Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

Management teams often have a “growth at any cost” mindset. For executives, there are a lot of benefits, both real and perceived, to achieving greater scale. Your peers are larger businesses, which drives your compensation higher. You get the pride and status of running a larger company. Lastly, you can easily sell future cost efficiencies through economies of scale to investors.

Executives (and investors) tend to focus on these benefits while ignoring the risks of this “growth at any cost” strategy. Such is the case with this week’s pick. It has made overpriced acquisitions to grow the topline while destroying shareholder value. These acquisitions have also exposed the company to significant data security and privacy risks. These issues, combined with an overvalued stock, make IQVIA Holdings (IQV: $103/share) this week’s Danger Zone pick.

Large Acquisition Destroys Shareholder Value

IQVIA was formerly Quintiles, a contract research organization that served pharmaceutical and biotech companies looking to outsource their clinical trials process. Quintiles was a highly profitable company and earned a return on invested capital (ROIC) above 25% for four straight years, from 2012-2015.

In 2016, Quintiles acquired IMS Health, which provides data and technology to the healthcare industry, and changed its name to IQVIA. The company, which had just $1.9 billion in invested capital prior to the acquisition, paid over $17.5 billion when factoring in the debt it took on as part of the deal.

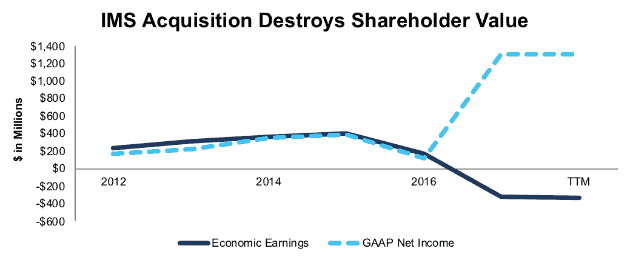

The acquisition has helped IQVIA grow after-tax operating profit (NOPAT) by 39%, from $495 million in 2015 to $687 million over the past twelve months. However, that profit growth pales in comparison to the nearly 1000% increase in invested capital over the same time. Put simply, IQVIA paid $17.5 billion for $192 million in annual NOPAT, and ROIC of just 1%. As Figure 1 shows, IQVIA’s economic earnings – the real cash flows of the business, which account for the cost of capital – have been negative since the acquisition.

Figure 1: IQVIA’s Misleading Earnings

Sources: New Constructs, LLC and company filings

IQVIA’s GAAP net income is especially misleading due to the impact of a $977 million (10% of revenue) one-time gain on the write-down of deferred tax liabilities as a result of the new tax law. Even without the tax impact, though, IQVIA has reported misleading growth. Adjusted EBITDA, the company’s preferred non-GAAP metric, has increased over 140% since 2015.

Executive Compensation Incentivizes Value Destruction

The combination of Adjusted EBITDA rising while economic earnings decline is bad for shareholders, but it has been great for executives. IQVIA’s executive compensation misaligns executives’ interests with shareholders’ interests by tying bonuses to metrics that are not related to long-term value creation. The four performance metrics IQVIA uses are:

- Revenue

- Adjusted EBITDA

- Adjusted EPS

- Total Shareholder Return (TSR)

The first three metrics can be boosted through accounting gimmicks and overpriced acquisitions. IQVIA continues to boost its growth numbers through acquisitions, spending $923 million on a variety of smaller deals in 2017. In addition, sophisticated investors have been pushing companies away from TSR in recent years due to the short-term mindset it creates, as we wrote about in “ISS Buying EVA Dimensions Signals More Focus on Fundamental Research.”

Both the Adjusted EPS and TSR targets likely influenced management’s decision to buy back $2.6 billion (13% of market) worth of stock in 2017 despite producing negative $566 million in free cash flow and having over $11 billion in total debt. Management is spending money the company doesn’t have to buyback overpriced shares to ensure they hit their bonus targets.

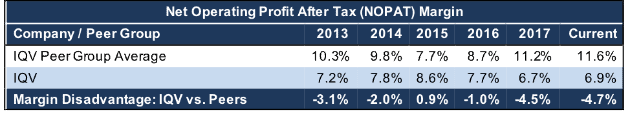

NOPAT Margins Reveal Competitive Disadvantage

In a challenging business environment, operational efficiency and cost control become increasingly important. If IQVIA faces the headwinds of shrinking R&D budgets or competition from new data-sharing technologies (as we discuss below), its ability to cut costs and compete on price will be a key differentiator. As Figure 2 shows, the company’s inferior margins compared to its listed peer group in its proxy statement should make competing on price difficult.

Figure 2: IQV’s Margin Disadvantage Vs. Peers

Sources: New Constructs, LLC and company filings

IQV’s current margin disadvantage versus the listed peers in its proxy statement is the worst it’s been in the past five years.

