We closed this position on June 1, 2017. A copy of the associated Position Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and Marketwatch.com

How can investors know when to “buy the dip?” While timing such a purchase will never be foolproof, one can look for certain metrics to determine whether a firm is seeing fundamental weakness, or simply a market overreaction. Increasing economic earnings, strong competitive position, or an undervalued stock can be a signal to “buy the dip.” Unfortunately, Zoe’s Kitchen (ZOES: $24/share) meets none of these criteria and is on September’s Most Dangerous Stocks List and in the Danger Zone this week.

Revenue Growth Masks Underlying Losses

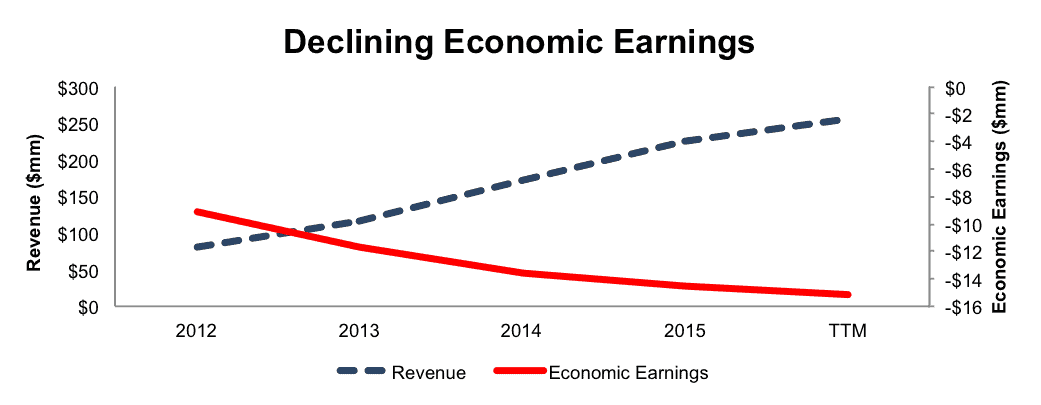

Zoe’s Kitchen’s economic earnings, the true cash flows of the business, have declined from -$9 million in 2012 to -$15 million over the last twelve months (TTM). This decline comes despite revenue growing from $80 million in 2012 to $256 million TTM. Figure 1 shows the disconnect between economic earnings and revenue. See a reconciliation of Zoe’s Kitchen’s GAAP net income to economic earnings here.

Figure 1: ZOES Economic Earnings in Decline

Sources: New Constructs, LLC and company filings

Zoe’s Kitchen has consistently earned a poor return on invested capital (ROIC), and currently earns a bottom-quintile 4% TTM ROIC. Even worse, growing revenues at such high rates has been a significant cash drain, as Zoe’s has burned through $131 million in free cash flow since 2013.

Compensation Plan Only Worsens Shareholder Destruction

Zoe’s Kitchen’s executives receive, apart from base salaries, annual cash bonuses paid out based upon the achievement of a target “adjusted” EBITDA goal. The “adjusted” portion of EBITDA includes the removal of certain “nonrecurring expenses.” However, when one digs deeper, it becomes clear that adjusted EBITDA removes pretty standard expenses (listed in the next section), such as equity-based compensation expense. Unsurprisingly, Zoe’s has done an excellent job of growing adjusted EBITDA, and therefore management bonuses, but not real profits, as we’ll show below. Through the use of “adjusted” EBITDA, executives are incentivized by metrics that do little to create shareholder value and can actually improve while shareholder value is destroyed, as in this case. The best way to create shareholder value, and align executives with the best interest of shareholders, is to tie performance bonuses to ROIC.

