We closed this position on May 17, 2022. A copy of the associated Position Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

The Large Cap Value style ranked third in our 4Q17 Sector Rankings for ETFs and Mutual Funds and gets our Neutral rating. This investment style has the most fund offerings (966) and the second most assets ($1.3 trillion) of any investment style or sector. It is also home to the majority of funds that carry the “equity income” label. By our estimation, roughly 370 (39%) of Large Cap Value funds are dividend focused.

With the S&P 500 dividend yield comparable to that of a ten-year treasury bond, investors are substituting dividend paying stocks into portfolios where bonds once resided. Investors who make such a move without performing the proper diligence on the funds’ holdings are taking unnecessary risks. There are wide holdings variations among Large Cap Value style funds, which will meaningfully affect future performance.

Our Robo-Analyst technology helps investors by doing diligence on the holdings of all Large Cap Value ETFs and mutual funds[1], which hold anywhere from 14 to 874 stocks. During this process, we uncovered a particularly unattractive mutual fund that backward-looking fund research is likely to overlook.

The BlackRock High Equity Income Fund is in the Danger Zone this week. Morningstar gives all five share classes of this fund a three star or higher rating, including four star ratings for BMCIX and BMCSX. Under our rating system, BMCIX and BMCSX earn an Unattractive rating, while the remaining three (BMECX, BRMBX, BMEAX) earn Very Unattractive ratings.

Don’t Blindly Buy “Dividend” or “Equity Income” Labels

The BlackRock High Equity Income Fund stands out as a fund to avoid within the Large Cap Value style, especially for investors lured by the “equity income” label. The five share classes of this fund rank between 942nd and 963rd among 966 Large Cap Value style funds. This fund is poised to remain near the bottom of the rankings based on its poor holdings quality and high total annual costs (TAC). The Large Cap Value style offers 423 Attractive-or-better alternatives, including a number of superior equity income funds with Attractive-or-better ratings (see our ETF and Mutual Fund Screener).

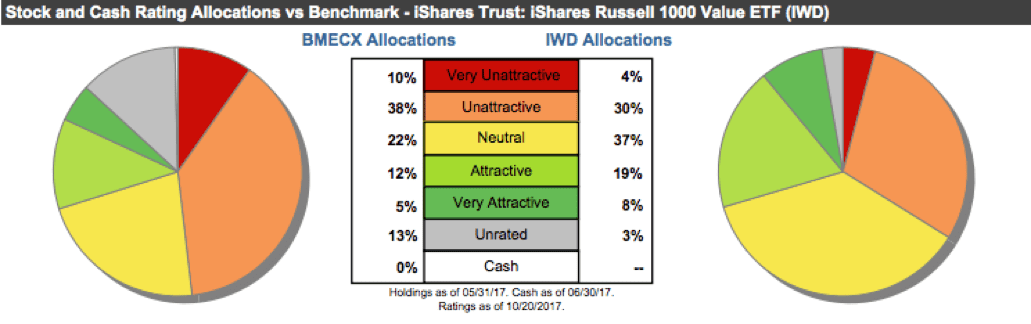

Figure 1: Comparing Quality of Holdings for BMECX to iShares Russell 1000 Value ETF(IWD)

Sources: New Constructs, LLC and company filings

Holdings Analysis Reveals Poor Capital Allocation

Per Figure 1, BMECX allocates just 17% of its assets to Attractive-or-better rated stocks compared to 27% for the benchmark iShares Russell 1000 Value ETF (IWD). Further, BMECX’s exposure to Unattractive-or-worse rated stocks is much higher at 48% compared to 34% for IWD. As a result, the allocation to Neutral-rated stocks is much lower for BMECX (22% of assets) than for IWD (37% of assets).

Given the high allocation to Unattractive-or-worse rated stocks, and under-allocation to Neutral-or-better rated stocks relative to the benchmark, BMECX appears poorly positioned to capture upside potential while minimizing downside risk. Compared to the average ETF or mutual fund, BMECX has a much lower chance of generating the outperformance required to justify its management fees above the cost of the IWD benchmark.

The only justification for a mutual fund to charge higher fees than its passively managed ETF benchmark is “active” management that leads to out-performance. A fund is most likely to outperform if it has higher quality holdings than its benchmark. To make a determination on holdings quality, we leverage our Robo-Analyst technology to drill down to the individual stocks of every fund. This capability empowers our unique holdings-based ETF and mutual fund rating methodology.

