We closed this position on November 3, 2021. A copy of the associated Position Update report is here.

This week’s Long Idea focuses on a company that improves the lives of owners, vets and pets. Pet owners pay less for care, vets can focus more on pet care, and pets get a higher quality of life.

This company is uniquely well-positioned to capitalize on the growth in this overlooked, niche market. However, the expectations baked into the stock price remain too low.PetMed Express (PETS: $41/share) is this week’s Long Idea.

PETS’ Impressive Profit Growth & Earnings Quality

In fiscal 2018, we made less than $4 million in adjustments (only 1% of revenue) on the income statement. For reference, 96% of companies under coverage require more adjustments as a percent of revenue to calculate after-tax operating profit (NOPAT). High earnings quality is not a new trend either, as the company has grown NOPAT and GAAP net income by 6.6% and 6.4% compounded annually over the past decade.

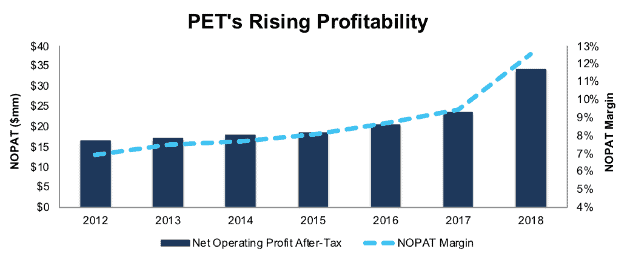

With so few adjustments, PETS reported earnings accurately reflect the firm’s profitability, and whether you’re analyzing GAAP net income or NOPAT, that profitability is strong. Since fiscal 2012, PETS has grown revenue by 2% compounded annually. Over the same time, it has grown NOPAT by 13% compounded annually, per Figure 1. Longer-term, PETS has grown NOPAT by 26% compounded annually since fiscal 2002.

Figure 1: PET’s NOPAT & Margin Since 2012

Sources: New Constructs, LLC and company filings

NOPAT growth has been fueled by rising NOPAT margins, which have improved from 7% in fiscal 2012 to 13% in fiscal 2018. As the same time, average invested capital turns, a measure of balance sheet efficiency, have increased from 5.1 in fiscal 2014 to 5.4 in fiscal 2018. Rising margins and efficient capital use have improved PETS’ return on invested capital (ROIC) from 43% in fiscal 2012 to 67% in fiscal 2018. The firm has also generated positive free cash flow in 13 of the past 14 years and a cumulative $105 million (13% of market cap) in FCF over the past five years.

E-commerce Creates High Return Business

Much like Amazon threatened traditional brick-and-mortar retailers, PetMed Express, which operates through phone, direct mail, and online channels, poses a challenge to traditional suppliers of prescriptions and over the counter (OTC) medicines for pets. PetMed Express does not need a physical store, unlike veterinarian offices and traditional pharmacies, and can fulfill orders in a more cost-effective manner.

This business model has not only proven attractive to consumers, as 2.3 million customers have purchased from PetMed Express within the last two years, but also to investors concerned about capital returns. The asset light model has allowed PETS to earn significant returns on the capital invested into its business.

PetMed Express’ ROIC, or the NOPAT generated per dollar of invested capital, has averaged 48% over the past five years and is currently 67%. Companies that PetMed Express identifies as peers, such as NutriSystem (NTRI), 1-800 Flowers (FLWS), and Overstock.com (OSTK), earn ROICs of 51%, 6%, and -30% respectively.

Falling Customer Acquisition Costs Create More Efficient Business

PetMed Express has effectively managed costs to build its leading position as an online pet pharmacy. Over the past decade, general & administrative costs have grown just 2% compounded annually and advertising costs have actually fallen 3% compounded annually. Meanwhile, revenue has grown 4% compounded annually over the same time.

