Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and Marketwatch.com

With news that Valeant Pharmaceuticals (VRX: $84/share) is likely to restate its 2014 financial results investors must ask themselves “is it safe to own VRX now?” If listening to Valeant management, one might think “yes”, but we say “no”. We’ve been highlighting the dangers of Valeant for over two years and we do not see them abating. As long as management is incentivized to destroy shareholder value, Valeant is in the Danger Zone.

History Of Questionable Accounting

In June 2014, we pointed out Valeant was presenting itself in a misleading way in an attempt to bolster its takeover bid of Allergan. The main issues at the time were:

- Valeant’s dubious claim of “undervaluation.” Valeant argued that it was undervalued based on P/E ratios, which we know to be a poor measure of value. Valeant failed to mention that it compared its adjusted P/E, which removed numerous “one-time costs” related to acquisitions, to the unadjusted P/E ratios of its industry, sector, and S&P 500. By comparing its non-GAAP metrics to others’ GAAP results, VRX was comparing apples and oranges. More rigorous metrics, like price-to-economic book value (PEBV), showed that VRX was significantly overvalued versus its peers.

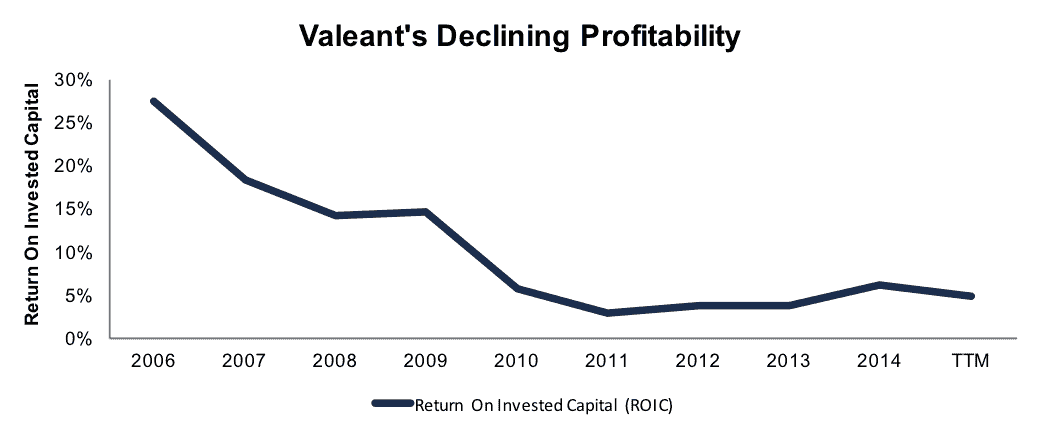

- Valeant’s false claims that previous acquisitions were value creating. In order to entice Allergan to consider the buyout, Valeant wanted to tout its acquisitions as value creating. However, Valeant’s return on invested capital (ROIC), which provides a true measure of if/how much the company creates value, had fallen from 15% in 2009 to 4% in 2013. The prior acquisitions had increased its invested capital 13 times over while net operating profit after-tax (NOPAT), or cash flows, only tripled. Figure 1 shows Valeant’s long-term declining ROIC.

Figure 1: Long-Term Decline of ROIC

Sources: New Constructs, LLC and company filings

Beware Companies That Point You to Non-GAAP Earnings

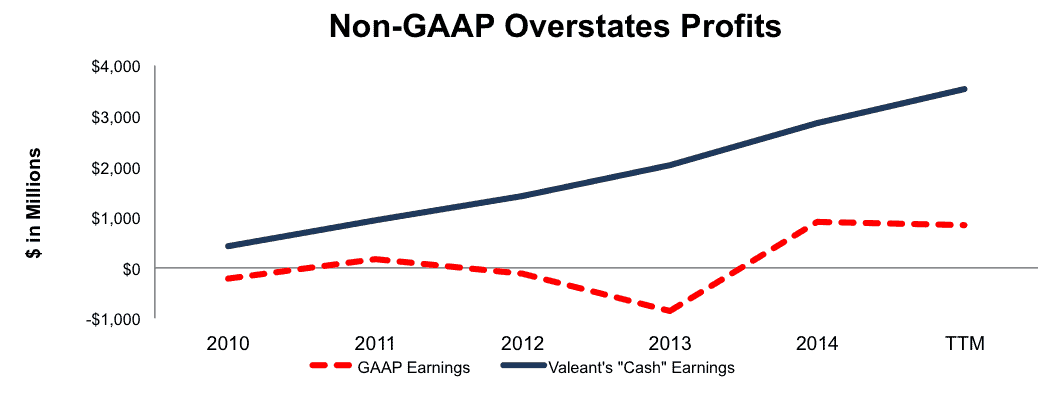

In July 2014, Valeant made our list of companies with the most misleading non-GAAP earnings. According to GAAP, Valeant lost $866 million in 2013, but by their non-GAAP metrics the company earned $2 billion. This disconnect stems primarily from excluding the costs related to its acquisitions. Does it make sense to exclude the costs related to how you grow your business from how you measure profits? We find that fishy. Figure 2 shows this large discrepancy.

