This is the fifth article in a five part series on AI in Finance. Read Part 1 here. Read Part 2 here. Read Part 3 here. Read Part 4 here.

Financial advisors face unprecedented challenges today. On the one hand, fee compression has made it difficult to maintain profits. On the other, the Fiduciary Rule and competition from robo-advisory technology requires increasingly higher levels of service and costs.

We see technology as one of the only true solutions to these challenges. Specifically, artificial intelligence empowers research automation[1] that gives advisors the diligence and research they need to impress new and existing clients and while avoiding regulatory scrutiny.

Embrace the Change: AI Is an Opportunity, Not a Threat

Before long, using AI will no longer be optional for advisors. In the coming decades, $30 trillion of wealth will be transferred to millennial investors that expect their advisors to be tech-savvy. The CFA exam plans to require knowledge about AI beginning in 2019.

For many advisors, the inevitable rise of AI raises two fears:

- AI will replace human advisors, and all investors will be served by robo-advisors.

- If human advisors do survive, they will need coding skills that are difficult to learn mid-career.

While these fears are a natural reaction to change, we think they are unfounded. Investors young and old want a human touch and personalized level of service that robo-advisors can’t deliver. They need a human they can rely on in a volatile market, not a robo-advisor that crashes when they try to check their accounts.

As we discussed in “AI Has a Big (Data) Problem”, machines can excel at specific tasks, but they’re nowhere near the level of sentience needed to deliver personalized service to a wide array of clients.

Nor will financial advisors need to become expert coders to work with AI. According to Stephen Horan, the managing director for credentialing for the CFA Institute, the technological hurdle is not nearly that high:

“Candidates will not be expected to code computer programs, but rather distinguish between structured and unstructured data analytic methods as well as identify characteristics of robust investment algorithms.”

Working with AI doesn’t mean you need a Ph.D. Advisors just need to understand the limitations of existing research processes and build a modern, more transparent process that leverages relevant technologies.

Advisors should think of AI technologies, like research automation, as partners that can automate large portions of manual processes. Automation frees advisors to serve a larger number of clients at a higher level.

AI Is Already Making Advisors More Money

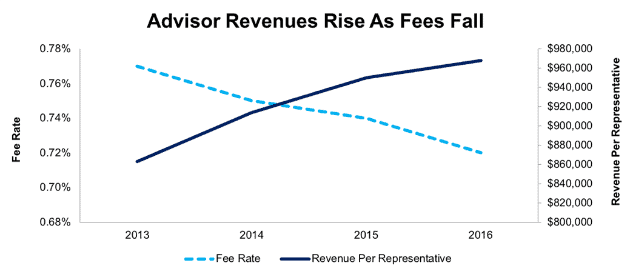

Morgan Stanley (MS) is already successfully leveraging artificial intelligence to support its advisors. Like every other firm, Morgan Stanley has felt the impact of fee compression. Figure 1 shows that the rate on its fee-based client assets has fallen from 0.77% to 0.72% since 2013.

Figure 1: Morgan Stanley Fee Compression and Revenue Per Advisor

Sources: New Constructs, LLC and company filings

Despite these falling fees, revenue per representative has risen by 12%, driven by an increase in assets per representative. Since 2013, assets per representative are up from $116 million to $133 million, a 15% increase.

Morgan Stanley has used AI to automate administrative tasks and assist advisors with simple decisions. The company’s “Next Best Action” system presents advisors with a range of suitable options for client portfolios, provides operational alerts, and even reminds advisors of notable events in their clients’ lives.

Crucially, Morgan Stanley’s AI empowers human advisors to do more, not to replace them. As Naureen Hassan, Morgan Stanley’s chief digital officer, said in a speech last year:

“We are bringing in the latest developments in predictive analytics and machine learning — not to replace our advisers with some cyborg bot — but rather help them be faster and smarter in serving their clients’ needs.”

So far, Morgan Stanley and other wealth management firms have been mostly focused on the “faster” part of the equation. The next task is to use AI to make advisors “smarter” by leveraging its superior data processing power to provide better advice and fulfill the Fiduciary Duty of Care.

AI Enables Fulfillment of the Fiduciary Duty Of Care

Fulfilling the fiduciary duty of care means showing clients and regulators that your investment advice is backed by research that is:

- Comprehensive: Incorporate all relevant publicly available data (e.g. 10-Ks and 10-Qs), including the footnotes and MD&A.

- Objective: Clients deserve unbiased research.

- Transparent: Client should be able to see how the analysis was performed and the data behind it.

- Relevant: There must be a tangible, quantifiable connection to stock, ETF or mutual-fund performance.

