Recap from October’s Picks

Our Most Attractive Stocks (5.9%) slightly outperformed the S&P 500 (5.9%) last month. Most Attractive Large Cap stock Lam Research Corp (LRCX) gained 17% and Most Attractive Small Cap stock Hawaiian Holdings (HA) was up 39%. Overall, 19 out of the 40 Most Attractive stocks outperformed the S&P 500 in October and 32 stocks had positive returns.

Our Most Dangerous Stocks (3.6%) rose less than the S&P 500 (5.9%) and outperformed as a short portfolio last month. Most Dangerous Large Cap stock Tenet Healthcare Corp (THC) fell by 14% and Most Dangerous Small Cap Stock Astrotech Corporation (ASTC) fell by 9%. Overall, 24 out of the 40 Most Dangerous stocks outperformed the S&P 500 as shorts in October.

The successes of the Most Attractive and Most Dangerous stocks highlight the value of our forensic accounting. Being a true value investor is an increasingly difficult, if not impossible, task considering the amount of data contained in the ever-longer annual reports. By analyzing key details in these SEC filings, our research protects investors’ portfolios and allows our clients to execute value-investing strategies with more confidence and integrity.

14 new stocks make our Most Attractive list this month and 10 new stocks fall onto the Most Dangerous list this month. November’s Most Attractive and Most Dangerous stocks were made available to members on November 4, 2015.

Our Most Attractive stocks have high and rising return on invested capital (ROIC) and low price to economic book value ratios. Most Dangerous stocks have misleading earnings and long growth appreciation periods implied by their market valuations.

Most Attractive Stock Feature for November: Diamond Resorts International (DRII: $28/share)

Diamond Resorts International (DRII), a hospitality and vacation ownership company, is one of the additions to our Most Attractive stocks for November.

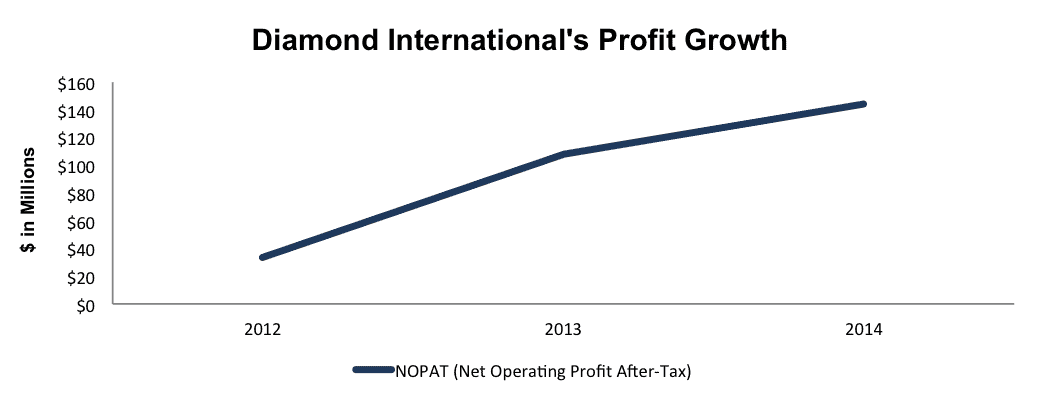

Diamond Resorts vacation ownership business is highly profitable, as the company has grown after-tax profit (NOPAT) by 107% compounded annually since 2012. More details in Figure 1.

Figure 1: DRII Impressive Profit Growth

Sources: New Constructs, LLC and company filings

The profit growth comes from improving the NOPAT margin from 6% to 21% and return on invested capital (ROIC) from 6% to a top quintile 24% from 2012 to the most recent trailing twelve months.

Impact of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to Diamond Resorts International’s 2014 10-K:

Income Statement: we made $178 million of adjustments with a net effect of removing $84 million (10% of revenue) in non-operating expenses. The largest adjustment was the removal of $25 million in expenses due to an increase in loan loss reserves. This adjustment represented 3% of revenue.

Balance Sheet: we made $423 million of adjustments to calculate invested capital with a net decrease of $7 million. The largest adjustment was the removal of $200 million due to excess cash. This adjustment represented 26% of reported net assets.

Valuation: we made $804 million of adjustments with a net effect of decreasing shareholder value by $427 million. The largest adjustment was the removal of $83 million due to outstanding employee stock options. This adjustment represents 4% of Diamond International’s market cap.

