We closed the NSIT position on April 14, 2023. A copy of the associated Position Close report is here.

2Q21 earnings reveal these three Long Ideas continue to have strong upside potential. Their businesses are aligned with favorable market trends and positioned to grow profits over the long term, but their stocks are priced for permanent profit decline. This week’s Long Ideas are Insight Enterprises, Inc. (NSIT: $97/share), Cummins Inc. (CMI: $234/share), and CVS Health Corp (CVS: $83/share).

We leverage more reliable fundamental data, proven in The Journal of Financial Economics[1], with qualitative research to highlight these firms whose stocks present excellent risk/reward.

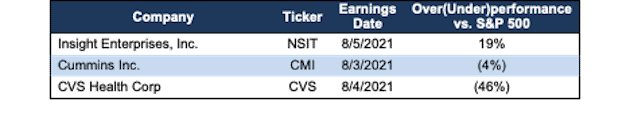

Figure 1: Long Idea Performance: From Date of Publication Through 8/10/2021

Sources: New Constructs, LLC

Performance measured from the date of publication of first Long Idea report for each stock. Dates can be seen in each company section below. Performance represents price performance and is not adjusted for dividends.

Insight Enterprises Has 62%+ Upside

We made Insight Enterprises a Long Idea in August 2018. Since then, the stock has outperformed the S&P 500 by 19% and still has more upside.

What’s Working: Net sales increased 13% year-over-year (YoY) in 2Q21, and management now believes that sales will grow at the “high-end” of previous guidance of 4% to 8% in 2021.

Strong client demand for cloud-based solutions drove Insight Enterprise’s 22% YoY increase in cloud services gross profit. The firm’s cloud business generated 22% of its total gross profit in 2Q21. Additionally, the heightened awareness and occurrence of cyber attacks boosts demand for the firm’s security business.

Insight Enterprises’ combination of strong business relationships, quality customer service, knowledgeable consultants, and integration of hardware and software solutions, creates an offering that add value to both customers and shareholders. The firm’s economic earnings have grown from $12 billion in 2015 to $96 billion over the trailing twelve months (TTM).

The pandemic accelerated many firms’ utilization of technological solutions to meet business needs. Going forward, businesses’ increased dependence on technology and data/analytics creates opportunities for continued profit growth for Insight Enterprises. Independent research firms expect strong growth in the major markets Insight Enterprises services.

- Allied Market Research estimates global cloud services will grow 16% compounded annually through 2030

- Grand View Research anticipates the artificial intelligence market to grow 40% compounded annually from 2021 to 2028

- ResearchAndMarkets forecasts the global ecommerce market will grow 14% compounded annually through 2030

What’s Not Working: As with many other industries, semiconductor shortages impact Insight Enterprises’ operations due to supply constraints and longer lead times to fill hardware orders. However, this disruption is expected to be temporary and widespread through the market, so we believe Insight Enterprises is not likely to lose market share over the issue.

While the firm’s large hardware and software sales grew 15% YoY in 2Q21, there are signs that elevated demand for hardware brought on by the pandemic may begin to ease. For example, the firm’s Chromebook supply levels rose quarter-over-quarter, which could indicate the market has largely met the increased demand from educational institutions during the pandemic.

NSIT Still Priced for Permanent Profit Decline: Insight Enterprises’ price-to-economic book value (PEBV) ratio is 0.9. This ratio implies that the market expects Insight Enterprises’ profits will permanently decline by 10%.

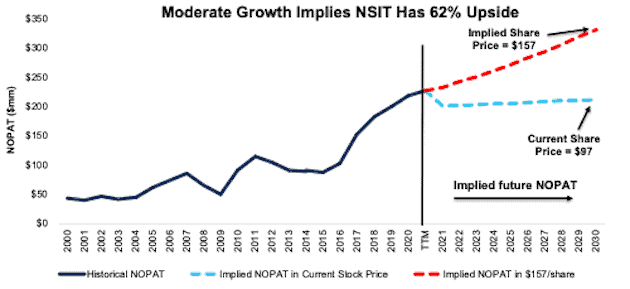

Below, we use our reverse discounted cash flow (DCF) model to analyze the expectations for future growth in cash flows baked into a couple of stock price scenarios for Insight Enterprises.

In the first scenario, we assume Insight Enterprises’:

- net operating profit after-tax (NOPAT) margin falls to 2% (five-year average vs. 3% TTM) from 2021 through 2030, and

- revenue grows at a <1% CAGR from 2021 to 2030 (vs. five-year CAGR of 9% from 2015-2020)

In this scenario, Insight Enterprises’ NOPAT falls by <1% compounded annually over the next decade and the stock is worth $97/share today – equal to the current price. See the math behind this reverse DCF scenario. For reference, Insight Enterprises grew NOPAT by 11% compounded annually over the past decade.

