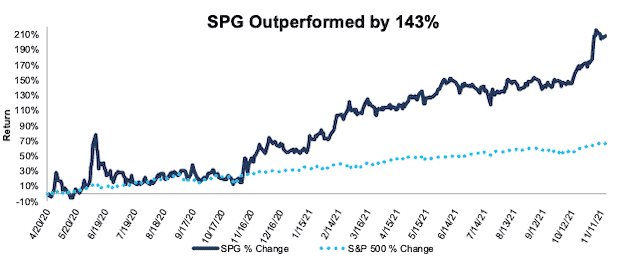

Simon Property Group (SPG) – Closing Long Position – up 209% vs. S&P up 66%

We made Simon Property Group (SPG: $166/share) a Long Idea on April 20, 2020 and reiterated our opinion on February 24, 2021. SPG earned a Very Attractive rating and an Attractive rating at the time of the reports, respectively. We felt the market was too focused on the short-term impact of COVID-19 shutdowns and undervalued the company’s best-in-class retail portfolio, strong balance sheet, industry-leading profitability, and potential for profit growth once the pandemic subsided.

This report, along with all of our research[1], leverages our more reliable fundamental data[2], as proven in The Journal of Financial Economics and shown to provide a new source of alpha, to get the truth about earnings.

During the 1.5+ year holding period, SPG outperformed as a long position, rising 209% compared to a 66% gain for the S&P 500.

Simon Property Group weathered the depths of the pandemic shutdowns and recently raised guidance for 2021 on the back of increased shopper traffic, retailer sales, leasing activity, and declining vacancies. The firm’s net operating profit after-tax (NOPAT) margin of 58% over the trailing-twelve-months is up from 48% in 2020 and its return on invested capital (ROIC) has rebounded from 8% in 2020 to 10% TTM.

However, Simon Property Group’s valuation has gotten too far ahead of its fundamentals and no longer provides the same risk/reward. The expectations for future cash flows baked into the current stock price imply Simon Property Group’s margins will improve to levels never achieved in the company’s history while revenue grows above consensus and 3x the compound annual growth rate of the previous decade. With limited upside potential, we’re taking gains and closing this long position.

Figure 1: SPG vs. S&P 500 – Price Return – Successful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on November 16, 2021.

Disclosure: David Trainer owns SPG. David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features our Robo-Analyst research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Three independent studies from respected institutions prove the superiority of our data, models, and ratings. Learn more here.