Missing the “Value” in Large Cap Value

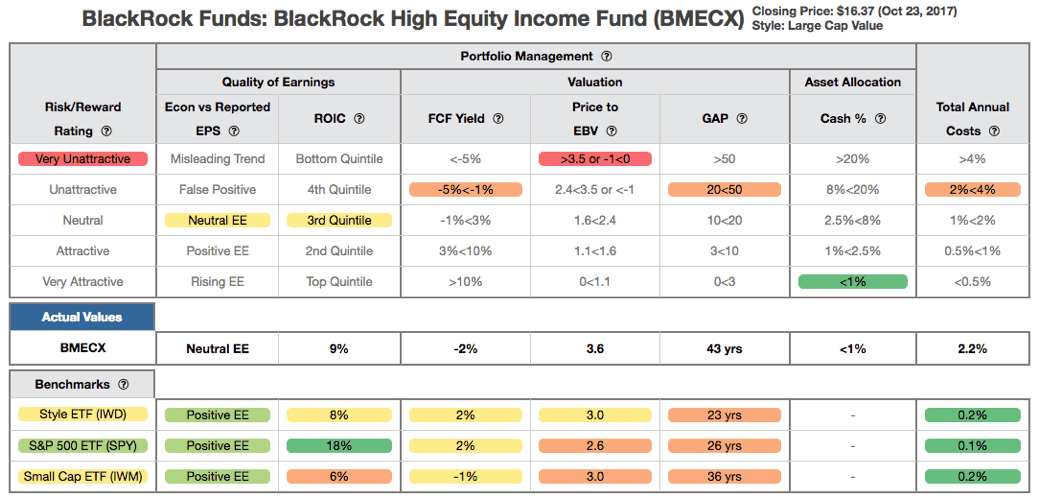

True value investing still works despite the proliferation of passive strategies. However, Black Rock High Equity Income Fund does a poor job allocating capital to higher-quality companies with lower relative valuations, which is the cornerstone of the value investing discipline. Figure 2 contains our detailed fund rating for BMECX, which includes each of the criteria we use to rate all funds under coverage. The Portfolio Management criteria are the same as our Stock Rating Methodology. This analysis reveals that BMECX does not provide the exposure to “value” stocks that one might assume based on its label.

Figure 2: BlackRock High Equity Income Fund (BMECX) Rating Breakdown

BMECX holdings earn a 9% return on invested capital (ROIC). While this is slightly above IWD holdings (8% ROIC), it is well below many equity income ETFs, which, by definition, focus on highly profitable cash cows. Schwab US Dividend Equity ETF (SCHD) holdings, the best-ranked equity income ETF in the Large Cap Value style, earn a 13% ROIC. BMECX holdings also rate lower on their economic earnings (Neutral EE) than the IWD benchmark (Positive EE) and have negative free cash flow (-1%) vs. positive free cash flow (+2%) for IWD.

Another major disadvantage of BMECX’s holdings is their high valuation. The market-implied future profit expectations baked into the prices of BMECX’s holdings are meaningfully higher than expectations for IWD or SCHD holdings. The price to economic book value (PEBV) ratio for BMECX holdings is 3.6 compared to 2.3 for IWD holdings and 1.4 for SCHD holdings. This ratio means the market expects the after-tax profits (NOPAT) of BMECX holdings to grow to 360% of current levels.

Our discounted cash flow analysis of fund holdings reveals a market implied growth appreciation period (GAP) of 42 years for BMECX holdings compared to 23 years for IWD holdings and 18 years for SCHD holdings. In other words, BMECX holdings have to grow economic earnings for roughly two decades longer than companies held by IWD or SCHD to justify their current stock prices.

High Costs Represent a Performance Headwind

With total annual costs (TAC) of 2.24%, BMECX expenses are higher than 76% of Large Cap Value style ETFs and mutual funds under coverage. Coupled with its low-quality holdings, above average fees make BMECX less attractive. For comparison, the average TAC of all Large Cap Value style ETFs and mutual funds is 1.65%, the weighted average is 1.20%, and the ETF benchmark (IWD) has a TAC of 0.22%.

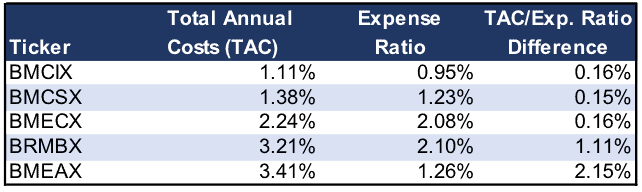

Figure 3: BlackRock High Equity Income Fund (BMECX) Cost Summary

Sources: New Constructs, LLC and company filings.

To justify its higher fees, the BlackRock High Equity Income Fund (BMECX) must outperform its benchmark (IWD) by the following over three years:

- BMCIX must outperform by an average of 0.9% annually.

- BMCSX must outperform by an average of 1.2% annually.

- BMECX must outperform by an average of 2.0% annually.

