Buying unjustly beaten down stocks is a staple of value investing. The idea is simple, but finding those stocks is hard. This week, we’ve found a company the market loves to hate in spite of its excellent operating results. With strong profit growth, prudent management decisions for future growth, and a greatly undervalued stock price, this week’s Long Idea is General Motors (GM: $31/share)

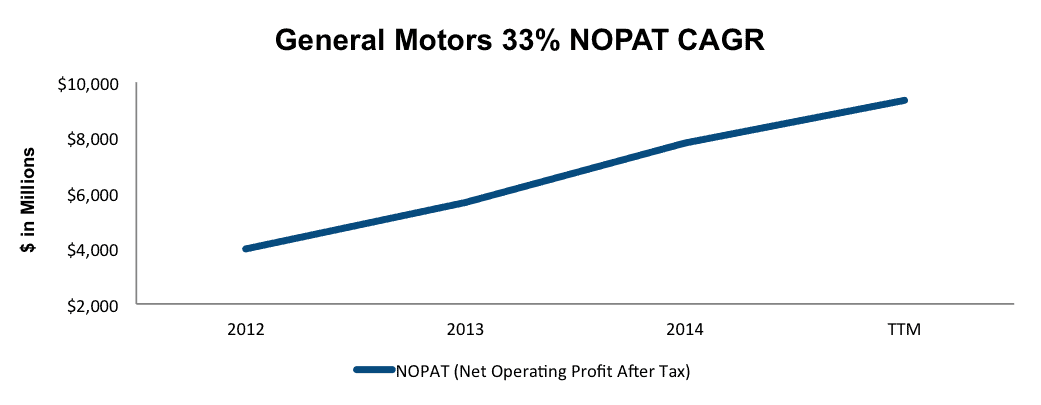

Profit Growth is Ramping Upwards

General Motors is a stock we’ve previously written about that fails to receive any love from the market. Market pundits amplify any bad news, and good news, of which there has been plenty, is pushed aside. As such, GM is down 16% over the past two years, despite its business operations only getting stronger. Since 2012, General Motors has grown after-tax profit (NOPAT) by 33% compounded annually.

Figure 1: Profit Growth is Great at General Motors

Sources: New Constructs, LLC and company filings

General Motors’ reported 2014 earnings misrepresent the profitability of the company. Hidden in its EPS were over $7 billion (4% of revenue) in unusual charges, including $2.9 in charges due to recalls and $700 million due to Korean wage litigation. These charges lead those relying on the reported financials to believe the company is much less profitable than it actually is. We remove all hidden and unusual charges and gains from NOPAT to find the true profitability.

Apart from growing profits, General Motors has improved its return on invested capital (ROIC) to a top quintile 15%, up from 6% in 2012.

Superior Products and a Strengthened Business Model

In the past two years, General Motors has won numerous awards, including Truck of the Year (Chevy Colorado), Lowest cost of ownership (Chevy Silverado), and six separate “Best Family Car” awards among others. Not surprisingly, consumers have been willing to pay up for GM cars, as the company had the industry’s highest average transaction price (ATP) in August, coupled with the lowest incentive as a percentage of ATP as well. The superior products have helped General Motors’ to a 17.6% market share of the U.S. auto industry where it derives ~70% of revenues.

Apart from making quality vehicles, General Motors is focusing on building a stronger business by targeting margin increases. General Motors’ management has made the decision to purposely reduce rental car sales as these vehicles are less profitable than retail sales. Accordingly, General Motors reported rental deliveries were down 45% in July and 38% in August. This focused effort on profits over volume is great news for shareholders and in fact, General Motors’ NOPAT margin has risen from 3% in 2012 to 6% on a trailing-twelve-month (TTM) basis. Increasing margins will not only make General Motors more profitable, but also allow it more pricing power over competitors when push comes to shove in the industry.

Bear Concerns Are Already Priced Into GM

One large concern regarding General Motors was the record recalls undertaken in 2014. The total cost, which came in at $4.1 billion, certainly hampered the company’s profitability. The subsequent criminal investigation also kept GM shares under a dark cloud. The good news though is that with the settlement of the Department of Justice investigation, this event appears to be behind the company, which will allow General Motors to focus on the future growth of its business.