Shares Could Reach $157 or Higher: If we assume Insight Enterprises:

- maintains its TTM NOPAT margin of 3% from 2021 through 2030, and

- grows revenue at a 4% CAGR from 2021 to 2030 (less than half its five-year CAGR), then

the stock is worth $157/share today – 62% above the current price. See the math behind this reverse DCF scenario. In this scenario, Insight Enterprises’ NOPAT grows 4% compounded annually over the next decade, which is well below Insight Enterprises’ 8% NOPAT CAGR since 2000.

Should Insight Enterprises grow profits closer to historical levels, the upside in the stock is even greater.

Figure 2: Insight Enterprises’ Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

Cummins Can Go 76%+ Higher

We made Cummins a Long Idea in November 2018. While the stock has slightly underperformed the market since then, we continue to see upside in the stock.

What’s Working: Sales were up 59% YoY in 2Q21, which shows the firm’s operations are recovering from pandemic-driven disruptions in 2020. The firm’s power generation segment had a strong quarter as sales grew 48% YoY with increased recreational vehicle, standby power, and datacenter demand. Overall, the firm is guiding 2021 total revenue to increase 20% to 24% YoY.

Elevated freight activity in North America is responsible for higher contract rates and greater fleet profitability, while high commodity prices are supporting mining operations. These end markets are using good times to improve their equipment, and Cummins is seeing strong demand for heavy duty trucks.

With 35% market share in 2020, Cummins installs more class 8 heavy-duty engines than any other manufacturer in North America. The firm has even more dominance in the heavy-duty engines under 10 liters market segment where the firm improved its share from 78% in 2017 to 87% in 2020.

As the world focuses on reducing carbon emissions, Cummins is strategically investing in an electric-driven future using hydrogen fuel cells. Toyota, the world’s second largest automaker, already promotes the use of hydrogen fuel cells as an effective means to achieve carbon neutrality, and Cummins believes the same can be achieved in the heavy-duty market. Hydrogen fuel cell technology is particularly appealing in the long-haul trucking market because it offers longer range, weighs less, and is faster to refuel compared to current battery technology. Major truck suppliers – Daimler, Paccar (PCAR), Volvo (VLVLY), and Navistar – who are both competitors and customers of Cummins are focused on adopting hydrogen fuel cell technology in their trucks.

Cummins is using its industry relationships and scale to grow its hydrogen fuel cell business. The firm will increase its hydrogen generating capacity through its recent joint venture agreement with Sinopec. Additionally, Cummins is partnering with Air Products to help bring its heavy duty truck fleet to zero emissions. With these partnerships, Cummins plans to deliver 2,000 heavy duty trucks equipped with hydrogen fuel cell electric powertrains by the middle of the decade.

What’s Not Working: While heightened freight demand may be good for Cummins’ top line, the firm incurred an additional $100 million in additional freight labor and logistics costs in 2Q21. For the year, Cummins anticipates $295 million in additional logistics costs.

Longer term, with the future of combustible engines in great doubt, the firm will likely be forced to transition its business to largely unproven EV operations. By so doing, the firm must re-establish its 100-year+ reputation for quality that currently drives strong customer loyalty. If the firm is unable to effectively transition its business, or if regulatory bodies accelerate customer demand faster than its ability to change, Cummins’ future could be in jeopardy. However, this risk is not specific to Cummins and applies to all auto/auto parts manufacturers. Cummins is already leveraging its extensive experience and relationships with end users to develop powertrain technology to meet customer demand.

Cummins’ customers are also its competition. If any of the major truck manufacturers seize electrification as an opportunity to vertically integrate operations, Cummins would have fewer customers. However, if Cummins applies its focus and commitment to developing high-quality, electric powertrains as it has with traditional engines over the past century, we expect customer demand for Cummins electric powertrains will be high.

CMI Is Still Priced for Permanent Profit Decline: Cummins’ price-to-economic book value (PEBV) ratio is 0.7. This ratio implies that the market expects Cummins’ profits will permanently decline by 30%.

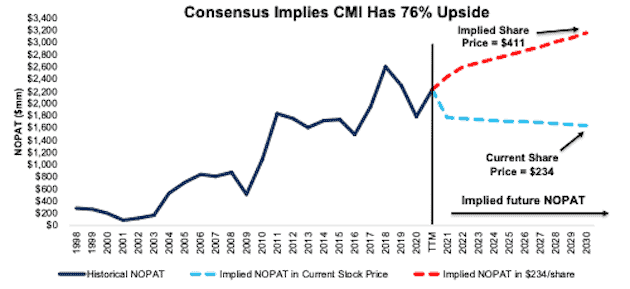

Below, we use our reverse DCF model to analyze the expectations for future growth in cash flows baked into a couple of stock price scenarios for Cummins.