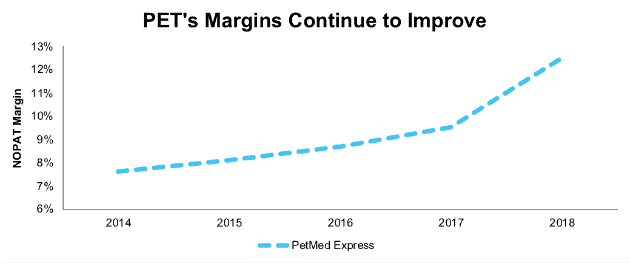

More recently, PETS has been able to reign in its customer acquisition costs, which despite rising to $37/new customer in fiscal 2018, remain well below $48/new customer cost of fiscal 2015. Overall, PETS’ NOPAT margin has improved in each of the past five years, from 8% in fiscal 2014, to 13% in fiscal 2018, per Figure 2.

Figure 2: PET’s Margin Improvement Over Last Five Years

Sources: New Constructs, LLC and company filings.

PetMed Express Benefits All in an Inefficient Industry

When you go to the doctor, you don’t expect them to maintain the inventory needed to sell you your prescription medication right there in the office. The doctor leaves that part of the process to dedicated pharmacies that have built up core competencies in distribution and fulfillment. However, most people still accept that veterinary offices will double as makeshift storefronts for selling prescription medication.

Enter PetMed Express. Rather than focusing on the treatment and examination aspects of pet care, PetMed Express focuses on fulfillment and distribution of prescription and over the counter medicines. It has scale and efficiencies in inventory management, logistics, and order fulfillment that allow it to offer products at a cheaper price than a vet’s office.

PetMed Express helps vets fulfill their Veterinarians Oath by getting patients access to lower cost medications while allowing vets to focus on providing the best possible care. A true win-win for both consumer and veterinarian.

In the past, the pet medicine market was too small to warrant a dedicated pet pharmacy. But, with the growth of annual spending on pet medication (roughly $5 billion in 2017), PetMed Express has significant opportunity to continue growing and taking market share. Already, PetMed Express has grown its revenue from $15 million in fiscal 2000 to $247 million in fiscal 2018, or 18% compounded annually. It has also grown its market cap from $18 million to $820 million over the same time.

For reference, competitor Drs. Foster and Smith ($250 million revenue in 2014), which was acquired by Petco in 2015, grew revenue by only 5% compounded annually from 2001 to 2014, based on publicly available reports. PetMed Express grew revenue by 27% compounded annually over the same time.

Bears Case Ignores Actual Economics of the Business

Despite its success, bears commonly argue that PetMed Express’ profitability has peaked, the firm is unsustainably cutting costs to boost margins, and benefiting from a one-time jump in drug prices.

It’s true that advertising spend fell from fiscal 2013 to fiscal 2017 and that rising cost of goods sold dropped gross margin from 34% to 32%. Bears will argue that the falling gross margin is more indicative of the long-term trend for the business, and that increased profitability is short-lived. The facts get in the way of this theory.

In fiscal 2018, year-over-year (YoY) advertising spend grew 9%, revenues grew 10%, gross margin improved to 36% (from 32%), and NOPAT margin increased to 13% (up from 9%). Across the board, PetMed was able to expand its business and improve profitability. Furthermore, PetMed Express has grown the number of new customers in each of the past three years, despite the argument that decreased ad spending would lead to a decline in customers.

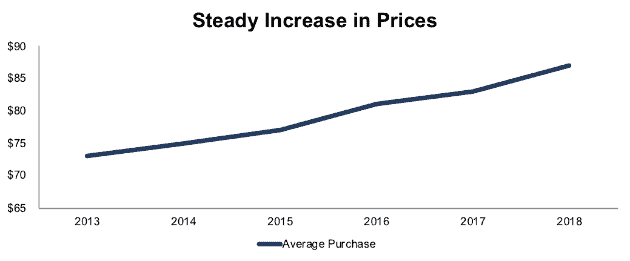

When faced with how fiscal 2018 contradicts much of their thesis, bears will argue that the 2018 results came from unusually high prices on new prescription products. PetMed Express admits that a new generation of medications helped profitability, but that does not mean these higher prices are a one-off event. Per Figure 3, the average purchase at PetMed Express has been steadily rising since fiscal 2013.

