Figs (FIGS: $17.50/share midpoint of IPO price range), an apparel company for healthcare workers, will be the first IPO retail investors can buy through Robinhood’s new IPO Access offering. Robinhood users will be randomly selected for the opportunity to buy Figs at its IPO price, before shares begin trading.

The Figs IPO is good news for Robinhood users, as Figs is the best looking IPO we’ve seen so far in 2021. At the midpoint of its expected May 27 IPO price range ($17.50/share), Figs is valued at ~$2.8 billion and earns our Neutral rating, while most IPOs earn our Unattractive-or-worse rating.

In other words, Robinhood is not only providing users access to an IPO, it also appears to be curating this offering to ensure it offers higher quality IPOs.

Figs achieved profitability in both 2019 and 2020 and has a plausible path to justify the expectations baked into the stock price if the firm can:

- maintain current margins and

- maintain above average revenue growth rates.

Nevertheless, investing in any IPO is not without risks. Our IPO research aims to provide investors with more reliable fundamental research.

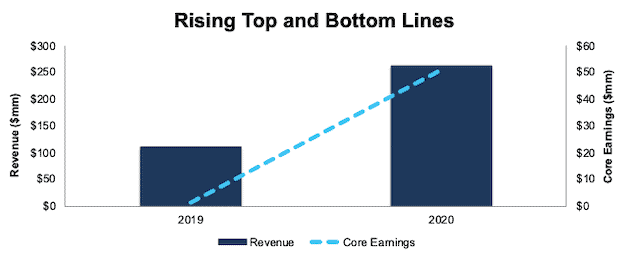

Revenue and Profits on an Upward Trend

As a supplier of healthcare workers’ apparel, perhaps it’s not surprising that Figs grew revenue 138% year-over-year in 2020 during the COVID-19 pandemic. Even better for an IPO these days, Figs’ Core Earnings[1] improved from $1 million in 2019 to $51 million in 2020, per Figure 1. The company’s return on invested capital (ROIC) also improved from 7% to an impressive 115% over the same time.

Figure 1: Figs’ Revenue & Core Earnings: 2019 - 2020

Sources: New Constructs, LLC and company filings

Small Market Share in Growing Market

Figs notes in its S-1 that it is the largest direct-to-consumer (DTC) platform in healthcare apparel and operates in the largest and fastest growing job segment (healthcare) in the United States.

Based on a Frost & Sullivan study, Figs estimates its 2020 total addressable market (TAM) to be $12 billion in the United States. Given revenue of $263 million in 2020, Figs’ market share is just 2% of its U.S. TAM. By using Forbes’ estimates for just the U.S. scrubs market, Figs’ holds ~15% market share based on its 2020 revenue.

The U.S. TAM is expected to grow 6% compounded annually over the next five years, according to a Frost & Sullivan study. For reference, the overall global apparel market is expected to grow at a slightly lower CAGR of 5.5% over the next five years.

DTC Model Removes Middleman and Helps Build Customer Loyalty

With the retail industry increasingly moving online, Figs has shown it can build a business without traditional brick-and-mortar stores. The firm notes in its S-1 that it sells 98% of its products through its website or mobile app. Such a business model allows the firm to market directly to consumers (which has also brought controversy) and control all aspects of the customer experience.

By owning its customer data and not relying on foot traffic to traditional retailers that may be unwilling to provide shelf space, Figs can better manage its sales process. This model can drive higher customer retention, as is the case with Figs. Per its S-1, for customers that were acquired between 2017 and 2019, 50% purchased a second time. 63% of those customers purchased a third time, and 70% of those customers purchased a fourth time.

Efficient Customer Acquisition

Without a retail presence, Figs is reliant upon word of mouth and traditional marketing to raise awareness of its products. The DTC business model only works if Figs can efficiently acquire new customers, as spending too much on marketing undermines profitability. Luckily for investors, Figs’ selling costs have fallen from 22% of revenue in 2019 to 20% of revenue in 1Q21, and marketing costs have fallen from 30% of revenue to 12% of revenue over the same time. In other words, the firm is efficiently scaling its sales and marketing, something that cannot be said of many high-growth businesses and recent IPOs.

