The U.S. and China took a meaningful step toward cooling trade tensions this week and announced a framework agreement in London that outlines potential mutual tariff reductions. Under the deal, China would ease rare-earth export restrictions, while the U.S. would loosen chip control measures. While structurally finalized, the framework still awaits formal approval from both presidents. However, it provides a brief moment of clarity in what has been an otherwise uncertain tariff standoff.

Markets were little changed on the news though, as investor sentiment remains cautious. Uncertainty around the broader economic outlook continues to fuel market volatility.

Navigating the noise requires a disciplined approach. By digging into the underlying financials, investors can uncover the true value of a stock – an essential skill for those looking to weather volatility, particularly with dividend-paying investments.

A particularly risky class of dividend stocks is those that offer decent yields and are backed by fundamentally sound businesses, yet trade at valuations that far exceed their true economic worth. These “dividend-trap” stocks carry extra risk with limited upside potential.

Our latest Long Idea is the opposite of a trap. This stock is positioned to benefit from the aging housing market and growth in its core markets. The company has strong fundamentals, returns ample capital to shareholders, and best of all, its stock is cheap.

We originally made Owens Corning (OC: $140/share) a Long Idea in January 2022 and most recently reiterated our thesis in July 2024. The stock has outperformed the S&P 500 since our original report by 22%, rising 62% compared to the S&P 500 rising 40%. Despite outperforming since our original report, our thesis on this stock remains intact and additional upside potential remains.

OC offers favorable Risk/Reward based on the company’s:

- position to benefit from an aging housing market,

- growing core markets,

- strong fundamentals and shareholder return,

- quality executive compensation, and

- cheap stock valuation.

What’s Working

Benefit From the Aging Housing Market

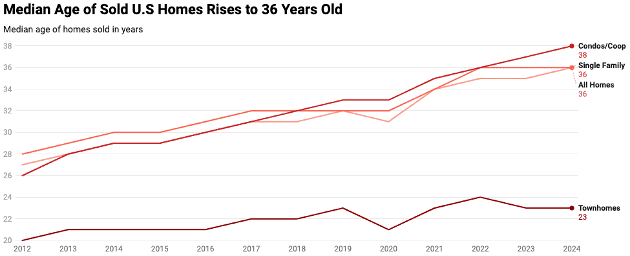

One of the most significant industry tailwinds driving Owens Corning is the aging housing stock in the U.S. The typical home hit a record age of 36 years old in 2024, which is up from 27 years in 2012. This increase in age of homes is due to the lack of new supply (fewer homes being built) and the better affordability of older homes.

The U.S. has been building fewer homes since the construction industry took a hit in 2008. Only 9% of U.S. homes were built in the 2010’s, which represents the lowest share of any one decade since the 1940’s.

While Owens Corning can sell products for new construction, the rising age of homes creates even more demand for Owens Corning’s remodel and repair products, such as roofing, insulation, and doors.

Figure 1: Median Age of U.S. Homes: 2012 – 2024

Sources: Redfin and New Constructs

Growing Markets Provides Long-Term Opportunities

On February 14, 2025, Owens Corning signed a definitive agreement to sell its glass reinforcement business (previously reported in the Composites segment) to Praana Group. The sale completes the company’s strategic review of the business and focuses resources into the residential and commercial building products markets in North America and Europe.

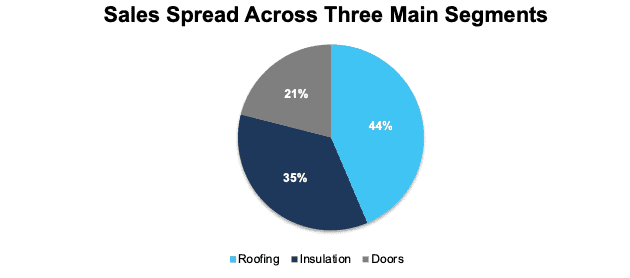

As part of this strategic review, Owens Corning now has three reportable business segments: Roofing, Insulation, and Doors. Best of all, each of these three markets are forecasted to grow through the next decade:

- The global roofing market is forecast to grow 4.3% compounded annually through 2034.

- The global insulation market is forecast to grow 7.7% compounded annually through 2034.

- The global doors market is forecast to grow 4.6% compounded annually through 2034.

As an existing industry leader, Owens Corning is in a great position to take advantage of the growth in each of the segments. Importantly, Owens Corning is not dependent on any one of these markets, as its business is well diversified across the three.

1Q25, Owens Corning generated 44% of its revenue from its roofing business, 35% from its insulation business, and 21% from its doors business. See Figure 2.

Figure 2: Owens Corning’s Revenue by Segment in 1Q25

Sources: New Constructs, LLC and company filings

Strong Fundamentals Across Decades

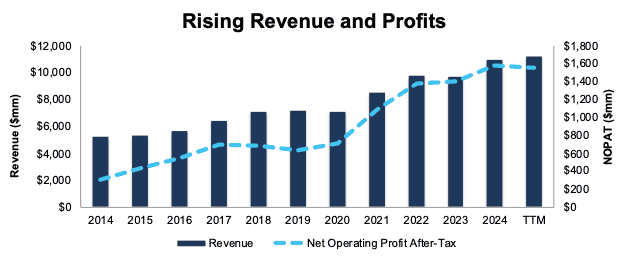

Owens Corning has grown revenue and net operating profit after-tax (NOPAT) by 8% and 17% compounded annually since 2014, respectively. See Figure 3.