Any peer group comparison is difficult for a company like IQVIA, which combines two distinct business lines, but individual company comparisons don’t look any better. Contract Research Organization and former Long Idea ICON, Plc (ICLR) has earned double digit NOPAT margins in each of the past four years, better than IQVIA did even before its merger.

Privacy Concerns Put Commercial Segment at Risk

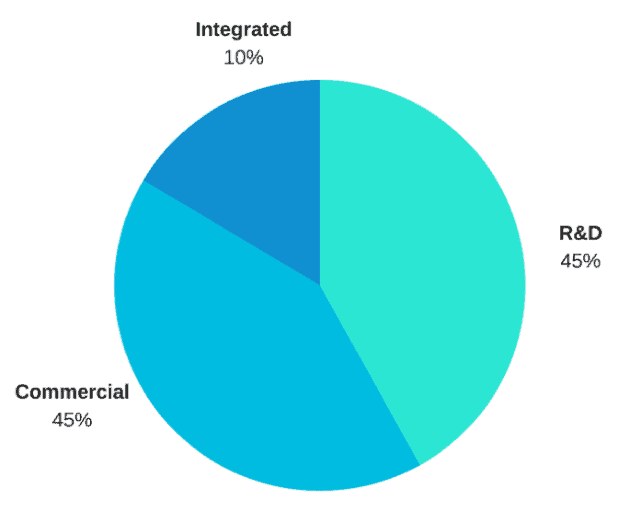

After the completion of the IMS Health acquisition, IQVIA now earns roughly the same amount of revenue from its Commercial Solutions segment – selling data and software services to healthcare companies – and its Research and Development segment – which assists pharmaceutical and biotech companies with the clinical trial process. Per Figure 3, both segments contribute ~45% of revenue, with the smaller Integrated Engagement Services segment contributing the remaining 10%.

Figure 3: IQV Revenue by Business Segment

Sources: New Constructs, LLC and company filings

As discussed above, the legacy R&D business is highly profitable. While there are some potential headwinds in that industry (which we’ll address later on), it should provide relatively stable cash flows in the future. However, the R&D business cannot support the stock’s valuation on its own, and IQVIA needs the commercial segment to fulfill the growth expectations implied by its stock price.

As we saw with Facebook’s (FB) Cambridge Analytica scandal, business models that rely on selling people’s data – especially when people don’t realize their data is being sold – carry significant risk. If people were surprised to learn that data from their social media accounts had been shared, how much more shocked would they be to discover that their private medical data is being stored and sold by a company most have never heard of?

IQVIA’s 10-K boasts of its database of 530 million patient records, including “sales, prescription and promotional data, medical claims, electronic medical records and social media.” This data is supposed to be anonymized, but numerous studies have shown that with just a few pieces of information, “anonymized” data can be attributed to a specific individual roughly 90% of the time. The fact that IQVIA’s records include social media information makes it especially hard to believe that data would remain anonymous if malevolent actors got their hands on it.

If even a portion of IQVIA’s patient data were made public, either through a direct hack of the company or misuse of the data by one of its customers, the public outcry could be immense. Patients would call for new laws and regulations to crack down on data sharing, and many healthcare providers would likely stop selling patient data to IQVIA. Congress would probably react at least as strongly as it did with the Facebook/Cambridge scandal.

Pharmacies such as CVS Health (CVS) sell prescription data for about a penny per script according to the book Our Bodies, Our Data by Adam Tanner of the Harvard Institute for Quantitative Social Science. That revenue amounts to a rounding error for a company like CVS, so it would almost certainly sacrifice the revenue from selling prescription data in the face of a public outcry. If pharmacies stop selling data, then IQVIA’s commercial division suddenly has much less product to sell.

To be clear, we have no information that suggests IQVIA is especially at risk of a data breach, but if there’s one thing the past few years have made clear, it’s that no one’s data is ever truly safe. If IQVIA joins Facebook, Yahoo, and Equifax (EFX) on the list of prominent data breaches, the consequences for investors could be severe.

Blockchain Could Disrupt Commercial Segment

Even if IQVIA doesn’t suffer a data breach, its business could face disruption from new technologies. Currently, sharing medical records is a cumbersome process that relies on outdated technologies such as fax machines and CD-ROMs. As a result, IQVIA has captured value as a middleman by centralizing the data collection and distribution process.

Modernization of the healthcare IT infrastructure could reduce IQVIA’s value as a middleman. Researchers and drug marketers could access the data directly from hospitals and pharmacies, allowing patients to have more understanding and control over how their data is being used and cutting IQVIA out of the process.

