With Americans and the market souring on traditional fast food restaurants, diners and Wall Street have turned to a new segment of the restaurant sector: so called “fast casual” restaurants. These restaurants, as their name implies, attempt to serve casual restaurant quality food at quick-service speeds. However, these speeds do not approach the efficiency of fast food restaurants, nor do most of these restaurants have drive-thrus. The tradeoff — and the apparent driver behind this segment’s growth — is that these businesses generally provide a fresher, higher quality, more expensive product than do traditional fast food joints.

With the runaway success of Chipotle (CMG), other fast casual restaurants have been clamoring for consumers’ and investors’ dollars. Wall Street has been all too eager to respond, and a number of fast casual restaurants have been taken public in the past year in an attempt to cash in on the gold rush. Many of them are billing themselves as “the next Chipotle” — but we’ll evaluate those claims to see if any of these stocks warrant your investment.

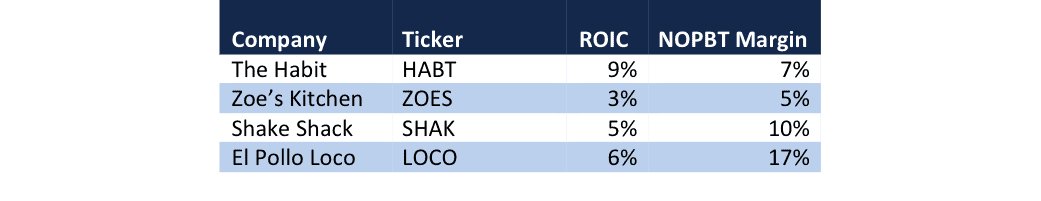

Figure 1 compares our list of fast casual restaurants in terms of return on invested capital (ROIC) and operating pretax profit margin (NOPBT).

Figure 1: Fast Casual IPOs Compared

Sources: New Constructs, LLC and company filings.

A Bad Habit? — The Habit Restaurants (HABT)

The Habit is a higher-end hamburger restaurant based in southern California. Relatively unknown just a few months ago, The Habit has received considerable buzz since topping Consumer Reports’ top burger list in 2014. The company went public at $18/share, but shares quickly jumped to almost $40 on its first day of trading.

The Habit has certainly been displaying some impressive top line growth. In 2014, Habit grew revenues by an impressive 45%, which was driven by the opening of around 25 new stores in 2014 and same store sales (SSS) growth of 11%. This is the highest annual same store sales growth Habit has ever reported, as the company has averaged 5% annual same store sales growth since 2010. This higher growth was likely a function of Habit’s appearance on the Consumer Reports’ list in July (SSS jumped 16% and 13% in 3Q14 and 4Q14, respectively) and its 42% increase in Selling, General and Administrative expenses.

All of this growth allowed Habit to increase its after-tax operating profit (NOPAT) by almost 33% in 2014 to $12 million — below its 35% NOPAT growth in 2013, but impressive nonetheless. Habit’s return on invested capital (ROIC) for 2014 was 9%, solid for a restaurant business and all businesses in general.

With its IPO and rapid growth, the company has poured record amounts of money into its business and the company’s invested capital grew by 32% in 2014. Opening brick-and-mortar restaurants tends to be capital intensive, and we expect to see large jumps in invested capital like this going forward. Habit needs to open more stores to continue growing as the bump in popularity from the Consumer Reports publicity begins to fade.

Habit has had to resort to borrowing to finance this significant rate of expansion. The company has $76 million in total debt — none of which is reported on its balance sheet. Habit holds all $76 million of its debt in the form of operating leases on its restaurant properties. These leases do not appear on the balance sheet, but are an alternative to traditional capital leases.

Habit is growing sales and profits a bit faster than its established competition Chipotle (30% NOPAT growth in 2014), but as an immature business its ROIC is lower than those of Chipotle (16%) and Panera (PNRA) (11%).

Habit is also certainly upmarket from base-level fast food joints, but isn’t seeking the same kind of consumer spending as Chipotle is. The average customer at Habit spends $7.56 on a meal, compared to $11.56 at Chipotle and $3.88 at McDonald’s (MCD). Habit might have some issues differentiating itself in the ever-crowded burger space — but the chain does offer things like tempura veggies, pastrami, steak sandwiches, salads, and a “sushi-quality” tuna burger to stand out.

