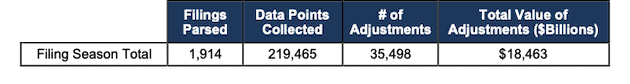

During the Real Earnings Season (February 19 – March 29[1]), we analyzed 1,914 10-K and 10-Q filings from which our Robo-Analyst[2] technology collected 219,465 data points. Our analyst team made 35,498 forensic accounting adjustments with a dollar value of $18 trillion.

Figure 1: Filing Season 2021 – The Power of the Robo-Analyst

Sources: New Constructs, LLC and company filings.

The adjustments were applied as follows:

- 13,255 income statement adjustments with a total value of $1.2 trillion

- 14,541 balance sheet adjustments with a total value of $7.5 trillion

- 7,702 valuation adjustments with a total value of $9.7 trillion

Below, we highlight some of the items investors relying on GAAP or other measures of profitability may have missed in the latest 10-Ks and 10-Qs. Adjusting for these unusual items reveals a much different picture of a firm’s profitability than reported or legacy data providers’ research.

Only our research enables investors to overcome flaws with legacy fundamental datasets and apply reliable fundamental data in their research. Core Earnings: New Data & Evidence, forthcoming in The Journal of Financial Economics, reveals the materiality of the problems with fundamental data provided by legacy firms like Bloomberg, Refinitiv, FactSet (FDS) and S&P Global (SPGI).

Gilead Sciences Hidden Non-Operating Items Mask Profit Growth in 2020

In its 2020 10-K, analyst Alex Sword found that Gilead Sciences recorded multiple unusual charges that were hidden in the footnotes of its annual filing. Detailed below, these hidden unusual items along with reported unusual items amount to over -$7.4 billion in Earnings Distortion and materially distort (by -6,049%) Gilead Sciences’ GAAP earnings:

Hidden Unusual Items, Net = -$1.4 billion:

- $881 million in “inventory step-up adjustments” – Page 74 2020 10-K

- $289 million in “accelerated share-based compensation expense” – Page 74 2020 10-K

- $144 million in “settlement of post-acquisition unvested employee stock options” – Page 73 2020 10-K

- $40 million write-down for “slow moving and excess raw material and work in process inventory” – Page 59 2020 10-K

- $39 million in “acquisition related expenses” – Page 74 2020 10-K

Reported Unusual Items on the income statement, Net = -$7.3 billion:

- $5.9 billion “acquired in process research and development expenses” – Page 56 2020 10-K

- $1.4 billion company defined “other expense” – Page 56 2020 10-K

In addition, we made a $1.2 billion adjustment for income tax distortion to normalize reported income taxes by removing the impact of unusual items.

After removing Earnings Distortion, which totals -$5.89/share, we find that Gilead Sciences 2020 Core Earnings of $5.99/share are significantly higher than GAAP net income of $0.10/share.

How We Treat Unusual Items: Non-operating items, such as restructuring or impairment charges are one of many reasons why GAAP net income doesn’t tell the whole story of a company’s profitability.

Unlike other research firms[3], we remove all unusual gains/losses, including restructuring charges, to calculate Gilead Sciences’ true recurring profits, i.e. Core Earnings.

Without careful footnotes research, investors would never know that these non-recurring items distort GAAP numbers to the point where traditional, unscrubbed earnings for U.S. stocks are off by an average of ~20%.

Other Material Earnings Distortions & Red Flags We Found

Below are a few other highly material items that we discovered while rigorously analyzing the footnotes and MD&A during the Real Earnings Season:

Avis Budget Group, Inc. (CAR) – Unusual COVID-Related Charge

- Analyst Robbie Woodward found on page 37 of Avis Budget Group’s 2020 10-K an unusual COVID-19 charge that impacts GAAP net income. Avis recorded a $10 million (1% of reported Loss before income taxes) write-down related to lost vehicles from a fire in an overflow parking lot. We remove this non-operating charge from our measure of net operating profit after tax (NOPAT) and Core Earnings. We also add-back the write-down to invested capital to hold companies accountable for all the capital invested in their businesses over their operating lives.

After removing all Earnings Distortion, which totals -$2.21/share (23% of GAAP net income), we find that Avis Budget Group’s 2020 Core Earnings of -$7.49/share are improved over GAAP net income of -$9.70/share.

S&T Bancorp, Inc. (STBA) – Non-operating loss due to fraud

- Analyst Devyn DeLange noticed on page 111 of S&T Bancorp’s 2020 10-K that the firm recognized a $59 million pre-tax loss due to fraud resulting from a check kiting scheme. We remove this non-operating charge from our measure of net operating profit after tax (NOPAT) and Core Earnings to calculate the true recurring profits of the business. After removing all Earnings Distortion (275% of GAAP EPS in 2020), S&T Bancorp’s 2020 Core Earnings of $2.01/share are greater than GAAP EPS of $0.54.

Surgalign Holdings Inc. (SRGA) – Acquisitions and Subsequent Write-Downs

- In the third week of the Real Earnings Season, while analyzing Surgalign Holdings’ 2020 10-K, analyst Alex Richmond found on page 82 of Surgalign’s 2020 10-K that the company acquired Holo Surgical for $95 million and immediately determined that the technology was not feasible and recorded a write-down of $94.5 million, or nearly the entire purchase price. This charge was reported on the income statement as an asset acquisition expense. We remove this non-operating charge from our measure of net operating profit after-tax (NOPAT) and Core Earnings to calculate the true recurring profits of the business. After removing all Earnings Distortion (40% of GAAP EPS in 2020), Surgalign’s 2020 Core Earnings of -$0.64/share are lower than GAAP EPS -$0.45.

This article originally published on March 31, 2021.

Disclosure: David Trainer, Robbie Woodward, Devyn DeLange, Alex Sword, Alex Richmond, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] We analyzed the majority of those filings (1,769) by March 17th.

[2] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[3] In Core Earnings: New Data & Evidence, professors from Harvard Business School & MIT Sloan expose the flaws in traditional, legacy fundamental data and research providers.