We closed this position on August 14, 2017. A copy of the associated Position Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and Marketwatch.com

The adage ‘content is king’ is true more so now than perhaps ever before. Media companies crave unique content, individuals can create content easier than ever before, and consumers can access content through a multitude of outlets. However, not all content is created equal. Original content, whether it be videos, images, or both, while costly, can be highly profitable. On the flip side, redistributing others’ content is not only undifferentiated, but also not a winning business strategy. This firm’s content redistribution platform, coupled with declining profits and overvalued stock price land Shutterstock (SSTK: $55/share) in the Danger Zone.

Revenue Growth Hides Profit Decline

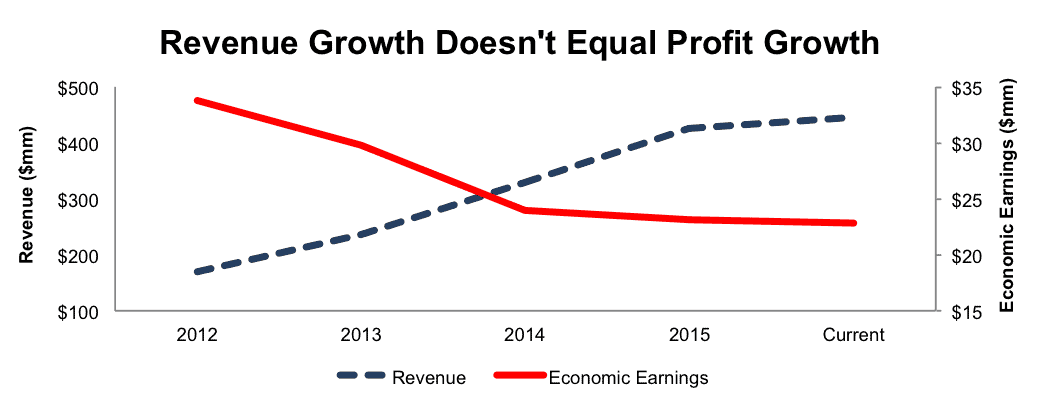

Shutterstock’s economic earnings, the true cash flows of the business, have declined from $34 million in 2012 to $23 million in 2015, or -12% compounded annually. This decline comes despite revenue growing from $170 million in 2012 to $425 million in 2015, or 36% compounded annually. Figure 1 highlights the disconnect between revenue and cash flows. See the reconciliation of Shutterstock’s GAAP net income to economic earnings here.

Figure 1: SSTK’s Profits Decline Despite Revenue Growth

Sources: New Constructs, LLC and company filings

Such impressive revenue growth doesn’t seem so impressive when one realizes it’s a byproduct of unsustainable spending. Since 2012, while revenue has grown 36% compounded annually, R&D, sales and marketing, and G&A expenses have grown 36%, 33%, and 42% compounded annually respectively. Cost of revenues has grown 39% compounded annually over the same time. Essentially, revenue growth fails to outpace the cost to grow that revenue, which is not a sustainable long-term strategy.

Over the past three years, Shutterstock has generated cumulative -$48 million in free cash flow. Additionally, the company’s return on invested capital (ROIC), which was once an astounding 899%, has fallen to 34% over the last twelve months.

Executive Compensation Won’t Fix Issues

Shutterstock’s CEO receives only $1 in base salary, a fact that taken at face value would seem like a quality compensation plan. However, no one works for free. In lieu of salary, SSTK’s CEO was granted stock options that are only exercisable if SSTK trades at or above a set target price. Incentivizing executives solely with stock price can have damaging effects, as business decisions can be made only to drive stock price appreciation with little regard to the long-term economic success of the business.

