Social media company Pinterest (PINS: $16/share midpoint of IPO price range) is expected to IPO on Thursday, April 18. At a price range of $15-$17 per share, the company plans to sell up to $1.2 billion of shares with an expected market cap of ~$8.5 billion. At the midpoint of the IPO price range, PINS currently earns our Unattractive rating.

At first glance, PINS looks like many of the other risky IPO’s we’ve seen recently: no profits, dual-class shares, and a challenging competitive landscape. The market appears to be pessimistic about PINS future, as evidenced by the fact that it is going public at a discount to its last private valuation. PINS may not be cheap overall, but compared to the other highly overvalued tech IPO’s we’ve seen over the past few years it’s a downright bargain.

This report aims to help investors sort through Pinterest’s financial filings to understand the fundamentals and valuation of this IPO.

Getting Closer to Profitability

Pinterest was founded in 2009 – two years before Snapchat (SNAP) and only three years after Twitter (TWTR). However, the company has been slower to monetize its audience than its social media peers. Despite boasting more users than SNAP and only 17% fewer users than TWTR, Pinterest significantly lags both of them in terms of revenue. The company earned just $755 million in revenue in 2018 compared to $1.2 billion for SNAP and $3 billion for TWTR.

However, Pinterest is now growing revenues and users at a much faster rate. Its revenue increased by 60% in 2018 compared to 43% for SNAP and 25% for TWTR. Additionally, Pinterest grew its user base by 23% last year while the other two platforms saw their user numbers decline.

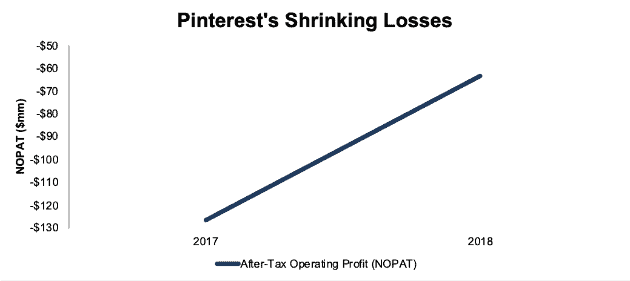

Investors should also be encouraged that Pinterest is moving closer to profitability. The company’s net operating loss after tax (NOPAT) halved from 2017 to 2018, from -$126 million to -$63 million.

Figure 1: PINS NOPAT: 2017-2018

Sources: New Constructs, LLC and company filings

The company’s shrinking losses are driven by revenue growing faster than expenses across the board. The following expense items grew by less than 60% in 2018:

- Cost of revenue: +35%

- Research and development: +21%

- General and administrative: +26%

Meanwhile, the company increased its sales and marketing expense by the same amount as revenue, 60%.

If the growth rate for both revenue and expenses stays the same in 2019, Pinterest will earn a pre-tax operating profit of $65 million.

International Monetization is Key

A big challenge for Pinterest is the fact that it may have already reached a saturation point in its core demographic, mothers in the United States. The company’s S-1 revealed that the stereotype of the “Pinterest Mom” is well founded; Pinterest claims that 80% of U.S. women between ages 18-64 with children are already users. U.S. users grew by just 8% in 2018, from 76 million to 82 million, so it appears that there’s not much room for domestic user growth.

The company’s international user base is much larger and growing rapidly. International users increased from 139 million at the end of 2017 to 184 million at the end of 2018, a 32% increase.

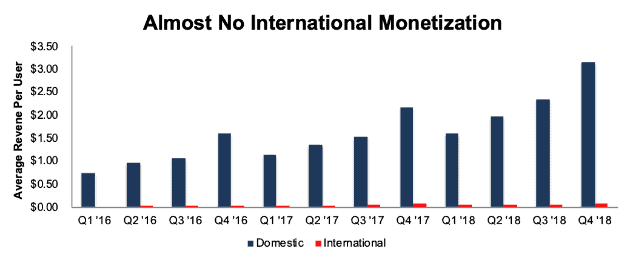

While the company’s international user base is large, its monetization efforts internationally are still in their infancy. Pinterest’s average revenue per user (ARPU) in 2018 was just $0.25 internationally in 2018. Each international user brought in just 3% of the revenue of a U.S. user. Figure 2, from the company’s S-1, breaks out ARPU by quarter over the past three years for more detail.

Figure 2: PINS Domestic vs. International ARPU: Q1 16- Q4 18

Sources: New Constructs, LLC and company filings

Pinterest’s ability to monetize its international user base will be crucial to the company’s long-term growth and profitability. If the company increased its international ARPU to match its monetization rate in the U.S., it would instantly add $1.6 billion in new revenue, which would more than triple its sales.

Former employees have criticized Pinterest for having a corporate culture that is slow-moving and “too nice”. The company’s delayed monetization efforts suggest there is some merit to that claim. Pinterest lags significantly behind Snapchat, a platform that was launched a year later, in terms of ARPU.

