We published an update on DFS on Oct 27, 2021. A copy of the associated Earnings Update report is here.

Stocks in the Financials sector trade at a significant discount to the rest of the market due to concerns over falling interest rates, technological disruption, and the possibility of a recession. These concerns are rational, but they are often overblown. As a result, some highly profitable and growing financial companies are currently trading at unusually cheap valuations.

This credit card issuer leads the industry in both profitability and customer satisfaction. It has a strong track record of growth and significant competitive advantages, yet the stock is priced for significant profit decline. Discover Financial Services (DFS: $76/share) is this week’s Long Idea.

GAAP Earnings Mislead Investors

We previously made DFS a Long Idea on December 3, 2014. In our article, we predicted that DFS would grow profits and expand its market share, both of which materialized. However, since the article, the stock has underperformed the market, up 17% vs. the S&P 500 up 41%.

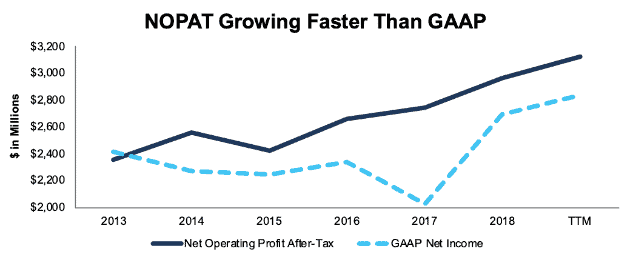

The company’s understated GAAP earnings growth may explain some of the stock’s underperformance. From 2013 to 2018, GAAP earnings grew by just 2% compounded annually. On the other hand, net operating profit after tax (NOPAT) – which reverses accounting distortions – grew by 5% compounded annually. See Figure 1.

Figure 1: DFS’s GAAP Net Income and Economic Earnings: 2013-TTM

Sources: New Constructs, LLC and company filings

Changes in reserves account for the majority of the disconnect between NOPAT and GAAP. The company’s reserves for loan losses have roughly doubled, from $1.6 billion in 2013 to $3.2 billion currently. The steady rise in DFS’s loan loss reserves has been a constant drag on GAAP net income since 2013.

Notably, the rate of growth for the company’s loan loss reserve is much faster than the increase in the size of its total loan portfolio, which is up 40% since 2013. DFS has also increased its reserves much more rapidly than its most direct competitor – Capital One Financial (COF) – whose loan loss reserve is up 65% since 2013.

DFS’s current loan loss reserve represents 3.5% of its gross loans receivable compared to 2.9% for COF. DFS looks more cautious in its accounting practices, which have led to GAAP earnings understating the company’s profit growth over the past five years.

Superior Credit Quality Reduces Risk

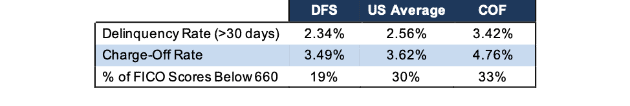

Firms need higher loan loss reserves if their loans are more risky. Looking at delinquencies and charge offs, Discover’s loan portfolio actually looks less risky than peers. Figure 2 compares the credit card portfolio of DFS to COF and the national average on the basis of delinquency rate (loans more than 30 days past due), charge-off rates (loans that have been determined unlikely to be collected), and the percentage of receivables attributable to customers with FICO scores below 660.

Figure 2: DFS’s Superior Credit Quality

Sources: New Constructs, LLC, company filings, and St. Louis Fed

DFS’s loan portfolio appears to be less risky than the national average, and significantly less risky than COF.

High Customer Satisfaction Is a Competitive Advantage

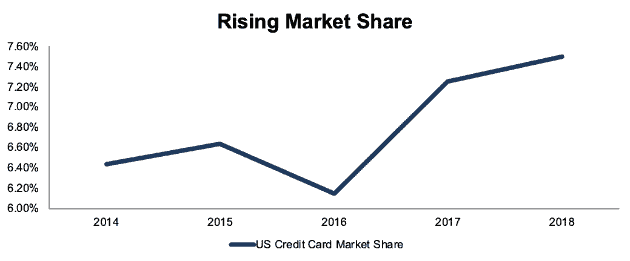

In our previous article on DFS, we pointed out that DFS ranked first in customer satisfaction by J.D. Power, and that this high customer satisfaction would enable the company to gain market share.

These factors remain true today. DFS ranked first in customer satisfaction again in 2019 – the fourth time over the past five years. DFS’s superior customer satisfaction helped the company expand its share of the U.S. credit card market from 6.4% in 2014 to 7.5% in 2018, as shown in Figure 3.

Figure 3: DFS U.S. Credit Card Market Share: 2014-2018

Sources: WalletHub

DFS should continue to gain market share in the industry as more consumers realize the higher quality service DFS provides its customers.