The blockchain offers one potential way to make health records more easily accessible while maintaining patient anonymity and data security. A “healthcare blockchain” would streamline the sharing of medical records while giving patients more control over their information. Companies and researchers, like Hashed Health, are already competing to design such a system. If healthcare providers buy-in, it could create a network that has no need for IQVIA as an intermediary

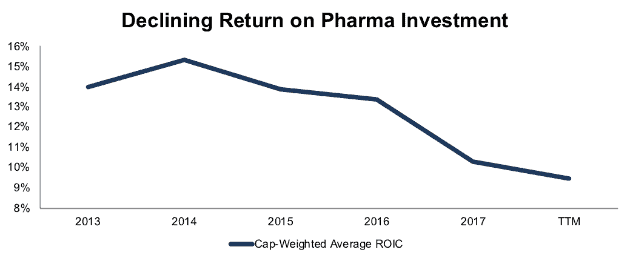

Declining Pharma ROIC Could Hurt R&D Spending

While the R&D segment is significantly less risky than the data business, it may face headwinds in the near future due to the declining ROIC of the pharmaceutical and biotech industries. As Figure 4 shows, the weighted average ROIC for the 168 pharmaceutical and biotech companies we cover has declined from 15% in 2014 to 9% over the past twelve months.

Figure 4: Weighted Average ROIC for Pharmaceutical and Biotech Companies

Sources: New Constructs, LLC and company filings

Other sources tell a similar story. Deloitte’s annual survey of pharma R&D investment found that the return on R&D spending for the world’s 12 biggest drug companies fell from 10.1% in 2010 to just 3.2% in 2017. It also found that the average cost of bringing a drug to market rose to $2 billion, up from $1.2 billion in 2010.

Drug companies have continued to increase their R&D spending in the face of these declining returns, but one has to question how long this trend can continue. Especially as the cost of capital continues to rise, it wouldn’t be surprising to see drug companies pull back on their unprofitable R&D spending.

Instead, we might see companies plow their capital into acquisitions. Many pharmaceutical executives are projecting a new wave of consolidation now that the uncertainty surrounding tax reform is out of the way. Takeda’s $62 billion deal for Shire (SHPG) could be just the first domino to fall.

Pharmaceutical consolidation increases the company’s customer concentration, reducing its leverage in negotiations. It also reduces the number of companies competing to develop the same drug, which means less opportunity for IQVIA to sell its R&D services.

The potential dual headwinds of declining R&D and increasing pharmaceutical consolidation could significantly hurt IQVIA’s organic growth over the next few years.

IQV Is Overvalued Compared to Peers

Since the conclusion of the IMS Health acquisition on October 6, 2016, IQV is up 27%, outperforming the Health Care SPDR ETF (XLV), which is up 14%. This increase in the stock price, combined with the company’s value destruction, has left shares significantly overvalued.

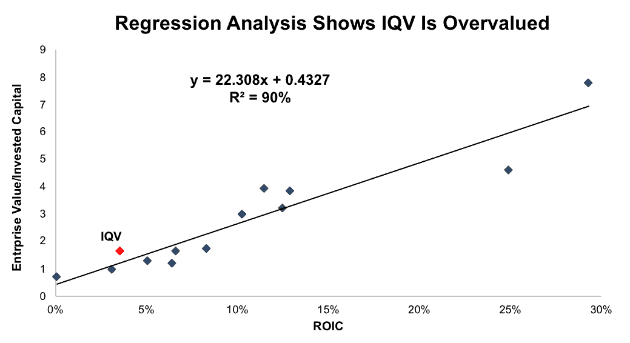

Figure 5 displays a regression analysis of IQV and its listed peer group – excluding outlier salesforce.com (CRM) – on the basis of ROIC versus enterprise value per invested capital (a cleaner version of price to book). It shows that differences in ROIC explain 90% of the difference in valuation for these companies.[1]

Figure 5: ROIC Explains 90% of Valuation for IQVIA’s Peers

Sources: New Constructs, LLC and company filings

If IQV traded in line with its peers, the stock would be worth just $60, 42% below the current stock price. At its current valuation, the market expects IQV’s ROIC to increase from 3.5% to 5.4%. We think it is far more likely that IQV’s ROIC will continue to decline rather than meet the market’s expectations.

Valuation Implies Unrealistic Growth

Our dynamic discounted cash flow (DCF) model tells a similar story to the regression analysis above. At IQV’s current valuation of $103/share, the market’s expectations for profit growth are simply unrealistic. To justify that valuation, IQV would need to immediately raise its NOPAT margin to 11% (compared to 7% TTM) and grow NOPAT by 15% compounded annually for the next seven years. See the math behind that dynamic DCF scenario here.

If the company can just get to 9% NOPAT margins (regaining the pre-tax margins of 12% it earned in 2015-2016 and benefiting from a reduction of its tax rate to 24%) and grow revenue by 5% compounded annually over the next 10 years, the stock is worth $70/share today, 32% below the current stock price. See the math behind that dynamic DCF scenario here.

