We published an update on PTON on June 23, 2022. A copy of the associated update report is here.

Acquiring Peloton (PTON: $37/share) anywhere close to its current valuation would be a poor use of capital. Peloton’s fiscal 2Q22 earnings, executive changes, and lowered full-year revenue guidance underscore our thesis that the stock is wildly overvalued and could fall as low as $8/share.

Peloton’s stock price recently soared on news of a potential acquisition by the likes of Amazon (AMZN) or Nike (NKE). However, we doubt Peloton will be acquired because there are far too many competitors that offer a similar product to Peloton, and there is nothing special about Peloton’s technology that make it an appealing acquisition target. Acquisition rumors often temporarily boost a stock to provide an opportunity for professionals to unload it.

Amazon, Nike, or even Apple (AAPL) likely do not want to acquire the equipment and manufacturing headaches that come with Peloton’s business, and the value add of acquiring subscribers is likely low, given the high likelihood that Peloton subscribers/users are also already customers of Amazon, Nike, and Apple.

For Peloton to become an attractive acquisition target, its stock would need to trade below $8/share, which is more than 50% lower than current levels. We believe investors that still own Peloton shares should get out now before the stock drops even lower.

We Remain Bearish on Peloton

We originally added Peloton to our Focus List Stocks: Short Model Portfolio in October 2020, and it outperformed the S&P 500 as a short by 103% in 2021. Even after falling 76% in 2021, Peloton’s valuation remains disconnected from the reality of the firm’s fundamentals and could fall much further.

The Downside of the COVID Bump is Here

After COVID-19-induced lockdowns drove consumers to in-home workout equipment,Peloton’s year-over-year (YoY) revenue comps were always going to be difficult to top. As expected, as economies reopened, interest in at-home exercise equipment fell, and Peloton’s “growth story” unraveled in 2021 as YoY revenue growth continued a downtrend.

Peloton recently cut its full fiscal 2022 revenue guidance to a range of $3.7 to $3.8 billion, down from a previous estimate of $4.4 to $4.8 billion. At the midpoint, such guidance would represent a 7% year-over-year revenue decline. The firm also cut its 2022 guidance for subscribers to 3 million, which is down from prior estimates of 3.35 to 3.45 million.

Such downturn in the business shouldn’t surprise investors. We warned investors in November 2021 that Peloton remained significantly overvalued, and many analysts issued concerning (for bulls) notes about Peloton’s future results. Guggenheim and Raymond James both noted that subscriptions are likely to be lower than expected due to weakening demand. JMP Securities highlighted website visits and page views declined YoY in December.

Competitive Pressure Drives 78%+ Downside

We outline the numerous headwinds Peloton faces in our report here. The biggest challenge to any Peloton bull case is the rising competition from incumbents and startups across the home exercise equipment industry, along with Peloton’s continued lack of profitability.

For instance, Apple has expanded its fitness subscription service, which already integrates with its existing suite of products. Amazon recently announced Halo Fitness, a service for home video workouts which integrates with Amazon’s Halo fitness trackers.

Tonal, which counts Amazon as an early investor, offers a wall-mounted strength training device, and Lululemon offers the Mirror. Brands such as ProForm and NordicTrack have offered bikes, treadmills, and more for years and are ramping up their efforts in subscription workout class offerings. In response, Peloton announced its latest product, “Guide”, a camera that connects to a TV while tracking user movements to assist in strength training. Truist analyst Youssef Squali called the offering “underwhelming” compared to the competition.

Peloton’s struggles also come as traditional gym competitors are seeing renewed demand.

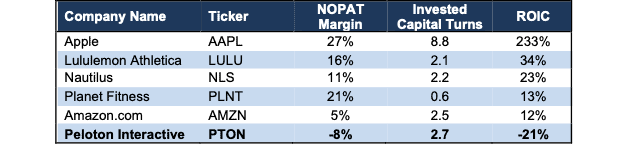

Furthermore, of its publicly-traded peers, which include Apple, Nautilus (NLS), Lululemon, Amazon, and Planet Fitness (PLNT), Peloton is the only one with negative net operating profit after-tax (NOPAT) margins. The firm’s invested capital turns are higher than most of its competitors but are not enough to drive a positive return on invested capital (ROIC). With an ROIC of -21% over TTM, Peloton is also the only company listed above to generate a negative ROIC. See Figure 1.

