We closed this position on July 21, 2022. A copy of the associated Position Update report is here.

At the midpoint of its expected May 5 IPO price range ($15.50/share), The Honest Company (HNST: $15.50/share midpoint of IPO price range) is valued at ~$1.4 billion and earns our Unattractive rating.

We think the stock is worth no more than $7/share. A valuation at $15/share implies the company’s profits will be three times greater than Revlon (REV), and we think the chances of that happening are very low because of the formidable large incumbent personal care products companies with which The Honest Company is competing. The incumbents already own all the shelf space and dominate the industry.

We also think the chances are very low that one of the large incumbent personal care products companies will buy The Honest Company because these incumbents already either have:

- products that compete directly with The Honest Company’s offerings

Or

2. large cash flows to develop (more) products that compete directly with The Honest Company.

Offering “clean and sustainable” personal care products is a nice gimmick, but it is not enough of a business to justify anywhere close to $15.50/share.

Our IPO research aims to provide investors with more reliable fundamental research.

Revenue Growth and Shrinking Losses

The Honest Company has been unable to turn a profit so far, though it was close in 2020. Revenue grew 28% year-over-year (YoY) in 2020 and Core Earnings[1] improved from -$26 million to -$2 million. The company’s return on invested capital (ROIC) saw similar improvement, rising from -12% in 2019 to -0.1% in 2020.

Small Market Share in Fast Growing Markets

The Honest Company provides “clean and sustainable” personal care products and is a niche player in a large market. Based on the firm’s own estimates of the size of its end markets, it held just 1.4% market share in 2019, and the firm currently notes its market share is “less than 5%”.

Despite having a small share, the expected growth of The Honest Company’s “clean and natural” product markets, when compared to the more traditional consumer packaged goods markets, may have investors eyeing The Honest Company’s potential. Based on data provided in the S-1, The Honest Company estimates:

- the clean and natural U.S. diapers and wipes market will grow at a 16% compound annual growth rate (CAGR) from 2019 – 2025

- the clean and natural U.S. skin and personal care market will grow at a 10% CAGR from 2019 – 2025

- the clean and natural U.S. household and wellness will grow at a 4% CAGR from 2019 – 2025

Overall, the company estimates that the clean and natural markets are expected to grow 6x faster than the same categories in the conventional U.S. markets. For reference, diapers and wipes, skin and personal care, and household and wellness products represented 63%, 26%, and 11% of revenue in 2020.

But Facing Significant Incumbent Opposition

With above average growth projections in the clean and natural markets, The Honest Company faces increasing competition from some of the largest consumer packaged goods firms in the world. For instance, competitors include, but are not limited to:

- In the Diapers and Wipes market

- Kimberly-Clark (KMB), maker of Huggies,

- Procter & Gamble (PG), maker of Pampers and Luvs

- In the Skin and Personal Care market

- Johnson & Johnson (JNJ), maker of Johnson’s Baby and Aveeno

- The Clorox Company (CLX), maker of Burt’s Bees

- Unilever (UL)

- Estee Lauder (EL)

- Revlon (REV)

- L’Oréal

- In the Household and Wellness market

- The Clorox Company

- Reckitt Benckiser, maker of Lysol

- Unilever, maker of Seventh Generation products

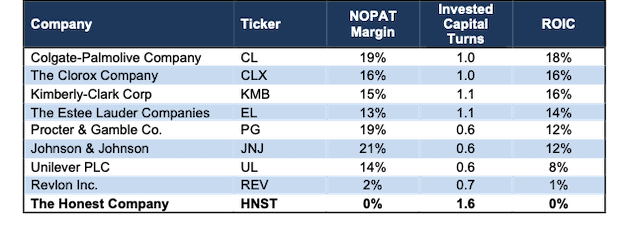

Figure 1 shows that The Honest Company’s net operating profit after-tax (NOPAT) margin and ROIC rank last amongst its main competitors. While the company’s balance sheet efficiency (invested capital turns) is superior to all competition, it is not enough to offset low operational efficiency.

Figure 1: The Honest Company’s Profitability Vs. Competition: TTM

Sources: New Constructs, LLC and company filings

Can’t Get the Shelf Space Required to Grow

We’ve analyzed the importance of shelf space and the competitive advantages it provides firms that already have it.