Figure 2: Valeant’s Non-GAAP Earnings Are Alarming

Sources: New Constructs, LLC and company filings

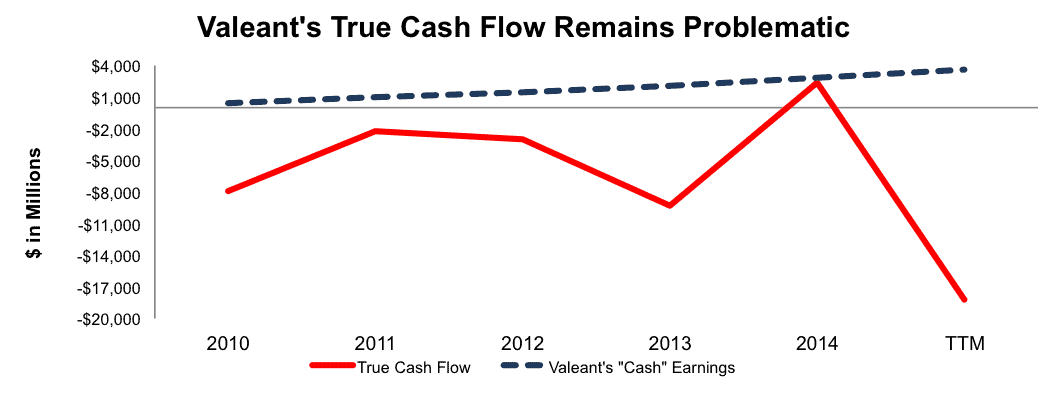

We revisited the non-GAAP red flag again in November 2015 ,and the story had only gotten worse. While the company’s non-GAAP “cash earnings” have been highly positive, growing from $421 million in 2010 to $3.55 billion over the latest trailing-twelve months (TTM), free cash flow has been highly negative with a cumulative -$38.4 billion in losses over the same time frame. Cumulative non-GAAP earnings during the same time are $11.2 billion. The alarming results can be seen in Figure 3.

Figure 3: True Cash Flow Provides True Picture of Valeant

Sources: New Constructs, LLC and company filings

Valeant uses non-GAAP metrics to make its business look better than it is according to corporate accounting rules (i.e. GAAP) while burning through cash at an unsustainable and alarming rate.

Further Issues Remain at VRX

These aren’t the only questionable accounting practices at Valeant. John Hempton, of Bronte Capital, has argued that the company may be misclassifying recurring items as one-time charges in an attempt to boost its non-GAAP earnings. Additionally, questions about the accounting practices between Valeant and Philidor (the reason for the upcoming restatement) have been around since October 2015.

Executive Compensation Only Worsens Issues

We’ve previously highlighted specific reasons why executives manipulate earnings. Similarly, we know that misaligned executive compensation destroys shareholder value. By focusing on non-GAAP metrics, Valeant executives can line their pockets with little regard to the real economics of their decisions. Executives receive bonuses, which can be 200% of annual salary, that are determined by meeting specific criteria, such as revenue growth and “cash EPS.”

By focusing on these metrics, executives are incentivized to grow revenue through acquisition, regardless of effects on of cash flow or shareholder value, and increase “cash EPS,” which just so happens to remove acquisition related costs. It’s not hard to see the cycle this incentive plan creates. Acquire a company, grow revenue, remove cost of acquisition, and increase “cash EPS” to distract from cash burn. Wash, rinse, and repeat. Until executives are held accountable to metrics that are proven to create shareholder value, like ROIC, Valeant executives’ actions will remain misaligned with shareholders best interests.

Shareholder Dilution Has Been Big

A result of the value destructive cycle created by Valeant’s executive compensation is the company’s large shareholder dilution. Valeant’s debt has increased from $372 million in 2009 to $30 billion over the last twelve months. Similarly, from 2009-2014, Valeant’s shares outstanding increased from 158 million to over 356 million, or 16% compounded annually. If Valeant has been so successful, as its non-GAAP accounting would have you believe, why has it consistently required so much more capital?

Insiders Are Selling, Should You?

Over the past 12 months, as shares have fallen nearly 60%, insiders have sold 6 million shares and purchased only 700 thousand shares for a net of 5.3 million shares sold, or 2% of shares outstanding. If shares were as undervalued as management claimed, one would expect insiders and executives to be purchasing shares not selling.

Stock Remains Overvalued, Even After Decline

Since our initial warning on Valeant in June 2014, the stock is down nearly 35%. The stock performance is even worse over the short term, having fallen 68% since August 2015. After such a drastic price decline, one might think shares are a bargain. Not even close. Those purchasing Valeant now would be buying a highly overvalued stock with a long history of misleading accounting. These are not exactly the characteristics of a quality investment.

In order to justify its current price of $84/share, the company would need to grow NOPAT by 15% compounded annually for the next 10 years. In this scenario, Valeant would be generating $39.7 billion in revenue, greater than that of GlaxoSmithKline’s (GSK) or AstraZeneca’s (AZN) 2014 revenues.

Even in an ideal scenario, in which Valeant focuses on internal growth and not destructive acquisitions, VRX still has significant downside. If Valeant can grow NOPAT by 9% compounded annually for the next decade, the stock is worth $20/share today – a 76% downside.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: valuewalk

4 replies to "Danger Zone: Valeant Pharmaceuticals (VRX)"

You were RIGHT, RIGHT & RIGHT! – but to conservative as VRX is now down 88% from last years high. This is classic ENRON – more & more non GAAP filings followed by more & more delays or refusals in answering the most basic financial questions during a recent Conference call. And – with 30B in debt; nearly 40B in grossly overstated Goodwill & Intangibles; an ongoing investigation by the US Justice Department; a serious probe by the SEC coupled with a possible breach of contract with Walmart leaves me with a valuation/share of not more than $10-15. Alternately, a massive sale of assets. A real “House of Cards”!

VRX falls over 15% as company reports quarterly loss and lowers full year guidance. Now down over 60% since Danger Zone report.

According to Bloomberg, U.S. prosecutors are focusing on Valeant’s former CEO and CFO as they build an accounting fraud case against the company. VRX down nearly 73% since Danger Zone report.

$VRX falls 11% as Bill Ackman dumps stake. Now down 84% since our original Danger Zone report