This report analyzes[1] free cash flow (FCF), enterprise value and the FCF yield for the S&P 500 and each of its sectors.

For reference, we analyze the core earnings for the entire S&P 500 in “S&P 500 Peaks As Earnings Trough” and for each S&P 500 sector in “Only One S&P 500 Sector’s Core Earnings Improved This Year.” We analyze ROIC and its drivers in “No S&P 500 Sector Has a Rising ROIC Through First Half 2020.”

These reports leverage cutting-edge technology to provide clients with a cleaner and more comprehensive view of every measure of profits[2]. Investors armed with our research enjoy a differentiated and more informed view of the fundamentals and valuations of companies and sectors.

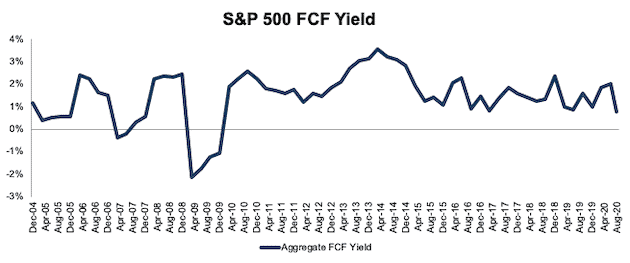

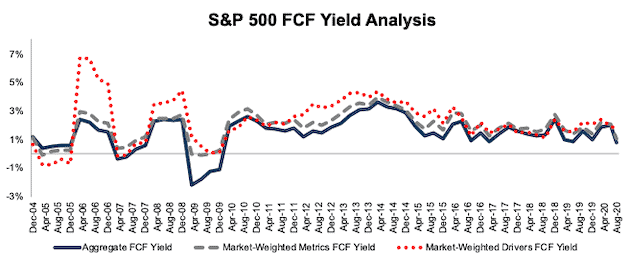

S&P 500 FCF Yield Falls to Lowest Level Since December 2009

FCF yield for the S&P 500 fell from 1.8% at the end of 2019 to 0.8% through 2Q20, or its lowest level since December 2009. See Figure 1. Only two S&P 500 sectors saw an increase in FCF yield since the end of 2019, as we’ll show below.

Figure 1: TTM FCF Yield for the S&P 500 From December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

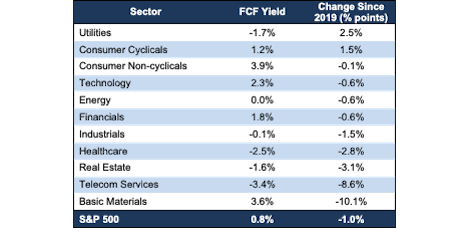

Ranking the S&P 500 Sectors by FCF Yield

Figure 2 ranks all 11 S&P 500 sectors by change in FCF yield from the end of 2019 to 8/11/20.

Figure 2: TTM FCF Yield as of 8/11/20 by Sector

Sources: New Constructs, LLC and company filings.

Investors are getting more FCF for their investment dollar in the Consumer Non-cyclicals sector than any other sector. On the flip side, the Telecom Services sector currently has the lowest FCF yield of all S&P 500 sectors.

Only the Consumer Cyclicals and Utilities sectors have seen an increase in FCF yield since the end of 2019.

Details on Each of the S&P 500 Sectors

Figures 3-13 show the FCF yield trends for every sector since 2004.

We present the components of FCF yield, FCF and enterprise value, for the S&P 500 and each S&P 500 sector in Appendix I.

Appendix II provides additional aggregated FCF yield analyses that adjust for company size/market cap.

