We published an update on DFS on April 26, 2023. A copy of the associated update report is here.

This company’s best-in-class customer service and extensive payment network insulate it from incumbents and disruptors. Discover Financial Services (DFS: $123/share) remains a Long Idea after 3Q21 earnings.

We leverage more reliable fundamental data, as proven in The Journal of Financial Economics[1], and shown to provide a new source of alpha, with qualitative research to highlight this firm whose stock present excellent risk/reward.

Discover Has More Room to Outperform

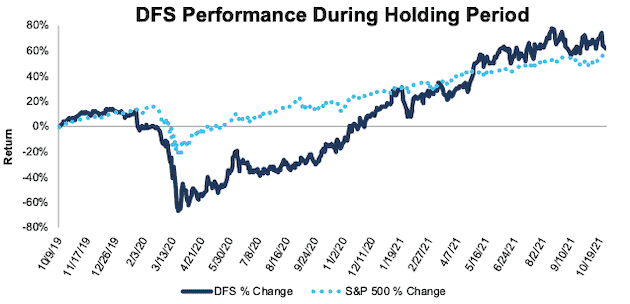

We made Discover Financial Services a Long Idea in October 2019 and the stock has outperformed the S&P 500 by 5% since then. Despite its slight outperformance, we still see upside in the stock.

Figure 1: Long Idea Performance: From Date of Publication Through 10/26/2021

Sources: New Constructs, LLC and company filings

What’s Working: While coming in below expectations, Discover’s revenue grew 2% year-over-year (YoY) in 3Q21. Importantly, after five consecutive quarters of YoY decline, Discover returned to growing its loan portfolio and total loans in 3Q21 were 1% higher than 3Q20. Furthermore, the company continues to attract new customers and new accounts are up 17% over 2019 levels.

During the pandemic, consumers paid down outstanding credit balances with the help of government stimulus payments and fewer opportunities for discretionary spending, which improves the quality of Discover’s loan portfolio. The company’s net charge-off rate fell from 3% in 3Q20 to 1.5% in 3Q21. Discover’s 30+ day delinquency rate fell 43 basis points YoY in 3Q21.

Discover operates an extensive payments network across 200+ countries that is rivaled only by other major credit card companies Visa (V), Mastercard (MA), and American Express (AXP).

Discover increased its share of outstanding balances from 7.6% in 2019 to 8.2% in 2020. The company’s high-level customer service, as proven by its customer satisfaction rankings, fosters strong customer relationships that create a competitive advantage. When coupled with Discover’s payment network, the company has a large moat that enables it to take market share from incumbents while protecting its business from new decentralized finance (DeFi) entrants.

Discover’s established network and deep customer relationships have also prevented perceived threats from buy now, pay later (BPNL) companies from materializing. Our recent report on Affirm Holdings (AFRM) shows that BPNL companies don’t replace credit cards, but rather just increase consumer debt.

Discover’s integrated digital bank and payments model is more profitable than its direct peers as well. The company’s trailing-twelve-months (TTM) return on invested capital (ROIC) of 19% is well above card issuing peers’ Capital One Financial (COP) and American Express (AXP) ROIC’s of 8% and 9%, respectively.

What’s Not Working: While card and organic student loans grew in 3Q21, Discover saw personal loan balances fall 4% YoY in 3Q21 as customers quickly paid down outstanding balances during the period. However, personal loans accounted for just 8% of the company’s total loan balance in 3Q21, and the company believes its return to pre-pandemic underwriting practices for this segment will lead to future growth.

Discover felt the pressure of the low-interest rate environment in 3Q21, which caused yields on personal loans to fall quarter-over-quarter. However, the company’s large credit card portfolio positions the company for continued profitability even if the current low-interest rate environment persists.

Credit cards traditionally have provided a convenient transaction method, which the proliferation of digital payment platforms and DeFi now challenges. Grand View Research expects the digital payment market to grow 19% compounded annually from 2021 to 2028. However, Discover’s extensive, secure network and credit facilities can be easily integrated within digital payment platforms. For example, Discover already leverages agreements with digital payment platforms such as PayPal, which contributed to the company’s strong 3Q21 sales.

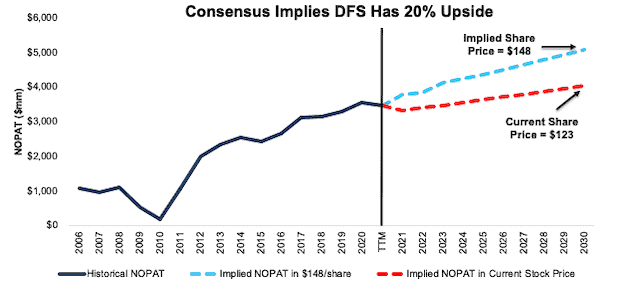

DFS Priced for Uncharacteristically Low Profit Growth: Discover’s price-to-economic book value (PEBV) ratio of 1.0 means that the stock is priced for profits to never meaningfully grow beyond current levels. For reference, Discover has grown NOPAT by 35% compounded annually over the past decade.