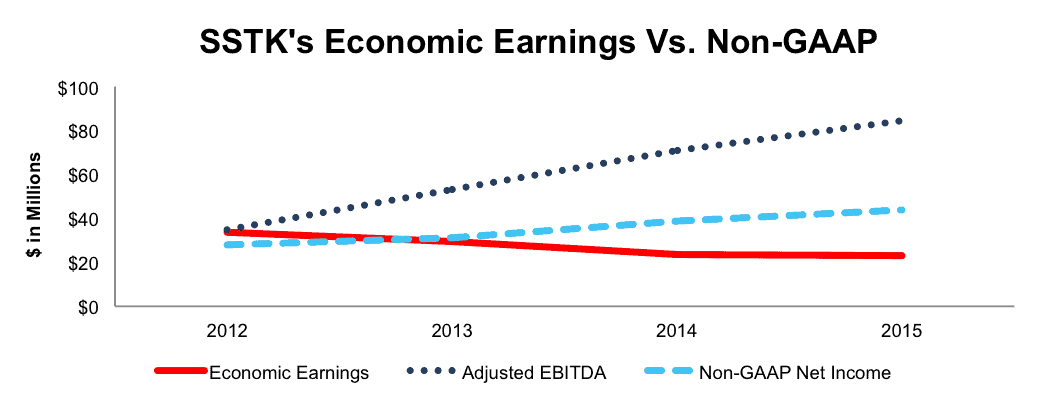

In fact, in a 2015 study, the number one reason cited as to why companies misrepresent earnings was to influence stock price. The larger takeaway from the study was that 20% of companies misrepresent earnings in one way or another. Create an incentive that can be achieved through accounting tricks and loopholes, and humans will exploit it. Apart from the CEO, other executives receive annual bonuses for the achievement of revenue and adjusted EBITDA goals. As seen in Figures 1 and 2, revenue and adjusted EBITDA do not accurately measure shareholder value creation. In fact, each of these metrics is rising while economic earnings are in decline. The best way to create shareholder value, and align executives with the best interest of shareholders, is to tie performance bonuses to ROIC because there is a clear correlation between ROIC and shareholder value. Until changes are made to the executive incentives at SSTK, expect further shareholder value destruction.

Non-GAAP Metrics Soar While Profits Decline

Investors need to understand there are inherent risks when analyzing and relying on non-GAAP metrics. For proof, look no further than Shutterstock’s use of non-GAAP. Here are expenses SSTK has removed when calculating its non-GAAP metrics, including adjusted EBITDA and non-GAAP net income:

- Write off of property & equipment

- Non-cash equity based compensation

- Acquisition related amortization expense

These costs have a material impact on results, particularly equity based compensation, which is a real cost of business. In 2015, SSTK removed $18 million net of tax (96% of GAAP net income) in equity-based compensation to calculate its non-GAAP net income. By removing this large expense, along with others, Shutterstock reports non-GAAP metrics that are much improved from economic earnings, and also trending upwards while economic earnings decline. Adjusted EBITDA grew from $35 million in 2012 to $85 million in 2015, or 34% compounded annually. Over this same time, non-GAAP net income grew 16% compounded annually while economic earnings declined 12% compounded annually, per Figure 2.

Figure 2: SSTK’s Misleading Non-GAAP Metrics

Sources: New Constructs, LLC and company filings

Content Delivery Does Not Provide High Margins

Similar to video content providers like Netflix or Hulu, Shutterstock faces competition from a litany of different outlets. A non-exhaustive list of online image distributors includes iStockPhoto, owned by Getty Images, Fotolia, owned by Adobe (ADBE) Dreamstime, or 123rf. Getty Images and Corbis Corporation are staples of the traditional stock image providers. Further fragmenting the market, image hosting sites such as Flickr, owned by Yahoo (recently acquired by Verizon (VZ)), Photobucket, or even Facebook (FB) offer images for licensing. This list does not include traditional photographers that may be hired for a specific client request.

