Last week, our Robo-Analyst analyzed 173 filings. We’re highlighting unusual items in the filings of General Electric (GE) and several other companies during the fourth week of The Real Earnings Season.

General Electric’s Hidden Non-Operating Items Mask Losses in 2020

In its 2020 10-K, analyst Hunter Anderson found that General Electric recorded multiple unusual charges that were hidden in the footnotes of its annual filing. Detailed below, these hidden unusual items along with reported unusual items amount to over $7.8 billion in Earnings Distortion and materially distort (by 150%) General Electric’s GAAP earnings:

Hidden Unusual Items, Net = -$1.62 billion:

- $693 million in restructuring & other – Page 41 2020 10-K

- $542 million in pre-tax impairments related to GE Capital Aviation Services business – Page 74 2020 10-K

- $316 million in a non-cash pre-tax impairment charge related to property, plant and equipment – Page 74 2020 10-K

- $146 million in amortization of prior service cost – Page 83 2020 10-K

- $113 million in non-cash pre-tax impairment charge related to amortization expense – Page 76 2020 10-K

- $100 million for an SEC settlement charge – Page 41 2020 10K

Reported Unusual Items, Net = $9.57 billion:

- $12.5 billion in purchases and sales of business interests reported on the income statement – Page 93 2020 10-K

- $2.6 billion adjustment for contra earnings distortion from recurring pension costs disclosed in non-recurring items

- $2.4 billion in non-operating benefit costs reported on the income statement – Page 56 2020 10-K

- $1.7 billion related to goodwill impairments reported on the income statement – Page 56 2020 10-K

- $1.5 billion in loss from net interest and investment bundled in “Other Income” – Page 93 2020 10-K

- $334 million in other items bundled in “Other Income” – Page 93 2020 10-K

- $125 million in loss from discontinued operations reported on the income statement – Page 56 2020 10-K

In addition, we made a -$131 million adjustment for income tax distortion. This tax adjustment normalizes reported income taxes by removing the impact of unusual items.

After removing Earnings Distortion, which totals $0.89/share, or 150% of GAAP EPS, we find that General Electric’s 2020 Core Earnings of -$0.30/share are significantly lower than GAAP net income of $0.60/share.

How We Treat Non-Operating Items: Non-operating items, such as restructuring or impairment charges are one of many reasons why GAAP net income doesn’t tell the whole story of a company’s profitability.

Unlike other research firms[1], we remove all unusual gains/losses, including restructuring charges, to calculate General Electric’s true recurring profits, i.e. Core Earnings.

Without careful footnotes research, investors would never know that these non-recurring items distort GAAP numbers to the point where traditional, unscrubbed earnings for U.S. stocks are off by an average of ~20%.

Other Material Earnings Distortions & Red Flags We Found

Since February 19, 2021, we have parsed 1,799 10-Q and 10-K filings, and General Electric’s hidden and reported non-operating items aren’t the only unusual items our analysts have found. Below are a few other highly material Earnings Distortions that we discovered while rigorously analyzing the footnotes and MD&A:

Surgalign Holdings Inc. (SRGA) – Acquisitions and Subsequent Write-Downs

- While analyzing Surgalign Holdings’ 2020 10-K, analyst Alex Richmond found on page 82 that the company acquired Holo Surgical for $95 million and immediately determined that the technology was not feasible and recorded a write-down of $94.5 million, or nearly the entire purchase price. This charge was reported on the income statement as an asset acquisition expense. We remove this non-operating charge from our measure of net operating profit after-tax (NOPAT) and Core Earnings to calculate the true recurring profits of the business. After removing all Earnings Distortion (40% of GAAP EPS in 2020), Surgalign’s 2020 Core Earnings of -$0.64/share are lower than GAAP EPS -$0.45.

American Airlines Group Inc. (AAL) – Federal Grant Disclosure

- Analyst Alex Richmond noticed that American Airlines had an interesting way of reporting their $6 billion grant from the federal government under the CARES act. Of the $6 billion, American Airlines recorded $1.8 billion as long-term debt. $3.7 billion is recorded as a credit bundled in “other operating special items, net” and $444 million is recorded as a credit bundled in “regional operating special items, net”. “Other operating special items, net” also includes $1.5 billion in fleet impairment charges and $1.4 billion in severance charges. Bundling the government benefits with asset impairments and severance in “Special Items” allows American Airlines to manage earnings and make operations look better than they are. After removing all Earnings Distortion (6% of GAAP EPS in 2020), American Airlines 2020 Core Earnings of -$19.47/share are less than GAAP EPS of -$18.36.

The Power of the Robo-Analyst

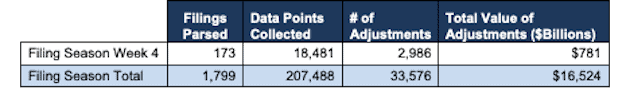

We analyzed 173 10-K and 10-Q filings last week, from which our Robo-Analyst[2] technology collected 18,481 data points. Our analyst team made 2,986 forensic accounting adjustments with a dollar value of $781 billion. The adjustments were applied as follows:

- 1,154 income statement adjustments with a total value of $53 billion

- 1,233 balance sheet adjustments with a total value of $334 billion

- 599 valuation adjustments with a total value of $395 billion

Figure 1: Filing Season Diligence for the Week of March 15 – March 19

Sources: New Constructs, LLC and company filings.

Every year in this six-week stretch from mid-February through the end of March, we parse and analyze roughly 2,000 10-Ks to update our models for companies with 12/31 and 1/31 fiscal year ends. This effort is made possible by the combination of expertly trained human analysts with our “Robo-Analyst.” Featured by Harvard Business School in “Disrupting Fundamental Analysis with Robo-Analysts”, our Robo-Analyst research automation technology uses machine learning and natural language processing to automate and improve financial modeling.

Only our “novel dataset”, which leverages our Robo-Analyst technology, enables investors to overcome flaws with legacy fundamental datasets to apply reliable fundamental data in their research. Core Earnings: New Data & Evidence, forthcoming in The Journal of Financial Economics, reveals the problems with fundamental data provided by legacy firms like Bloomberg, Refinitiv, FactSet (FDS) and S&P Global (SPGI).

This article originally published on March 24, 2021.

Disclosure: David Trainer, Alex Richmond, Hunter Anderson, Alex Sword, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] In Core Earnings: New Data & Evidence, professors from Harvard Business School & MIT Sloan expose the flaws in traditional, legacy fundamental data and research providers.

[2] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.