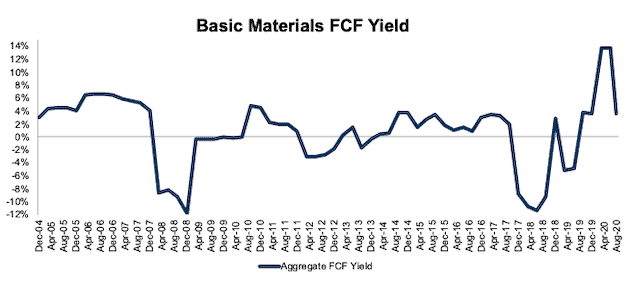

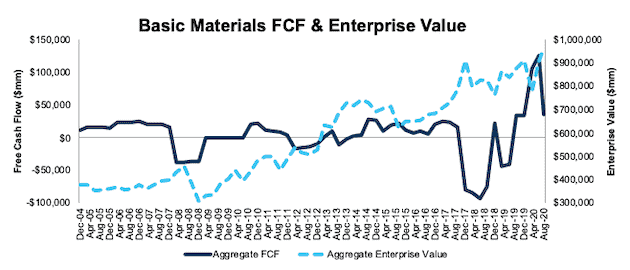

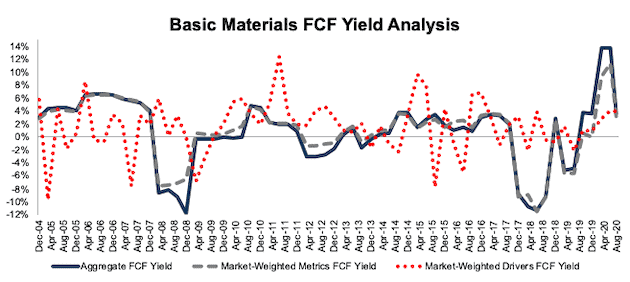

Basic Materials

Figure 3 shows the FCF yield for the Basic Materials sector increased significantly since mid-2018 even after the COVID-19 induced downturn in 2020. The Basic Materials sector FCF fell from $106 billion at the end of 2019 to $35 billion TTM while enterprise value increased from $778 billion to $966 billion over the same time.

Figure 3: Basic Materials FCF Yield: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

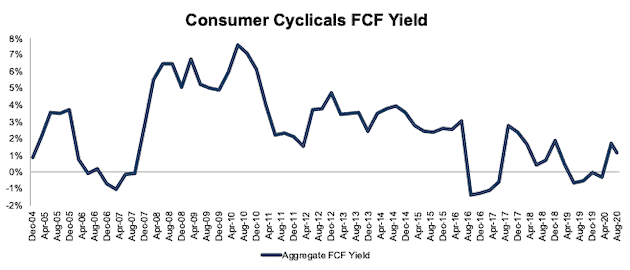

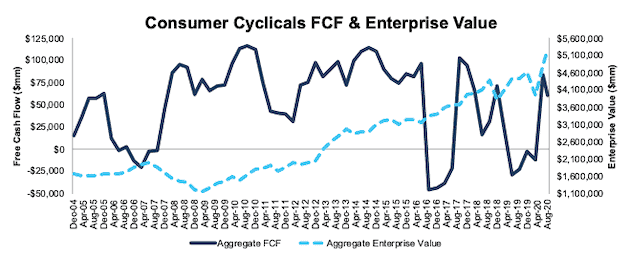

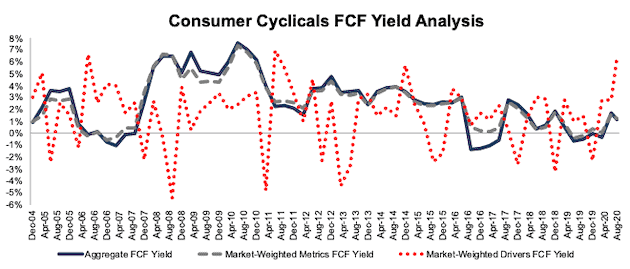

Consumer Cyclicals

Figure 4 shows the FCF yield for the Consumer Cyclicals sector has mostly been in a long-term decline since 2010. The Consumer Cyclicals sector FCF improved from -$12 billion at the end of 2019 to $61 billion TTM while enterprise value increased from $3.9 trillion to $5.3 trillion over the same time.

Figure 4: Consumer Cyclicals FCF Yield: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

