Our latest featured stock is a telecom giant with confusing and inconsistent accounting earnings. We pulled this highlight from last week’s research of 364 10-K filings.

Analyst Jacob McDonough found several unusual items in the footnotes of Verizon’s (VZ) 2018 10-K.

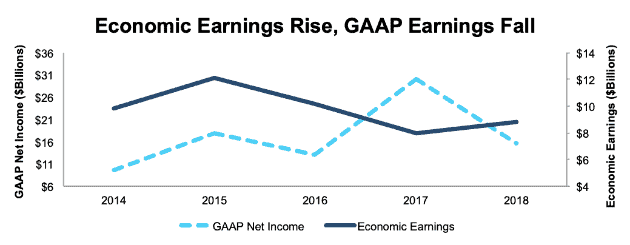

Verizon’s GAAP net income declined by nearly 50% in 2018, but Figure 1 shows that its economic earnings, the true cash flows of the business, grew by 10%.

Figure 1: GAAP vs. Economic Earnings for VZ Since 2014

Sources: New Constructs, LLC and company filings.

In 2017, VZ’s GAAP net income was overstated due to a $16.8 billion (13% of revenue) benefit from tax reform. After the passage of the tax law, we listed VZ as one of our “Tax Reform Winners” due to its large amount of deferred tax liabilities.

Meanwhile, in 2018, GAAP net income understated VZ’s profitability due to two major non-recurring expenses:

- $3.4 billion (3% of revenue) in restructuring and acquisition-related costs

- A $4.6 billion (4% of revenue) write-down to the goodwill in its Oath (AOL and Yahoo) segment

While our adjustments make VZ’s income statement look better, they make the balance sheet look worse. We add the Oath write-down back to VZ’s invested capital in order to hold the company responsible for the capital invested in those acquisitions. We also add the company’s $21.1 billion (9% of reported net assets) in off-balance sheet debt, which is up from $16.8 billion in 2017. These adjustments show that while VZ’s reported net assets increased by just 1% in 2018, its invested capital increased by 5%.

In addition, the large write-down raises a red flag about the company’s capital allocation. VZ’s rising economic earnings led our rating system to upgrade the stock to Attractive after we analyzed its 10-K, but investors should still approach this stock with caution until management demonstrates that it can avoid more wasteful acquisitions.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

In total, we made the following adjustments to Verizon’s 2018 10-K:

Income Statement: we made $21.6 billion of adjustments, with a net effect of removing $7.1 billion in non-operating expense. We removed $7.3 billion in non-operating income and $14.4 billion in non-operating expense. You can see all the adjustments made to VZ’s income statement here.

Balance Sheet: we made $172.9 billion of adjustments to calculate invested capital with a net increase of $83.3 billion. You can see all the adjustments made to VZ’s balance sheet here.

Valuation: we made $193.3 billion of adjustments with a net effect of decreasing shareholder value by $193.1 billion. The largest adjustment to shareholder value was $140.7 billion in total debt, which includes the off-balance sheet debt discussed above. This debt adjustment represents 33% of VZ’s enterprise value.

The Power of the Robo-Analyst

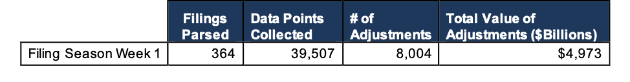

We pulled this highlight from last week’s research of 364 10-K filings, from which our Robo-Analyst technology collected 39,507 data points. Our analyst team used this data to make 8,004 forensic accounting adjustments with a dollar value of $5 trillion. The adjustments were applied as follows:

- 3,187 income statement adjustments with a total value of $305 billion

- 3,416 balance sheet adjustments with a total value of $2.2 trillion

- 1,401 valuation adjustments with a total value of $2.4 trillion

Figure 2: Filing Season Diligence for Week of February 19-24

Sources: New Constructs, LLC and company filings.

Every year in this six-week stretch from mid-February through the end of March, we parse and analyze roughly 2,000 10-Ks to update our models for companies with 12/31 and 1/31 fiscal year ends. This effort is made possible by the combination of expertly trained human analysts with what we call the “Robo-Analyst.” Featured by Harvard Business School in “Disrupting Fundamental Analysis with Robo-Analysts”, our research automation technology uses machine learning and natural language processing to automate robust financial modeling.

No Substitute for Diligence

Our technology enables us to deliver fundamental diligence at a previously impossible scale. We believe this research is necessary to uncover the true profitability of a firm and make sound investment decisions. Ernst & Young’s recent white paper, “Getting ROIC Right”, demonstrates how the adjustments we make contribute to materially superior models and metrics.

Only by reading through the footnotes and making adjustments to reverse accounting distortions can investors and advisors alike get beyond the noise and get the truth about earnings and valuation.

This article originally published on February 26, 2019.

Disclosure: David Trainer, Jacob McDonough, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter (#filingseasonfinds), Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.