Customer retention, owning the sales experience, and efficient customer acquisition provide competitive advantages, but ultimately need to result in higher profitability if Figs is to grow market share long-term. As we show below, Figs’ profitability is best-in-class.

Competition Is Plentiful, but Figs Is More Profitable

As a new startup focused solely on DTC sales, Figs must disrupt incumbents and fend off similar startups. Competitors include, but are not limited to:

- Traditional wholesalers

- Careismatic, maker of Cherokee uniforms, Dickies Medical, and more

- Barco Uniforms, licenses Skechers and Grey’s Anatomy brands

- Landau Uniforms

- Superior Group of Companies

- Healthcare retailers

- Scrubs & Beyond

- Uniform Advantage

- DTC brands

- Jaanuu

Careismatic is estimated to own ~40% of the U.S. scrubs market (compared to ~15% for Figs) and represents Figs’ largest competitor. While most of Figs’ competition is privately owned, we can compare the firm to apparel industry peers[2] to get a sense of whether its DTC business model translates to higher profitability.

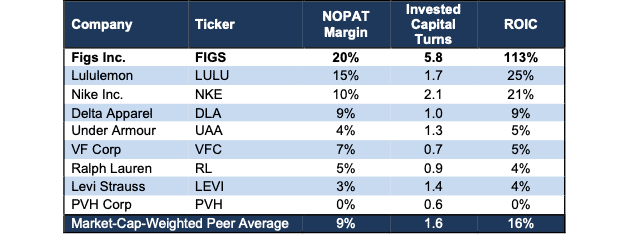

Per Figure 2, it does. Figs’ TTM ROIC ranks higher than each of the 30 Apparel and Accessories firms under coverage, including Lululemon (LULU), Nike (NKE), Ralph Lauren (RL) and more. The firm’s operational efficiency is highlighted by its leading net operating profit after-tax (NOPAT) margin. Its invested capital turns of 5.8 are significantly higher than retail peers, which illustrates the firm's capital efficient DTC business model.

Figure 2: Figs’ Profitability Vs. Traditional Retail Peers: TTM

Sources: New Constructs, LLC and company filings

Figs generated positive free cash flow (FCF) in 2020 and over the trailing-twelve months and held $74 million in cash and cash equivalents on its balance sheet in 1Q21.

Don’t Bet on a Buyout, Which Isn’t Needed

Figs’ expected ~$3 billion valuation indicates investor optimism about its ability to grow well above industry growth rates. However, for those hoping the firm could be a buyout target, we don’t have to look far to see a recent acquisition at a much lower valuation.

In January 2021, Partners Group bought Careismatic Brands for $1.3 billion, which is well below Figs’ expected valuation. Considering Figs generates less than half the expected revenue of Careismatic, any acquisition at a premium to its IPO price would look increasingly expensive given Careismatic’s much lower buyout valuation. That said, if Figs can continue to maintain its impressive ROIC while growing at double-digit rates, then it could command a much higher valuation than Careismatic .

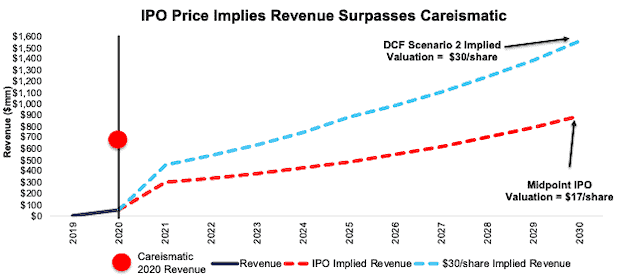

Figs Is Priced to Be the Next Careismatic

When we use our reverse discounted cash flow (DCF) model to analyze the future cash flow expectations baked into FIGS, we find that shares are closer to fairly valued.