45% of The Honest Company’s 2020 revenue was generated from its Retail channel, which means its lack of shelf space creates a large competitive disadvantage, and one that the company is acutely aware of. As the firm notes in its S-1, it faces major challenges in getting shelf space:

- “we may be unable to secure adequate shelf space in new markets, or any shelf space at all, until we develop relationships with the retailers that operate in such markets.”

- “We may not be able to increase or sustain our volume of retail shelf space or offer retailers price discounts sufficient to overcome competition and, as a result, our sales and results of operations could be adversely affected.”

Catch-22: Growth or Profits, But Not Both

Another quote from the S-1:

“Many of our competitors also have well-established relationships with our current and potential consumers who purchase Diapers and Wipes, Skin and Personal Care or Household and Wellness products at retail stores”.

In other words, The Honest Company’s competitors control significantly more shelf space and have long-term relationships with the retailers that provide it. Further, The Honest Company may not be able to gain shelf space by offering lower prices. If they do lower prices to get shelf space, they’ll not likely improve margins enough to generate any profits.

Don’t Bet On a Buyout

Considering the competitive advantages of the potential buyers, their ability to develop their own “clean and sustainable” personal care products, and The Honest Company’s nosebleed valuation, we think a buyout is unlikely. There’s no need for any of the large incumbent personal care products companies to pay such a high price to sell a product they could just as easily develop and grow on their own.

Customer and Supplier Concentration Add Risk

The Honest Company is largely missing from many retailers’ shelves. In 2020, ~70% of The Honest Company’s retail sales resulted from relationships with Target (TGT) and Costco (COST).

Such heavy customer concentration increases the risks of investing in the company, as its distribution network is less diversified than its competition. As noted in the S-1, “the loss of our relationship with Target, Costco or any other large retail partner could have a significant impact on our revenue.”

The Honest Company also notes in its S-1 that it currently buys all of its diapers from one supplier and “substantially all” of its wipes from one supplier. Should issues arise with that supplier, The Honest Company’s reliance on few suppliers could cause “delays in manufacturing and possible loss of sales.”

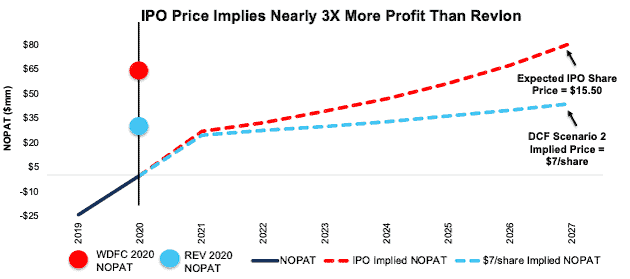

Priced to Be More Profitable Than Revlon

When we use our reverse discounted cash flow (DCF) model to analyze the future cash flow expectations baked into HNST, we find that shares are priced for growth in revenue that outpaces the projected growth of its target markets. Accordingly, risk/reward at the IPO price is unattractive.

In order to justify the midpoint of its IPO price range ($15.50/share), The Honest Company must:

- achieve an 8% NOPAT margin (half the average of competitors in Figure 1, which benefit from economies of scale, compared to -0.1% for The Honest Company in 2020) and

- grow revenue by 20% compounded annually for the seven years, (double the average CAGR through 2025 of its end markets noted earlier)

In this scenario, The Honest Company would generate nearly $81 million in NOPAT, which is nearly 3x Revlon’s 2020 NOPAT and 131% of consumer packaged goods peer WD-40’s (WDFC) 2020 NOPAT.

Figure 2 compares the firm’s implied future NOPAT in this scenario to its historical NOPAT, along with the NOPAT of the peers noted above. We also include the implied NOPAT in a more realistic scenario, which is detailed below.

Figure 2: Midpoint IPO Valuation Is Too High

Sources: New Constructs, LLC and company filings

DCF Scenario 2: Growth Is More In-Line with the Industry Expectations

We review an additional DCF scenario to highlight the downside risk should The Honest Company’s revenue growth fall more in-line with industry expectations.

