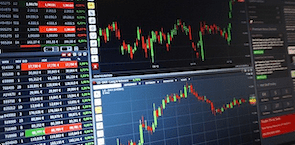

This Company Has the Tools to Outperform

With deep customer relationships and innovative solutions for future equipment needs, this global supplier has a durable business ready for a changing industry.

Matt Shuler, Investment Analyst II