Retailers have been under attack in recent years but not by the online competitors that may first come to mind. Instead, retailers have been under attack from Wall Street analysts who can’t wait to bury the next traditional retail business. This strong pessimism has created a great investing opportunity in a company we’ve liked for quite some time. With a strong brand and a history of growing profits, this week’s long idea is Wal-Mart Stores, Inc. (WMT: $69/share)

Consistency Throughout All Business Cycles

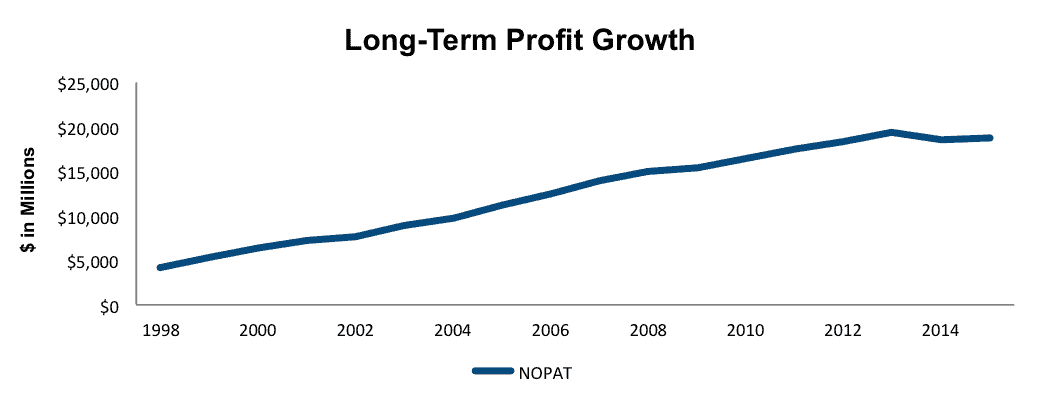

The current negative sentiment surrounding Wal-Mart ignores the company’s resiliency through all economic cycles. Since 1998, Wal-Mart has grown after-tax profit (NOPAT) by 9% compounded annually. As Wal-Mart became the retail giant we know today, NOPAT growth has slowed, but remains steady at 3% compounded annually over the last five years. Figure 1 shows the long-term growth of Wal-Mart’s profits, including the slowed rate as of late.

Figure 1: Increasing Profits is Key to Success

Sources: New Constructs, LLC and company filings

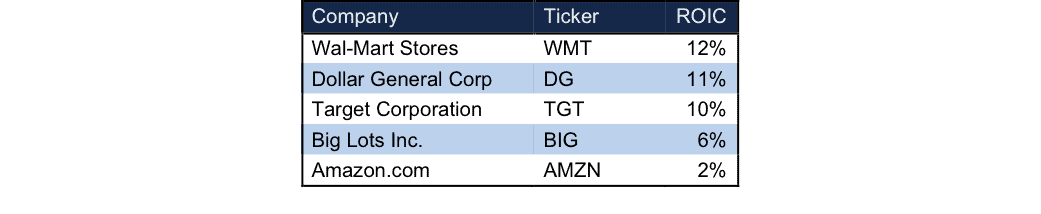

Despite the up-down cycles of the retail industry, another constant has been Wal-Mart’s impressive return on invested capital (ROIC) of 12%. Wal-Mart has generated at or above 12% ROIC every year since 1999, showcasing the strength and stability of its business operations.

Wal-Mart’s NOPAT margin of 4% in 2015 has remained relatively unchanged since the 3.5% generated in 1998. Wal-Mart’s consistency across profit growth, ROIC, and margins is unmatched across the market.

Labor Costs Should Not Be a Concern

Many are concerned about the minimum wage increases happening around the country and what affect that will have on Wal-Mart. This concern misses the point, as an increase to minimum wage will affect the entire industry, not just Wal-Mart. As can be seen in Figure 2, Wal-Mart operates more profitably than competitors, which gives it the ability to better absorb nationwide wage increases.

Figure 2: Wal-Mart a Step Ahead of Competition

Sources: New Constructs, LLC and company filings

Wal-Mart Can Win the War with Amazon

As the popularity of online shopping grows, the perception of Amazon’s threat to Wal-Mart grows too. We think Wal-Mart’s chances of success when taking on Amazon are greater than most people realize because too many people overlook the competitive advantages that Wal-Mart can extract from its impressive store footprint and distribution systems.

Among these advantages is same-day store pickup, which allows the company to leverage its large store base to create shipping cost advantages. While Amazon must ship almost every order all the way to the consumer, shipping to the store leverages Wal-Mart’s impressive distribution system and is less expensive and more efficient. Ultimately, the store footprint gives Wal-Mart the ability to charge lower prices.

Expanding upon in-store pickup, Wal-Mart is allowing consumers to order groceries online and pick them up in store the same day or at a later date if the consumer prefers. There are many benefits to this service including time savings, easier errand planning, and fresher perishables as items are brought to the consumer upon arrival at the store. We think this new service has big potential not only to grow Wal-Mart’s business but also to keep market share away from Amazon.