The company improved its NOPAT margin from 6% in 2014 to 14% in the TTM while invested capital turns remained the same at 0.8 over the same time. Rising NOPAT margins drive return on invested capital (ROIC) from 4% in 2014 to 11% in the TTM.

Additionally, the company’s Core Earnings grew 20% compounded annually from $209 million in 2014 to $1.4 billion in the TTM.

Figure 3: Owens Corning’s Revenue and NOPAT Since 2014

Sources: New Constructs, LLC and company filings

Executives Are Aligned with Shareholders

Corporate governance plays a crucial role in finding good stocks because it shows us how well executives’ interests are aligned with shareholders’ interests. By evaluating executive compensation plans, we can identify companies with quality corporate governance, such as Owens Corning.

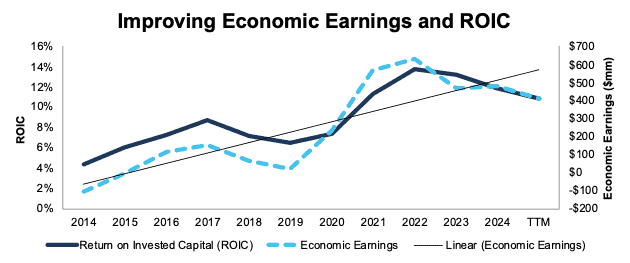

Owens Corning’s executive compensation plan aligns the interests of executives and shareholders by tying one third of its long-term performance share awards to return on capital (ROC), a variation of ROIC.

As we mentioned in past reports, there is a strong correlation between improving ROIC and increasing shareholder value. Even though the company’s executive compensation plans could be improved by increasing the weighting of ROC or using ROIC as the main performance goal, the company’s inclusion of ROC, as a performance goal has helped create shareholder value by driving higher ROIC and economic earnings.

Per Figure 4, Owens Corning’s ROIC has increased from 4% in 2014 to 11% in the TTM. Economic earnings rose from -$104 million to $409 million over the same time.

Figure 4: Owens Corning’s ROIC and Economic Earnings Since 2014

Sources: New Constructs, LLC and company filings

Attractive Dividend and Repurchase Yield of 5%+

Since 2019, Owens Corning has paid $898 million (8% of market cap) in cumulative dividends and has increased its quarterly dividend from $0.22/share in 1Q19 to $0.69/share in 1Q25. The company’s current dividend, when annualized, provides a 1.9% yield.

Owens Corning also returns capital to shareholders through share repurchases. From 2019 through 1Q25, the company repurchased $2.8 billion (24% of market cap) worth of shares.

In May 2025, Owens Corning’s board of directors authorized a new 12 million share repurchase program. With the 5.7 million shares remaining from the previous authorization, the company currently is authorized to repurchase a total of 17.7 million shares.

Should the company repurchase shares at its TTM rate, it would repurchase $414 million of shares over the next year, which equals 3.5% of the current market cap. When combined, the dividend and share repurchase yield could reach 5.4%.

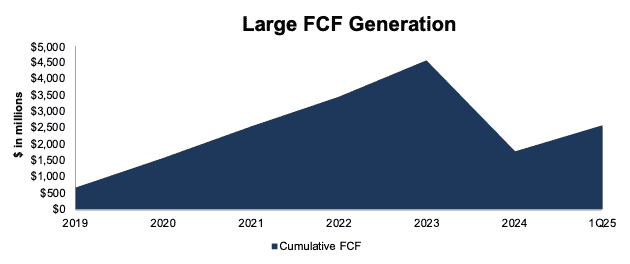

Strong Cash Flow Generation

We believe Owens Corning will be able to afford to pay its dividends and repurchase shares because of its large free cash flow (FCF). From 2019 through 2023, Owens corning generated $4.6 billion in FCF, which equals 25% of the company’s enterprise value.

The company completed its acquisition of Masonite in 2Q24, which led to FCF of -$3.7 billion in the quarter.

In each quarter since the acquisition (3Q24, 4Q24, and 1Q25), Owens Corning’s free cash flow has been positive and rising quarter-over-quarter (QoQ). Given the company’s consistent margins and steadily growing markets, we would expect free cash flow generation to continue rising in the future.

Overall, even with the acquisition, Owens Corning generated a cumulative $2.6 billion in FCF from 2019-1Q25. See Figure 5.