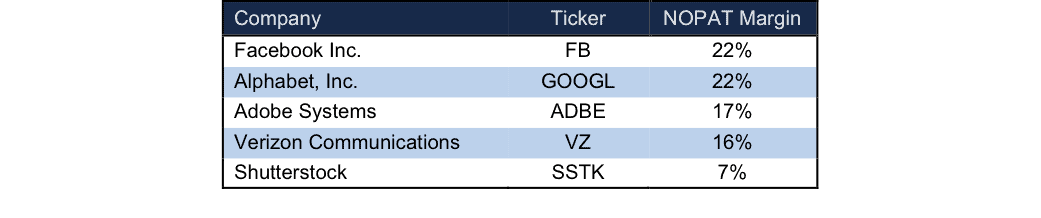

A content distribution platform provides few barriers to entry, as seen in the numerous competitors, and, apart from pricing, provides little opportunity for differentiation. Such commoditization of content would not be a problem if Shutterstock already had greater profitability than that of its competition, However, it does not. When comparing margins with Adobe, we see that the benefits of selling an actual product (Adobe’s Creative Suite) reveal themselves in superior margins. Apart from ADBE, the companies in Figure 3 may not seem like direct competition, but each of them offers images for license through a captive service. The high profitability of each illustrates the uphill battle facing Shutterstock, particularly in regards to pricing power.

Figure 3: Shutterstock’s Margins Lag Larger Competition

Sources: New Constructs, LLC and company filings

Bull Hopes Rest On Differentiated Content Delivery Platform

The largest bull case around SSTK revolves around its ability to continually grow its content library, attract more users, and ultimately be the leading stock image provider on the web. Once it reaches this scale, bulls would argue that the company could cease the massive spending that is currently ongoing, and become highly profitable.

The biggest issue with this argument, and any bull case around Shutterstock, is that adding undifferentiated content is a process that only stops if you can provide unique, original content. A middle man content delivery platform will not ever generate significant profits. If this situation sounds similar, its because we’ve long been alerting investors to the downfalls of this business strategy at Netflix. Without costly original content, Shutterstock is reliant upon other entities (photographers) to populate its main service being provided (stock images). A content delivery platform is not particularly hard to create, as noted by the many different online image services.

Without exclusive rights to images, Shutterstock has no “leg up” on other image providers either. Content creators are free to submit their work across numerous platforms which lead to the same image being available at many competitors. It should be no surprise that each of these services boasts such a large library. For instance, Shutterstock and Alamy claim to have over 80 million pieces of content in their libraries, Fotolia and 123rf claim 60 million, and Dreamstime claims 45 million images.

At the end of the day, Shutterstock is simply one of many content providers, and ultimately battling it out on price. With margins well below that of competition, specifically Adobe (see Figure 3) SSTK can ill afford to get into a pricing war. Similar to Amazon (AMZN), which has consistently been willing to take losses to gain market share, any of these competitors could easily afford to adopt a similar strategy, while having little effect on the overall corporation. For Shutterstock though, where image distribution is its main business, the firm doesn’t have this luxury of profitable business lines that can support a pricing war in another segment.

At the same time, it can’t afford to raise the amount paid to content providers (to attract them away from other services) without eating away at an already low margin.

The largest risk to the bear case is what we call ‘stupid money risk.’ Another firm could step in and acquire SSTK at a value that is much higher than the current market price. As we’ll show below, only in the event a firm is willing to destroy shareholder value is SSTK worth more than its current share price.

Would A Competitor Acquire This Content Redistributor?

The biggest risk to our thesis would be if an outside firm was to acquire SSTK at a value at or above today’s price. We’ll show below that Shutterstock is not an attractive acquisition target because unless a buyer is willing to destroy shareholder value, an acquisition at current prices would be unwise.

To begin, SSTK has liabilities that investors may not be aware of that make it more expensive than the accounting numbers suggest.

- $61 million in off-balance-sheet operating leases (3% of market cap)

After adjusting for this liability we can model multiple purchase price scenarios. Even in the most optimistic of scenarios SSTK is worth less than the current share price.

