Honest Company (HNST: $4/share) – Closing Short Position – down 82% vs. S&P down 5%

We put Honest Company in the Danger Zone in May 2021, prior to its IPO. At the time of our report, the company earned an Unattractive rating. We pointed out that Honest Company’s lack of profitability, significant incumbent competition, the unlikelihood of an acquisition, and high valuation, gave the stock poor risk/reward.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior fundamental research and support more cost-effective fulfillment of the fiduciary duty of care[1].

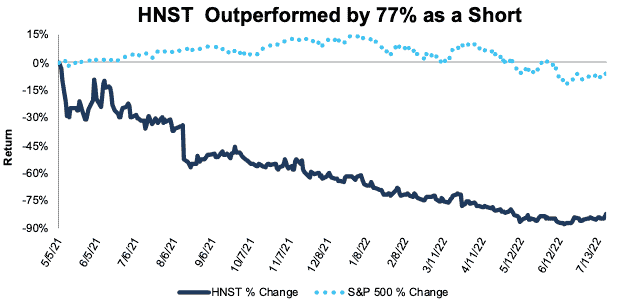

During the 1+ year holding period, the stock has outperformed the S&P 500 as a short by 77%.

Since our report, Honest Company has proven it is not a “growth story” stock. The company’s trailing-twelve-month (TTM) revenue is below 2021 levels and just 2% above 2020 levels. Even worse, profitability is not improving. Honest Company’s return on invested capital (ROIC) has fallen from 0% in 2020 to -16% TTM.

Despite the deterioration of the company’s fundamentals, the stock’s 82% decline since its IPO, makes further downside less likely. However, should the company match its improved distribution (such as the recent announcement of availability in Walmart) with positive profitability, shares could have more upside from their current depressed levels. While we still doubt this company’s turnaround story, we’re taking the gains and walking away from any increased stupid money risk.

Figure 1: HNST vs. S&P 500 – Price Return – Through 7/19/2022

Sources: New Constructs, LLC

This article originally published on July 21, 2022.

Disclosure: David Trainer, Kyle Guske II, Matt Shuler, and Brian Pellegrini receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.