The downside for IQV could be even greater than 32%. As noted above, the company has an organic growth rate of 4%, below the 5% annual growth in this scenario. Even in a relatively optimistic scenario, IQV poses significant risk to investors.

Current Growth Is Not Sustainable and Poses Risks to Valuation

Bulls will point to IQVIA’s rapid revenue growth and increase in backlog as evidence of the company’s ability to combat the challenges above and reach the growth expectations implied by its valuation. Revenue grew 9% year over year in Q1 2018, and the company’s R&D backlog increased 57%.

On the revenue front, that growth is largely the product of acquisitions and favorable currency swings. CEO Ari Bousbib told analysts on the company’s earnings call that constant currency organic revenue growth for both segments was just 4%.

Similarly, the backlog growth was primarily the function of accounting rule changes. Starting in Q1, the company began including “pass-through” revenues in its backlog calculation. Pass-through revenues are just reimbursements for costs the company has incurred, and it doesn’t earn any margin on them. We don’t have a good point of comparison year over year, but we know that IQVIA’s contracted backlog increased just 2% over the past quarter.

In addition, the level of backlog does not necessarily guarantee future revenues, as clients have the ability to cancel contracts or decrease the scope of work without having to pay the full contracted payment. In the event that IQVIA faces the headwinds listed above, one could imagine clients significantly decreasing their contracted payments.

Should IQV’s growth fail to meet the lofty expectations, or should demand for IQVIA’s services decline, shares could see an immediate and significant drop.

Acquisition Appears Unlikely

IQV’s size and competitive position make it an unlikely acquisition candidate. It’s the second largest contract research organization in the world, behind only Laboratory Corporation of America (LH). IQV has a larger market cap than LH ($21 billion vs. $18 billion), and its $11 billion in debt would make any acquisition deal difficult.

It’s also hard to imagine any large pharmaceutical or healthcare service company doing a strategic acquisition. IQV’s business requires it to be a neutral third party between all the major players in the healthcare industry. If it was acquired by one of those large companies, none of the competitors would outsource their research or sell their data to IQV.

The lack of potential acquirers eliminates the Stupid Money Risk. If IQV’s business struggles, there’s nobody on the horizon to bail out shareholders.

Insider Selling Raises Red Flags and Short Interest Is Minimal

Over the past year, 15.3 million insider shares have been sold and 10 thousand insider shares have been purchased for a net effect of 15.3 million insider shares sold. These sales represent 7% of shares outstanding. Roughly 13 million of the sales come from the Canadian Pension Plan Investment Board and TPG Group Holdings – both of whom hold seats on IQV’s board – selling shares in a secondary offering last November.

Short interest is currently 5.4 million shares, which equates to 3% of shares outstanding and 3 days to cover. The lack of heavy short interest reduces the risk of a “short squeeze” driving up the stock price in the near term.

Critical Details Found in Financial Filings By Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[2] findings in IQVIA’s 2017 10-K:

Income Statement: we made $2 billion of adjustments, with a net effect of removing $655 million in non-operating income (7% of revenue). We removed $1.3 billion in non-operating income and $657 million in non-operating expenses. You can see all the adjustments made to IQV’s income statement here.

Balance Sheet: we made $2.5 billion of adjustments to calculate invested capital with a net increase of $200 million. One of the largest adjustments was $629 million related to off-balance sheet debt. This adjustment represented 1% of reported net assets. You can see all the adjustments made to IQV’s balance sheet here.

Valuation: we made $13.1 billion of adjustments with a net effect of decreasing shareholder value by $12 billion. Apart from $11.1 billion in total debt, the most notable adjustment to shareholder value was $715 million in deferred tax liabilities. This adjustment represents 3% of IQV’s market cap.

Unattractive Funds That Hold IQV

The following funds receive our Unattractive-or-worse rating and allocate significantly to IQVIA

- AB Concentrated Growth Fund (WPASX) – 4.4% allocation and Unattractive rating

- Lateef Focused Growth Fund (LIMAX) – 4.1% allocation and Very Unattractive rating

- Steinberg Select Fund (STMIX) – 3.7% allocation and Very Unattractive rating

- JAG Large Cap Growth Fund (JLGAX) – 3.3% allocation and Very Unattractive rating

- First Trust NYSE Arca Biotechnology Index Fund (FBT) – 3.2% allocation and Unattractive rating

This article originally published on May 14, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Ernst & Young’s recent white paper “Getting ROIC Right” demonstrates the link between an accurate calculation of ROIC and shareholder value.

[2] Harvard Business School features the powerful impact of our research automation technology in the case study New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

Click here to download a PDF of this report.

Photo Credit: Trey Ratcliff (Flickr)