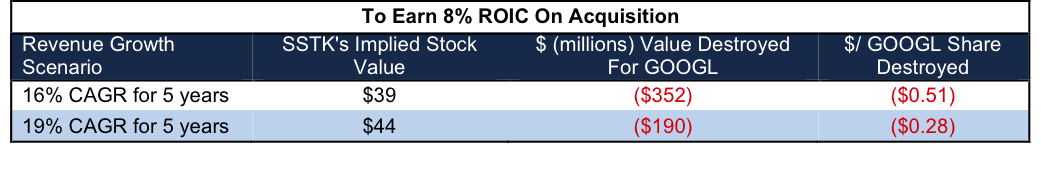

Figures 4 and 5 show what we think Alphabet (GOOGL) should pay for SSTK to ensure it does not destroy shareholder value. Shutterstock recently built its service into Google’s Adwords service, so purchasing the firm could leverage search capabilities or marketing efforts to further boost Shutterstock’s market share and provide the financial security needed to compete with more profitable firms. However, there are limits on how much GOOGL would pay for SSTK to earn a proper return, given the NOPAT or free cash flows being acquired.

Each implied price is based on a ‘goal ROIC’ assuming different levels of revenue growth. In each scenario, the estimated revenue growth rates in year one and two equal the consensus estimates for 2016 (19%) and 2017 (15%). For the subsequent years, we use 15% in scenario one because it represents a continuation of 2017 expectations. We use 20% in scenario two because it assumes a merger with Alphabet could create additional revenue opportunities.

We conservatively assume that Google can grow SSTK’s revenue and NOPAT without spending on working capital or fixed assets. We also assume SSTK achieves an 11% NOPAT margin. This margin is below GOOGL’s NOPAT margin (22%), which is boosted by its other business segments, and is the average NOPAT margin achieved by SSTK since 2012, when SSTK went public. For reference, SSTK’s TTM NOPAT margin is 7%, so this assumption implies immediate improvement.

Figure 4: Implied Acquisition Prices For GOOGL To Achieve 8% ROIC

Sources: New Constructs, LLC and company filings.

$ values in millions except per share amounts.

$ value destroyed equals the difference between implied price and acquisition at current market price plus net assets/liabilities.

Figure 4 shows the ‘goal ROIC’ for GOOGL as its weighted average cost of capital (WACC) or 8%. Even if Shutterstock can grow revenue by 19% compounded annually with an 11% NOPAT margin for the next five years, the firm is not worth more than its current price of $55/share. We include the 19% scenario to provide a best-case view. Note that any deal that only achieves an 8% ROIC would be only value neutral and not accretive, as the return on the deal would equal GOOGL’s WACC.

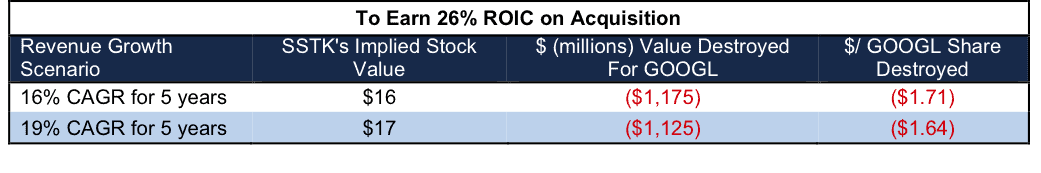

Figure 5: Implied Acquisition Prices For GOOGL To Achieve 26% ROIC

Sources: New Constructs, LLC and company filings.

$ values in millions except per share amounts.

$ value destroyed equals the difference between implied price and acquisition at current market price plus net assets/liabilities.

Figure 5 shows the next ‘goal ROIC’ of 26%, which is GOOGL’s current ROIC. Acquisitions completed at these prices would be truly accretive to GOOGL shareholders. Even in the best-case growth scenario, the most Alphabet should pay for SSTK is $17/share (69% downside). Any deal above $17/share would lower GOOGL’s ROIC.