One thing to note is that the company’s tax status. Prior to its IPO Habit did not pay federal income tax, but instead paid the California LLC tax as a member and sole managing partner of The Habit Restaurants, LLC. Now that it’s a public company, Habit will be subject to federal income tax as well as its portion of the LLC tax. This will substantially increase Habit’s tax burden and drag down after-tax margins going forward. In addition, Habit’s going public will put other administrative and regulatory costs on the company, increasing expense and further dragging down margins.

Habit expects to receive $66 million in total from its IPO, and plans to purchase LLC Units from The Habit Restaurants, LLC (the LLC Habit belonged to). The Habit Restaurants, LLC will subsequently use such proceeds to repay all of the borrowings under its existing credit facility with California Bank & Trust (which was $11.1 million as of September 30, 2014). In addition, Habit took out a “bridge loan” before its IPO to pay $30 million to The Habit, Inc. to fund the purchase of LLC units from the Habit, LLC. The proceeds of the IPO will go toward furnishing this $30 million, which was not incurred at the time of the filing and had a two-day maturity date. It looks as if a primary function of the IPO was to eliminate debt and line management’s pockets — not grow more stores.

Enthusiasm surrounding Habit’s growth and the fast casual segment in general has driven up the company’s valuation. To justify its current valuation of $36/share, HABT would need to grow NOPAT by 21% compounded annually for the next eight years. This scenario implies that pre-tax margins will rise to 9% and that taxes will increase to a very conservative 30% going forward. These growth expectations approaches Chipotle’s 29% NOPAT growth rate since 2006.

Essentially, a bet on HABT at these prices is a bet on another Chipotle, but we expect The Habit’s after-tax margins and ROIC to fall as it continues to expand and begins to pay federal income tax. If the company’s pretax margins remain flat and Habit can grow NOPAT by a still-impressive 17% compounded annually for the next 10 years, the stock is worth $27/share, a 25% downside.

The Habit receives our Dangerous rating. This is a quickly growing business with good press, but the company’s current valuation implies a kind of growth that very few restaurants have ever achieved. The Habit has been around since 1969, and owned by a private equity firm since 2007. It has yet to take off, and we feel very uncomfortable betting on that kind of growth. The Habit must also compete with similar premium burger concepts Five Guys, In-N-Out, and Shake Shack.

Will Flatbread Fall Flat? — Zoe’s Kitchen (ZOES)

Zoe’s Kitchen, which serves Mediterranean-themed cuisine, went public in April 2014 and quickly surged over 65% on its market debut. However, do the fundamentals of this company add up to justify the stock’s $33 share price? Or has the stock already soared past reasonable expectations for this small fast casual restaurant?

Zoe’s defines itself as a fast casual restaurant serving Mediterranean inspired dishes delivered with Southern hospitality. Zoe’s operated 132 restaurants at the end of 2014 and has exhibited the trademarks of recent fast casual restaurants garnering attention in the market: rapid revenue growth and big expansion plans. However, profits so far have remained elusive for Zoe’s.

The rapid revenue growth exhibited by the company since 2010 has certainly been impressive (as has been the case with other companies on this list). Over this time frame, Zoe’s has grown revenues by 52% compounded annually, but this growth has been slowing. After achieving revenue growth upwards of 55% in 2011 and 2012, revenue growth in 2013 and 2014 was slightly lower at 46% and 47% respectively. However, this growth is expected to take a nosedive, as management expects revenue growth of only 26-29% in 2015. While this growth rate would not be bad by any means, it certainly puts a damper on Zoe’s previous revenue growth rates as well as on investor expectations based on those historical growth rates.

The revenue growth highlighted above has come mainly on the back of significant store expansion. In 2008, Zoe’s operated only 21 stores across seven states and by the end of 2014 operated 132 stores across 15 states. The company touts its excellent comparable stores sales growth, but this too slowed significantly in 2013 and 2014. After achieving comparable sales upwards of 12% for the three years prior to 2013, this metric fell to 7% in both 2013 and 2014. As above, this does not signal huge issues as of yet, but a continued downward trend in comparable store sales is certainly something to keep an eye on.

Diving deeper into Zoe’s fundamentals brings us to the largest warning sign, and that is the declining operating margins Zoe’s experiences as it expands. Obviously there are varied expenses incurred when operating a restaurant business, such as cost of food and labor, but as Zoe’s has expanded, stores have become even more costly. In 2012, Zoe’s had an operating margin of 3%, which declined to 1% in 2013, and to -3% in 2014. A small fast casual restaurant’s best chance of creating rapid revenue growth is to open new stores, yet these new stores are becoming more of a drag on profits, which leaves Zoe’s in quite the predicament. Does the company spend more capital to expand the store base and achieve excellent revenue growth while sacrificing profits? Or does it focus on profits and risk letting revenue growth decline? We’ve highlighted issues of costly expansion before when analyzing Dunkin Brands (DNKN).