- BRMBX must outperform by an average of 3.0% annually.

- BMEAX must outperform by an average of 3.2% annually.

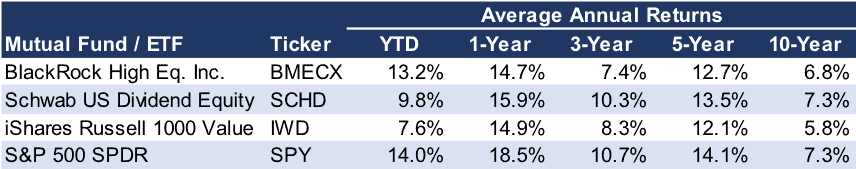

Performance Doesn’t Justify Active Management Fees

Investors should recognize that past performance is no guarantee of future results, especially short-term performance. While BMECX has done well vs. the IWD benchmark on a year-to-date basis, its longer-term track record is less impressive. BMECX has been within +/-1% of the IWD benchmark over all periods one year and longer. The outperformance required by BMECX management fees over a three-year period (as outlined above) is a hurdle that has not been surpassed over the past three years. BMECX has also underperformed the S&P 500 and the Schwab US Dividend Equity ETF (SCHD) over the past one, three and five years.

Figure 4: BlackRock High Equity Income Fund (BMECX) Performance

Sources: New Constructs, LLC and company filings.

Beware Misleading Fund Labels

The proliferation of ETFs with similar labels yet vastly different holdings shows how truly passive investing is made difficult, if not impossible, by the sheer number of options and the wide variations among them. An analysis of the BlackRock High Equity Income Fund (BMECX) compared to the Schwab US Dividend Equity ETF (SCHD) provides a good case study.

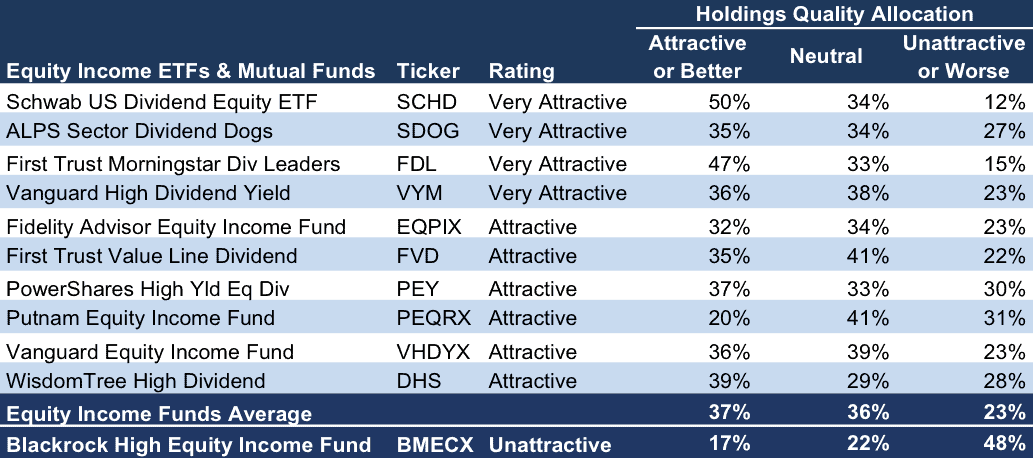

While the two ETFs appear similar on the surface, BMECX earns an Unattractive fund rating compared to a Very Attractive rating for SCHD. Per Figure 5, BMECX has a much lower allocation to Attractive-or-better rated stocks and a much higher allocation to Unattractive-or-worse rated stocks. Relative to SCHD holdings, the ROIC for BMECX holdings is lower (9% vs. 13%), while the PEBV ratio is much higher (3.6 vs. 1.4) and the GAP is much longer (42 years vs 18 years).

Figure 5: Ranking the Quality of Equity Income Fund Holdings

The Importance of Holdings Based Fund Analysis

Investors have many options when looking to invest in Large Cap Value, or equity income, ETFs and mutual funds. “Passive” investors analyzing funds solely on fund labels or fees are exposing themselves to unnecessary risks. Diligence at the holdings level is required to make informed decisions and to fulfill the fiduciary duty of care.

Each quarter we rank the 11 sectors in our Sector Ratings for ETF & Mutual Funds and the 12 investment styles in our Style Ratings For ETFs & Mutual Funds report. This analysis allows investors to avoid funds that traditional fund research may overlook, such as the BlackRock High Equity Income Fund (BMECX).

[1] Ernst & Young’s recent white paper “Getting ROIC Right” proves the superiority of our holdings research and analytics.

This article originally published on October 24, 2017.

Disclosure: David Trainer, Kenneth James, and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.