The past seven years since the financial crisis have seen the S&P 500 bounce back by 150%, even as GDP growth continues to be slow. Digging deeper, stagnant wages and extremely low productivity growth show that the real economy has not kept pace with Wall Street.

Inevitably, that gap was going to have to close, and I think we are seeing the start of that process in late 2015 and early 2016. The combination of a slowdown in China, falling energy prices, and the end of zero interest rate policy from the Fed have put markets and the global economy in an interesting state of transition.

Note that this does not mean we expect financial Armageddon. Mohamed El-Erian did a great job in laying out the challenges for the economy and charting a path forward to stability. Stocks are expensive currently, but it is not too late for policy makers to steer us out of the gutter.

We expect the increased volatility in the stock market to continue. For years, the Fed has created artificial demand, both in terms of low rates for consumer spending and excess liquidity to prop up asset prices. As markets shift from being driven by this artificial demand to the real economic fundamentals, many high-flying stocks will get left behind.

As Benjamin Graham said, “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.”

The Big Issue Is Demand

Low rates have boosted consumption in the U.S. by making it inexpensive to borrow against future earnings. Since 2011, consumer credit has grown by 6.5% compounded annually, nearly three times the GDP growth rate. This process of borrowing against future earnings cannot go on forever, and we’re already starting to see signs of it letting up.

Many economists predicted heavy consumer spending in December due to savings from low gas prices. Instead, consumer savings hit a three-year high. We appear to have hit the ceiling of artificial demand, and rising interest rates will incentivize more saving and less borrowing.

More importantly, easy money has failed to stimulate heavy levels of investment. Consumer spending doesn’t actually create anything of value, it just keeps the wheels of the economy going. Ultimately, high return investments that grow existing businesses and create new ones drive economic growth in the long-term.

In theory, easy money should stimulate more investment by lowering the returns an investment needs to deliver in order to earn an economic profit. Instead, we see companies holding on to trillions of dollars in cash and actually cutting back on capital spending[1].

What are they doing with all that money? Channeling it into buybacks and dividends that don’t actually create economic growth. Stock buybacks prop up prices by creating artificial demand for shares and engineering EPS growth, while dividends attract income-seeking investors and often get reinvested, boosting prices even more.

Again, we’re starting to see the end of this cycle as well. Buyback activity continues unabated, but 2015 saw a record number of dividend cuts as weak commodity prices, slowing growth, and tightening credit markets forced many companies to reduce their payments to shareholders.

Creative Destruction

As I argued last year, artificially low interest rates were probably necessary to help the labor market recover and keep consumer sentiment up, but now a tightening cycle is necessary. For one, lower rates reduces future savings, meaning there’s less capital available down the road to continue to fuel growth. Credit-driven spending is not a sustainable method for growth.

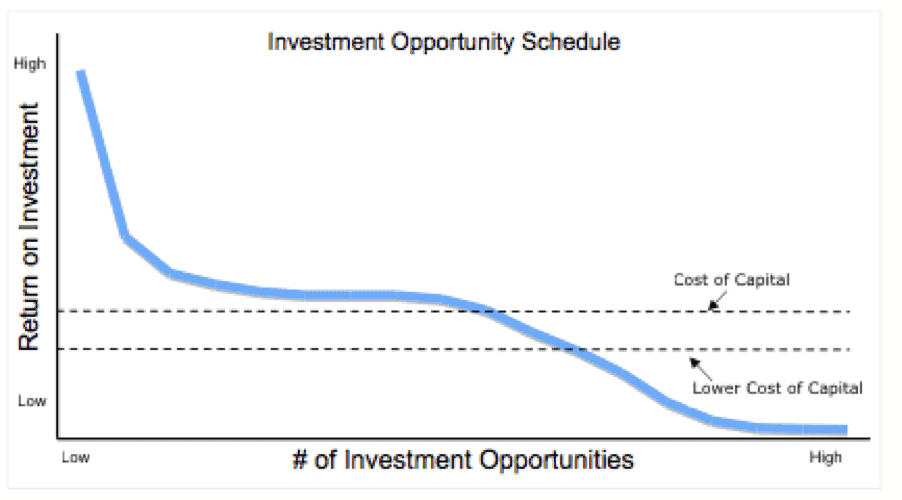

Secondly, artificially low rates harm the economy in the long-term by delaying the process of creative destruction. Low interest rates make subpar investments profitable and keep capital tied up in businesses that would not justify the investment during a period of normal rates. Figure 1 shows how this process works.

Figure 1: Low Interest Rates Subsidize Losing Investments

Sources: New Constructs, LLC and company filings.

The opportunity cost of subsidizing investment in low-return businesses is that it reduces the amount of capital available for investment in higher-return opportunities. The process of creative destruction can be painful, as it involves shutting down underperforming investments, but it delivers higher economic growth in the long run.

These forces explain why the Fed’s dialogue continues to revolve around raising rates. Yes, low rates helped to drag our economy out of the recession, but now we need to think long-term. That means getting rid of the Yellen/Bernanke put and allowing for the volatility that comes from the market picking winners and losers.

We’re in the very early stages of that process right now. The stock market has been volatile. Liquidity is declining on the margins. Stocks that had been trading on enthusiasm and momentum are reverting to their fundamentals.