If we assume The Honest Company:

- achieves a NOPAT margin of 8% and

- grows revenue by 10% compounded annually (average through 2025 for each end market noted above) for the next seven years, then

HNST is worth just $7/share today – a 53% downside to the midpoint of the IPO price range. See the math behind this reverse DCF scenario.

Each of the above scenarios also assumes The Honest Company is able to grow revenue, NOPAT, and FCF without increasing working capital or fixed assets. This assumption is highly unlikely but allows us to create best-case scenarios that demonstrate the expectations embedded in the current valuation.

More Red Flags

With a lofty valuation that implies significant improvement in both revenue and profits, investors should be aware that The Honest Company’s S-1 also includes these other red flags.

Public Shareholders Have Diminished Rights: While The Honest Company forgoes the multi-class share structure of many recent IPOs, investors in this offering still have little to no say over corporate governance.

As noted in the firm’s S-1, following the offering, executive officers, directors, and stockholders will hold ~61% of outstanding stock (or 55% if the underwriters exercise their option to purchase additional shares of common stock).

In other words, this IPO takes investors’ money while giving them almost little voting power or control of corporate governance.

And Majority of Shares Sold at IPO Are From Existing Shareholders: The Honest Company is offering ~6.5 million shares as part of its IPO. However, selling stockholders, which include directors, executive officers, and other large shareholders are selling ~19.4 million shares in the IPO. The company will not receive any proceeds from the sale of shares by these stockholders. In other words, the majority of the IPO proceeds will reward existing shareholders and not help the company itself.

We Don’t Know If We Can Trust the Financials: Investors should take The Honest Company’s GAAP numbers with a grain of salt.

As an emerging growth company, The Honest Company is not required to have an independent auditor provide an opinion on the firm’s internal controls. While the lack of disclosure around the firm’s internal controls over financial reporting may never be an issue, it does increase the risk that the firm’s financials are fraudulent and/or misleading when compared to a firm required to have an auditor attest to its internal controls.

Non-GAAP EBITDA Misleads: Long a favorite of unprofitable companies, The Honest Company’s chosen non-GAAP metric, adjusted EBITDA, shows a much rosier picture of the firm’s operations than GAAP net income or our Core Earnings. Adjusted EBITDA gives management significant leeway in how it presents results. For example, The Honest Company’s adjusted EBITDA calculation removes stock-based compensation expense, “Innovation Strategy” expenses, and transaction related expenses which include IPO bonuses.

The Honest Company’s adjusted EBITDA in 2020 removes $26 million (9% of revenue) in expenses including $10 million in related offering costs and transaction related expenses, $8 million in stock-based compensation expense, and $1.5 million in “Innovation Strategy” expenses. After removing these items, The Honest Company reports adjusted EBITDA of $11 million in 2020. Meanwhile, economic earnings, the true cash flows of the business, are much lower at -$10 million.

While The Honest Company’s adjusted EBITDA follows the same trend in economic earnings over the past two years, investors need to be aware that there is always a risk that adjusted EBITDA could be used to manipulate earnings going forward.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Fact: we provide superior fundamental data and earnings models – unrivaled in the world.

Proof: Core Earnings: New Data and Evidence, forthcoming in The Journal of Financial Economics.

Below are specifics on the adjustments we make based on Robo-Analyst findings in The Honest Company’s S-1:

Income Statement: we made $14 million of adjustments, with a net effect of removing $14 million in non-operating expenses (5% of revenue). You can see all the adjustments made to The Honest Company’s income statement here.

Balance Sheet: we made $96 million of adjustments to calculate invested capital with a net decrease of $2 million. The most notable adjustment was $31 million in operating leases. This adjustment represented 17% of reported net assets. You can see all the adjustments made to The Honest Company’s balance sheet here.

Valuation: we made $300 million of adjustments with a net effect of decreasing shareholder value by $202 million. The largest adjustment to shareholder value was $181 million in outstanding employee stock options. This adjustment represents 13% of the midpoint of The Honest Company’s IPO price range. See all adjustments to The Honest Company’s valuation here.

This article originally published on May 4, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Only Core Earnings enable investors to overcome the errors, omissions and biases in legacy fundamental research, as proven in Core Earnings: New Data & Evidence, forthcoming in The Journal of Financial Economics.