We published an update on this Danger Zone pick on January 18, 2022. A copy of the associated Earnings Update report is here.

We’re reiterating a Danger Zone pick that recently reported calendar 2Q21 earnings. Despite beating top line estimates, this business is losing ground to formidable incumbents and looks increasingly unlikely to achieve the profits implied by its stock price. Beyond Meat (BYND: $121/share) is in the Danger Zone.

We leverage more reliable fundamental data, proven in The Journal of Financial Economics[1], with qualitative research to highlight these firms whose stocks present poor risk/reward.

Beyond Meat Still Has 76%+ Downside

We first put Beyond Meat in the Danger Zone in September 2020 and reiterated our opinion in February 2021. Since our original Danger Zone report the stock has outperformed the S&P 500 as a short by 31%. Below, we’ll show we what learned from 2Q21 earnings and why Beyond Meat still holds 76%+ downside risk.

What’s Working for the Business: Beyond Meat beat 2Q21 top line estimates, as revenue grew 32% year-over-year (YoY). A robust rebound in foodservice sales in the United States (+269% YoY), as restaurants were largely closed in the year ago period, and rising international retail and foodservice sales drove the quarter’s revenue growth.

Shortly after the end of 2Q21, Beyond Meat launched a new line of meat-free chicken tenders in U.S. restaurants, after discontinuing its previous chicken strips in 2019. In August, the firm announced an expansion of its partnership with Pizza Hut to test new meat-free pepperoni as well.

What’s Not Working for the Business: While Beyond Meat beat revenue estimates, digging deeper reveals more troubling results. Retail sales in the United States (around half of revenue) were down 14% YoY in 2Q21 and up less than 1% YoY in the first half of 2021. Total revenue in the first half of 2021 was up just 22% YoY, compared to 37% YoY growth in 2020 and 239% YoY growth in 2019.

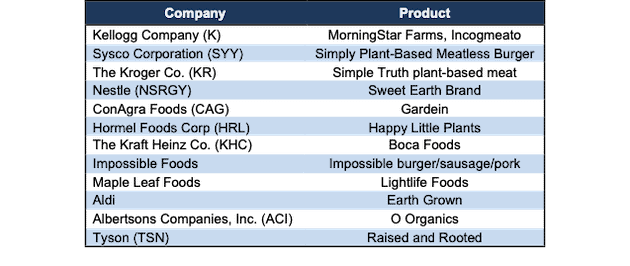

Competition, from both incumbent meat processors and distribution partners, continues to undermine Beyond Meat’s growth and profitability. These competitors can leverage superior production scale, distribution scale, and more retail shelf space to sell their alternative meat products more and more effectively. Figure 1 provides a sample list of direct competitors.

Figure 1: Beyond Meat’s Competition is Plentiful

Sources: New Constructs, LLC and company filings.

The cost of developing new products, marketing those products to consumers, and fending off these competitors is getting more and more expensive:

- selling, general, and administrative costs rose from 25% of revenue in 2019 to 34% of revenue in the first half of 2021.

- Research and development costs rose from 7% of revenue in 2019 to 12% in 1H21

- total operating expenses, after falling to 100% of revenue in 2019 (from 188% in 2017), rose to 117% of revenue in 1H21.

While Beyond Meat is great at grabbing headlines with new partnerships and product launches, it’s not so great a turning those headlines into profits. From a fundamental perspective, Beyond Meat’s Core Earnings , which adjust for unusual and non-core expenses and income, have fallen from $7 million in 2019 to -$66 million over the trailing-twelve months (TTM) while the firm’s return on invested capital (ROIC) declined from 6% in 2019 to -18% over the TTM.

As we predicted in our original Danger Zone report, competition is forcing Beyond Meat to spend more and sacrifice margins in an attempt to gain market share. We expect Beyond Meat will struggle to achieve and sustain positive margins.

The growth trajectory of the firm does not look good either. The firm is guiding for revenue to grow anywhere from 27%-48% YoY but cautions that rising COVID-19 cases around the globe, along with recent losses of distribution channels and labor issues, will likely result in a slowdown in international and U.S. foodservice revenue growth.

The biggest threat to any bull case for investing in Beyond Meat remains its valuation. Beyond Meat’s current valuation implies the firm will drastically improve margins and maintain double digit growth rates, or the exact opposite of what is taking place.

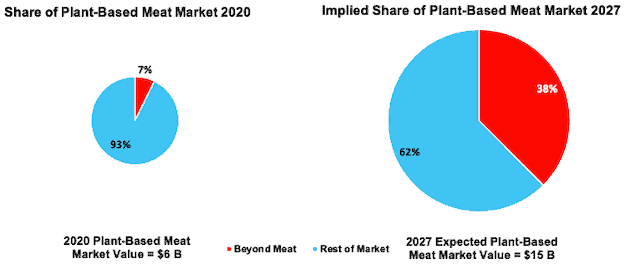

Current Price Implies Beyond Meat Increases Market Share from 7% to 38%: To justify its current price of $121/share, Beyond Meat must:

- immediately improve NOPAT margin to 6% (which equals Tyson’s [TSN] 5-year average margin, double Beyond Meat’s best ever margin, and above Beyond Meat’s -15% TTM margin) and

- grow revenue at a 45% CAGR through 2027 (nearly 3x projected industry growth).