To justify the midpoint of its IPO valuation, Figs must:

- maintain a 20% NOPAT margin (equal to 2020 margin) and

- grow revenue by 13% compounded annually (just over 2x industry growth rates through 2025, but well below Figs’ 138% YoY growth in 2020) for the next decade.

In this scenario, Figs would earn $893 million in revenue in 2030, or 128% of Careismatic’s estimated 2020 revenue. This scenario implies Figs achieves an estimated 6% of its U.S. TAM. For reference, Figs has grown revenue by 146% compounded annually since 2017, which indicates even double industry growth rates could prove conservative.

Figure 5 compares the firm’s implied future revenue in this scenario to its historical revenue, along with the estimated revenue of Careismatic. We also include the implied revenue in a more optimistic scenario, which is detailed below.

Figure 3: Midpoint IPO Isn’t Unreasonable

Sources: New Constructs, LLC and company filings

DCF Scenario 2: Elevated Growth Persists Post COVID-19

We review an additional DCF scenario to highlight the upside potential in the stock should Figs’ elevated ROIC and growth persist after the COVID-19 pandemic. This scenario implies Figs grows its customer base (currently 1.5 million active customers compared to 20 million healthcare professionals in the U.S.) and brand awareness efficiently, as it has done during to date.

If we assume Figs:

- maintains its 2020 NOPAT margin of 20% and

- grows revenue by 73% in 2021 (half its 2017-2020 revenue CAGR) and

- grows revenue by 18% compounded annually from 2022-2025 (3x industry average CAGR from 2020-2025) and

- grows revenue by 12% compounded annually from 2026-2030 (2x industry average from 2020-2025), then

FIGS is worth $30/share today – a 71% upside to the midpoint of the IPO price range. See the math behind this reverse DCF scenario.

In other words, Figs’ IPO valuation is very reasonable compared to other IPOs like Squarespace (SQSP) and Coinbase (COIN) where it’s difficult to make a straight-faced argument to invest in at any price.

Red Flags Investors Need to Know About

Despite a more reasonable valuation relative to recent IPOs (with share prices that implied >100% of market share), investors should be aware that Figs’ S-1 is not absent of some red flags.

Public Shareholders Have Diminished Rights: A risk of investing in Figs’ IPO, and other recent IPOs, is the fact that the shares sold provide little to no say over corporate governance.

Figs is going public with a dual class share structure, both with different voting rights. Investors in the IPO will get class A shares, with just one vote per share while directors and early investors hold Class B shares, with 20 votes per share.

Following the completion of the IPO, all outstanding shares of Class B stock will be held by the firm’s co-founders and co-CEOs, and Tulco, LLC, Figs’ majority shareholder. These shareholders will hold 79% of the voting power in the newly public company.

In other words, this IPO takes investors’ money while giving them almost little voting power or control of corporate governance.

And Majority of Shares Sold at IPO Are From Existing Shareholders: Figs is offering ~5.9 million shares as part of its IPO. However, selling stockholders, which include Tulco, LLC, are selling ~16.6 million shares in the IPO. The company will not receive any proceeds from the sale of shares by these stockholders. In other words, the majority of the IPO proceeds will reward existing shareholders and not help the company itself.

We Don’t Know If We Can Trust the Financials: Investors should take Figs’ GAAP numbers with a grain of salt.

As an emerging growth company, Figs is not required to have an independent auditor provide an opinion on the firm’s internal controls. While the lack of disclosure around the firm’s internal controls over financial reporting may never be an issue, it does increase the risk that the firm’s financials are fraudulent and/or misleading when compared to a firm required to have an auditor attest to its internal controls.

Claims of Misleading Marketing Could Hurt Sales Practices

Since as early as 2019, Figs’ leading competition, Careismatic Brands, has filed lawsuits claiming Figs’ marketing misleads consumers about the protection its garments provide. Figs maintains that the lawsuits are simply competition trying to thwart an upstarts advances in the industry. However, as reported by The Wall Street Journal, “Figs has since removed some of the marketing statements from its website, though it says none were inaccurate.”