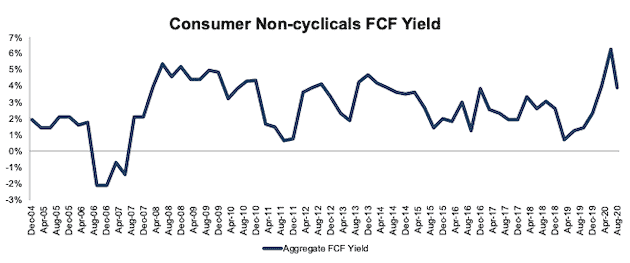

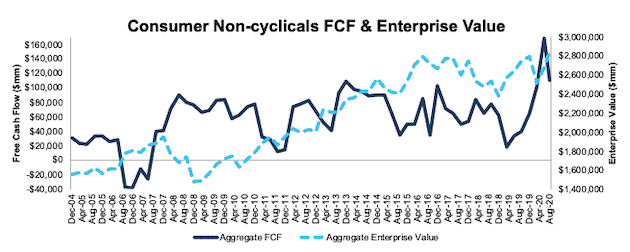

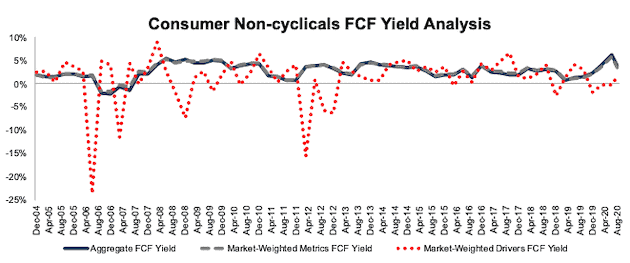

Consumer Non-cyclicals

Figure 5 shows FCF yield for the Consumer Non-cyclicals sector soared in 2019 before falling to 3.9% TTM. The Consumer Non-cyclicals sector FCF improved from $101 billion at the end of 2019 to $111 billion TTM while enterprise value increased from $2.5 trillion to $2.8 trillion over the same time.

Figure 5: Consumer Non-cyclicals FCF Yield: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

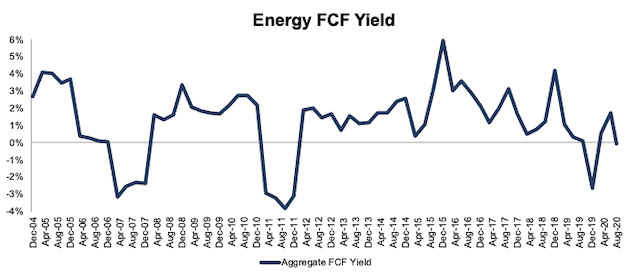

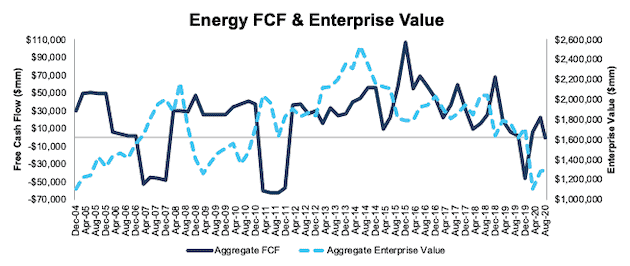

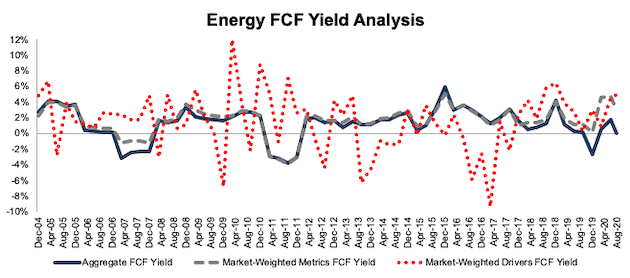

Energy

Figure 6 shows the volatile nature of the FCF yield for the Energy sector. The Energy sector’s FCF yield fell from 0.6% at the end of 2019 to -0.05% TTM. The Energy sector FCF declined from $6 billion in 2019 to -$623 million TTM and enterprise value increased from $1.1 trillion to $1.3 trillion over the same time.