In this scenario, Beyond Meat would generate nearly $6 billion in revenue in 2027, which is 14x its 2020 revenue and 38% of the global plant-based meat market[2] in 2027. Market share is estimated at 7% in 2020. Figure 2 compares Beyond Meat’s 2020 market share with the market share in 2027 implied by its stock price.

For reference, in the more mature $1.3 trillion global meat market, JBS S.A., the largest meat processor in the world, has only 4% market share. Beyond Meat’s 7% share of the plant-based meat market is high now, due to its first mover advantage, but as more competition enters the market, we expect its market share to fall, not rise.

We think it’s beyond optimistic (pun intended) to assume Beyond Meat’s share of the global plant-based meat market will ever be as high as implied by the stock price, especially considering its competition (see Figure 1). Additionally, it seems unlikely Beyond Meat will raise margins to match one of the largest meat processers in the world while also growing at nearly 3x projected industry growth.

Figure 2: Beyond Meat’s Market Share vs. Market Share Implied by Stock Price

Sources: New Constructs, LLC and company filings

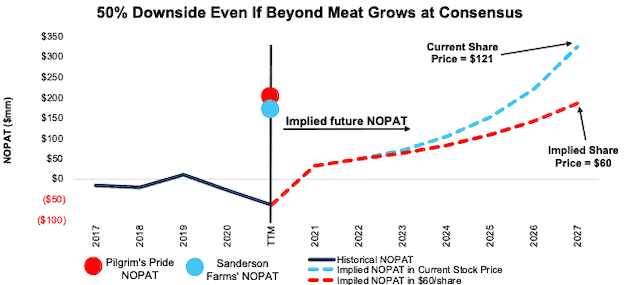

There’s 50%+ Downside If Consensus is Right: In this scenario, Beyond Meat’s:

- NOPAT margin improves to 6% and

- revenue grows at consensus rates in 2021, 2022, and 2023, and

- revenue grows 30% a year from 2023-2027 (continuation of 2023 consensus), then

the stock is worth just $60/share today – a 50% downside to the current price. This scenario still implies that Beyond Meat increases its market share from 7% in 2020 to 21% in 2027. If Beyond Meat’s growth continues to slow, it is unable to boost falling retail sales in the United States, or fails to reverse rising costs, the downside risk in the stock is even higher, as we show below.

Figure 3 compares the firm’s historical NOPAT and implied NOPATs for the two scenarios we presented to illustrate just how high the expectations baked into Beyond Meat’s stock price remain. For reference, we also include the TTM NOPAT of meat product peers Pilgrim’s Pride (PPC) and Sanderson Farms (SAFM).

Figure 3: Beyond Meat’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

There’s 76%+ Downside If Growth Slows to More Reasonable Level: In this scenario, Beyond Meat’s:

- NOPAT margin improves to 6% and

- revenue grows at consensus rates in 2021, 2022, and 2023, and

- revenue growth slows beyond 2023, and grows at 20% in 2024, 15% in 2025, and 12% in 2026 and 2027, then

the stock is worth just $29/share today – a 76% downside to the current price. This scenario still implies that Beyond Meat increases its market share from 7% in 2020 to 13% in 2027.

Each of these scenarios also assumes Beyond Meat is able to grow revenue, NOPAT, and free cash flow without increasing working capital or fixed assets. This assumption is unlikely but allows us to create best-case scenarios that demonstrate how high expectations embedded in the current valuation are. For reference, Beyond Meat’s invested capital has grown 57% compounded annually since 2017.

Other Danger Zone Picks That Recently Reported Earnings

Figure 4 shows other Danger Zone picks that have recently reported their calendar 2Q21 earnings along with their relative performance.

Figure 4: More Danger Zone Picks That Recently Reported Earnings: Through 8/13/21

| Company | Ticker | Earnings Date | Out (under)performance as Short vs. S&P 500 |

| Zynga Inc. | ZNGA | 8/5/21 | 11% |

| AMC Entertainment | AMC | 8/9/21 | 45%** |

| Compass Inc. | COMP | 8/9/21 | 31%* |

| Squarespace Inc. | SQSP | 8/9/21 | 16%* |

| Coinbase Global | COIN | 8/10/21 | 39%* |

| Bottomline Technologies | EPAY | 8/10/21 | 39% |

| Airbnb | ABNB | 8/12/21 | 42% |

| DoorDash Inc. | DASH | 8/12/21 | 14%* |

Sources: New Constructs, LLC

Performance measured from the date of publication of each respective report linked in the table. Performance represents price performance and is not adjusted for dividends.

*Measured from the opening price on the day of each firm’s IPO.

** Focus List Stocks: Short performance

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

This article originally published on August 16, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, proven by professors at Harvard Business School & MIT Sloan and featured in The Journal of Financial Economics.

[2] We estimate market share using Research and Market’s projection that the global plant-based meat market will grow 15% compounded annually to nearly $15 billion in 2027.