We published an update on this Long Idea on August 9, 2023. A copy of the associated report is here.

PACCAR Inc. (PCAR: $89/share) was added to our list of Long Ideas in July 2020. The stock has underperformed the market in 2021, but strong brand awareness, manufacturing expertise, and a large distribution network give it a leg up in an industry facing change. As we’ll show in this report, the stock could be worth $155/share.

We leverage more reliable fundamental data, as proven in The Journal of Financial Economics[1], and shown to provide a new source of alpha, with qualitative research to pick this Long Idea.

PACCAR Has 74%+ Upside Potential

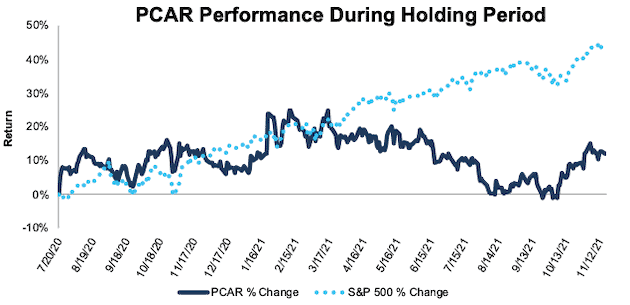

- PCAR has underperformed the market by 32% since we made it a Long Idea in July 2020, per Figure 1. Despite its underperformance, we believe the stock still presents favorable risk/reward as PACCAR can grow profits over the long term and is well-positioned for the move away from legacy combustion engines.

- At its current price, PACCAR has a price to economic book value (PEBV) ratio of 0.9, which means the market expects profits to permanently decline by 10%. Meanwhile, consensus estimates expect PACCAR’s earnings to improve YoY in 2021, 2022, and 2023.

- In a scenario where PACCAR is able to achieve modest margin improvement and meet consensus revenue growth expectations, the stock is worth $155/share today.

Figure 1: Long Idea Performance: From Date of Publication Through 11/16/2021

Sources: New Constructs, LLC and company filings

What’s Working for the Firm

Revenue Growth Continues. Despite delivering fewer trucks in 3Q21 compared to the year prior, PACCAR beat consensus estimates with revenue growth over 4% year-over-year (YoY). Like its competitors, PACCAR struggled with the global semiconductor shortage. Supplier constraints prevented PACCAR from delivering ~7,000 additional units in the third quarter. PACCAR is hurting on volume, but more than making up that pain in pricing strength and increased parts sales.

Truck Demand Is Strong. The outlook for the trucking industry remains very favorable. Rising freight rates and high fleet utilization rates drive demand for new heavy-duty trucks over the short term. The long-term demand for new trucks looks strong as well for the industry that transports 74% of all U.S. freight. Mordor Intelligence expects the heavy-duty truck market to grow 7% compounded annually from 2021 to 2026.

New Models Help Customers in Short Term. PACAAR’s Peterbilt, Kenworth, and DAF brands are positioned to meet rising demand for new trucks as rising fuel costs and driver shortages continue to drive freight rates higher. The latest DAF model is 10% more fuel efficient than the prior model, and the latest Peterbilt and Kenworth models are each 7% more fuel efficient than their predecessors.

Supply Constraints Drive Parts Sales. The supply chain disruption, and difficulties created in delivery new trucks means that operators must run current fleets longer and harder, causing more wear and tear on ever-aging fleets. As a manufacturer of aftermarket parts PACCAR’s parts segment is benefiting from this supply/demand imbalance. In 3Q21 the truck parts segment revenue grew 24% YoY and accounted for 26% of total revenue in the quarter, up from 16% in 3Q19.

Profitability Is Improving. PACCAR’s net operating profit after tax (NOPAT) margin improved from 7% in 2016 to 9% in 2019 before the pandemic. PACCAR’s TTM NOPAT margin bottomed at 6.5% in 4Q20 and has since risen to 7.5% over the TTM ended 3Q21. The company’s TTM invested capital turns improved from 1.8 to 2.0 over the same time.

Rising NOPAT margin and improved invested capital turns drive PACCAR’s TTM return on invested capital (ROIC) from 12% in 4Q20 to 15% in 3Q21. PACCAR’s TTM ROIC of 15% ranks higher than all but two (Toro Company [TTC] and Deere & Company [DE]) of the 23 Heavy Machinery and Vehicle companies under coverage.

Industry Change Presents Opportunity: With the rise of electric vehicles and automated driving, the trucking industry faces large technological changes. PACCAR has actively positioned itself to grow alongside these trends. The company already provides seven battery electric vehicle trucks across its Peterbilt, Kenworth, and DAF brands. PACCAR also delivered hydrogen fuel cell trucks for field trials with Shell, Toyota, and UPS in 3Q21. Most recently, PACCAR partnered with the U.S. Department of Energy (DOE) on its SuperTruck 3 program. The program is a DOE initiative to develop zero emissions medium- and heavy-duty trucks and PACCAR received a $33 million matching grant for its participation in the program.