Stocks That Get Hit Hard In A Tightening Cycle

There’s a certain type of stock that can do very well during an easy money-fueled bull market but gets crushed when conditions shift. These are the stocks with exciting growth prospects but no real track record of success. The ones where investors say things like “valuations don’t matter” or “they don’t care about profits.” As it turns out, valuations do matter, and people do start to care about profits once the market gets more volatile.

For years, we’ve been putting these kinds of companies, the ones where market expectations don’t line up with reality, in the Danger Zone. We had a good number of successes on those calls even when the markets were up in 2013 and 2014, but some stocks continued to fly higher despite their weak fundamentals.

However, their valuations and lack of profits caught up with them over the past 12 months. Here are just a few formerly high-flying stocks we called out long before they got crushed.

- LinkedIn (LNKD): In August of 2013, we raised concerns over the fact that LNKD was priced for massive long-term profit growth even though it faced significant competitive pressure that would limit its ability to grow and monetize users. The stock fell by almost 50% last Friday on poorer than expected revenue and earnings forecasts, as well as the revelation that unique visiting members and member page views declined in the most recent quarter. That’s the problem with a stock whose valuation is based on assumptions of massive growth; it only takes a little bit of negative data to spark a big correction.

- Twitter (TWTR): June of last year, we argued that TWTR’s business model wasn’t able to turn revenue into profits, and that the company would struggle to monetize users. Over the past eight months, the market awoke to those concerns and drove the stock down over 60%.

- Men’s Wearhouse[2] (TLRD): High-flying tech stocks aren’t the only ones getting crushed. We put this clothing retailer in the Danger Zone a year ago due to its disastrous acquisition of competitor Joseph A. Bank. TLRD squandered $1.8 billion on a company with declining sales and barely break-even profits, all while doing nothing to address the competition from discount department stores and online retailers. Capital allocation becomes more important in a volatile market, and investors punished TLRD’s wasteful acquisition by taking 75% off its market cap.

All three of the companies above have had impressive periods in recent years where they made investors lots of money, but the potential was always there for a crash.

What’s Next: Watch Out For FANG Stocks

One of the big narratives from 2015 was that a handful of large-cap tech companies helped to prop up the market with their strong performance. People even developed an acronym for it: FANG, which represents Facebook (FB), Amazon (AMZN), Netflix (NFLX), and Google[3] (GOOGL).

Those four stocks averaged close to 100% return, leading some to believe they’d be immune from market volatility. However, three of the four earn our Dangerous rating, and we think this bundle could be exposed to significant risk in the near future.

In particular, NFLX and AMZN pose a major risk for investors, one we’ve documented many times. Both companies face the same basic challenge. Their growth potential is tremendous, but they operate in highly competitive industries with little differentiation and stubbornly low margins. Both companies could continue to grow revenues, but it’s hard to see either of them achieving the profitability implied by their valuations.

NFLX continues to see content costs outpace revenue growth, while AMZN emphasizes cash flow numbers that don’t tell the whole story. Investors seem to be catching on, as AMZN has fallen 29% in 2016 while NFLX is down 25%. Look for these stocks to fall much further as investors look for profits that just aren’t there.

On the other hand FB and GOOGL have plenty of profits. The only problem is that both companies have declining returns on invested capital (ROIC) mixed with expensive valuations. Since ROIC is the primary driver of valuation, that’s a bad combination.

FB in particular earns our Dangerous rating. Its ROIC has fallen from 29% to 12% since 2013. Meanwhile, its current valuation of ~$100/share implies that it will grow revenue by 23% compounded annually over the next decade while increasing its ROIC to 42%.

To be fair, things for FB aren’t as bad as those numbers might seem. The dramatic drop in ROIC comes from the expensive purchase of WhatsApp, which was made with an eye on the long-term future and not current profitability. The core FB business model is much stronger and more profitable than NFLX or AMZN, but it may not be able to justify quite as high of a valuation as it currently gets from the market.

GOOGL is the best of this bunch and earns our Neutral rating. Still, its ROIC has been in steady decline since 2010. There’s no reason to suspect this stock will crash, but it may not be a big winner like it was in 2015.

This Market Rewards Fundamental Research

While we don’t necessarily think a full market crash is coming, look for even more volatility and flat overall performance for a while. This can mean pain for some investors, but it also leads to opportunity on both the long and short side for investors that can look past the topline numbers and get to the real drivers of valuation.

Our strategy remains focused on buying and holding low risk stocks with strong cash flows, high ROIC and cheap valuations. We continue to find stocks that have strong enough fundamentals to withstand the inevitable market pullbacks we can expect over the next several months. There are still plenty of pockets of opportunity for good long positions.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

[1] This may be in part an issue with measurement. Many businesses today prioritize investing in “human capital” over physical capital, so there’s an argument to be made that wages for certain types of employees (especially those engaged in R&D) qualifies as investment. Whatever the case, there’s no arguing the fact that businesses continue to sit on a massive amount of cash.

[2] Men’s Wearhouse recently shifted its corporate structure and is now part of a holding company called Tailored Brands.

[3] Yes, I know Google is technically now called Alphabet, but FANA is not a very good acronym.

Click here to download a PDF of this report.

Photo Credit: Broo_am (Andy B) (Flickr)