Figure 1: Peloton’s Profitability vs. Competition: TTM

Sources: New Constructs, LLC and company filings.

Reverse DCF Math: Peloton Is Priced to Triple Sales Despite Weakening Demand

We use our reverse discounted cash flow (DCF) model to quantify the expectations for future profit growth baked into Peloton’s stock price. To justify ~$37/share, Peloton must become more profitable than any time in its history. We see no reason to expect an improvement in profitability and view the expectations implied by $37/share as unrealistically optimistic about the company’s prospects.

Specifically, to justify a price of ~$37/share, Peloton must:

- improve its NOPAT margin to 5% (3x Peloton’s best-ever margin, compared to -8% TTM), and

- grow revenue at a 17% CAGR through fiscal 2028 (more than 2x projected home gym equipment industry growth over the next seven years).

In this scenario, Peloton would generate $12.4 billion in revenue in fiscal 2028, which is over 3x its TTM revenue and 7x its pre-pandemic fiscal 2020 revenue. At $12.4 billion, Peloton’s revenue would imply an 18% share of its total addressable market (TAM) in calendar 2027, which we consider the combined online/virtual fitness and at-home fitness equipment markets. For reference, Peloton’s share of its TAM in calendar 2020 was just 12%. Of competitors with publicly available sales data, iFit Health, owner of NordicTrack and ProForm, Beachbody (BODY), and Nautilus held, respectively, 9%, 6%, and 4% of the TAM in 2020.

We think it is overly optimistic to assume Peloton will vastly increase its market share given the current competitive landscape, and inability to sell existing product, while also achieving margins three times higher than the company’s highest ever margin. Recent price cuts to its products indicate high prices are unsustainable and could pressure margins even more in the coming years. In a more realistic scenario, detailed below, the stock has large downside risk.

PTON Has 51%+ Downside if Consensus Is Right: Even if we assume Peloton’s

- NOPAT margin improves to 4.2% (more than 2x its best-ever margin and equal to Nautilus’ 10-year average NOPAT margin prior to COVID-19),

- revenue falls -7% in fiscal 2022 (midpoint of management guidance),

- revenue grows at consensus rates in 2023 and 2024, and

- revenue grows 14% a year in fiscal 2025-2028 (nearly 2x home gym equipment industry CAGR through calendar 2027), then

the stock is worth $18/share today – a 51% downside to the current price. This scenario still implies Peloton’s revenue grows to $8.8 billion in fiscal 2028, a 12% share of its total addressable market, equal to its share of the TAM in calendar 2020.

PTON Has 78% Downside Even if Profitability Surpasses COVID Highs: If we assume Peloton’s

- NOPAT margin improves to 3.4% (1.5x highest margin in company history) and

- revenue grows 11% compounded annually through fiscal 2028, then

the stock is worth just $8/share today – a 78% downside to the current price.

If Peloton fails to achieve the revenue growth or margin improvement we assume for this scenario, the downside risk in the stock would be even higher.

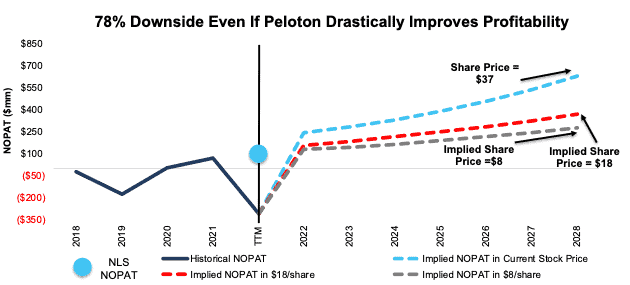

Figure 2 compares Peloton’s historical NOPAT to the NOPAT implied by each of the above DCF scenarios.

Figure 2: Peloton’s Historical vs. Implied NOPAT

Sources: New Constructs, LLC and company filings.

Dates represent Peloton’s fiscal year, which runs through June of each year

The above scenarios assume Peloton’s change in invested capital equals 10% of revenue in each year of our DCF model. For reference, Peloton’s annual change in invested capital averaged 24% of revenue from fiscal 2019 to fiscal 2021, and equaled 52% of revenue over the TTM.

Each scenario above also accounts for the recent share offering and subsequent cash received. We conservatively treat this cash as excess cash on the balance sheet to create best-case scenarios. However, should Peloton’s cash burn continue at current rates, the company will likely need this capital much sooner, and the downside risk in the stock is even higher.

This article originally published on February 9, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.