Below, we use our reverse DCF model to analyze the expectations for future growth in cash flows baked into different stock price scenarios for Discover.

In the first scenario, we assume Discover’s:

- net operating profit after tax (NOPAT) margin falls to 25% (three-year average vs. 28% TTM) from 2021 through 2030, and

- revenue grows by 2% compounded annually from 2021 to 2030 (vs. consensus CAGR of 6% for 2021-2023)

In this scenario, Discover’s NOPAT grows by just 1% compounded annually over the next decade and the stock is worth $123/share today – equal to the current price. See the math behind this reverse DCF scenario. In this scenario, Discover’s NOPAT in 2030 is just 3% above 2020 levels.

Shares Could Reach $148 or Higher: If we assume Discover’s:

- NOPAT margin falls to 27%, (vs. 28% TTM) from 2021 through 2030, and

- revenue grows at a 6% CAGR through 2023 (same as consensus 2021-2023 CAGR), and

- revenue grows 3% a year from 2024 – 2030, then

the stock is worth $148/share today – 20% above the current price. See the math behind this reverse DCF scenario. In this scenario, Discover grows NOPAT by 4% compounded annually over the next decade. For reference, Discover grew NOPAT by 8% compounded annually over the past five years.

In the above scenarios, we assume a WACC of 9.7%, which is 100 basis points higher than Discover’s current WACC, and functions to lower the terminal value in our DCF model in the event that Discover and/or credit card companies in general are disrupted by DeFi in the mid-to-long term. Should the company continue to fend off competition through its strong customer relationships and ease of use/availability of its network, this WACC assumption and lower terminal value could prove conservative, in which case DFS has even greater upside.

Figure 2: Discover’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article originally published on October 27, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.

6 replies to "Superior Service and Exclusive Network Set This Company Apart"

And as of 10/29, you rate DFS as “neutral”?

Roger,

Our Stock Ratings are based on five criteria that measure the strength of a business and the valuation of its stock to assess the risk/reward of owning the stock. However, our Long Ideas and Danger Zone picks offer a more in-depth analysis of a stock’s risk/reward based on an examination of a company’s earnings quality, competitive position, growth opportunities, secular trends, and more. Thanks for reading!

Matt

Thanks for responding. Please help me out here, because I’m afraid I don’t quite fully grasp your response. I understand that “Stock Ratings” are applied to hundreds or thousands of companies using five criteria. I understand that Long Ideas involve more in depth analysis. What I don’t understand about this specific situation is that as of 10/29, the Stock Rating criteria classified DFS as “Neutral”. Yet two days earlier, it was rated as a top pick. Your comment of 11/8 suggests you stand behind that rating. While I understand that not every stock in the top 20% would be a top pick, I read your response to state that even a stock rated “neutral”, that is in the 40-60% quintile, might be one of the very best stocks to buy based upon in depth analysis. If that is correct, why should I have any faith in the “Stock Ratings”? If a “neutral” stock is better than those rated Attractive, and even better than those rated Most Attractive, then it sounds to me like you readers should take the Stock Ratings with a grain of salt. I’m not trying to be critical. I just want to understand. If a “neutral” stock is one of the 10 best choices in the market, it seems to me I should consider the stock ratings as next to worthless. Do you agree?

Roger,

Thanks for the reply. My apologies for not being more clear. While our Stock Ratings have been proven superior to human analysts and are generally in line with our Long Ideas and Danger Zone picks, they cannot incorporate all the factors that might impact the stock’s future performance.

Specifically in this case, Discover’s Neutral rating is driven by the rise in GAAP earnings despite its falling economic earnings over the trailing twelve months. However, as we detailed in this report, we believe its extensive network and customer service (which our Stock Rating does not evaluate) will enable the firm to grow economic earnings from current levels. If the company’s economic earnings improve as we expect, then its rating will also improve.

Our Stock Ratings diligently evaluate five of the most important criteria for assessing the risk/reward of stocks. However, we do not suggest investors exclusively rely on Stock Ratings for making investment decisions. Rather, we encourage investors to incorporate our Stock Ratings as part of their investment process.

Like Roger, I find the inconsistency between the Neutral Stock Rating for DFS and its continued inclusion in the Long Ideas difficult to reconcile. To justify continued economic earnings growth based on highly subjective parameters like extensive network and superior customer service would, in my opinion, appear to fly in the face of a true data-driven assessment.

Also the massive gap between GAAP earnings and Economic Earnings over TTM for DFS should be a huge red flag. When I search for DFS in the Reasearch section I find that in 2011 there were also misleading earnings that resulted in the stock moving from the Most Dangerous list to the Most Atttractive List and then back again within a four month period.

Patrick, Thanks for your message. As we noted to Roger, our Stock Ratings provide an accurate measure of the fundamentals of a business, but they still act as a starting point. Subjective parameters can help build or break down an investment thesis. For instance, fundamentals cannot take into account a large competitor entering an industry (at least until the impact has been realized), but such information would be important in developing an investment thesis.

As laid out in our report, we believe Discover is positioned well to grow economic earnings from current levels, and should it do so, its rating will also improve.