In the first scenario, we assume Cummins’:

- NOPAT margin falls to 9% (vs. 10% TTM) from 2021 through 2030, and

- revenue falls by 1% compounded annually from 2021 to 2030 (vs. consensus CAGR of 10% for 2021-2023)

In this scenario, Cummins’ NOPAT falls by 1% compounded annually over the next decade and the stock is worth $234/share today – equal to the current price. See the math behind this reverse DCF scenario. For reference, Cummins grew NOPAT by 5% compounded annually over the past decade.

Shares Could Reach $411 or Higher: If we assume Cummins:

- maintains its TTM NOPAT margin of 10%, (its five-year average) from 2021 through 2030, and

- revenue grows at a 10% CAGR through 2023 (same as consensus 2021-2023 CAGR), and

- revenue grows 2% a year from 2024 - 2030 (extension of 2023 consensus estimate), then

the stock is worth $411/share today – 76% above the current price. See the math behind this reverse DCF scenario. In this scenario, Cummins grows NOPAT by 6% compounded annually over the next decade. For reference, Cummins grew NOPAT by 8% compounded annually over the past five years.

Should Cummins grow profits closer to historical levels, the upside in the stock is even greater.

Figure 3: Cummins’ Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

CVS Health Has 71%+ Upside Even If Profits Permanently Decline

We made CVS Health a Long Idea in October 2018. Though the stock has underperformed the S&P 500 since then, we believe it still provides attractive risk/reward.

What’s Working: Total revenue was up 11% YoY in 2Q21 and the firm raised its EPS and cash flow from operations outlook for the year. CVS Health continues to grow its vertically integrated business by launching a new clinical trials services segment during the quarter.

The firm’s acquisition of Aetna at the end of 2018 was valued at $70 billion, and while shareholders typically end up worse off after large acquisitions, the Aetna acquisition has created shareholder value. Economic earnings have grown from $3.1 billion in 2018 to $5.2 billion over the TTM. The acquisition has also led to large free cash flow (FCF) generation. Over the past two years, the firm generated $27.4 billion (25% of market cap) in FCF.

CVS Health has the leading market share in two of its three operating segments. The firm is the largest pharmacy in the U.S., with ~25% share of the prescription drug market. Additionally, CVS Health’s pharmacy benefit management (PBM) segment, which helps insurance companies manage prescription drug costs, has a market share of 32%, which is larger than all competitors including Cigna’s (CI) 24% share and UnitedHealth’s (UNH) 21% share.

What’s Not Working & Potential Risks to the Business: The firm lost a large customer in 2Q21 in its health care benefits segment which led to a decline of 116 thousand (<1% of total members) members.

CVS Health competes in three different segments of the healthcare market, all of which have unique challenges. The firm’s retail, PBM, and insurance segments account for 34%, 37%, and 28% of total 2Q21 revenue, respectively.

- The retail business faces tough competition from ecommerce retailers such as Amazon (AMZN); big box retailers such as Walmart (WMT), Costco (COST), and Dollar General (DG); and supermarkets such as The Kroger Company (KR) and Albertsons (ACI). Despite stiff competition, CVS Health’s retail pharmacy segment has grown sales 5% compounded annually since 2018. While the firm’s front store, which includes non-prescription products, grew at a much lower 2% CAGR over the same time, this segment of the business accounted for just 7% of total revenue in 2Q21. With ResearchAndMarkets' expectation that the pharmaceuticals market will grow 8% compounded annually through 2025, CVS Health’s retail segment is well-positioned for future continued growth.

- CVS Health is the largest PBM in the U.S., but the heavily regulated healthcare industry adds additional risk to this part of CVS’s business. For example, the firm’s PBM segment faces long-term regulatory pressure on certain rebates it receives through the Medicare program. Such regulation could lower CVS Health’s margins. Nonetheless, CVS Health’s PBM segment is likely to continue growing as ResearchAndMarkets expects the PBM market to grow 7% compounded annually through 2025.

- CVS Health is the sixth largest (by revenue) health insurer in the U.S. and trails prominent firms such as UnitedHealthcare, Centene (CNC), Anthem (ANTM), and Humana (HUM). CVS Health’s less profitable retail and PBM segments drive its return on invested capital (ROIC) lower than its insurance peers. The firms 6% TTM ROIC is well below the 11% market-cap-weighted average ROIC of the above-mentioned peers. Despite its smaller size and inferior ROIC, the firm’s health insurance premiums have grown from $63 billion in 2019 to $72.7 billion over the TTM.