Shares Remain Undervalued

Diamond International shares have traded in-line with the S&P 500 and are up 2% year-to-date, which has left shares undervalued. At its current price of $28/share, DRII has a price to economic book value (PEBV) ratio of 0.9. This ratio means that the market expects Diamond International’s NOPAT to permanently decline by 10%. However, if Diamond International can grow NOPAT by 8% compounded annually for the next five years, the stock is worth $34/share today – a 21% upside.

Most Dangerous Stock Feature: On Assignment, Inc. (ASGN: $48/share)

On Assignment, Inc. (ASGN), an employee staffing services company, is one of the additions to our Most Dangerous stocks for November.

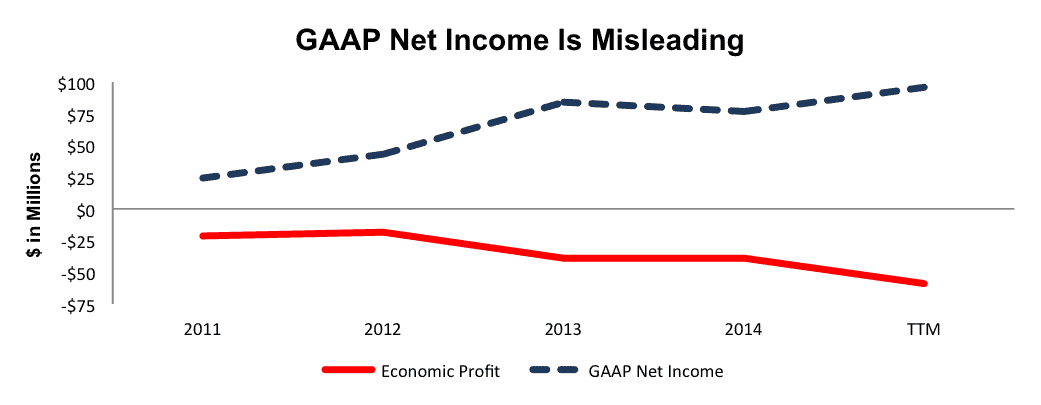

On Assignment provides an excellent snapshot of why GAAP net income numbers should not be used when evaluating a company. Since 2011, GAAP net income has grown from $24 million to $96 million on a TTM basis. Economic earnings have declined from -$22 million to -$59 million over the same timeframe. Figure 2 illustrates how the disconnect between accounting and economic earnings is growing.

Figure 2: On Assignment’s Misleading Earnings Growth

Sources: New Constructs, LLC and company filings

Because GAAP net income fails to properly account for off balance sheet liabilities and equity capital, investors using this metric get a false picture of On Assignment. In fact, the cost of On Assignment’s invested capital in 2014 was $130 million, or 2.46/share. After removing this cost we see that the company’s economic EPS was actually -$0.72/share compared to GAAP EPS of $1.42.

Further issues with On Assignment’s business operations can be found in the company’s 6% ROIC and -13% free cash flow yield.

Only Forensic Accounting Reveals Overstated EPS

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to On Assignment’s 2014 10-K

Income Statement: we made $35 million of adjustments with a net effect of removing $14 million in non-operating expenses (<1% of revenue). We removed $25 million related to non-operating expenses and $10 million related to non-operating income.

Balance Sheet: we made $230 million of adjustments to calculate invested capital with a net increase of $163 million. The largest adjustment was the inclusion of $125 million (11% of net assets) due to accumulated asset write-downs.

Valuation: we made $943 million of shareholder value decreasing adjustments. There were no adjustments that increased shareholder value. One of the most notable adjustments was the removal of $878 million related to the fair value of total debt. This adjustment represents 35% of On Assignment’s market cap.

Valuation Is Alarming

ASGN has soared nearly 35% since its late August lows as the company reported second and third quarter EPS growth. Further improvement in the labor market has also helped drive shares higher. However, as we highlighted above, EPS is not a quality metric to determine the health of a business. This price increase has driven shares to levels that cannot be justified by business operations.

In order to justify its current price of $48/share, ASGN must grow NOPAT by 12% compounded annually for the next 24 years.

Even if we assume On Assignment can grow NOPAT by an impressive 16% compounded annually for the next decade, the stock is only worth $30/share today – a 38% downside. A business model destroying shareholder value and an overvalued stock price make it clear why ASGN lands on this month’s Most Dangerous Stocks list.

Disclosure: David Trainer and Blaine Skaggs receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.