Superior Profitability Compared to Peers

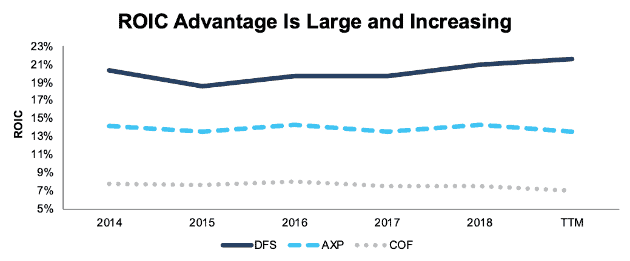

In addition to its industry-best customer satisfaction, DFS also leads its peers in terms of profitability. The company’s two primary competitors, as pure credit card issuers, are COF and American Express (AXP). As Figure 4 shows, DFS earns a significantly higher return on invested capital (ROIC) than both peers.

Figure 4: ROIC for DFS, AXP, and COF: 2014-TTM

Sources: New Constructs, LLC and company filings

The gap between DFS and its peers continues to widen. In 2014, DFS’s ROIC was six percentage points higher than AXP and 13 percentage points higher than COF. Over the TTM period, DFS’s ROIC is eight percentage points higher than AXP and 15 percentage points higher than COF.

DFS’s superior ROIC gives it more flexibility to absorb credit losses in a downturn, as well as the ability to grow profits while investing capital at a lower rate.

Bear Case: Apple Card Is an Overhyped Threat

The primary bear case against DFS – along with other credit card companies – is that technology companies will compete with them by offering new consumer credit products. Most notably, Apple (AAPL) recently launched its own Apple credit card, which is available to all iPhone owners in the U.S.

Some analysts have predicted that the Apple Card will disrupt the financial services industry, with one analyst even saying its impact will be as big as the iPod’s was on the music industry.

When you look past the hype, though, the Apple Card appears to be a pretty standard issue credit card without any real unique features. It’s issued by Goldman Sachs (GS), offers comparable rewards to other entry-level cards, and has a relatively standard interest rate.

Previous efforts by Apple to enter the financial services industry haven’t been particularly disruptive either. The company’s mobile payments app, Apple Pay – which relies on traditional credit cards itself – has just a 9% adoption rate in the U.S. Traditional credit cards, on the other hand, are used by 80% of consumers.

Apple’s new card will likely have an appeal to hardcore Apple fans, but it doesn’t seem likely to be a major disruptor to the credit card industry as a whole.

Bear Case: Falling Interest Rates Aren’t Hurting Profits

The other bear case against DFS is that falling interest rates will hurt the company’s interest income, its key source of profits. As the Fed cuts interest rates, investors are afraid that credit card rates will decline as well.

So far, though, credit card interest rates haven’t declined. In fact, the interest rates on credit cards are near record levels, and the credit spread continues to increase.

Most credit card companies appear to be competing based on rewards and customer service rather than on lower interest rates. DFS, with its top-ranked customer satisfaction, should be well placed to compete on this front and win new business while maintaining a high credit spread.

Cheap Valuation Creates Upside

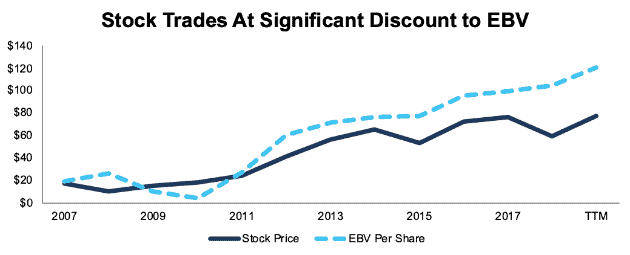

DFS’s recent underperformance means the stock now looks significantly undervalued. As Figure 5 shows, the company’s economic book value (EBV) – or zero-growth value – has continued to rise while the stock has been mostly flat over the past five years.

Figure 5: Stock Price vs. Economic Book Value: 2007-Present

Sources: New Constructs, LLC and company filings

At its current price of $76/share, DFS has a price to economic book value (PEBV) of 0.6. This ratio means the market expects DFS’s NOPAT to permanently decline by 40%.

By comparison, COF also has a PEBV of 0.6. We believe DFS should have a premium valuation compared to COF due to its superior credit quality and higher ROIC.

Investors may mistakenly believe DFS is more expensive due to its P/E ratio of 9, which is higher than COF’s 7. Accounting distortions make DFS look like the more expensive stock, but the cash flow decline implied by their valuations are the same.

We use our reverse DCF model to quantify DFS’s potential under different growth scenarios.

If DFS can maintain a 22% NOPAT margin (slightly down from 23% in 2018) and grow NOPAT by 5% compounded annually over the next decade, the stock is worth $158/share today, a 107% upside to the current stock price. See the math behind this dynamic DCF scenario.