However, the fact that Pinterest has been slow to monetize its international user base doesn’t mean it can’t do so. Of all the smaller – i.e. non-Facebook (FB) – social media platforms, Pinterest seems like the most easily monetizable. After all, the platform is essentially a large collection of products to buy. It also boasts a more affluent user base, as 40% of its users make over $100 thousand a year.

International monetization will always be more challenging than in the U.S. due to cultural differences, regulations, and lower incomes in other parts of the world. Still, Pinterest should be able to drive significant revenue growth in the near future by increasing its international ARPU.

Threat from Facebook/Instagram

As with any social media platform, the biggest threat to Pinterest comes from Facebook and Instagram. Instagram killed Snap’s growth by copying the “Stories” feature right before SNAP’s 2017 IPO. Now, the Facebook-owned app looks to be developing a “Collections” feature that would mirror Pinterest’s boards.

Instagram has four times as many users as Pinterest, so if it can mirror the platform’s features it might be more appealing to both users and advertisers due to its strong network effects.

However, there are some reasons to believe that Pinterest might not be as easy for Instagram to copy as Snapchat was. After all, Instagram Stories fit nicely with the platform’s strategy of allowing people to share updates/images from their daily lives. Instagram users may not be as eager to see collections of products throughout their feeds.

Also, Facebook has tried, with little success, to copy Pinterest’s features in the past. In 2017, Facebook launched a feature called “Sets” that allowed users to create collections of photos and statuses similar to Pinterest boards. This copycat feature does not appear to have killed Pinterest’s growth to the same degree as “Stories” did Snap.

Public Shareholders Have No Rights

Public shareholders will get almost no voting rights after Pinterest’s IPO, as has become the norm in recent years. The Class A shares sold to the public will get one vote per share, while the Class B shares held by insiders and early investors will get 20 votes per share. After the completion of the IPO, Class B shareholders will have 99% of the voting rights in the company.

The one bit of good news for investors is that these Class B shares do have a sunset clause. Any investor that sells over 50% of their Class B shares will have both their remaining shares and the shares they sold automatically converted to Class A seven years after the IPO. This at least means that early investors who cash out substantial portions of their stake will not be able to permanently exercise outsized influence on corporate governance.

How Is PINS Worth Less Than SNAP?

Pinterest has the unusual distinction of being an “Undercorn”, a multi-billion dollar company going public at a valuation below its last private valuation. Even accounting for all the potential dilution from its employee stock options (ESO’s) and restricted stock units (RSU’s), Pinterest’s valuation of $11 billion is below the $12.3 valuation from its last funding round in 2017.

While this decrease in valuation can’t feel good for early investors, it does decrease the risk to public investors. Many IPO’s significantly understate the potential cost of ESO’s and RSU’s by pegging their value to previous, lower, valuations. PINS, on the other hand, actually overstates its potential ESO liability. In its S-1, the company values its outstanding ESO’s at $1.3 billion, but at the proposed offering price of $16/share those ESO’s are actually only worth ~$900 million.

More importantly, PINS looks cheap compared to SNAP, which has an enterprise value of $16.1 billion. It’s hard to understand how PINS – which has more users, faster growth, and much smaller losses – can be worth ~30% less than SNAP.

Our reverse DCF model shows that the growth expectations implied by PINS valuation appear much more reasonable than previous IPOs. In order to justify a valuation of $16/share, PINS must achieve after-tax operating profit (NOPAT) margins of 16% – equal to Twitter – and grow revenue by 25% compounded annually for eight years. See the math behind this dynamic DCF scenario.

In this scenario, PINS would earn $4.5 billion in revenue eight years from now. To hit that revenue target, the company would need to achieve a global ARPU of $9 (equal to its current ARPU in the U.S.) and grow its user base by 8% compounded annually.

Those goals are no slam dunk, but they, at least, seem to be within the realm of possibility. In the midst of so many IPO’s with valuations that embed future cash flows outside the realm of possibility – i.e. Uber and Lyft – it’s nice to see a company whose valuation is more realistic.

We’re not recommending investors buy PINS, as evidenced by our Unattractive rating, but it doesn’t look nearly as dangerous as most of the other IPO’s we’ve seen recently.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments[1] we make based on Robo-Analyst[2] findings in Pinterest’s S-1:

Income Statement: we made $26 million of adjustments, with a net effect of removing $1 million in non-operating income (1% of revenue). You can see all the adjustments made to PINS’ income statement here.

Balance Sheet: we made $1.2 billion of adjustments to calculate invested capital with a net increase of $300 million. The most notable adjustment was $220 million in off-balance sheet debt (which will soon have to be reported on the balance sheet). This adjustment represented 29% of reported net assets. You can see all the adjustments made to PINS’ balance sheet here.

Valuation: we made $1.9 billion of adjustments with a net effect of decreasing shareholder value by $1 billion. You can see all the adjustments made to PINS’ valuation here.

This article originally published on April 16, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Ernst & Young’s recent white paper “Getting ROIC Right” demonstrates the link between an accurate calculation of ROIC and shareholder value.

[2] Harvard Business School Features the powerful impact of research automation in the case study New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.