We published an update on the BYND Danger Zone pick on August 16, 2021. A copy of the associated Earnings Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

With so many meme stocks and Bitcoin reaching all-time highs, it’s should come as no surprise that we’re finding more micro-bubbles. We think investors should consider the disconnect between fundamentals and valuations before trading micro-bubble stocks. This week’s Danger Zone pick, and micro-bubble loser is Beyond Meat (BYND: $175/share), which we pair with micro-bubble winner Kellogg Company (K: $57/share).

New Micro-Bubble Loser: Beyond Meat vs. New Micro-Bubble Winner: Kellogg

We first put Beyond Meat in the Danger Zone on September 2020 based on its extremely high valuation amid rising competition from deep-pocketed food industry incumbents. In this report, we juxtapose:

- the high-risk disconnect between the bubble in Beyond Meat’s stock and its poor fundamentals[1] with

- the low-risk disconnect between the depressed valuation of Kellogg’s stock and its strong fundamentals.

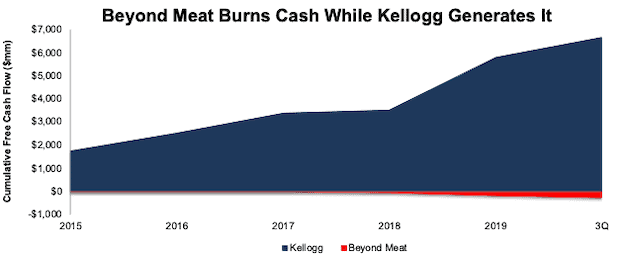

Kellogg’s Strong Cash Flows Versus Beyond Meat’s Losses

Beyond Meat burned $278 million (3% of market cap) in cash from 2018 through 3Q20. For comparison, Kellogg generated $6.7 billion (34% of market cap) in cumulative free cash flow (FCF) from 2015 through 3Q20. Figure 1 compares Beyond Meat’s cumulative FCF since 2018 compared to Kellogg’s cumulative FCF since 2015.

Figure 1: Kellogg vs. Beyond Meat: Cumulative Free Cash Flow Since 2015

Sources: New Constructs, LLC and company filings.

Beyond Meat’s Valuation Is Beyond Reason

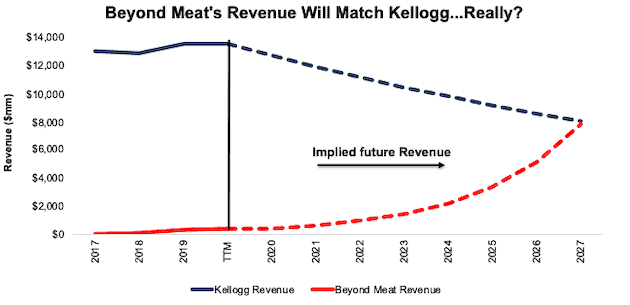

We use our reverse discounted cash flow (DCF) model to highlight the disconnect in the future revenue and profit growth expectations baked into Beyond Meat’s and Kellogg’s current stock prices.

To justify its current price of $175/share, Beyond Meat must:

- Immediately achieve a net operating profit after-tax (NOPAT) margin of 5.8% (up from its -4% TTM margin and equal to Tyson’s TTM margin) and

- grow revenue by 51% (vs. 3-year average consensus estimate of 47%) compounded annually over the next 8 years.

In this scenario, Beyond Meat’s revenue eight years from now rise to $7.9 billion, which equals 59% of Kellogg’s and 72% of ConAgra’s (CAG) TTM revenues. See the math behind this reverse DCF scenario.

Market expectations for Kellogg’s revenue are much more pessimistic, and at $57/share assume:

- NOPAT margin falls to 9% (equal to 10-year low compared to 11% TTM) and

- revenue falls 6% compounded annually over the next eight years.

In this scenario, Kellogg’s revenue eight years from now would be $8.1 billion, or 41% below its TTM revenue and just 3% higher than Beyond Meat’s implied revenue in the scenario above. See the math behind this reverse DCF scenario.

Figure 2 illustrates the DCF scenarios above and contrasts the huge increase in revenue implied by Beyond Meat’s valuation to the decrease in revenue implied by Kellogg’s valuation.

Figure 2: Kellogg vs. Beyond Meat: Revenue Expectations vs. Historical Revenue

Sources: New Constructs, LLC and company filings.

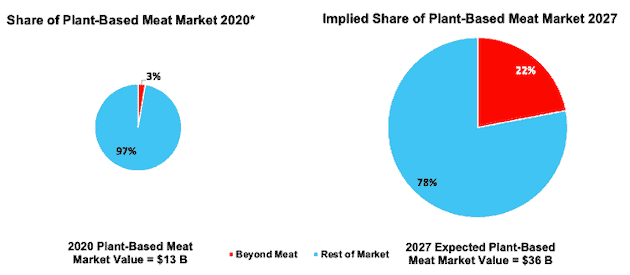

BYND Valuation Implies Unrealistic Market Share Growth: from 3% in 2020 to 22% in 2027

The expectations for $7.9 billion in revenue by 2027 baked into Beyond Meat’s share price implies the firm’s share of the global plant-based meat market[2] will grow from 3% in 2019 to 22% in 2027. See Figure 3. $7.9 billion in revenue ranks as the eighth largest among meat and poultry processors in the U.S. for 2020.