Barring Acquisition, Shares Still Overvalued

On its own, SSTK still has unrealistically high expectations baked into the current stock price. Specifically, to justify the current price of $55/share, SSTK must maintain TTM NOPAT margins (7%) and grow NOPAT by 20% compounded annually for the next 12 years. In this scenario, SSTK would be generating over $3.4 billion in revenue 12 years from now. For reference, Technavio estimates that the entire stock image market won’t exceed $4 billion until 2020.

In other words, current expectations imply SSTK reaching a sales volume that nearly equals the size of the entire expected market in 2020. SSTK must take significant market share from all competition over the next decade.

Even if we assume SSTK can maintain TTM NOPAT margins and grow NOPAT by 14% compounded annually for the next decade, the stock is only worth $31/share today – a 44% downside.

Each of these scenarios also assumes the company is able to grow revenue and NOPAT without spending on working capital or fixed assets , an assumption that is unlikely, but allows us to create a very optimistic scenario. For reference, SSTK’s invested capital has grown on average $43 million (10% of 2015 revenue) each year since 2013.

Catalyst: Market Values SSTK As The Content Provider It Is

Shutterstock’s business model puts the firm in a tough position. As a content platform, spending aggressively to consistently expand its library can maintain the high revenue growth rates investors have come to expect. However, as shown above, such aggressive spending has directly correlated to a decline in profits, as spending outpaces revenue growth. Investors will not fund losses forever.

On the other hand, the greatest differentiation of any content platform is original content. As we’ve seen at Netflix, creating original content can attract a more loyal user base, but is much more expensive than simply providing others’ content. It also doesn’t lead to high-flying revenue growth rates year in and year out.

SSTK would not be as Dangerous a stock if its valuation were not so high. If it maintains its topline growth and aggressive spending, it cannot achieve the profits already baked into the stock price. At the same time, if it moves into original content, the market must reevaluate it as a content creator, and the potentially smaller market share this move would entail. Worse yet, with the amount of competition, becoming a content creator would likely not provide enough differentiation to pull the vast majority of clients away from other larger libraries.

At the end of the day, neither of these options meets the current expectations embedded in the market price. Shutterstock does not own the keys (content) that are driving its high valuation, and with low margins and significant competition, it’s only a matter of time before SSTK’s market share is encroached upon.

Insider Action Is Low While Short Interest Is High

Over the past 12 months 400 thousand insider shares have been purchased and 11 thousand have been sold for a net effect of 389 thousand insider shares purchased. These purchases represent 1% of shares outstanding. Additionally, there are 3.9 million shares sold short, or just over 11% of shares outstanding.

Impact of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to Shutterstock’s 2016 10-K:

Income Statement: we made $21 million of adjustments with a net effect of removing $9 million in non-operating expenses (2% of revenue). We removed $15 million related to non-operating expenses and $6 million related to non-operating income. See all adjustments made to SSTK’s income statement here.

Balance Sheet: we made $387 million of adjustments to calculate invested capital with a net decrease of $251 million. The most notable adjustment was $61 million (20% of net assets) related to operating leases. See all adjustments to SSTK’s balance sheet here.

Valuation: we made $314 billion of adjustments with a net effect of increasing shareholder value by $192 million. The largest adjustment was the addition of $253 million (13% of market cap) due to excess cash. Despite increasing shareholder value, SSTK remains overvalued.

Dangerous Funds That Hold SSTK

The following funds receive our Dangerous-or-worse rating and allocate significantly to Shutterstock.

- Virtus Small-Cap Sustainable Growth Fund (PSGAX) – 6.0% allocation and Very Dangerous rating.

- Delaware Smid Cap Growth Fund (DFCIX) – 2.6% allocation and Dangerous rating.

This article originally published here on August 1, 2016.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

1 Response to "Danger Zone: Shutterstock (SSTK)"

SSTK down 18% after 4Q earnings and revenue missed estimates. Now down 23% since the Danger Zone report was published while the S&P is up 9% over the same time.