Non-GAAP Metrics Portray Inaccurate Picture of Business

Despite the SEC stepping up scrutiny of non-GAAP metrics, businesses still have large discretion over which items are removed to calculate non-GAAP metrics. Such discretion ends up creating metrics that not only tell a different story of business fundamentals, but also lead investors to thinking a firm is highly profitable when that is not the case. See the dangers of non-GAAP metrics for more on this topic. In relation to Zoe’s Kitchen, here are some of the expenses ZOES has removed in the past or still currently removes to calculate its adjusted EBITDA and non-GAAP net income:

- Management & consulting fees

- Equity-based compensation expense

- Pre-opening costs

- Offering related expenses

- Executive transition costs

- Executive relocation costs

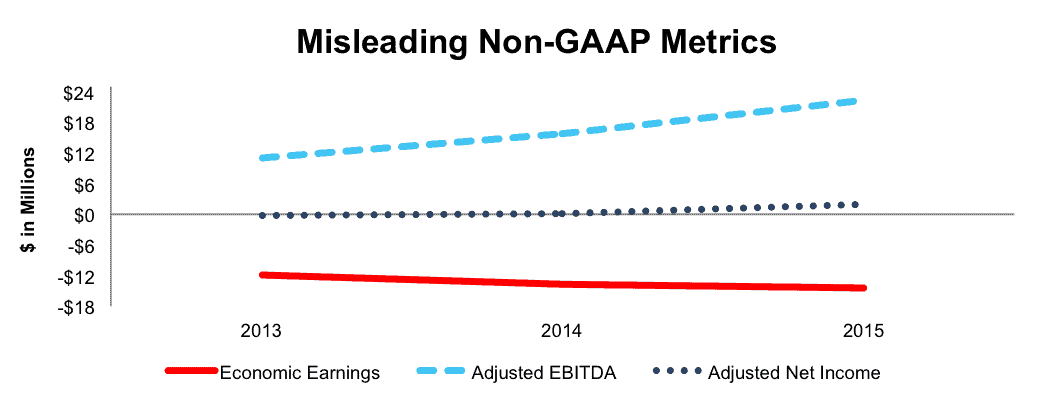

The removal of these items has a significant impact on the disparity between economic earnings and ZOES non-GAAP metrics. In 2014, when ZOES went public, the company removed just over $6 million in equity-based compensation expense (4% of revenue). Through the removal of this equity-based compensation and other expenses, ZOES reported an adjusted net income of $213,000, compared to GAAP net income of -$10 million. In 2015, the company removed $2.5 million related to pre-opening costs when calculating its adjusted EBITDA. This expense equaled 227% of GAAP net income. By removing these large expenses, Zoe’s Kitchen reports non-GAAP metrics that are much better than economic earnings. Adjusted EBITDA grew from $11 million in 2013 to $22 million in 2015, or 43% compounded annually while adjusted net income grew from -$400 thousand in 2013 to $2 million in 2015. Meanwhile economic earnings declined from -$12 million in 2013 to -$15 million in 2015, per Figure 2.