Falling demand for COVID-related services, such as testing and vaccinations, could serve as a near-term catalyst for shares to fall.

Longer term, CVS Health’s insurance business could face disruption from new entrants that leverage blockchain protocols, which have the potential to attract funding for more competitively priced insurance products. The firm can mitigate this risk by becoming an early adopter of blockchain technology within the healthcare industry, which could help it increase its operational efficiency, improve the accuracy of its data, and reduce administrative costs.

Despite these potential headwinds, the stock is still too cheap. The expectations for long-term profit decline baked into the stock are overblown and make the stock look particularly undervalued.

Priced for Permanent Profit Decline: CVS Health’s PEBV ratio of 0.4 means the market expects CVS Health’s profits to will permanently decline by 60%. This expectation seems overly pessimistic for a firm that has grown NOPAT by 10% compounded annually over the past decade.

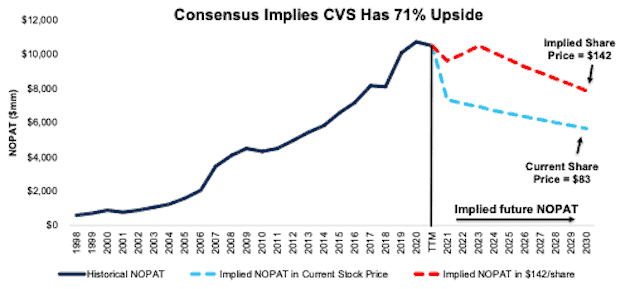

Below, we use our reverse DCF model to quantify the expectations for future growth in cash flows baked into a couple different stock price scenarios for CVS Health.

In the first scenario, we assume CVS Health’s:

- NOPAT margin falls to 2.8% (below average TTM segment competitors’[2] margin of 3.2%, compared to all-time low 3.6% TTM) from 2021 through 2030 and

- revenue falls by 3% compounded annually from 2021-2030 (vs. consensus estimate CAGR of +5% through 2023)

In this scenario, CVS Health’s NOPAT falls by 6% compounded annually over the next decade and the stock is worth $83/share today – equal to the current price. See the math behind this reverse DCF scenario. For reference, CVS Health grew NOPAT by 13% compounded annually over the past two decades.

$142/Share If Consensus Is Right, and we assume CVS Health’s:

- NOPAT margin falls to 3.4% (below all-time low of 3.6%) from 2021 through 2030 and

- revenue grows by 5% compounded annually through 2023 (equal to consensus estimates) and

- revenue falls by 4% a year from 2023-2030, then

the stock is worth $142/share today, or 71% above the current price. See the math behind this reverse DCF scenario. In this scenario, CVS Health’s NOPAT falls by 3% compounded annually over the next decade. Should CVS Health’s NOPAT grow in line with historical growth rates, the stock has significantly more upside.

Figure 4: CVS Health’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

Other Long Ideas That Recently Reported

Figure 5 shows other Long Ideas that have recently reported calendar 2Q21 earnings along with their relative performance.

Figure 5: More Long Ideas That Recently Reported Earnings: Through 8/10/2021

| Company | Ticker | Earnings Date | Out (under)performance vs. S&P 500 |

| General Motors | GM | 8/4/21 | 62%* |

| SYSCO Corporation | SYY | 8/10/21 | 10%* |

| Hyatt Hotels Corp | H | 8/3/21 | 4%* |

| Valvoline Inc. | VVV | 8/4/21 | 3% |

| Allstate Corp | ALL | 8/4/21 | (15%)* |

| Phillips 66 | PSX | 8/3/21 | (23%)* |

| HollyFrontier Corp | HFC | 8/4/21 | (33%)* |

| Western Union | WU | 8/4/21 | (36%) |

| Lear Corp | LEA | 8/6/21 | (56%) |

| Spirit AeroSystems Holdings | SPR | 8/4/21 | (106%) |

Sources: New Constructs, LLC

Performance measured from the date of publication of first Long Idea report for each stock. Performance represents price performance and is not adjusted for dividends.

*Performance measured from the date of publication of the first report included in our “See Through the Dip” series.

This article originally published on August 11, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, proven by professors at Harvard Business School & MIT Sloan.

[2] We average the TTM NOPAT margin for the following firms that directly compete in at least one of CVS Health’s operating segments: Cigna (PBM), Anthem (health insurance), and Kroger (retail).