That growth rate assumption may prove conservative considering DFS has grown NOPAT 10% compounded annually since 2008.

Sustainable Competitive Advantages That Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around Discover Financial’s business will enable the company to generate higher profits than the current valuation of the stock implies. This list of competitive advantages helps DFS offer better products/services at a lower price and prevents competition from taking market share.

- Industry leading customer satisfaction

- Superior credit quality

- Higher ROIC compared to peers

What Noise Traders Miss with DFS

These days, fewer investors focus on finding quality capital allocators with shareholder friendly corporate governance. Instead, due to the proliferation of noise traders, the focus tends toward technical trading tends while high-quality fundamental research is overlooked. Here’s a quick summary for noise traders when analyzing DFS:

- GAAP earnings understate profit growth due to increased loan loss reserves

- P/E ratio makes DFS looks more expensive than COF when they are actually evenly valued

- Risk from Apple Card and falling interest rates are overstated

Catalyst: New Accounting Rule Could Send Shares Higher

Beginning in 2020, companies will be required to adopt accounting standards update (ASU) 2016-13: Measurement of Credit Losses on Financial Instruments. This new rule will change the way companies account for their reserve for loan losses.

Under the current standard, companies use an “incurred loss” model, where the reserve for loan losses is based on loans that are currently impaired. Under the new standard, companies will have to use a “current expected credit loss” model that attempts to forecast all future potential impairments over the life of their loan portfolios.

This new standard will significantly increase the reserve for loan losses for DFS and other credit card issuers. DFS estimates the new standard will lead to a 55-65% increase, while COF and AXP haven’t given forecasts yet. However, it seems likely that the impact of the new rule will be worse for other firms, like COF and AXP, with higher credit risk and lower loan loss reserves.

Corporate Governance Could Be Improved

DFS ties executive compensation to a large number of financial metrics, including net income, return on equity (ROE), earnings per share, total revenue, net charge-offs, and operating expense.

It’s good that DFS does include a return metric in its compensation plan, but ROE has numerous flaws that make it an imperfect metric for evaluating profitability. DFS should replace ROE with ROIC to better hold executives accountable for all forms of capital in the business.

As our article, “CEO’s That Focus on ROIC Outperform,” highlighted, there is a strong correlation between improving ROIC and increasing shareholder value. DFS should align its executives with long-term shareholders by tying a portion of their compensation to ROIC. This would be beneficial to the long-term profitability of the company, and we believe sophisticated investors would reward the company with a higher valuation in the short-term.

Dividends and Buybacks Provide 10% Yield

DFS has increased its dividend in nine straight years. Since 2014, DFS has increased its dividend by 11% compounded annually. Its current annualized dividend of $1.60 equates to a dividend yield of 2.3%

In addition to dividends, DFS returns capital to shareholders through share repurchases. Over the trailing twelve months, DFS repurchased $1.9 billion (8% of market cap) worth of shares. DFS has $2.2 billion remaining on repurchase authorizations, and it generated $2.3 billion in free cash flow TTM, so it can easily maintain or increase its rate of capital return going forward.

Combined, DFS’s dividend and buyback activity provide shareholders with a nearly 10% yield.

Insider Trading and Short Interest Trends are Minimal

Insider activity has been minimal over the past 12 months, with 587 thousand shares purchased and 669 thousand shares sold for a net effect of 82thousand shares sold. These sales represent less than 1% of shares outstanding.

There are currently 6 million shares sold short, which equates to 2% of the float and 3 days to cover. There does not appear to be much appetite to bet against this stock.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[1] findings in Discover Financial Service’s 2018 10-K:

Income Statement: we made $737 million of adjustments, with a net effect of removing $269 million in non-operating expense (2% of revenue). We removed $234 million in non-operating income and $503 million in non-operating expenses. You can see all the adjustments made to DFS’s income statement here.

Balance Sheet: we made $4.5 billion of adjustments to calculate invested capital with a net increase of $3.1 billion. You can see all the adjustments made to DFS’s balance sheet here.

Valuation: we made $724 million of adjustments with a net effect of decreasing shareholder value by $724 million. Despite this decrease in value, DFS remains undervalued. You can see all the adjustments made to DFS’s valuation here.

Attractive Funds That Hold DFS

The following funds receive our Attractive-or-better rating and allocate significantly to Discover Financial.

- Sterling Capital Equity Income Fund (STEX) – 4.6% allocation and Very Attractive rating

- Nationwide Diamond Hill Large Cap Concentrated Fund (NWGKX) – 3.9% allocation and Attractive rating

- Redwood AlphaFactor Tactical Core Fund (RWTIX) – 3.7% allocation and Very Attractive rating

This article originally published on October 9, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.