Figure 2: Discrepancy Between Non-GAAP & Economic Earnings

Sources: New Constructs, LLC and company filings

Lagging Profitability In A Highly Competitive Market

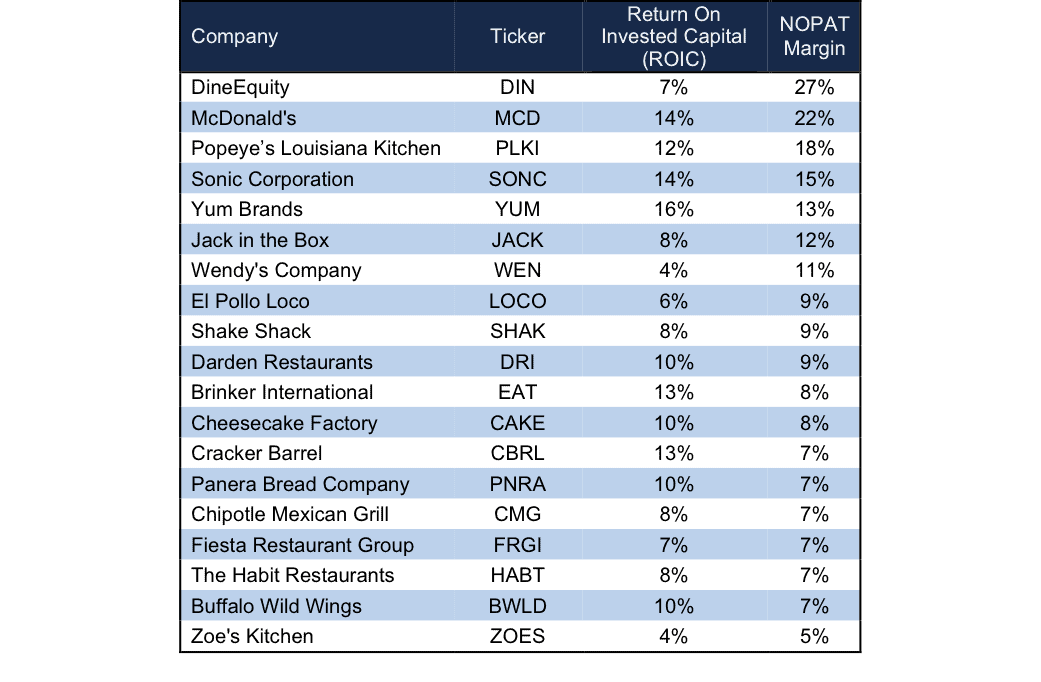

Zoe’s Kitchen provides diners with Mediterranean inspired dishes in a fast-casual setting. The dining industry is highly fragmented, with competitors of all sizes, offering any assortment of food options. In the fast casual segment, Zoe’s faces competition from the likes of Panera Bread Company (PNRA), Chipotle Mexican Grill (CMG), and Fiesta Restaurant Group (FRGI). Zoe’s also faces competition from traditional dine-in restaurants such as Applebee’s and IHOP (owned by DineEquity (DIN)), Olive Garden and Longhorn Steakhouse (owned by Darden Restaurants (DRI)), and Chili’s Bar & Grill (owned by Brinker International (EAT)). Additionally, Zoe’s competes with traditional fast food operators such as McDonalds (MCD), Yum Brands (YUM), and Wendy’s (WEN). While each of these segments caters to different markets, they have significant overlap in that each firm is ultimately competing for the same pool of money, consumer spending on food. However, despite the differences, each of the competitors listed, as well as those below in Figure 3, have one thing in common, they’re all more profitable than Zoe’s Kitchen.

Per Figure 3, Zoe’s Kitchen has a lower NOPAT margin and ROIC than 18 competitors listed. Such low profitability leaves ZOES with limited pricing power in an industry largely predicated on price. At the same time, Zoe’s low profitability leaves it less flexibility in regards to expansion, changes in labor regulations, or unexpected issues such as food shortages and health issues (as we saw recently with Chipotle). While a higher margin doesn’t guarantee success, it allows a firm to operate more freely, while continuing to invest in the business, and ultimately reaching the expectations embedded in its stock price. With such low margins, Zoe’s Kitchen will have a hard time reaching those lofty expectations, as we’ll detail later.

