With the advent of streaming video services such as Netflix and Amazon Live, DVD rentals have been declining. However, this company, which mainly operates through its DVD segment, has built a unique business model that primarily serves the offline video market. This market is shrinking but will remain alive for the foreseeable future because of its price and convenience advantages. With a remarkably profitable business, strong potential for profit growth, and a significant undervaluation, this week’s Stock Pick of the Week is Outerwall Inc. (OUTR: $80/share).

Investors Are Too Quick to Judge

With over 37% of shares outstanding sold short, Outerwall is the tenth most shorted stock in the NASDAQ. Ever since Blockbuster’s bankruptcy in 2010, the market has had extremely low expectations for DVD rental providers and high praise for streaming services. OUTR shares are down almost 6% since mid June, and many investors have all but written off Outerwall as just another doomed rental provider. Buying into this common misconception risks overlooking the fundamental strength of the business and missing an excellent investment opportunity.

Outerwall Is No Stranger to Profit

Outerwall operates two main segments, Redbox and Coinstar, which make up 82% and 14% of revenue in 2014, respectively. The remaining revenue was generated through Outerwall’s “new ventures” segment, which includes ecoATM. Despite concerns regarding the DVD industry, Redbox has demonstrated impressive profit growth throughout its history.

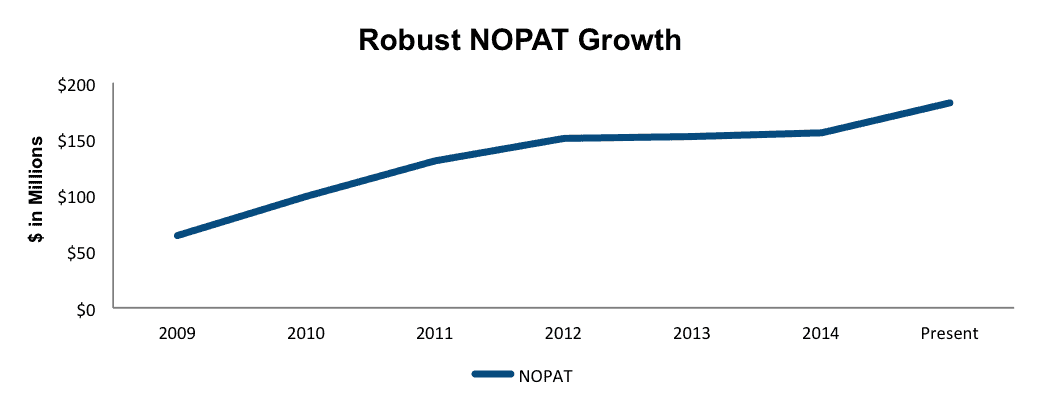

Since 2009, when Outerwall took full control of Redbox, after-tax profit (NOPAT) has grown by 19% compounded annually. Over the same time period, revenue has grown by 15% compounded annually.

Figure 1: Long-Term Profit Growth

Sources: New Constructs, LLC and company filings

While revenue and profit growth has slowed over the past two years, 2015 has been promising. In 1Q15, Outerwall reported 2% year over year revenue growth and 32% growth in operating income. Outerwall also earns a return on invested capital (ROIC) of 14%, which has almost doubled since 2009.

Pricing Power and Margin Expansion

While other companies scramble to build out online streaming services, Redbox caters to consumers seeking a convenient and affordable way to watch new movies. Despite increasing DVD and Blu-Ray prices to $1.50 and $2.00, respectively, Redbox still offers the lowest prices. On demand offerings cost upwards of $6 per movie and video subscription services charge anywhere from $7 to $20 monthly. Redbox has room to raise prices significantly while still charging less than most of the competition.

Redbox pricing power comes from its low cost advantage. Netflix, often viewed as the company’s largest threat, provides a vast library of TV shows and older movies, which create huge content costs. Redbox limits costs and differentiates its offerings by stocking its small kiosks with mainly recent DVDs. This specialized, limited selection attracts consumers with the newest and most exciting titles while avoiding the costs of carrying older, seldom watched titles.

Moreover, Redbox kiosks require little cost to set up, take down, or operate. Low set-up and take-down costs enable the company to be nimble about where to place the kiosks. This flexibility helps Redbox safeguard its margins as unprofitable locations can be removed quickly. Expect margins to increase as management is looking to remove between 1000 to 1900 unprofitable kiosks in 2015.

Providing Cheaper & Better Access to HD Movies

Although DVDs may be losing their luster, Blu-Ray discs are becoming a more attractive revenue stream due to the demand for HD quality movies. 53% of Americans living in rural locations and 17% of all Americans do not have access to Internet capable of streaming high quality video. For these consumers, Redbox provides access to videos they wouldn’t otherwise have.

Creating a Diversified Revenue Stream

Redbox also offers video games, which tap into a consumer base that may not overlap with the DVD renting crowd. Renting has broad appeal to video gamers: casual players can rent a game to play with friends for a day or two, while more serious players can save money by finishing a game even within a few days and avoid paying full retail price.

In addition, Outerwall’s ecoATM presents an intriguing business prospect. Only in its early stages, ecoATM grew revenues by 24% in 1Q15 over the prior year. The business segment has been unprofitable while Outerwall scales up locations and improves efficiency, but it has great potential. Gartner projects that 120 million secondhand smartphones will be resold in 2017, up from 57 million in 2014. Staking a claim in this growing industry will help offset any decline in DVD rentals by creating a huge potential growth avenue for Outerwall. The company has proven its ability to turn self-service kiosks into profitable entities and there’s little reason to expect different with ecoATM.

Impact of Footnotes Adjustments and Forensic Accounting

To reveal the true economic performance of Outerwall, we look deeper into the company’s 10-K report. For 2014, we made the following adjustments:

Income Statement: we removed $58 million (2% of revenue) in reported non-operating expenses in our assessment of NOPAT. The net effect of income statement adjustments after removing non-operating income was $48 million.

Balance Sheet: we made $432 million worth of adjustments to calculate invested capital. The largest adjustment made when calculating invested capital was the addition of $135 million (12% of net assets) due to asset write-downs.

Valuation: we made $1.2 billion worth of adjustments with a net effect of $957 million. The largest adjustment we made to Outerwall’s shareholder value was $61 million (4% of market value) to reflect the claim on cash flows due to off balance sheet operating leases.

Buying Opportunity

The overblown fears of the DVD business decline have left OUTR greatly undervalued. At its current price of $80/share, OUTR has a price to economic book value (PEBV) ratio of 0.6. This ratio implies the market expects Outerwall’s NOPAT to permanently decline by 40%. While Outerwall’s profits could see a slight decline along with the industry, we believe this expectation is extremely pessimistic. Outerwall currently has an economic book per share value, or no growth value of $125.

Even if Outerwall’s NOPBT margins decline to 9% (currently 11%) and the business is only able to grow NOPAT by 2% compounded annually for the next decade, the stock is worth $106/share. At this price, Outerwall would still be trading well below its economic book value. There is huge upside in OUTR at current prices, regardless of the DVD market’s expected decline.

Disclosure: David Trainer, Kyle Guske II, and Max Lee receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: Ian Lamont (Flickr)