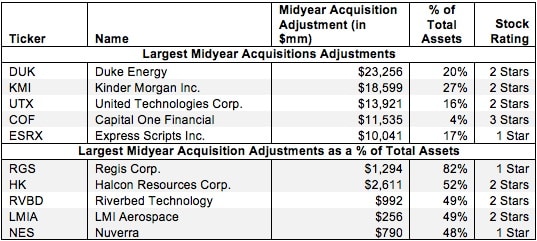

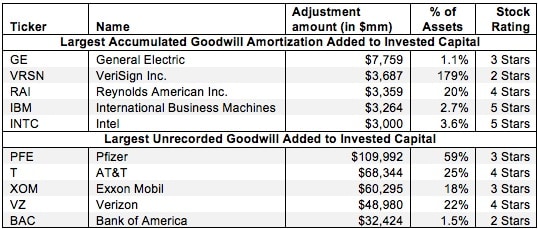

Midyear Acquisitions – Invested Capital Adjustment

When a company makes an acquisition, the entire purchase price is added to the company’s balance sheet in the year of the acquisition along with any assumed debts or other long-term liabilities. However, the only income added to the income statement is that which occurs after the acquisition closes. In other words, the balance sheet is charged with the full price of the acquisition while the income statement only gets partially impacted.

David Trainer, Founder & CEO