We published an update on this Danger Zone pick on August 17, 2022. A copy of the associated report is here.

Chewy (CHWY: $18/share midpoint of IPO price range), online pet supply retailer, is expected to IPO on Friday, June 14. At a price range of $17-$19 per share, the company plans to sell up to $106 million, while controlling shareholder PetSmart plans to sell an additional $684 million. At the midpoint of the IPO price range, CHWY will have an expected market cap of $7.2 billion and currently earns our Very Unattractive rating.

Investors can be forgiven for feeling some déjà vu when they look at CHWY. After all, it’s not the first online pet retailer with huge losses and a sky-high valuation to IPO in the late stages of a bull market. Is this another Pets.com, or does CHWY have a competitive advantage that will allow it to achieve sustained profitability and justify its valuation?

This report aims to help investors sort through Chewy’s financial filings to understand the fundamentals and valuation of this IPO.

Little Progress Towards Profitability

According to the company’s S-1, Chewy was founded in 2011 with the goal of being “the most trusted and convenient online destination for pet parents everywhere.” The company has scaled rapidly, going from just $2 million in sales in 2011 to over $3.5 billion in 2018. Chewy accounts for 55% of online pet food sales and ~35% of online pet supply sales overall.

Chewy claims that its “high-touch” customer service model sets it apart from the competition. The company offers 24/7 customer service and encourages its representatives to go over the top for customers. Customer service reps will spend extra time on the phone with customers, send sympathy cards to customers whose pets die, and even surprise customers with free paintings of their pets.

This over-the-top dedication to customer service means that Chewy hires an unusually large number of customer service representatives. Chewy has almost as many employees (~10,000) as fellow online retailer Wayfair (~12,000) despite earning only about half as much revenue.

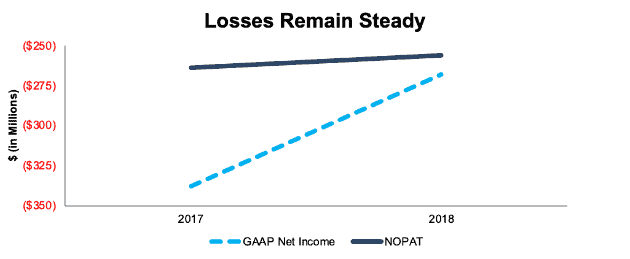

As a result of its high employee count, Chewy has incurred significant losses throughout its history. Figure 1 shows that after-tax operating loss (NOPAT) has been ~$260 million in each of the past two years.

Figure 1: CHWY GAAP Net Income and NOPAT: 2017-2018

Sources: New Constructs, LLC and company filings

Investors who only look at GAAP net income would believe that Chewy’s losses are shrinking. However, the company’s net loss in 2017 was inflated by $62 million in non-recurring expenses. When we adjust for these and other one-time items, we see that net operating losses improved by just 3% in 2018.

Chewy’s customer-centric business model has enabled the company to rapidly gain significant market share. However, the company doesn’t show any signs of the economies of scale it needs to achieve sustained profitability.

How Reliable Are Recurring Revenue Streams?

Chewy bulls will argue that the company’s significant losses don’t matter because the money it spends to acquire new customers will pay off over the long-run through recurring revenue streams. This argument is often made about SaaS companies such as Salesforce.com (CRM) and Workday (WDAY). In fact, Chewy’s IPO filing reads more like that of a software company than a retailer. It’s filled with charts of revenue growth by annual cohort and subscription sales growth.

Chewy boasts that 66% of its revenue comes from Autoship subscription customers who receive recurring shipments of food, medications, and other pet supplies. However, the company does not provide churn rates for its Autoship customer base. More broadly, the company discloses that it grew revenue from existing customers by 20% in 2018, but it still doesn’t say how many customers it lost last year. Without this disclosure of customer turnover, it’s difficult to assess the reliability of the company’s subscription revenue.

In the most bearish scenario, Chewy could be the next Blue Apron (APRN). The meal-kit service also went public with a rapidly growing “recurring revenue” base, only for that revenue to dry up quickly. Blue Apron’s revenue declined by 24% last year.