Rising prices are not the outlier, they are the continuation of a longer-term trend. We believe rising standards of living for humans will trickle down to pets and that humans will continue to spend more and more on pet health comparable to how we continue to spend more on our own health.

Figure 3: Average Purchase ($) at PetMed Express Since Fiscal 2013

Sources: New Constructs, LLC and company filings

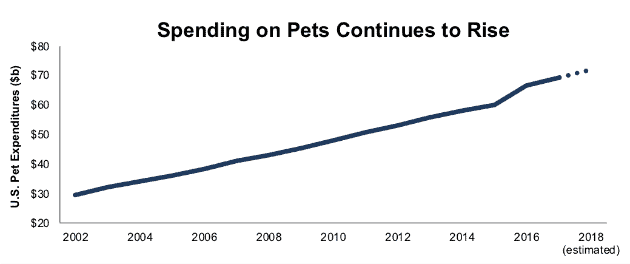

Bears Must Also Ignore the Consumers’ Willingness to Spend on Pets

According to the American Pet Products Association, U.S. pet industry expenditures have grown from $29.6 billion in 2002 to $69.5 billion in 2017, or 6% compounded annually. Expenditures are expected to rise further, to $72.1 billion in 2018. See Figure 4 for details.

As Bob Vetere, president and CEO of APPA, puts it, “Talk to any pet owner and they’ll tell you how difficult it is to put a dollar limit on what they’d spend to give their loyal companion a happy life, and it’s this outlook that continues to drive growth.”

We think it is fair to expect that pet prescription sales growth over the next several years to be comparable to human prescription sales growth (7% compounded annually since 2012) over the past several years.

Figure 4: United States Pet Expenditures Since 2002

Sources: New Constructs, LLC and American Pet Products Association

Any bear case relies on the belief that PetMed Express will not benefit from increased pet spending, or even that its business cannot be sustained in a competitive field. However, as we’ll show below, PetMed Express has been taking steps to build its competitive moat over the years.

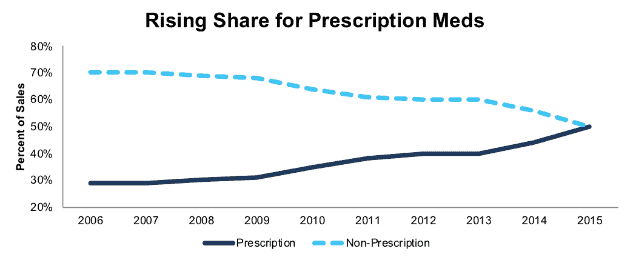

PETS is Building its Competitive Moat with Prescription Sales

To combat the rise of non-prescription medicines available for purchase at other outlets, such as PetSmart, Petco, or Amazon, PetMed Express has successfully diversified into prescription sales. Per Figure 5, prescription sales were only 29% of sales in 2006, and were 50% in 2015, the last year this specific data point was made available. In October 2017, on the fiscal 2Q17 earnings call, PETS CEO Mendo Akdag maintained that prescriptions were now a majority of PetMed Express’ business.

Figure 5: PetMed Express’ Sales Breakdown Since 2006

This shift in sales is important, as it differentiates PetMed Express from any other online retailer while also providing a revenue stream that cannot easily be replicated. Prescriptions sales create barriers to entry (for possible entrants such as Amazon) in the form of acquisition of pharmacy licenses and navigating regulatory requirements set forth by each state’s Board of Pharmacy.

One such accreditation program, Pharmacy Verified Websites, is only issued by the National Association of Boards of Pharmacy and identifies online pharmacies as safe and legitimate. This accreditation allows websites to advertise online and be considered a legitimate pharmacy merchant by Visa and Mastercard.

Earning accreditation is no small feat, either. To do so, a pharmacy must comply with the licensing and inspection requirements of each state in which it operates, demonstrate compliance with privacy and security, and adhere to a quality assurance policy. Information about the company, pharmacists on staff, and facility is required, in addition to an on-site inspection.

PetMed Express is currently licensed to conduct business in all 50 of the United States. These licenses and accreditations provide a competitive moat and position PetMed Express to expand upon its first mover advantage in this market.