For reference, JBS S.A., the largest meat processor in the world, generated ~$52 billion of revenue in 2019, which gives it just a 4% share of the $1.2 trillion global meat market.

Betting that Beyond Meat would ever achieve market share so much greater than the largest companies in the meat business is imprudent for fiduciaries and risky, to say the least.

Figure 3: Beyond Meat: 2020 Market Share vs. 2027 Implied Market Share

Sources: New Constructs, LLC and Polaris Market Research.

*2020 market share estimated based on Beyond Meat’s 2020 consensus revenue estimate

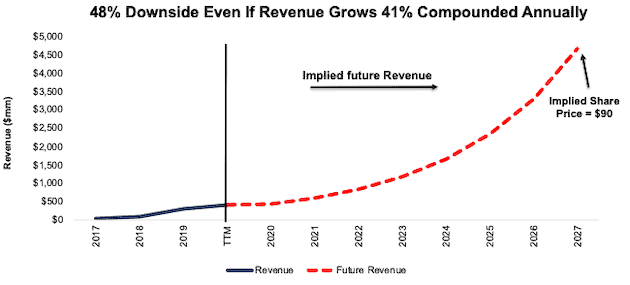

Significant Downside Even If Beyond Meat Becomes a Remarkable Growth Story

The revenue growth expectations baked into Beyond Meat’s stock price are so high we have to look beyond the food industry to find a firm that’s ever achieved comparable growth. Monster Beverages (MNST) had a popular product that allowed it to achieve eight years of rapid (41% CAGR) revenue growth and take significant market share from incumbents.

Even if we assume Beyond Meat can immediately reach a NOPAT margin of 5.8% and grow revenue by 41% (equal to Monster’s fastest eight-year period) compounded annually, the stock is worth just $90/share today – a 49% downside to the current price. See the math behind this reverse DCF scenario. If the firm grows at industry growth rates (16%) and generates $977 million in revenue by 2027, the stock is worth $8/share. In other words, the downside risk in BYND is huge if the firm doesn’t significantly outgrow the industry.

Figure 4: Beyond Meat: Revenue Growth Expectations vs. Historical Revenue

Sources: New Constructs, LLC and company filings.

Both reverse DCF scenarios also assume Beyond Meat is able to grow revenue, NOPAT and FCF without increasing working capital or fixed assets. This assumption is unlikely but allows us to create best-case scenarios that demonstrate how high expectations embedded in the current valuation are. For reference, Beyond Meat’s invested capital increased from $66 million in 2017 to $339 million TTM.

The Pepsi Deal Shows Beyond Meat’s Dependency on Competitors

After Beyond Meat announced it formed a joint venture with PepsiCo Inc. (PEP), BYND rose by as much as 30%. Bullish investors believe Beyond Meat will be able to leverage Pepsi’s marketing and distribution capabilities.

While this deal might be good news for short-term revenue growth, it actually highlights Beyond Meat’s biggest limitations: production capabilities, distribution outlets, and shelf space – all of which many of the firm’s competitors have in abundance.

Beyond Meat recognizes this problem and discloses its overreliance on third-party distribution in its 2019 10-K:

“If we lose one or more of our significant distributors and cannot replace the distributor in a timely manner or at all, our business, results of operation and financial condition may be materially adversely affected.”

As incumbent food companies continue to develop alternative meat products, more of Beyond Meat’s distribution partners become direct competitors.

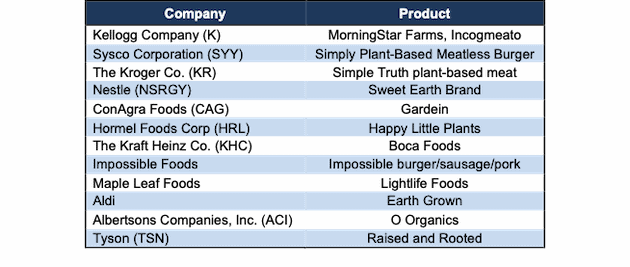

Low Barriers to Entry Mean Competition Is Everywhere

Perhaps, the greatest threat to Beyond Meat’s business are low barriers to entry. While Beyond Meat’s products are available in 80 countries, incumbents can leverage superior production capabilities, distribution outlets, and existing shelf space to sell alternative meat products on a larger scale very quickly. For example, Kellogg’s and Tyson (TSN) distribute products to over 180 and 100 countries, respectively. They’re not the only competitors in the market either, as Figure 5 provides a sample list of direct competitors.

Figure 5: Beyond Meat’s Competition

Sources: New Constructs, LLC and company filings.