The next issue bears will point to is General Motor’s exposure to foreign markets and how they will negatively impact the company for the foreseeable future. Apart from this expectation being more than baked into the stock price, it is simply not occurring. In 2Q15, foreign sales made up ~30% of revenues and total sales were down just 4%. Additionally, costs were down 8%, which negated the revenue decline. Best of all, we believe the strength of the U.S. market can more than make up for any foreign currency concerns. GM has reported record-breaking results in America throughout the year including the best GMC January sales since 2004, the highest March demand for the Cadillac Escalade since 2008, and the best July Buick sales since 2005. Additionally, in August, General Motors reported that Chevrolet truck sales increased for the 16th consecutive month and the company as a whole had the largest retail sales increase in the industry. Amidst global economic concerns, General Motors’ American operations are firing on all cylinders.

Impact of Footnotes Adjustments and Forensic Accounting

We have made several adjustments to General Motors’ 2014 10-K. The adjustments are:

Income Statement: we made $22.9 billion adjustments with a net effect of removing $5 billion of unusual expenses. The largest adjustment was the removal of $7.1 billion (4% of revenue) related to hidden non-operating expenses, many of them related to the ignition switch recall.

Balance Sheet: we made $91.9 billion of balance sheet adjustments to calculate invested capital with a net decrease of $24.7 billion. The largest adjustment made was the removal of $35.2 billion due to deferred tax assets. This adjustment represented 40% of reported net assets.

Valuation: we made $60 billion of adjustments with a net effect of decreasing shareholder value by $24.2 billion. The largest adjustment to shareholder value was the removal of $30.8 billion due to GM’s underfunded pensions, which represents 62% of General Motors’ market cap.

Stock Valuation Presents Great Buying Opportunity

GM is down 19% in the past six months, which has left shares significantly undervalued. At its current price of $31/share, GM has a price to economic book value (PEBV) ratio of 0.6. This ratio implies that the market expects the company’s NOPAT to permanently decline by 40%. This expectation seems awfully pessimistic given the profit growth General Motors has achieved over the past few years, as well as the awards and record-setting sales seen through 2015.

Even if we assume General Motors fails to grow profits again, its current economic book value, or no growth value, is $53/share, which represents a 72% upside from current prices.

However, if General Motors can grow NOPAT by just 5% compounded annually for the next decade, the stock is worth $57/share – an 84% upside.

Stock Sell-Off Was a Mistake That Will Reverse

The irrational sell-off this year was a classic case of short-term noise driving share prices. Not only do we believe that the global economic concerns are overblown, but also General Motors will thrive as a result of management’s focus on producing award-winning cars while slashing costs and improving margins. Look past the settlement charges in the company’s next quarterly results for continued strength in its truck sales specifically, as well as overall vehicle sales. While sales numbers may lag in the short-term due to reduced rental sales, the long-term advantages of profit margin improvement will benefit investors.

Insider Trends/Short Interest Raise No Alarms

In the past 6 months, there have been no insider share purchases and only 25 thousand shares sold. This represents less than 1% of shares outstanding. Short interest in GM stands at 50 million shares, or around 3% of shares outstanding.

Executive Compensation Looks Promising

In addition to base salary, General Motors’ executives receive short-term cash awards and long-term stock awards. 89% of the CEO’s pay is considered “at risk” and for all other executives, 84% is “at risk”. General Motors bases short-term incentive pay on adjusted EBIT, adjusted free cash flow, global market share, and quality of products. Long-term awards are given based on global market share and meeting a target ROIC of 20%. While the short-term incentives could be better, to see a company basing executive pay off ROIC is very promising since ROIC is one of the best measures of profitability and shareholder value creation.

Share Buyback Plans Are Aggressive and Provide High Yield

In March 2015, General Motors announced a $5 billion (10% of market cap) share repurchase plan that is to be completed by the end of 2016. Through June 2015, General Motors has repurchased $2 billion (4% of market cap) worth of common stock under this plan. The company would be wise to continue these buybacks, as shares remain undervalued.

Attractive Funds That Hold GM

The following funds receive our Attractive-or-better rating and allocate significantly to General Motors.

- Mass Mutual Select Focused Value Fund (MMFVX) – 6% allocation and Very Attractive rating

- Valued Advisors Trust Green Owl Intrinsic Value Fund (GOWLX) –3.7% allocation and Very Attractive rating

- Value Advisors Fund Granite Value Fund (GVFIX) – 3.6% allocation and Very Attractive rating.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: Toban B. (Flickr)