Our latest featured stock is a toy company with multiple hidden expenses. Last week, we analyzed 475 10-Ks and 10-Qs.

Analyst Robert Hicks found several unusual items in Mattel’s 2019 10-K.

On page 101, MAT disclosed $22 million in restructuring costs as part of its “Structural Simplification” cost savings program hidden in other selling and administrative expenses.

On page 102, MAT disclosed $19 million in restructuring costs as part of its “Capital Light” program hidden in other selling and administrative expenses and $19 million restructuring costs hidden in cost of sales.

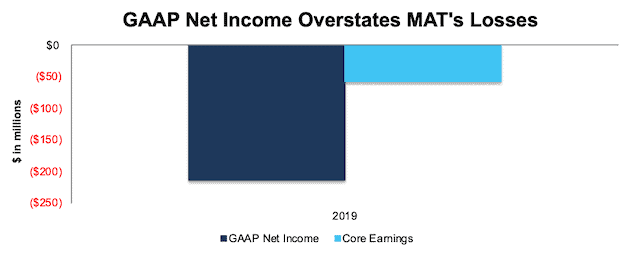

In total, we identified -$156 million in earnings distortion that caused GAAP earnings to be understated. After removing these unusual expenses, we see that MAT’s core earnings, a superior measure of profits[1], of -$57 million are less of a loss than GAAP net income of -$214 million. Understated earnings earn MAT a “Beat” Earnings Distortion Score (as featured on CNBC Squawk Box).

Figure 1: MAT’s GAAP Net Income Vs. Core Earnings

Sources: New Constructs, LLC and company filings

Despite the likelihood to beat upcoming consensus expectations, MAT does not represent attractive risk/reward over the long-term. MAT currently earns our Unattractive rating, has a bottom-quintile return on invested capital (ROIC) of 1%, and has high expectations for future profit growth baked into its stock price.

Other Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Balance Sheet: we made $5.9 billion of adjustments to calculate invested capital with a net increase of $4.8 billion. One of the most notable adjustments was $3.1 billion (78% of reported net assets) in goodwill. See all adjustments to MAT’s balance sheet here.

Valuation: we made $4.0 billion of adjustments with a net effect of decreasing shareholder value by $3.1 billion. Apart from total debt, which includes operating leases, the most notable adjustment to shareholder value was $202 million in underfunded pensions. This adjustment represents 5% of MAT’s market cap. See all adjustments to MAT’s valuation here.

The Power of the Robo-Analyst

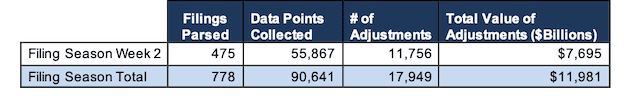

We analyzed 475 10-Ks and 10-Qs filings last week, from which our Robo-Analyst[2] technology collected 55,867 data points. Our analyst team made 11,756 forensic accounting adjustments with a dollar value of 7.7 trillion. The adjustments were applied as follows:

- 4,688 income statement adjustments with a total value of $498 billion

- 4,992 balance sheet adjustments with a total value of $3.2 trillion

- 2,076 valuation adjustments with a total value of $4.0 trillion

Figure 2: Filing Season Diligence for the Week of February 24 – March 1

Sources: New Constructs, LLC and company filings.

Every year in this six-week stretch from mid-February through the end of March, we parse and analyze roughly 2,000 10-Ks to update our models for companies with 12/31 and 1/31 fiscal year ends. This effort is made possible by the combination of expertly trained human analysts with what we call the “Robo-Analyst.” Featured by Bloomberg and Harvard Business School in “Disrupting Fundamental Analysis with Robo-Analysts”, our research automation technology uses machine learning and natural language processing to automate and improve financial modeling.

No Substitute for Diligence

Our technology enables us to deliver diligence on fundamentals at a previously impossible scale. We believe this research is necessary to uncover the true profitability of a firm and make sound investment decisions. “Core Earnings: New Data and Evidence,” a recent paper from professors at Harvard Business School and MIT Sloan, shows how our adjustments create a measure of core earnings that is more predictive of future earnings than comparable metrics from Compustat and IBES.

Only by reading through the footnotes and making adjustments to reverse accounting distortions can investors and advisors alike get beyond the noise and get the truth about earnings and valuation.

This article originally published on March 3, 2020.

Disclosure: David Trainer, Robert Hicks, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter (#filingseasonfinds), Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] In Core Earnings: New Data & Evidence, professors at Harvard Business School (HBS) & MIT Sloan empirically show that our “novel dataset” is superior to “Street Earnings” from Refinitiv’s IBES, owned by Blackstone (BX) and Thomson Reuters (TRI), and “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).

[2] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.