Figure 6: Energy FCF Yield: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

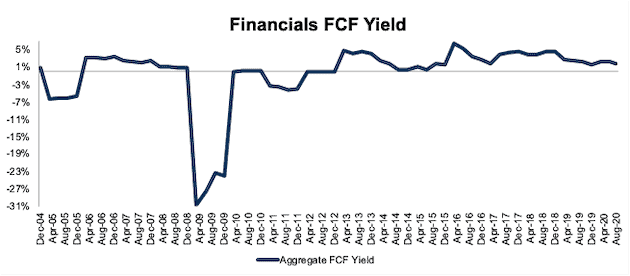

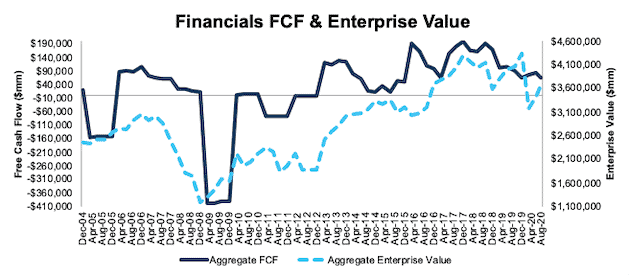

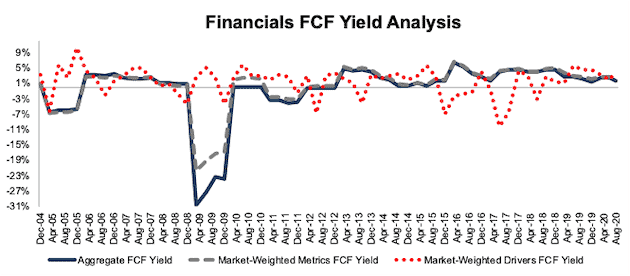

Financials

Figure 7 shows FCF yield for the Financials sector has been largely stable except during the Financial Crisis. The Financials sector FCF yield declined from 2.4% at the end of 2019 to 1.8% TTM. The sector’s FCF declined from $75 billion in 2019 to $64 billion TTM while enterprise value increased from $3.2 trillion to $3.7 trillion over the same time.

Figure 7: Financials FCF Yield: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

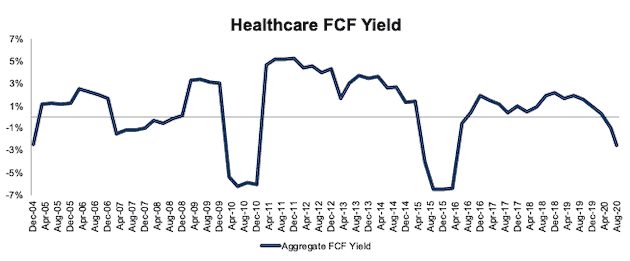

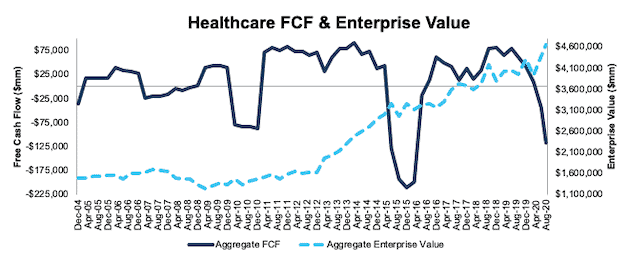

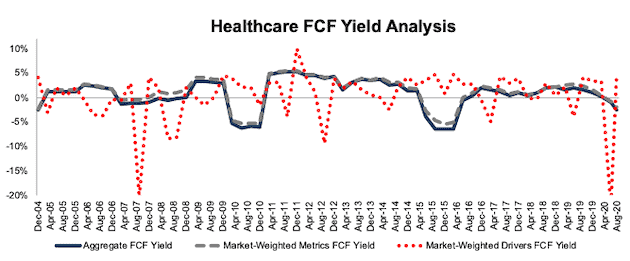

Healthcare

Figure 8 shows FCF yield for the Healthcare sector fell from 0.3% at the end of 2019 to -2.5% TTM. The decline in FCF yield stems from FCF falling from $10 billion in 2019 to -$117 billion TTM. Meanwhile, enterprise value increased from $3.9 trillion to $4.7 trillion over the same time.

Figure 8: Healthcare FCF Yield: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