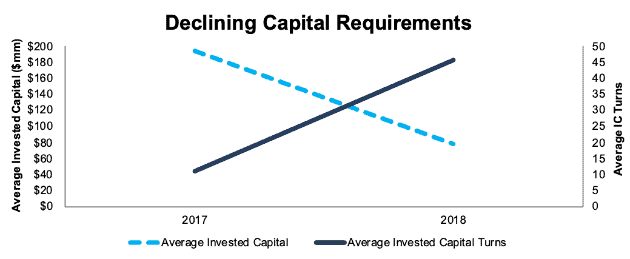

Low Capital Requirements

Chewy also resembles a SaaS company in its ability to generate a high amount of revenue from very little invested capital. The company’s fixed assets – mostly comprised of $234 million in operating lease commitments – are relatively small, and it has negative working capital. As a result, Chewy generated $3.5 billion in revenue from just $77 million in average invested capital in 2018. The company’s average invested capital turns of 46 is the highest of any Consumer Cyclicals company we cover. See Figure 2.

Figure 2: CHWY Average Invested Capital and Capital Turns: 2017-2018

Sources: New Constructs, LLC and company filings

Chewy’s low capital requirement explains why the company itself is selling just $106 million worth of stock in the IPO. The purpose of this IPO is not to provide capital for Chewy, it’s an opportunity for PetSmart to cash out on its investment. The brick and mortar retailer is at risk of bankruptcy due to its high debt load, so it needs this cash infusion to survive.

Dual Class Structure Sets Up Possible Conflict of Interest

Not only will PetSmart derive most of the benefit from this IPO, it will also maintain control of Chewy after the IPO is completed. PetSmart will still own 70% of the shares in the company and will control 77% of the voting rights due to Chewy’s dual-class share structure.

PetSmart’s control over Chewy should raise significant concerns for public shareholders due to the intertwined nature of the two companies. Chewy sells PetSmart branded products online, and PetSmart sells Chewy’s private label brands in its stores. If PetSmart continues to struggle, it may use its control over Chewy to subsidize the brick and mortar operations in a way that would disadvantage CHWY shareholders.

DCF Model Reveals High Expectations

Our reverse discounted cash flow (DCF) model quantifies the high expectations implied by CHWY’s IPO price.

In order to justify the midpoint of its IPO range, $18/share, CHWY must grow revenue by 15% compounded annually for 9 years and achieve NOPAT margins of 6%, the same as PetSmart’s historical average. See the math behind this dynamic DCF scenario.

In this scenario, Chewy would earn $12.4 billion in revenue in 2028, about ~70% of the estimated total revenue ($17.5 billion) for the online pet supply market. It seems unrealistic that Chewy could ever achieve 70% market share and such high margins when it has to compete with Amazon (AMZN), which sold over $1 billion of pet food last year.

If we assume that CHWY grows revenue by 10% compounded annually for 10 years and has slightly lower NOPAT margins of 5%, the stock is worth just $9/share today, a 50% downside from the midpoint of the IPO range. See the math behind this dynamic DCF scenario.

Even this scenario assumes that Chewy can achieve sustained profitability, which the company has never done.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments[1] we make based on Robo-Analyst[2] findings in Chewy’s S-1:

Income Statement: we made $12 million of adjustments, with a net effect of removing $12 million in non-operating expense (1% of revenue). You can see all the adjustments made to CHWY’s income statement here.

Balance Sheet: we made $350 million of adjustments to calculate invested capital with a net increase of $350 million. You can see all the adjustments made to CHWY’s balance sheet here.

Valuation: we made $234 million of adjustments with a net effect of decreasing shareholder value by $234 million. You can see all the adjustments made to CHWY’s valuation here.

This article originally published on June 11, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] This paper compares our analytics on a mega cap company to other major providers. The Appendix details exactly how we stack up.

[2] Harvard Business School Features the powerful impact of research automation in the case study New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.