Vet Offices Cannot Fight the Tide Forever

In a last-ditch effort to keep prescription revenues in house, vets are looking to third-party platforms, such as Vets First Choice. Vets First Choice provides veterinarians patient analytics and allows their customers to purchase prescriptions fulfilled by Vets First Choice (“VFC”).

However, third-party platforms like VFC, add a middleman to the prescription drug purchase process. VFC has admitted in the past that it has outsourced prescriptions to competing online pharmacies when its unable to fill the prescription. Furthermore, VFC notes that in some instances, it fills prescriptions for the very same online pharmacies the veterinarians are losing business to.

Rather than creating price efficiencies, a third-party middleman only adds complexity to an already inefficient process. Now, markups must be high enough to earn both the vet and the third-party platform a reasonable profit. Meanwhile, PetMed Express gives pet owners the best prices, which are in the best interest of the pets and their owners while allowing vets to focus on their goal of providing the best possible care.

Opioid Sales Claim Seems Baseless

One issue that sent PETS on a rollercoaster ride in the summer of 2017 was a report from Aurelius Value. In the report, Aurelius claimed that PetMed Express was exploiting the opioid addiction gripping the United States by promoting opioid drugs to humans, rather than pets. PetMed Express issued a statement categorically denying the allegations and noted it would defend itself “vigorously against these false claims”.

In a follow-up statement PetMed Express pointed out that the two drugs noted in the Aurelius Value report, Tramadol and Gabapentin, accounted for approximately 0.4% of the company’s total sales for the six-month period ending June 30, 2017. They also noted that sales of the two medications have declined over the past five years and “were not driving the company’s growth.” There has been little mention of the issue since Aurelius’ initial report. We see no evidence to suggest the allegations were true.

PETS Offers Significant Upside

For those that think PetMed Express cannot maintain its profitability and leading position in the growing pet industry, it’s important to note that PETS’ valuation already has low profit growth expectations baked into it, despite what traditional valuation metrics show.

At its current price of $41/share, PETS looks overvalued by traditional ratios. PETS’ P/E ratio of 24.3 is well above the Consumer Non-cyclicals sector average of 15.1 and in line with the S&P 500 average of 24.6.

However, when we analyze the cash flow expectations baked into the stock price, we find that PETS holds significant upside potential. At $41/share, PETS’ price-to-economic book value (PEBV) ratio is 1.2. This ratio means the market expects PETS’ NOPAT to only grow by 20% over the remaining life of the firm. This expectation seems overly pessimistic for a firm that has grown NOPAT by 15% compounded annually over the past five years and 7% compounded annually over the last decade.

If PETS can maintain fiscal 2018 NOPAT margins of 13% and grow NOPAT by just 6% compounded annually for the next decade, the stock is worth $53/share today – a 29% upside. See the math behind this dynamic DCF scenario here.

Given the positive impact of the recently enacted tax legislation (details below), this margin scenario could prove conservative. Furthermore, should PETS continue to grow profits above the industry average (6% compounded annually since 2002) as it has in recent years, the potential upside would be even greater. The mix of strong fundamentals and low expectations earned PETS a spot in this month’s Most Attractive Stocks Model Portfolio.

Tax Reform Will Help Boosts Margins

PETS stands to benefit from tax reform more than most companies as it paid a cash tax rate of 34% in fiscal 2018, which is higher than the median S&P 500 company at 28%. If PETS lowers its cash tax rate to the new statutory rate of 21%, it can generate 20% more NOPAT and increase its NOPAT margin from 13% to 15%.

Earnings Beat Could Send Shares Soaring

With a heavy short interest and bear concerns (albeit unfounded) about the future profitability of the business, PETS shares could soar should the company report earnings that beat expectations. We know the bottom line will benefit from a lower tax rate, and the company plans to increase its ad spending going forward, which should help boost sales, as we saw in fiscal 2018. Furthermore, management expects new, higher margin, drug sales to continue for the next few years.