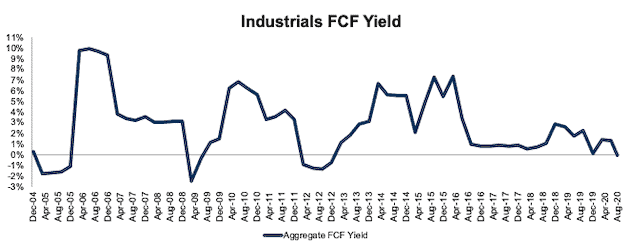

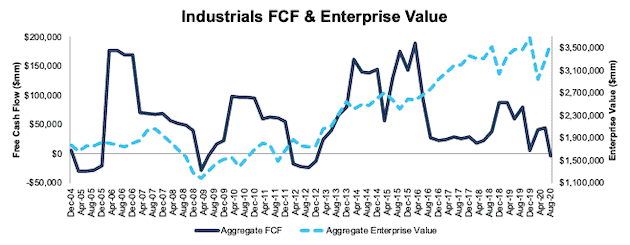

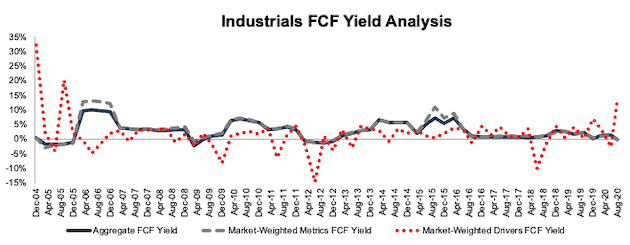

Industrials

Figure 9 shows FCF yield for the Industrials sector sits at -0.1%, which is the lowest level since 2012. The Industrials sector FCF fell from $41 billion in 2019 to -$3 billion TTM while enterprise value increased from $2.9 trillion to $3.6 trillion over the same time.

Figure 9: Industrials FCF Yield: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

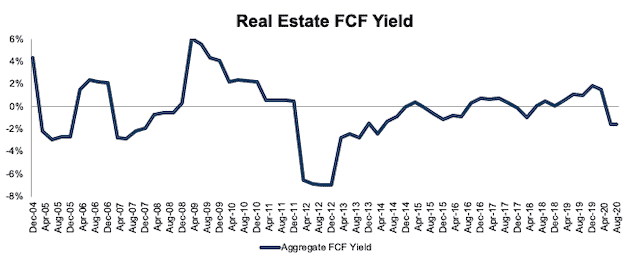

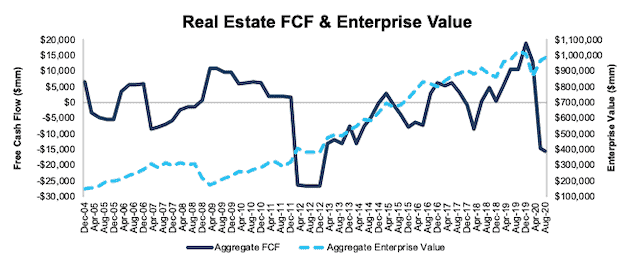

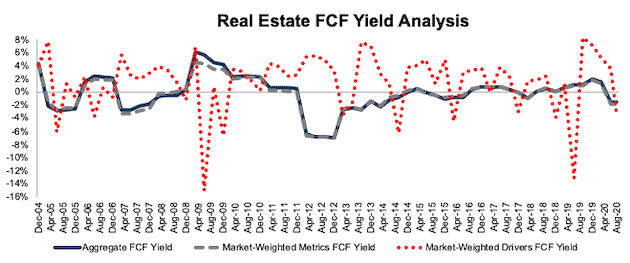

Real Estate

Figure 10 shows the FCF yield for the Real Estate sector rather steadily improved from 2012-2019 before falling in 2020. The Real Estate FCF yield fell from 1.5% in 2019 to -1.6% TTM. FCF for the sector fell from $13 billion in 2019 to -$15 billion TTM and enterprise value increased from $869 billion to $984 billion over the same time.

Figure 10: Real Estate FCF Yield: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