Most investors would be quite upset to learn that traditional research is far from meeting these qualifications.

Before AI, no human analyst or team of analysts could possibly perform comprehensive research[2] on their own for more than a handful of companies. The typical 10-K annual filing is over 200 pages of complex disclosures. Even if all you did was read 10-Ks all day every day, you’d never be able to keep up with the flood of documents filed with the SEC.

Historically, many advisors have trusted Wall Street to do comprehensive research. Unfortunately, the sell-side research model has some not-so-well-known flaws that make it unreliable in a fiduciary environment.

Advances in research automation technology now give advisors an alternative to traditional Wall Street research so they can faithfully fulfill the fiduciary duty of care for clients.

How AI Powers Research Automation

Our machine learning technology enables us to scale a “comprehensive” research process that big four accounting firm, Ernst & Young, proves is the best in the business. By automating large portions of the 10-K and 10-Q data collection process, we free up our human analysts for higher-value and more challenging work. In addition, our Robo-Analyst technology never tires and is not constrained by materiality thresholds. It collects everything all the time while also building highly complex financial models to QA and analyze the data. Meanwhile, our analysts focus on the most difficult and novel problems that the machine doesn’t already know how to solve.

Our human analysts spend more time reviewing difficult disclosures in the management discussion and analysis (MD&A) like new deferred compensation plans for executives, changes in accounting practices, or unusual acquisitions and mergers. These are critical tasks that the machines do not know how to perform, yet.

For example, the Robo-Analyst recently flagged two items with a combined value of $322 million on Page 96 of PayPal’s (PYPL) 2017 10-K. Analyst Pete Apockotos was able to quickly determine that these items—reversals of the loan loss allowance on a credit portfolio that was being sold—were non-operating income despite being included in the company’s earnings and EPS. With the click of a button, Pete directed our Robo-Analyst technology to remove these items from our calculation of net operating profit after tax (NOPAT).

These non-recurring items accounted for 15% of PYPL’s reported operating income. Any model that doesn’t make an adjustment for them will significantly overstate the company’s profitability.

We designed our AI to learn from every human analysts’ insight. Once our human experts show the machine how to analyze data, the machine can do the work on its own. Since 2003, we’ve carefully seeded our AI and Robo-Analyst technology with millions of human analysts’ insights from parsing over 120,000 10-K and 10-Q filings. Every day, our analysis of filings gets a little faster and a little smarter; so our analysts and our clients can spend more time focusing on more sophisticated activities than data gathering and model building.

This virtuous cycle allows us to continue to work together with machines rather than be threatened or replaced by them. The beauty of machines that learn is they enable us, humans, to do more.

How AI Can Help Advisors Grow and Keep Assets

AI becomes less frightening when you realize it’s about expanding human capabilities, not replacing them. The robots are coming, and that’s a good thing.

Transferring the slow, tedious work of reading 10-Ks to machines frees up analysts to spend time on higher-level strategic thinking and gives advisors more time to spend communicating with clients and better understanding their needs. Think of AI as an assistant that does the dirty work so you can be more productive.

AI-driven research automation is a great tool for client retention, both as a value-added service and a way to educate clients about the logic and diligence behind recommendations. It’s much easier to build buy-in on the investment process when you can be transparent about it.

Research automation technology also gives advisors more time to solicit new business, handle a larger client load, and serve clients at a lower asset level that has not previously been profitable. AI makes fiduciary-quality financial advice accessible to a larger number of people, which creates more potential clients.

It’s true that AI will replace some human jobs, but as chess champion Garry Kasparov (who experienced firsthand being made obsolete when he lost to IBM supercomputer Deep Blue in 1997) puts it:

“Waxing nostalgic about jobs lost to technology is little better than complaining that antibiotics put too many gravediggers out of work. The transfer of labor from humans to our inventions is nothing less than the history of civilization.”

This article is the last in a five-part series on the role of AI in finance. The first, “Cutting Through the Smoke and Mirrors of AI on Wall Street” highlights the shortcomings of current AI in finance. The second, “Opening the Black Box: Why AI Needs to Be Transparent” focuses on how transparency is crucial to both developers and users of AI. The third, “AI Has a Big (Data) Problem” details the difficulty machines have in reading large amounts of unstructured data. The fourth, “Working With Intelligent Machines” describes how humans can optimize their processes to collaborate with artificial intelligence.

This article originally published on March 5, 2018.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] For example, institutional analysts, like Wells Fargo’s Mike Mayo, leverage our research automation technology to enhance their work.

Click here to download a PDF of this report.

Photo Credit: rawpixel.com (Pexels)