Also, we think it naïve to overlook the fact that Wal-Mart has a formidable online offering as well. For those who are willing to wait for items to be shipped, Wal-Mart has comparable online offerings, including ShippingPass, which is like Amazon Prime. For $50/year, members receive unlimited free 3-day-or-less shipping on all online orders.

Wal-Mart’s ability to connect the online and in-store shopping experience is showing strength in the company’s 2Q16 results, with global e-commerce sales up 16% year-over-year.

Impact of Footnotes Adjustments and Forensic Accounting

We have made several adjustments to Wal-Mart’s 2015 10-K. The adjustments are:

Income Statement: we made $4.9 billion adjustments with a net effect of removing $2.4 billion of unusual expenses (<1% of revenue). We removed $3.6 billion related to non-operating expenses and $1.2 billion in non-operating income.

Balance Sheet: we made $31.7 billion balance sheet adjustments to calculated invested capital with a net increase of $25.2 billion. The largest adjustment made was the inclusion of $13.6 billion due to operating leases. This adjustment represented 10% of reported net assets.

Valuation: we made $82.1 billion adjustments that decreased shareholder value. There were no adjustments that increased value. The largest adjustment to shareholder value was the removal of $74 billion in adjusted total debt. This liability represents 2% of Wal-Mart’s market cap.

Significantly Undervalued Stock

The concerns over Wal-Mart’s future as a leader in retail have led to WMT declining 19% year-to-date. This price decline has presented an excellent opportunity to invest in a great company. At its current price of $69/share, Wal-Mart has a price to economic book value (PEBV) ratio of 0.7. This ratio implies that the market expects the company’s NOPAT to permanently decline by 30%. Such low expectations contradict the consistency of Wal-Mart’s profits as referenced in Figure 1.

Making shares even more attractive, the current share price has all potential issues priced in and ignores not only the current state of business, but also any potential for future growth. If Wal-Mart failed to grow profits again, its current economic book value, or no growth value is $98/share, which represents 42% upside from the current price.

However, if Wal-Mart is able to continue growing NOPAT by just 2% compounded annually for the next five years, the stock is worth $112/share today – a 62% upside.

Lowered Expectations Provide Share Price Room Grow

With the release of the company’s 2Q16 earnings, Wal-Mart disappointed many investors by lowering guidance for the year. The lowered expectations allow Wal-Mart some breathing room from those who expect the business to transform overnight. Wal-Mart is making investments, such as the opening of new fulfillment centers, and taking a long-term approach rather than attempting to simply beat quarterly earnings.

Going forward, we believe continued growth in e-commerce sales, spurred by further integration of “site-to-store”, expansion of online grocery shopping, and unlimited free shipping membership will provide a lift for Wal-Mart. E-commerce is becoming more important in the retail space and Wal-Mart has the ability and resources to meet the challenge.

Insider Sales and Short Interest is Minimal

In the past three months, insiders have bought 36,000 shares and sold 845,000 for a net of 809,000 shares sold, which represents less than 1% of shares outstanding. Currently there are 23.8 million shares sold short, which is less than 1% of shares outstanding.

No Red Flags in Executive Compensation

Wal-Mart’s executive compensation appears correctly aligned with shareholder interests. In 2015, executives received cash bonuses and equity awards on top of their base salary based on achievement of sales, operating income, ROI, and gross merchandise value goals. Each of these metrics is directly related to the success of the business and not a management-derived “adjusted earnings” number than can be manipulated to increase executive pay while profits decline.

Share Buyback Plans Remain Intact

In 2013 Wal-Mart instituted a $15 billion share repurchase plan. This plan replaced the previous plan, which had almost maxed out the authorized repurchase amount. In the company’s 2Q16, Wal-Mart repurchased $1 billion in shares, which represents the largest share purchase activity in the last four quarters. It appears that management would agree that shares are currently undervalued. After 2Q16, $9 billion remains under the current authorization.

Attractive Funds That Hold WMT

- State Street SPDR Consumer Staples Select ETF (XLP) – 6.5% allocation and Very Attractive rating

- Fidelity MSCI Consumer Staples Index ETF (FSTA) – 6.0% allocation and Very Attractive rating

- Vanguard Consumer Staples Index Fund (VCSAX) – 5.6% allocation and Attractive rating.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: Mike Mozart (Flickr)

1 Response to "A Retail Giant Positioning for Future Profit Growth"

As the popularity of online shopping grows, the perception of Amazon’s threat to Wal-Mart grows too… and so does the perception of Wal-Mart’s threat to Amazon.

Impact of labor cost increase announced by WMT last February to WMT’s bottom line…Announced $1B spend for FY or about $660 million after tax (~$0.20/shr). At $166B IC, that equates to about a 0.4% drop in ROIC. Still keeps them above DG, even if DG makes no similar cost increase.

However, if you look at the ROICs of some of the retailers (HD/TGT/KR), they are in an uptrend (they’re finding their way in an improving US economy) whereas WMT is still working on it. Still, agree WMT a good value proposition if they can get that comp sales trending a little stronger…but then again that’s maybe why they can be bought on the cheap now with the risk being when they can strengthen that trend.