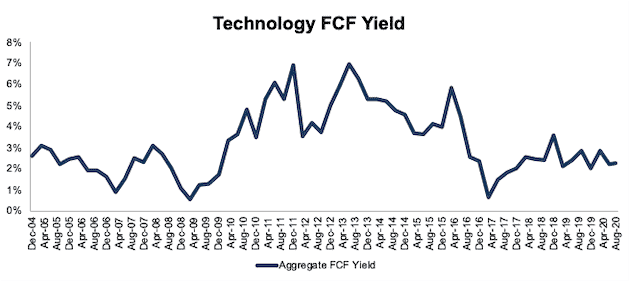

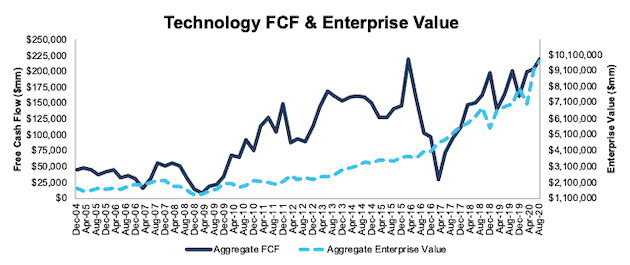

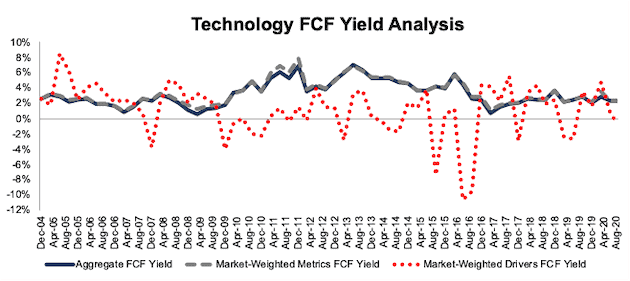

Technology

Figure 11 shows the FCF yield for the Technology sector remains well below prior highs in 2011, 2013, and 2015. The sector’s FCF yield fell slightly from 2.8% in 2019 to 2.3% TTM. The Technology sector FCF increased from $199 billion in 2019 to $220 billion TTM and enterprise value improved from $7.0 trillion to $9.7 trillion over the same time.

Figure 11: Technology FCF Yield: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

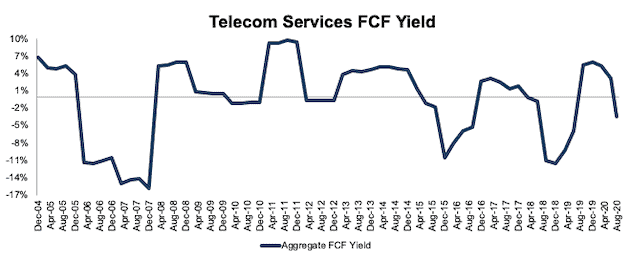

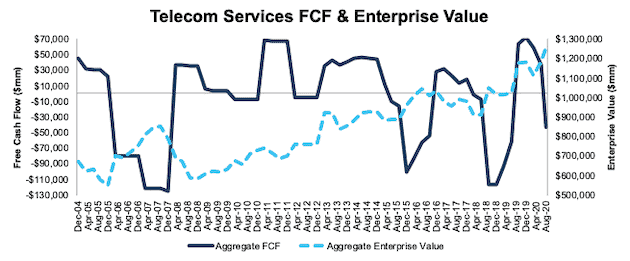

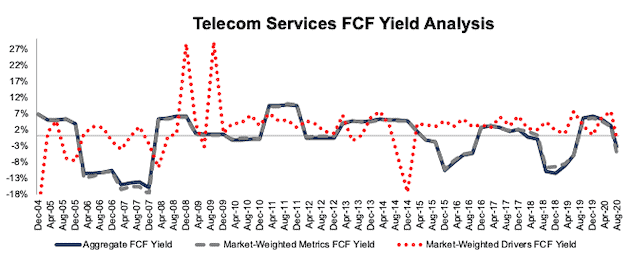

Telecom Services

Figure 12 shows the FCF yield for the Telecom Services sector has fallen from 5.3% in 2019 to -3.4% TTM. The sector’s FCF fell from $59 billion in 2019 to -$42 billion TTM and enterprise value increased from $1.1 trillion to $1.3 trillion over the same time.

Figure 12: Telecom Services FCF Yield: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