Figure 3: Zoe’s Profitability Ranks Last

Sources: New Constructs, LLC and company filings

Bull Hopes Imply Store Growth Can Cure All Issues

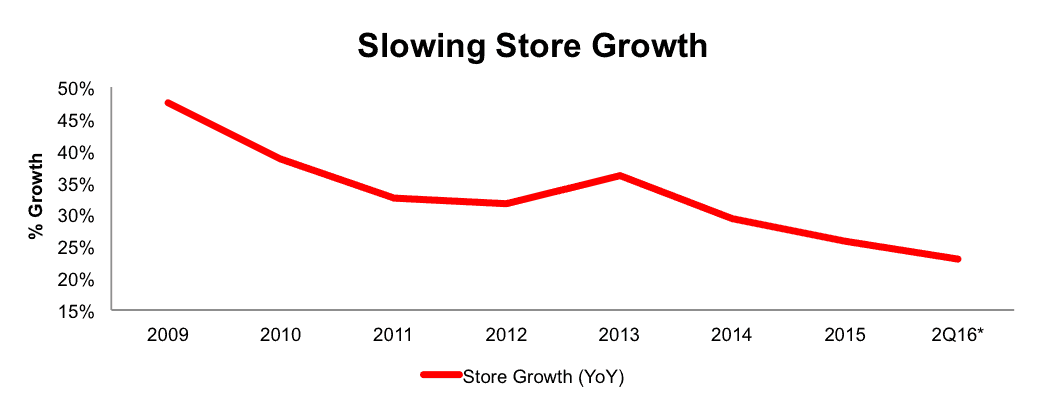

Bulls will argue that Zoe’s Kitchen is simply in the beginning of its growth phase and that ultimately achieving the company’s goal of operating 1,600 stores (from 186 at the end of 2Q16) justifies the current valuation. However, to make the case that store growth can alleviate the shareholder value destruction that is ongoing ignores not only the manner in which store growth is slowing, but also that regular operating expenses, such as store maintenance/repair and labor costs are growing just as fast as revenues.

Per Figure 4 below, the year over year (YoY) growth in store count has been in a downward trend since 2009. In that year, store count grew 48% YoY, compared to just 26% YoY in 2015. At the end of 2Q16, store count grew only 23% YoY. At 23%, it would take over a decade for Zoe’s to reach its 1,600 store goal. For reference, from 2005-2015, Chipotle’s store base grew 15% compounded annually.

Figure 4: Slowing Store Growth Threatens Bull Case

*Year over year growth based on store count at end of 2Q16.

Sources: New Constructs, LLC and company filings/press releases

The company must continue opening new stores in order to grow the top line. However, this approach, to appease the market at-large, does little to combat operating costs, which are growing just as fast (and even faster in some instances) as revenue.

Since 2012, Zoe’s revenue has grown by 42% compounded annually. However, cost of sales has grown almost as fast, at 40% compounded annually. Core operating expenses such as labor, store operating expenses, and general & administrative expenses have grown by 44% compounded annually, outpacing revenue growth. One could argue that with continued efforts to raise the minimum wage across the country, labor costs are likely to rise further. In addition, as stores age, maintenance and repair costs will increase, leading to continued growth in store operating expenses. The takeaway here is not to be fooled by top line revenue growth. The core operations of the business look rotten to us. Businesses do not survive for long when expenses grow faster than revenues.

When put together, soaring expenses and slowing store growth place a serious question mark on the valuation of the stock. The current share price implies that ZOES will not only continue the breakneck growth rates, but also become highly profitable while doing so, an expectation that clearly contradicts the current trends. Given the competitive landscape, Zoe’s Kitchen’s already low profitability, and the spending required to maintain top-line growth, it’s hard to make a case for ZOES meeting the high expectations already baked into the share price. More details on this topic are below.

The largest risk to the bear case is what we call “stupid money risk”, which is higher in today’s low (organic) growth environment. Another firm could step in and acquire ZOES at a value that is much higher than the current market price. However, we see an acquisition as possible only if a firm is willing to destroy shareholder value.

Is ZOES Worth Acquiring?

The biggest risk to our bear thesis is that an outside firm acquires ZOES at a value at or above today’s price. If the shareholder destruction and weak competitive position noted above were not enough, we’ll show below that ZOES is not an attractive acquisition target unless a buyer is willing to destroy even more shareholder value.

To begin, ZOES has liabilities of which investors may not be aware that make it more expensive than the accounting numbers suggest.

- $152 million in off-balance-sheet operating leases (32% of market cap)

- $3 million in outstanding employee stock options (<1% of market cap)

After adjusting for these liabilities we can model multiple purchase price scenarios. Even in the most optimistic of scenarios, ZOES is worth no more than the current share price.