Such lawsuits have clearly not impacted Figs’ growth (as evidenced by Figure 1), should a court determine that Fig did mislead consumers, it could impact the firm’s loyal customer base, which some have equated to the “cult-like followings” of Lululemon and Peloton (PTON). In such an event, the rapid revenue growth, and in turn profits, Figs has achieved could slow.

On the flip side, these lawsuits could be dismissed and end up as a non-factor, In any case, investors considering investing in this IPO should at least be aware of such risks.

Non-GAAP EBITDA Overstates Profitability: Figs’ chosen non-GAAP metric, adjusted EBITDA, shows a much rosier picture of the firm’s operations than GAAP net income or our Core Earnings. Adjusted EBITDA gives management significant leeway in how it presents results. For example, Figs’ adjusted EBITDA calculation removes stock-based compensation expense, transaction costs, and “expenses related to non-ordinary course disputes.”

Figs’ adjusted EBITDA in 2020 removes adjusted EBITDA in 2020 removes $19 million (7% of revenue) in expenses including $9 million in stock-based compensation expense. After removing all items, Figs reports adjusted EBITDA of $69 million in 2020. Meanwhile, 2020 economic earnings, the true cash flows of the business, are lower at $50 million.

While Figs’ adjusted EBITDA follows the same trend in economic earnings over the past two years, investors need to be aware that there is always a risk that adjusted EBITDA could be used to manipulate earnings going forward.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Fact: we provide superior fundamental data and earnings models – unrivaled in the world.

Proof: Core Earnings: New Data and Evidence, forthcoming in The Journal of Financial Economics.

Below are specifics on the adjustments we make based on Robo-Analyst findings in Figs’ S-1:

Income Statement: we made $4 million of adjustments, with a net effect of removing $3 million in non-operating expenses (1% of revenue). You can see all the adjustments made to Figs’ income statement here.

Balance Sheet: we made $89 million of adjustments to calculate invested capital with a net decrease of $56 million. The most notable adjustment was $16 million in operating leases. This adjustment represented 15% of reported net assets. You can see all the adjustments made to Figs’ balance sheet here.

Valuation: we made $457 million of adjustments with a net effect of decreasing shareholder value by $368 million. The largest adjustment to shareholder value was $397 million in outstanding employee stock options. This adjustment represents 14% of the market cap implied by the midpoint of Figs’ IPO price range. See all adjustments to Figs’ valuation here.

This article originally published on May 26, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Only Core Earnings enable investors to overcome the errors, omissions and biases in legacy fundamental research, as proven in Core Earnings: New Data & Evidence, forthcoming in The Journal of Financial Economics.

[2] Entire peer group in this analysis includes Canada Goose Holdings (GOOS), Columbia Sportswear (COLM), Compagnie Financiere Richemont (CFRUY), Crocs Inc. (CROX), Culp Inc. (CULP), Dockers Outdoor (DECK), Delta Apparel (DLA), Duluth Holdings (DLTH), Fossil Group (FOSL), G-III Apparel (GIII), Gildan Activewear (GIL), Hanesbrands (HBI) Hugo Boss (BOSSY), Iconix Brand (ICON), Lakeland Industries (LAKE), Levi Strauss (LEVI), Lululemon (LULU), Movado Group (MOV), Nike Inc. (NKE), Oxford Industries (OXM), PVH Corp (PVH), Ralph Lauren (RL), Skechers USA (SKX), Steven Madden (SHOO), Under Armour (UAA), Unifi Inc. (UFI), Vera Bradley (VRA), VF Corporation (VFC) Weyco Group (WEYS), and Wolverine Worldwide (WWW).

1 Response to "Figs Stands Out Amidst a Sea of Overvalued IPOs"

If it’s “the best looking IPO we’ve seen so far in 2021” then why is it 3/neuteral in New Constructs rating?