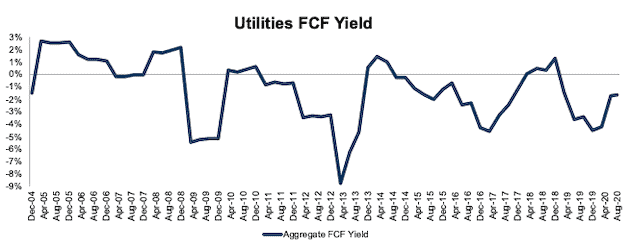

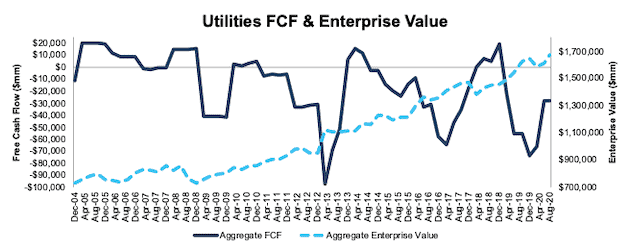

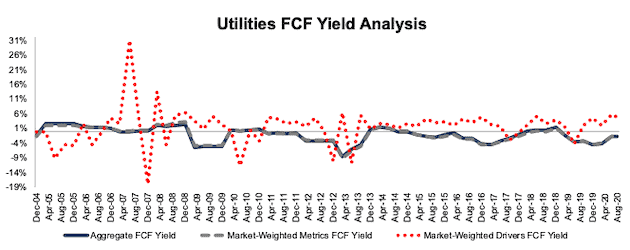

Utilities

Figure 13 shows the FCF yield for the Utilities sector is rather consistently negative and, despite improving since its 2019 lows, remains negative at -1.7%. The Utilities sector’s FCF improved from -$66 billion in 2019 to -$28 billion TTM while enterprise value increased from $1.6 trillion to $1.7 trillion over the same time.

Figure 13: Utilities FCF Yield: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

This article originally published on September 28, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

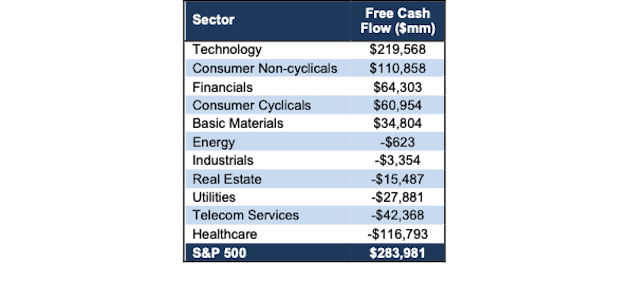

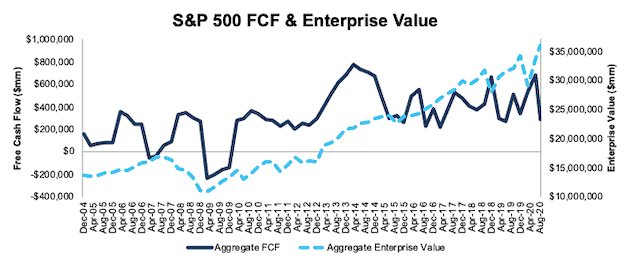

Appendix I: Free Cash Flow and Enterprise Value Since 2004

This appendix shows the two drivers used to calculate FCF yield – free cash flow and enterprise value – for the S&P 500 and each S&P 500 sector going back to December 2004. We sum the individual S&P 500 constituent values for free cash flow and enterprise value. We call this approach the “Aggregate” methodology, and it matches S&P Global’s (SPGI) methodology for these calculations. More methodology details in Appendix II.

Figure 15 ranks all 11 sectors by TTM free cash flow.

Figure 15: Free Cash Flow by Sector – TTM as of 8/11/20

Sources: New Constructs, LLC and company filings.

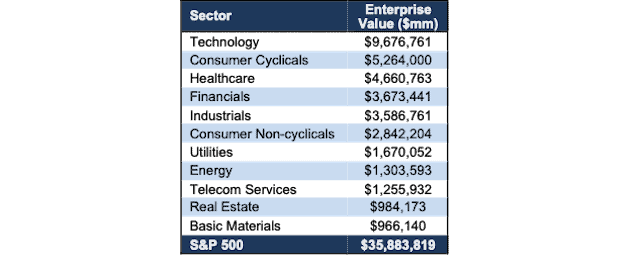

Figure 16 ranks all 11 sectors by TTM enterprise value.

Figure 16: Enterprise Value by Sector – TTM as of 8/11/20

Sources: New Constructs, LLC and company filings.

These two tables show the Technology sector not only generates the most free cash flow, but it also has the highest enterprise value of all sectors.

Figures 17-28 compare the FCF and enterprise value trends for the S&P 500 and every sector since 2004.