Figures 5 and 6 show what we think Chipotle (CMG) should pay for ZOES to ensure it does not destroy shareholder value. Chipotle, as one of the prominent fast casual restaurants, has shown its willingness to branch out into new food categories when the company announced plans to open a burger restaurant. Acquiring Zoe’s Kitchen could be another way to diversify Chipotle’s brand while bringing the operational capabilities that have made CMG a success. However, there are limits on how much CMG would pay for ZOES to earn a proper return, given the NOPAT or free cash flows being acquired.

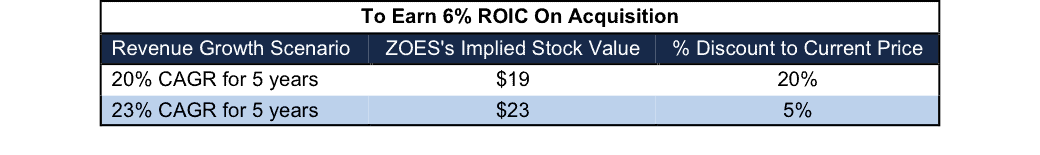

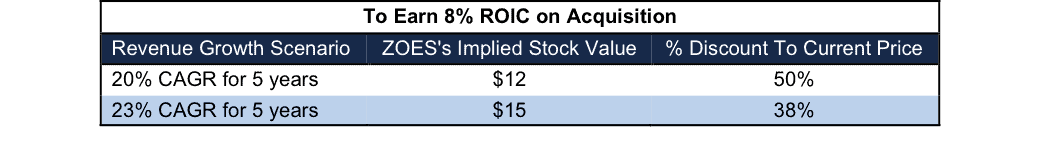

Each implied price is based on a ‘goal ROIC’ assuming different levels of revenue growth. In each scenario, the estimated revenue growth rate in year one and two equals the consensus estimate for 2016 (23%) and 2017 (20%). For the subsequent years, we use 20% in scenario one because it represents a continuation of 2017 expectations. We use 25% in scenario two because it assumes a merger with Chipotle could create revenue growth through increased advertising/marketing opportunities.

We conservatively assume that Chipotle can grow ZOES’ revenue and NOPAT without spending on working capital or fixed assets. We also assume ZOES achieves a 5.9% NOPAT margin, which is the average NOPAT margin of CMG and ZOES. For reference, ZOES’ TTM NOPAT margin is 4.5%, so this assumption implies immediate improvement and allows the creation of a truly best case scenario.

Figure 5: Implied Acquisition Prices For CMG To Achieve 6% ROIC

Sources: New Constructs, LLC and company filings.

Figure 5 shows the ‘goal ROIC’ for CMG as its weighted average cost of capital (WACC) or 6%. Even if Zoe’s Kitchen can grow revenue by 23% compounded annually with a nearly 6% NOPAT margin for the next five years, the firm is not worth more than its current price of $24/share. It’s worth noting that any deal that only achieves a 6% ROIC would be only value neutral and not accretive, as the return on the deal would equal CMG’s WACC.

Figure 6: Implied Acquisition Prices For CMG To Achieve 8% ROIC

Sources: New Constructs, LLC and company filings.

Figure 6 shows the next ‘goal ROIC’ of 8%, which is CMG’s current ROIC. Acquisitions completed at these prices would be truly accretive to CMG shareholders. Even in the best-case growth scenario, the most CMG should pay for ZOES is $15/share (38% downside). Even assuming this best-case scenario, CMG would destroy $369 million by purchasing ZOES at its current valuation. Any scenario assuming less than 23% CAGR in revenue would result in further capital destruction for CMG.