Regardless of propulsion type, autonomous driving promises to transform the trucking industry over the long-term by solving its ongoing labor shortage, and PACCAR is investing in this technology to reap future rewards. The company is collaborating with autonomous driving company Aurora and FedEx (FDX) to test an autonomous hauling route between Houston and Dallas. As autonomous driving technology improves, gains widespread adoption, and creates lasting efficiencies, demand for newer model trucks will rise over the long-term.

Executives Are Paid to Create Shareholder Value: PACCAR links executive compensation, in the form of long-term cash awards, to return on capital, which is similar to our calculation of ROIC. There is a strong correlation between improving ROIC and increasing shareholder value, so PACCAR’s decision to use return on capital is a positive for investors, as it ensures executives’ interests are aligned with shareholders’ interests.

What’s Not Working for the Firm

Tesla Is a New Market Entrant: Whether justified or not, fears of Tesla disrupting the trucking industry have undoubtedly weighed on PACCAR’s stock price. While Tesla has made much of its semi, it doesn’t expect to make deliveries until 2022, which is now three years beyond its original planned delivery date. PACCAR, on the other hand, has a leg up on Tesla as it already delivered ten EV trucks in 3Q21. As noted above, PACCAR has an industry-leading number of seven battery-electric truck models.

Additionally, PACCAR’s deep industry ties, manufacturing expertise, and extensive network of over 2,200 dealers means that the company has the scale to meet the rising demand for EV trucks.

Market Share Loss Reveals Short-Term Problems: The company lost market share in the nine-months ended 2021. Its share of heavy-duty Class 8 trucks fell from 29.7% in the nine-months ended 2020 to 29.6% in the nine-months ended 2021 and its share of medium duty trucks fell from 23.3% to 20.6% over the same time.

However, PACCAR’s shares of the heavy-duty Class 8 and medium duty markets are both still above their levels in the first nine-months of 2019. Furthermore, with 10,000 nearly finished trucks on hand, the company’s market share could see a boost once it obtains the missing components and delivers the finished trucks. The firm does not account for revenue until the buyer has taken possession of the vehicle so these unfinished trucks could generate a surge in revenue and profits when the necessary components come through.

Rising Material Costs Could Compress Margins: Rising material costs and inflation throughout the automotive supply chain could slow the company’s NOPAT margin recovery. While PACCAR may be able to mitigate higher cost of materials through its new, higher-priced vehicles in the short-term, the company must prove it can pass increased costs through to customers over the long-term.

PCAR Is Priced for Profits to Remain 35% Below 2019 Levels

At its current price, PACCAR has a price to economic book value (PEBV) ratio of 0.9, which means the market expects profits to permanently decline by 10%. Meanwhile, consensus estimates expect PACCAR’s earnings to improve YoY in 2021, 2022, and 2023.

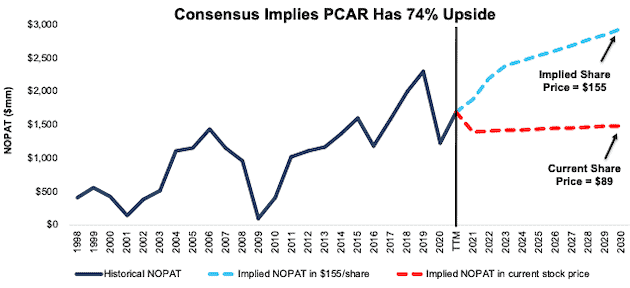

Below, we use our reverse discounted cash flow (DCF) model to analyze the expectations for future growth in cash flows baked into a couple of stock price scenarios for PACCAR.

In the first scenario, we assume PACCAR’s:

- NOPAT margin falls to 7% (equal to 10-year average vs. 8% TTM) from 2021-2030, and

- revenue grows by just 1% compounded annually from 2021-2030 (vs. consensus CAGR of 16% from 2021-2023)

In this scenario, PACCAR’s NOPAT grows by 2% compounded annually over the next decade and the stock is worth $89/share today – equal to the current price. See the math behind this reverse DCF scenario. For reference, PACCAR grew NOPAT by 11% compounded annually over the five-year pre-pandemic period from 2014-2019. In this scenario, PACCAR’s NOPAT in 2030 is $1.5 billion, or 35% below 2019 and 12% below TTM levels.

Shares Could Reach $155 or Higher. If we assume PACCAR’s:

- NOPAT margin improves to 8% (average from 2015-2019, compared to 7.5% TTM) from 2021-2030, and

- revenue grows at a 16% CAGR through 2023 (equal to 2021-2023 consensus CAGR), and

- revenue grows just 3% a year in each year thereafter through 2030, then

the stock is worth $155/share today – 74% above the current price. See the math behind this reverse DCF scenario. In this scenario, PACCAR grows its NOPAT by 9% compounded annually over the next 10 years, compared to a 12% CAGR over the prior 10 years (COVID-19 downturn included).

Should PACCAR grow revenue and profits more in line with historical levels, the stock has even more upside.

Figure 2: PACCAR’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article originally published on November 18, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.