To warrant investment, a company needs a great product, and its stock price should be cheap. With a growing brand and undue negative market sentiment regarding its future, this week’s stock pick of the week, Ralph Lauren (RL: $134/share) meets both criteria.

Currency Drags Down Quality Year

After the company’s disappointing third quarter earnings, investors sent RL down nearly 25%. Investors are worried that the highly promotional environment prevailing in the retail industry is undermining Ralph Lauren’s sales. In reality, foreign currency was the drag on Ralph Lauren’s results. Removing the impact of unusual currency fluctuations would have resulted in even better operating performance in 2015. The market is getting hung up on minor details and not looking at the improving picture of the business.

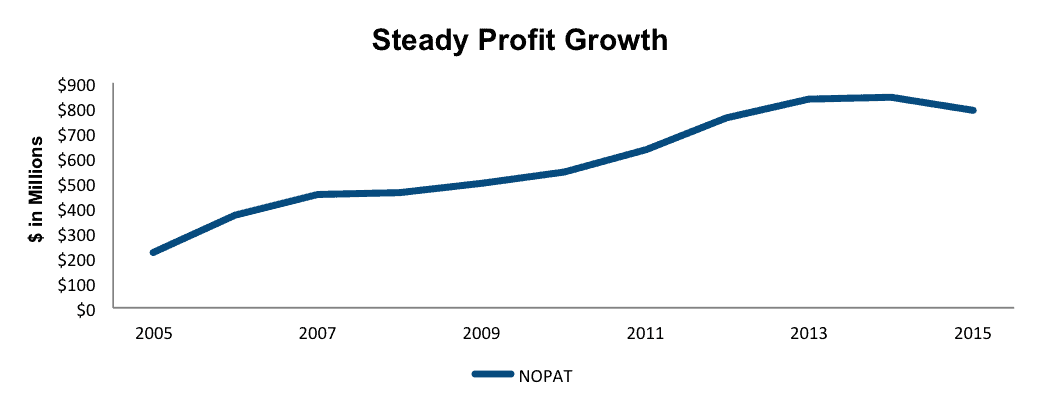

Strong and Reliable Profit Growth

According to Forbes, Ralph Lauren has one of the most valuable apparel and accessories brands in the world. Leveraging its brand, Ralph Lauren has been excellent at growing revenue and profits. Over the past decade, Ralph Lauren has grown revenue by 9% compounded annually. At the same time, the company has grown after-tax operating profit (NOPAT) by 14% compounded annually. While NOPAT did decline in 2015, the decline was due to currency headwinds, store launches/upgrades, and increases in marketing spend to further build the brand. These one-time store expenses should bolster the future growth of Ralph Lauren, not detract from it, as the stock price decline implies.

Figure 1: Consistently Growing the Bottom Line

Sources: New Constructs, LLC and company filings

Ralph Lauren has a return on invested capital (ROIC) of 13% and has achieved positive economic earnings every year dating back to 2002. The company generated $435 million in free cash flow in 2015 and maintains and excellent pre-tax (NOPBT) margin of 15%.

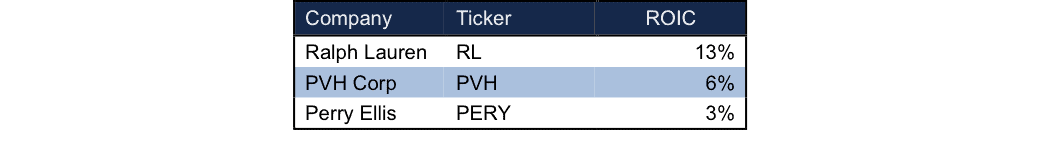

A Superior Lifestyle Brand

Those worried about the future of Ralph Lauren are neglecting the brand cache of the company. Ralph Lauren is investing in restaurants, home furnishings, and new brand extensions. These new products, although not related to core operations, reinforce Ralph Lauren’s image and position as a lifestyle, not simply a clothing company. Consumers are therefore willing to pay premium prices for the Ralph Lauren lifestyle. The success of the brand expansion strategy manifests in Ralph Lauren’s superior financial strength versus its competitors. Figure 2 below shows the superiority of RL’s ROIC relative to publicly-traded competitors: PVH (Tommy Hilfiger, Calvin Klein, IZOD) and Perry Ellis.

Figure 2: Higher Returns Lead to Stronger Business

Sources: New Constructs, LLC and company filings

Strong Foundation for Future Profit Potential

Ralph Lauren has excellent growth opportunities across multiple product categories. Currently only 12% of revenues come from Asia, providing strong future growth for the company. An expanding Chinese middle class, rising credit card penetration, and higher spending is fueling luxury market growth in China. By the end of 2015, China is expected to represent one-third of the estimated $175 billion global luxury market.

Since taking back control of its China business, Ralph Lauren has launched numerous stores in China with a flagship store in Hong Kong. An e-commerce platform specifically for the Chinese market has been created as well. Global e-commerce sales increased 16% year over year in 2015 and continued expansion in China could drive further growth.

The company has also begun to change its product mix to address investor concerns about declining margins. It has introduced new Polo branded handbags and leather goods, which have higher margins than traditional clothing. Ralph Lauren also introduced a new Women’s Polo brand, aimed at shifting the sales mix to become closer to 50/50 male/female.

Investments in new products, ecommerce, and expansion are costly in the short term. In our opinion, these investments will only lead to higher margin growth and profit in the future.

Impact of Footnotes Adjustments and Forensic Accounting

To reveal the true economic performance of Ralph Lauren, we look deeper into the company’s 10-K reports. For 2015 we made the following adjustments:

We removed $134 million (19% of net income) in non-operating expenses in our assessment of NOPAT. The net effect of income statement adjustments after removing non-operating income was $85 million.

We made $3.6 billion worth of balance sheet adjustments when calculating invested capital. One of the largest adjustments made when calculating invested capital was the removal of $763 million in excess cash. This amount represented 15% of reported net assets.

As it pertains to Ralph Lauren’s valuation, we made $3.4 billion worth of adjustments with a net impact of $1.9 billion. The largest adjustment we made to Ralph Lauren’s shareholder value was the removal of $1.8 billion to reflect the claim on cash flows due to off balance sheet debt. This adjustment represents 16% of the firm’s market value.

Buy Now While the Stock Is Still Cheap

For long-term value investors, the recent stock price decline provides an excellent entry point. At its current price of $139/share, Ralph Lauren’s price to economic book value (PEBV) ratio is 1.3. This ratio implies the market is expecting profits over the entire life of the company to grow by 30%. Considering that NOPAT has grown by 14% compounded annually for the past decade, this expectation seems low.

If we give Ralph Lauren credit for just 7% compounded annual NOPAT growth for the next decade, the stock is worth $186/share – 28% upside. However, if Ralph Lauren’s international expansion initiatives continue growing as they have been, we believe the company could grow NOPAT at 12% for the next 10 years and be worth $256/share. Invest in Ralph Lauren now before the market realizes just how undervalued its shares are.

Disclosure: David Trainer, Allen Jackson, and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: SimonQ (Flickr)

1 Response to "A Lifestyle Brand Worth Buying In To"

Would have lost alot of money if I purchased at suggested price. 10/12 price is down to $101.