There Might Be Another Winner of the Alternative Meat Market

While plant-based meat is highly popular, another new technology could quickly make Beyond Meat’s goal of attracting traditional meat eaters more difficult. Cell-based meat (aka lab grown meat) could disrupt the traditional meat and plant-based market alike. First, since cell-based meat is actually meat, it already has the flavor Beyond Meat strives to imitate.

Second, it could prove more environmentally friendly than Beyond Meat’s products, which already use 99% less water and 93% less land than a beef burger. Memphis Meats, a food technology company developing cell-based meat, claims it can produce alternative meat products using just 1% of the land and 1% of the water compared to traditional meat-producers.

Should cell-based meat production costs continue to decline, Beyond Meat could find itself disrupted just as it hopes to disrupt incumbents.

Private Label Is Also a Growing Obstacle

For years food companies have lost market share to grocery stores’ private label selections, and Beyond Meat may be no different. Kroger (KRO), Aldi, and Albertsons (ACI) each have their own alternative meat products that they offer at lower price points than Beyond Meat.

Grocery stores can also limit the shelf space they allocate to other alternative meat products, including Beyond Meat, as their private label alternative meat products grow in popularity. Competition with lower prices and control over shelf space is a major obstacle for Beyond Meat to come close to meeting the expectations baked into its stock price.

First Mover Advantage Is Gone as Alternative Meat Becomes Commoditized

While Beyond Meat markets itself as disrupting the global meat market, the number of competing products suggests its first mover advantage is long gone.

Now, as each firm in the industry aims to make products that imitate the taste and texture of meat, differentiation between products will diminish as firms get closer to that goal. With an inability to compete on the basis of innovation alone, Beyond Meat faces an uphill battle to improve profitability as the market grows more commoditized.

Beyond Meat’s Lack of Profitability Makes It Even More Unlikely to Best Peers

The profit expectations embedded in Beyond Meat’s valuation are out of touch with reality given the numerous challenges facing the business (noted above) and exacerbated by its current lack of profitability. While Kellogg has years of proven profitability, Beyond Meat generated just $10 million in NOPAT in 2019 and -$16 million over the TTM.

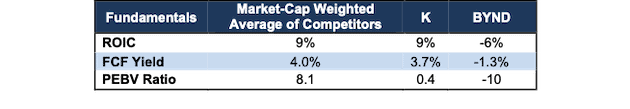

Per Figure 6, Beyond Meat’s current return on invested capital (ROIC) of -6% and NOPAT margin of -4% are significantly below Kellogg’s and the market-cap weighted average of competitors[3]. Beyond Meat is not only much less profitable than Kellogg, but it is also much more overvalued as measured by price-to-economic book value (PEBV) ratio and the reverse DCF scenarios featured above.

Figure 6: Beyond Meat vs. Kellogg & Competitors: Fundamental Metrics Comparison

Sources: New Constructs, LLC and company filings.

Keep These Winners & Sell These Losers

Beyond Meat isn’t the only micro-bubble loser. We believe the micro-bubble winners will outperform micro-bubble losers going forward, especially because the expectations implied by the micro-bubble winner’s valuations are much less than those of the micro-bubble losers. Figure 7 lists all of our micro-bubble winners and micro-bubble losers.

Figure 7: Micro-Bubble Winners & Micro-Bubble Stocks

| Micro-Bubble Winners | Micro-Bubble Losers | Report Date |

|---|---|---|

| Kellogg Company (K)* | Beyond Meat Inc. (BYND)* | 2/16/21 |

| Hyatt Hotels Corp (H) | Airbnb, Inc. (ABNB) | 2/10/21 |

| Williams-Sonoma Inc. (WSM) | Wayfair, Inc. (W) | 2/3/21 |

| Sysco Corporation (SYY) | DoorDash, Inc. (DASH) | 1/27/21 |

| Alphabet, Inc. (GOOGL) | GoDaddy Inc (GDDY) | 9/26/18 |

| Microsoft Corporation (MSFT) | Dropbox Inc. (DBX) | 9/26/18 |

| General Motors Co (GM) | Tesla Inc (TSLA) | 8/16/18 |

| The Walt Disney Company (DIS) | Netflix Inc. (NFLX) | 8/16/18 |

| Oracle Corporation (ORCL) | Salesforce.com Inc. (CRM) | 8/16/18 |

| Walmart, Inc. (WMT) | Amazon.com Inc. (AMZN) | 8/16/18 |

Sources: New Constructs, LLC and company filings.

*New to the list as of this report.

This article originally published on February 16, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Only our “novel database” enables investors to overcome the inaccuracies, omissions and biases in legacy fundamental data and research, as proven in Core Earnings: New Data & Evidence, a forthcoming paper in The Journal of Financial Economics by professors at Harvard Business School (HBS) & MIT Sloan.

[2] We estimate market share using Polaris Market Research’s projection that the global plant-based meat market will grow 16% compounded annually from $11 billion in 2019 to nearly $36 billion in 2027.

[3] Competitors include Tyson Foods (TSN), Sysco (SYY), The Kroger Company (KR), Nestle (NSRGY), ConAgra (CAG), Hormel (HRL), and the Kraft Heinz Co (KHC).