Standalone Valuation Implies Significant Profit Growth

Despite falling nearly 18% in late August after disappointing 2Q16 results, ZOES remains significantly overvalued. To justify the current price of $24/share, ZOES must maintain TTM NOPAT margins (4.5%) and grow NOPAT by 20% compounded annually for the next 11 years. This scenario assumes ZOES can grow revenue by 20% each year. For reference, Chipotle, once considered the measuring stick for fast casual restaurants, has grown revenue by 21% compounded annually over the past nine years. Essentially, Zoe’s current valuation implies the firm will be the “next Chipotle” despite a more saturated market and lower profitability than Chipotle when it was in its big growth stage.

Even if we assume ZOES can maintain that 4.5% NOPAT margin and grow NOPAT by 17% compounded annually for the next decade, the stock is only worth $14/share today – a 42% downside. Each of these scenarios also assumes the company is able to grow revenue and NOPAT without spending on working capital or fixed assets. This assumption is unlikely given Zoe’s plans for store expansion, but allows us to create a very optimistic scenario. For reference, ZOES’ invested capital has grown on average $51 million yearly (22% of 2015 revenue) over the past three years.

Pricing Concerns and Consumer Preferences Could Bring Shares Lower

As a fast casual restaurant, Zoe’s Kitchen is reliant upon customer willingness to choose higher cost options against lower cost alternatives. However, consumers may have reached a tipping point as it relates to price. As reported by NDP Group, at the end of 2Q16, fast casual restaurant traffic was down 9% from the year ago period, after years of traffic increases. This decline in traffic was marked by a 4% decline in lunch traffic, which made up 60% of Zoe’s day-part mix in 2015. Furthermore, it was found that average lunch checks have increased 5% year over year, which has put pressure on consumer decisions.

This decline in traffic, particularly within lunch, and the higher check prices create further concern when, after 2Q16, Zoe’s reported that 3.1 percentage points of its 4% comparable store sales was due to price increases. This price increase adds onto the 2.1% increase in price in 1Q16. If consumers are balking at price, Zoe’s faces a situation where its low margin does not allow it to match competitor price (and maintain profitability) while also growing revenue at rates the market has come to expect. If it chooses to discount price, already low margins are pressured. On the other hand, if it maintains price in an effort to maintain margins, it faces losing customers to competition that can provide a “more valuable” offering. In either situation, Zoe’s is unable to meet the lofty expectations already baked into its stock price.

Insider Action Is Low While Short Interest Is High

Over the past 12 months, two thousand insider shares have been purchased and 159 thousand have been sold for a net effect of 157 thousand insider shares sold. These sales represent under 1% of shares outstanding. Additionally, there are 5.7 million shares sold short, or just under 29% of shares outstanding. A large portion of investors recognizes the overly optimistic expectations embedded within ZOES.

Impact of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to ZOES’s 2015 10-K:

Income Statement: we made $17 million of adjustments with a net effect of removing $9 million in non-operating expenses (4% of revenue). We removed $13 million related to non-operating expenses and $4 million related to non-operating income. See the adjustments made to ZOES’s income statement here.

Balance Sheet: we made $191 million of adjustments to calculate invested capital with a net increase of $115 million. The most notable adjustment was $152 million (85% of net assets) related to off-balance sheet operating leases. See all adjustments to ZOES’s balance sheet here.

Valuation: we made $191 million of adjustments with a net effect of decreasing shareholder value by $188 million. Aside from the operating leases noted above, one notable adjustment was the inclusion of $2 million (<1% of market cap) due to excess cash.

Dangerous Funds That Hold ZOES

The following funds receive our Dangerous-or-worse rating and allocate significantly to Zoe’s Kitchen.

- Scotia Dynamic U.S. Growth Fund (DWUGX) – 5.1% allocation and Dangerous rating.

- DF Dent Small Cap Growth Fund (DFDSX) – 1.2% allocation and Dangerous rating.

This article originally published here on September 26, 2016.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

2 replies to "Danger Zone: Zoe’s Kitchen (ZOES)"

Thanks for the warning!

ZOES falls 20% after reporting a decline in same store sales. Now down 46% since our original Danger Zone report while the S&P is up 12%.