Figure 17: S&P 500 FCF & Enterprise Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 18: Basic Materials FCF & Enterprise Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 19: Consumer Cyclicals FCF & Enterprise Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 20: Consumer Non-Cyclicals FCF & Enterprise Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 21: Energy FCF & Enterprise Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 22: Financials FCF & Enterprise Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 23: Healthcare FCF & Enterprise Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 24: Industrials FCF & Enterprise Value: December 2004 – 8/11/20[3]

Sources: New Constructs, LLC and company filings.

Figure 25: Real Estate FCF & Enterprise Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 26: Technology FCF & Enterprise Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 27: Telecom Services FCF & Enterprise Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 28: Utilities FCF & Enterprise Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Appendix II: Analyzing FCF Yield with Different Weighting Methodologies

We derive the metrics above by summing the individual S&P 500 constituent values for free cash flow and enterprise value to calculate FCF yield. We call this approach the “Aggregate” methodology.

The Aggregate methodology provides a straightforward look at the entire sector, regardless of market cap or index weighting, and matches how S&P Global (SPGI) calculates metrics for the S&P 500.

For additional perspective, we compare the Aggregate method for free cash flow with two other market-weighted methodologies. These market-weighted methodologies add more value for ratios that do not include market values, e.g. ROIC and its drivers, but we include them here, nonetheless, for comparison:

- Market-weighted metrics – calculated by market-cap-weighting the FCF yield for the individual companies in each sector in each period. Details:

- Company weight equals the company’s market cap divided by the market cap of the S&P 500 or its sector

- We multiply each company’s FCF yield by its weight

- S&P 500/Sector FCF yield equals the sum of the weighted FCF yields for all the companies in the S&P 500/sector

- Market-weighted drivers – calculated by market-cap-weighting the FCF and enterprise value for the individual companies in each sector in each period. Details:

- Company weight equals the company’s market cap divided by the market cap of the S&P 500 or its sector

- We multiply each company’s free cash flow and enterprise value by its weight

- We sum the weighted FCF and weighted enterprise value for each company

- S&P 500/Sector FCF yield equals weighted FCF divided by weighted enterprise value

Each methodology has its pros and cons, as outlined below:

Aggregate method

Pros:

- A straightforward look at the entire sector, regardless of company size or weighting in any indices.

- Matches how S&P Global calculates metrics for the S&P 500.

Cons:

- Vulnerable to impact of companies entering/exiting the group of companies, which could unduly affect aggregate values. Also susceptible to outliers in any one period.

Market-weighted metrics method

Pros:

- Accounts for a firm’s market cap relative to the S&P 500/sector and weights its metrics accordingly.

Cons:

- Vulnerable to outlier results from a single company disproportionately impacting the overall FCF yield.

Market-weighted drivers method

Pros:

- Accounts for a firm’s market cap relative to the S&P 500/sector and weights its free cash flow and enterprise value accordingly.

- Mitigates the disproportionate impact of outlier results from one company on the overall results.

Cons:

- More volatile as it adds emphasis to large changes in FCF and enterprise value for heavily weighted companies.

Figures 29-40 compare these three methods for calculating S&P 500 and sector FCF yields.

Figure 29: S&P 500 FCF Yield Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 30: Basic Materials FCF Yield Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 31: Consumer Cyclicals FCF Yield Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 32: Consumer Non-cyclicals FCF Yield Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 33: Energy FCF Yield Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 34: Financials FCF Yield Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 35: Healthcare FCF Yield Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 36: Industrials FCF Yield Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 37: Real Estate FCF Yield Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 38: Technology FCF Yield Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 39: Telecom Services FCF Yield Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 40: Utilities FCF Yield Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

[1] We calculate these metrics based on S&P Global’s (SPGI) methodology, which sums the individual S&P 500 constituent values for free cash flow and enterprise value before using them to calculate the metrics. We call this the “Aggregate” methodology. Get more details in Appendix II and III.

[2] For 3rd-party reviews on the benefits of adjusted Core Earnings, historically and prospectively, across all stocks, click here and here.

[3] The Industrials sector free cash flow is heavily influenced by General Electric (GE) in 2005. In 2005 GE restated ~$135 billion of Investment Securities to Assets of Discontinued Operations. This reclassification caused a large year-over-year change in invested capital from 2004-2005, and therefore a large increase in FCF. However, due to poor disclosures in the filings, we’re unable to specifically track the changes beyond reclassifying an operating asset as a non-operating asset.