As can be seen from above, Zoe’s is not in the perfect shape its stock price may have you believe, as revenue growth, same store sales growth, and margins are all falling. In 2014 Zoe’s had a bottom-quintile ROIC of just 3%, well below that of other fast casual restaurants. In addition, free cash flow was -$66 million in 2014, which comes on the heels of a -$14 million outflow in 2013. Zoe’s has also failed to generate positive economic earnings in any of the three fiscal years in our model. Despite these issues, the stock is up 33% since its IPO and is now vastly overvalued.

To justify its current price of $33/share, Zoe’s would need to grow NOPAT by 22% compounded annually for the next 11 years. This would also entail growing sales by 20% for every year over the next 11 years. If the declining sales growth seen over the past five is any sign of the future, this expectation is already out of touch with reality.

If we give Zoe’s credit for a more reasonable 18% compounded annual NOPAT growth rate for the next decade, the stock is worth only $17/share today — a 48% downside. Downside like this is why ZOES earns our Dangerous rating.

A Premium Burger at a Premium Price — Shake Shack (SHAK)

Shake Shack, perhaps the most hyped of the fast casual IPOs, went public earlier this year at $21/share, and quickly rose to $46 on its first day of trading. Shares have had a somewhat bumpy ride since then, but SHAK has risen to $66/share today, where it is grossly overvalued.

Shake Shack sells mainly hamburgers and French fries, but also hot dogs, shakes, custard, and alcohol. If you’re thinking that this sounds very familiar to the offerings of any number of hamburger restaurants, you’re on the right track. Shake Shack operates in a space that is highly competitive and filled with countless other companies. Continuing success in this market will require excellent management and differentiation, something that could be hard to offer.

On the face of it, Shake Shack looks very similar to the other fast casual restaurants we’ve analyzed. Revenues grew 43% year over year in 2014 while expansion to new markets throughout the world was robust. However, the company’s billing as “the next Chipotle,” much like many other fast casual restaurants, drove its stock price up in the early days after its IPO. However, this comparison is far off base, and Shake Shack is not near the investment many believe it to be.

Shake Shack has 63 stores across 10 states and eight other countries at the end of 2014. The company opened 23 new stores in 2014, but is expecting to open 15 stores in 2015. Despite the company’s stellar revenue growth, management is expecting this to continue to slow, and they are projecting a 35-38% revenue growth rate in 2015.

Something investors should note as Shake Shack continues to grow is its same store sales growth — or lack thereof. In 2012, same store sales grew 7%. In 2013 however that had fallen to 6%, and in 2014 fell even further to only 4%. When comparing Shake Shack to Chipotle, it’s worth nothing that Chipotle achieved same store sales growth upwards of 13% to 20% in 2014, and 10% in 1Q15.

Another troubling number for Shake Shack is its rising costs. Costs are increasing as quickly as — if not more quickly than — total sales. Total expenses grew 51% and 46% in 2014 and 2013 respectively. If Shake Shack can only grow sales marginally faster, or worse yet, slower than sales, how can investors expect the company to provide true shareholder value. These increasing costs led to NOPAT falling 16 in 2014 after increasing 17% in 2013. Much like Zoe’s Kitchen, as the company continues its expansion, its bottom line has failed to follow.

Again, it’s important to note that Chipotle has grown NOPAT every single year since going public. Shake Shack’s ROIC declined from 7% in 2013 to 5% in 2014 which is worse than Chipotle’s lowest-ever ROIC of 6%, and nowhere near its current ROIC of 16%. Shake Shack generated -$25 million free cash flow in 2014 and has $127 million in off balance sheet operating leases. Further highlighting the costly nature of store expansion, NOPBT margin declined from 17% in 2012 to 10% in 2014.

As we’ve shown above, Shake Shack is a poor comparison to Chipotle, and is beyond overpriced at current levels. To justify its current price of ~$67/share, Shake Shack would have to grow NOPAT by 33% compounded annually for 13 years. To put this into perspective, Chipotle has only grown NOPAT by 29% compounded annually since going public in 2006.