Figure 5: Owens Corning’s Cumulative FCF: 2019 – TTM

Sources: New Constructs, LLC and company filings

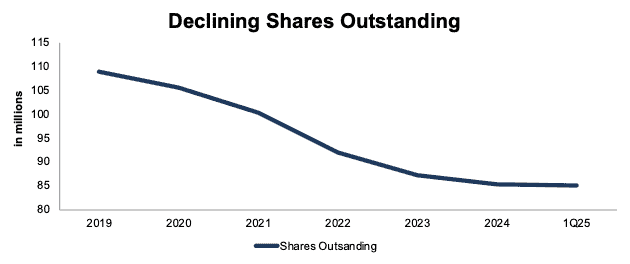

Owens Corning’s past repurchases have also meaningfully reduced its shares outstanding from 109 million in 2019 to 85 million at the end of 1Q25. See Figure 6.

Figure 6: Owens Corning’s Shares Outstanding: 2019 – 1Q25

Sources: New Constructs, LLC and company filings

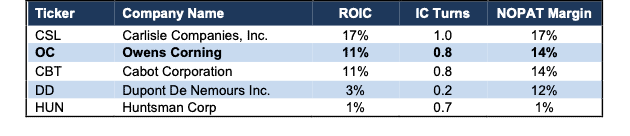

Great Margins

Owens Corning is vertically integrated across each of its business segments. This integration creates efficiencies that manifest in consistently high profit margins.

Per Figure 7, Owens Corning has the second highest NOPAT margin among its competitors, which include Carlisle Companies (CSL), Cabot Corp (CBT), Dupont De Nemours (DD), and Hunstman Corp (HUN).

Figure 7: Owens Corning’ Profitability Vs. Peers: TTM

Sources: New Constructs, LLC and company filings

What’s Not Working

Slowdown in Home Sales

The current economic uncertainty is hurting consumer spending, especially when it comes to home purchases. According to Redfin, homes are selling at the slowest pace in the last six years, as demand is waning and homes remain expensive in the eyes of potential homebuyers. Additionally, $698 billion worth of homes are currently for sale, which represents an all-time high and an increase of 20% from a year ago.

A freezing of the home sale market could lead to (1) consumers slowing remodel plans, as sellers don’t want to spend on a home they plan to sell or (2) cautious owners who want to delay a remodel until the economy improves.

Management alluded to the cautious mindset of consumers in the company’s 1Q25 earnings call when they noted residential remodel activity is expected to remain weaker through the first half of the year.

However, while activity might be weaker in the short-term, the good news is the leading indicator of remodeling activity (LIRA) projects that remodeling activity in the U.S. will increase by 2.5% year-over-year in the first quarter of 2026.

Additionally, even if remodeling activity remains sluggish longer than forecasted, any potential downside to Owens Corning’s business is already priced into its current stock price, as we’ll show below.

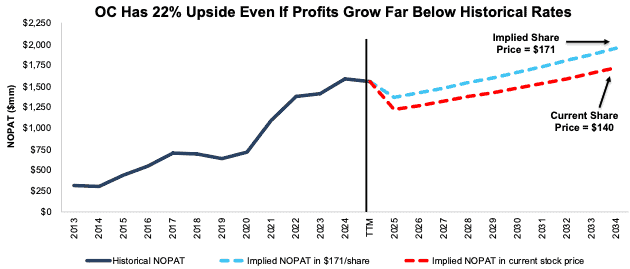

Current Price Implies Permanent Profit Decline

At its current price of $140/share, OC has a price-to-economic book value (PEBV) ratio of 0.9. This ratio means the market expects the company’s profits to permanently decline 10% from TTM levels. For context, Owens Corning has grown NOPAT by 19% compounded annually over the last five years and 17% compounded annually over the last decade.

Below, we use our reverse discounted cash flow (DCF) model to analyze expectations for different stock price scenarios for OC.

In the first scenario, we quantify the expectations baked into the current price. If we assume:

- NOPAT margin immediately falls to 11% (below five-year average of 13% and TTM NOPAT margin of 14%) through 2034, and

- revenue grows 4% a year through 2034 (compared to 9% CAGR over the last five years and 8% CAGR over the last decade) then

the stock would be worth $140/share today – nearly equal to the current stock price. In this scenario, revenue grows at the low end of the company’s end-market forecast growth. Additionally, Owens Corning’s NOPAT would grow just 1% compounded annually from 2025 – 2034, which is far below the company’s historical NOPAT growth rates. Contact us for the math behind this reverse DCF scenario.

Shares Could Go 20%+ Higher Even If Profits Grow Far Slower Than Historical Rates

If we instead assume:

- NOPAT margin falls to 12% (still below five-year average of 13% and TTM NOPAT margin of 14%) through 2034,

- revenue grows 4% a year through 2034 (compared to 9% CAGR over the last five years and 8% CAGR over the last decade) then

the stock would be worth $171/share today – a 22% upside to the current price. In this scenario, Owens Corning’s NOPAT would grow just 2% compounded annually through fiscal 2034, which would still be well below the company’s historical growth rates dating back to 2007. Contact us for the math behind this reverse DCF scenario. Should NOPAT grow closer to historical rates, the upside is even larger.

Figure 8 compares Owens Corning’s historical NOPAT to the NOPAT implied in each of the above scenarios.

Figure 8: Owens Corning’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article was originally published on June 11, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.