Our latest featured stock is a large cap home improvement retailer with a flattering ROIC calculation.

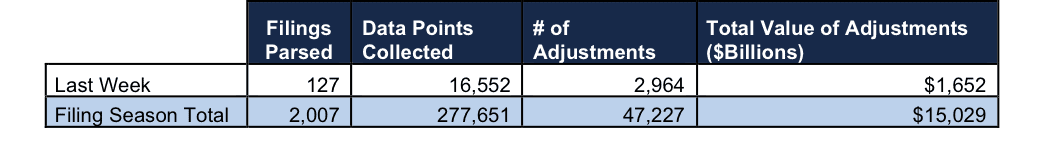

We pulled this highlight from last week’s research of 127 10-K filings, from which our robo-analyst technology collected 16,552 data points. Our analyst team used this data to make 2,964 forensic accounting adjustments with a dollar value of $1.7 trillion. Those adjustments were applied as follows:

- 1,279 income statement adjustments with a total value of $141 billion

- 1,196 balance sheet adjustments with a total value of $668 billion

- 489 valuation adjustments with a total value of $843 billion

Figure 1: Filing Season Diligence

Sources: New Constructs, LLC and company filings.

Fewer filings are coming in on a daily basis as filing season winds down, so we are no longer providing daily updates on our research. However, we will still be highlighting significant finds for our readers. Follow us on Twitter and check out the hashtag #filingseasonfinds for regular updates on our research.

Every year in this six-week stretch from mid-February through the end of March we parse and analyze roughly 2,000 10-Ks to update our models for companies with a 12/31 fiscal year end. This effort is made possible by the combination of expertly trained human analysts with what we call the “Robo-Analyst.” The Robo-Analyst uses machine learning and natural language processing to automate much of the parsing process.

A Fiduciary Level of Diligence

Our technology enables us to deliver fundamental diligence at a previously impossible scale. We believe that in time investors will come to demand this level of diligence when it comes to their investment advice.

Only by reading through the footnotes and making adjustments to reverse accounting distortions can advisors go beyond the suitability standard and provide a fiduciary level of diligence to their clients.

One Company To Watch In 2017

We’ve praised Home Depot (HD) in the past for its decision to tie executive compensation to return on invested capital (ROIC). The company’s 10-K, filed last week and parsed by analyst Peter Apockotos, gives us a chance to evaluate the accuracy of its ROIC calculation.

HD discloses its ROIC calculation on page 23 of its 10-K. To get net operating profit after tax (NOPAT), HD simply eliminates interest expense and then makes an income tax adjustment. There is no effort to account for non-operating items in the footnotes.

Fortunately, this does not throw off the calculation too much, as HD rarely buries non-operating items in the footnotes. Only 19% of companies have fewer earnings adjustments than HD.

On the invested capital side, HD has more significant issues. The company uses average debt plus equity to calculate invested capital, an all-too-common method with serious drawbacks.

Using debt plus equity does not hold management responsible for the $800 million in accumulated asset write-downs incurred over the years, or the nearly $900 million in accumulated other comprehensive loss.

Most importantly, though, it leaves out the company’s substantial off-balance sheet debt. HD has $7.5 billion in operating lease obligations with a present value of $5.7 billion. These leases are economically equivalent to debt and assets on the balance sheet—and in fact companies will soon be required to account for them on the balance sheet—but HD excludes them from its calculation of invested capital.

When we adjust for all these hidden forms of invested capital, we see that HD earned an ROIC of 23% last year, well below its reported number of 31%. HD is still a great company, and it earns our Attractive rating, but its reported ROIC calculation is overly flattering.

This article originally published on March 27, 2017.

Disclosure: David Trainer, Peter Apockotos, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Scottrade clients get a Free Gold Membership ($588/yr value) as well as 50% discounts and up to 20 free trades ($140 value) for signing up to Platinum, Pro or Unlimited memberships. Login or open your Scottrade account & find us under Quotes & Research/Investor Tools.