All told, PetMed Express is in a prime position to beat expectations moving forward, even if it can simply grow alongside the industry. Such an earnings beat can have a dramatic impact on the stock, as we’ve seen in the past.

- Stock jumped 35% following fiscal 4Q16 earnings

- Stock jumped 18% following fiscal 1Q17 earnings

- Stock jumped 18% following 2Q17 earnings

In the meantime, investors receive a growing dividend providing quality yield.

A Growing Dividend and Potential Share Repurchases Offer 3.6% Yield

PetMed Express has increased its annual dividend seven times in the last ten years. PETS’ annual dividend has grown from $0.66/share in fiscal 2018 to $0.85/share in fiscal 2018, or 7% compounded annually. The current dividend provides a 2.4% dividend yield. Best of all, PetMed Express generates the necessary cash flow to continue paying its dividend. Over the past five years, PETS has generated a cumulative $105 million (13% of market cap) in free cash flow while paying about $75 million in dividends.

In addition to dividends, PETS has the ability to return capital to shareholders via share purchases. However, no shares have been repurchased under the current plan since September 2012. At the end of March 2018, PETS had $10.2 million remaining under its current repurchase authorization. Were the company to repurchase this stock, it would equate to 1.2% of the current market cap. When combined with the 2.4% dividend yield, the total yield to shareholders could reach 3.6%.

Executive Compensation Plan Could be Improved but Hasn’t Led to Value Destruction

Incentive goals used to determine executives’ compensation package include net revenue, operating profit, general & administrative expenses as a percentage of sales, inventory average cost reduction, and net promoter score. These goals are directly related to growing the top line, while also keeping an eye on expenses to increase the bottom line. While it’s a positive that PETS does not include misleading non-GAAP metrics in its executive compensation plan, that doesn’t mean there isn’t room for improvement.

PETS should tie performance compensation to improvement in ROIC, as there is a strong correlation between improving ROIC and increasing shareholder value[1]. Tying exec comp to ROIC also ensures that executives’ interests are properly aligned with shareholders’ interests.

However, despite excluding ROIC and using different metrics, PETS’ current plan has not led to executives getting paid while destroying shareholder value. The company has improved economic earnings, the true cash flows of the business, from $1 million in fiscal 2002 to $32 million in fiscal 2018, or 28% compounded annually.

Insider Trading is Minimal While Short Interest Shows Pessimistic Expectations

There has been no insider activity over the past three months and insider activity has been minimal over the past 12 months, with 41 thousand shares purchased and 95 thousand shares sold for a net effect of 55 thousand shares sold. These sales represent less than 1% of shares outstanding.

There are currently 5.3 million shares sold short, which equates to 26% of shares outstanding and 12 days to cover. Short interest has decreased 2% from the prior month and is down 31% from its 52-week high. Continued improvement in PetMed Express’ fundamentals could bring about a short squeeze and send shares even higher.

Critical Details Found in Financial Filings By Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[2] findings in PetMed Express’ fiscal 2018 10-K:

Income Statement: we made $4 million of adjustments, with a net effect of removing $3 million in non-operating income (1% of revenue). We removed $3 million in non-operating income and $1 million in non-operating expenses. You can see all the adjustments made to PETS’ income statement here.

Balance Sheet: we made $67 million of adjustments to calculate invested capital with a net decrease of $66 million. The most notable adjustment was $64 million in excess cash. This adjustment represented 55% of reported net assets. You can see all the adjustments made to PETS’ balance sheet here.

Valuation: we made $65 million of adjustments with a net effect of increasing shareholder value by $63 million. Apart from the $64 million in excess cash noted above, the most notable adjustment was $1 million in deferred tax liabilities. The excess cash adjustment represents 8% of PETS’ market cap.

Attractive Funds That Hold PETS

The following funds receive our Attractive-or-better rating and allocate significantly to PetMed Express.

- Copeland SMID Cap Dividend Growth Fund (CSMDX) – 1.0% allocation and Attractive rating.

This article originally published on June 13, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Ernst & Young’s recent white paper “Getting ROIC Right” proves the superiority of our holdings research and analytics.

[2] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.