 15: Lemonade Inc. Lack of Discount Rate Disclosure in 2020 10-K

Sources: New Constructs, LLC and company filings

Ugly Disclosure #5: Sublease Income: Per Figure 16, United Natural Foods (UNFI) disclosed the exact amount of sublease income in its 2020 10-K, but omits this important data in its 1Q21 10-Q. United Natural Foods does not even mention sublease income in its 1Q21 10-Q. This poor disclosure makes it impossible for investors to know and adjust earnings for sublease income.

Figure 16: United Natural Foods Discloses Sublease Income in 2020 10-K

Sources: New Constructs, LLC and company filings

Note that when companies make no mention of sublease income whatsoever, we do not know whether or not they have sublease income. We have to assume that companies disclose the existence of any material amounts of sublease income. However, given that we see companies not disclose material information in other areas, we also have to assume that some companies with material sublease income may have it, but do not disclose it.

Without adequate enforcement of disclosure compliance, investors are unable to make fully informed decisions.

This article originally published on May 12, 2021.

Disclosure: David Trainer, Kyle Guske II, Alex Sword, Hunter Anderson, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Only Core Earnings enable investors to overcome the inaccuracies, omissions and biases in legacy fundamental data and research, as proven in Core Earnings: New Data & Evidence, a forthcoming paper in The Journal of Financial Economics written by professors at Harvard Business School (HBS) & MIT Sloan.