So not only does Shake Shack have to be the next Chipotle, it has to be even better than Chipotle. This scenario would also leave SHAK with $2.9 billion in sales, up from its current $118 million in sales in 2014.

If we give Shake Shack credit for a still optimistic 24% compounded annual NOPAT growth rate for the next decade, stock is only worth $16/share today — 77% downside. The stock’s current valuation — which implies that Shake Shack will be more efficient and grow faster than Chipotle — is unreasonable, and as a result SHAK earns our Dangerous rating.

A Crazy Chicken and a Crazy Valuation — El Pollo Loco (LOCO)

El Pollo Loco is a Mexican-inspired chain serving primarily chicken with operations primarily in the western half of the United States. The company was founded in 1980 in Los Angeles. Since then, the company has spread rapidly throughout the west and now owns and franchises nearly 400 restaurants. The company attempts to differentiate itself with fresh, authentically prepared food based on its Mexican heritage.

In July of 2014, the company went public at $15/share, and shares jumped nearly 30% on the first day of trading. By August, the shares had ballooned to over $41. Currently the stock is trading at $28/share with significant downside risk remaining. In short, we still believe this company to be grossly overvalued relative to its fundamentals.

In 2014, Loco’s NOPAT declined by 37%, and fell below 2013 and 2012 profit levels. This was due primarily to a decline in after-tax margins from 15% in 2012 to just 9% in 2014 as Loco began to pay taxes beginning in 2014.

Our previous report on Loco emphasized issues related to NOPAT growth and overall expansion. Many of those issues still remain, namely the difficulty of expansion into the eastern United States. The company is not unique in its product offerings, as the company would have you believe. In fact, the company has direct competition from Fiesta Restaurant Group (FRGI) in many of its key growth markets. Fiesta owns a direct competitor of Loco called Pollo Tropical. It also owns Taco Cabana which has slightly different product offerings, but competes for the same target demographic as Loco.

The Pollo Tropical restaurant chain offers nearly identical product offerings as Loco. It also has a very established and concentrated presence in the eastern portion of the United States, where Loco is attempting to expand. The bulk of its stores are located in heavily Hispanic markets in Florida and Texas — again, the same markets that Loco is attempting to penetrate.

The stiff competition on the east coast becomes very apparent when we research previous efforts in which Loco has attempted to expand west. In 2009 Loco had 12 stores east of the Rockies in places like Atlanta, Georgia and Bergen, New Jersey. Within three years, all 12 of these stores had closed. Contrast this performance with Fiesta’s brands, which operate heavily in the southeast, including in Georgia. Fiesta has achieved NOPAT growth of 16% compounded annually since 2012 and has increased ROIC every year, growing from 8% in 2012 to 9% in 2014. The company continues to thrive long after Loco closed its locations in the region. However, as we noted in our last repot, some regions are just too hard to penetrate based on demographics — even Pollo Tropical was forced to close its restaurants in New Jersey in 2012.

With Loco’s struggles in expanding to the east, you may be wondering, “Can’t the company just expand in its existing markets?” Yes it can — and that’s partially what the company has been doing. However, the company must deal with rising labor costs and its inability to pass those costs on to consumers. The company employs a disproportionate amount of its workforce as hourly crewmembers. Of the 4687 employees the company has, 4545 of them are hourly, mostly concentrated in California. The minimum wage in California is set to increase from $9 to $10 beginning next year, and Loco’s labor expense is 25% of current sales.

Wage hikes have already affected labor costs, raising them 7% in 2014. Expect labor costs to continue to rise as further wage-hike initiatives take effect in Los Angeles and San Diego, the latter of which just passed a resolution raising the minimum wage to $11.50 by 2017, and the former of which is considering boosting its minimum wage to over $15. These initiatives will have a direct impact on the company’s margins going forward.

Investors appear to be ignoring the significant financial performance decline, and have instead elected to focus solely on growth. Although store growth and expansion is important, it should not be evaluated in isolation. The growth of Loco, although impressive, has not resulted in strong financial performance. In fact, as mentioned above, it has resulted in margin compression, NOPAT decline and lower ROIC. Investors however still have lofty expectation for the firm even though its prospects do not warrant this optimism. To justify its current price of $28/share, the company would need to grow NOPAT at 16% for the next 10 years. Given the margin, ROIC and NOPAT pressures mentioned above, this growth rate seems overly optimistic.

Disclosure: David Trainer, André Rouillard, Allen Jackson and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: Pamela Graham (Flickr)